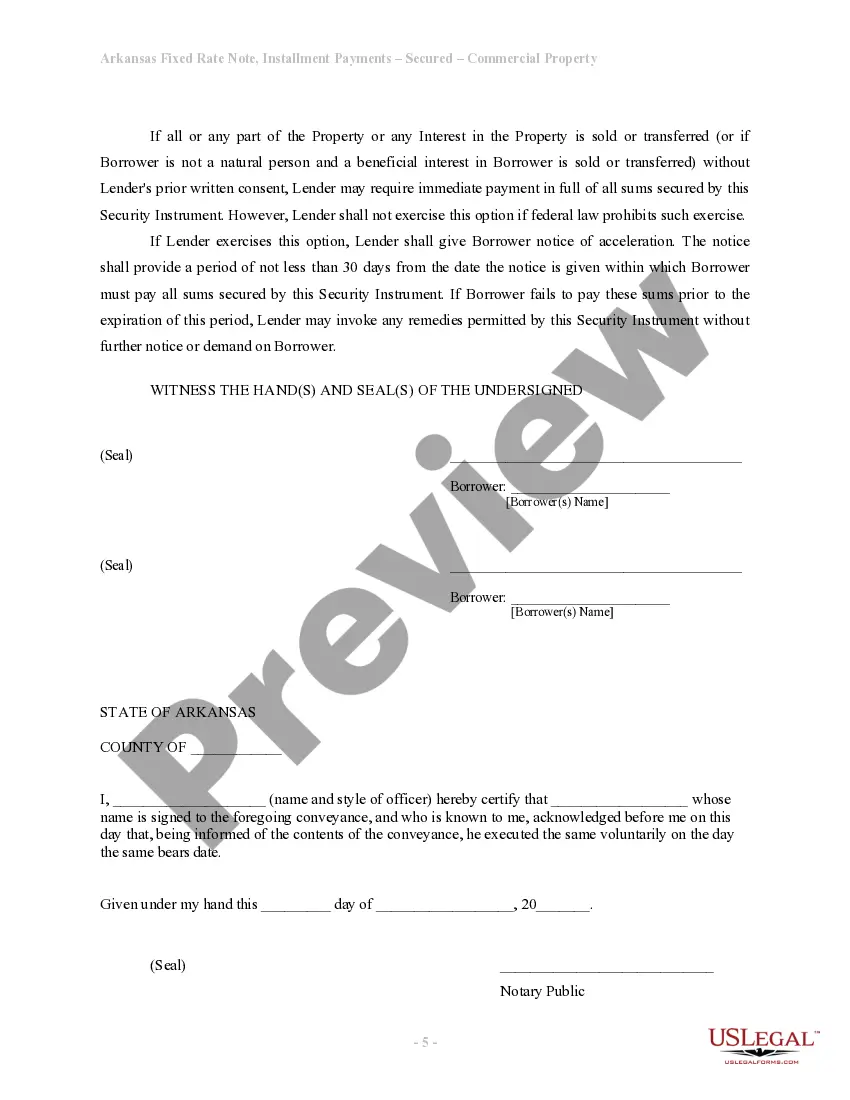

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Arkansas Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Utilizing Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate samples produced by experienced attorneys allows you to prevent stress when completing documents.

Simply download the template from our site, fill it in, and request a lawyer to review it.

This can help you conserve significantly more time and effort than seeking legal advice to create a document entirely from the ground up for you.

Utilize the Preview feature and review the description (if provided) to determine if you require this specific template, and if so, click Buy Now. Locate another sample using the Search field if needed. Choose a subscription that suits your requirements. Begin using your credit card or PayPal. Choose a file format and download your document. After you’ve completed all the steps above, you'll have the capability to fill out, produce a hard copy, and sign the Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate template. Remember to double-check all entered information for accuracy before submitting or dispatching it. Minimize the time spent on document creation with US Legal Forms!

- If you possess a US Legal Forms membership, just sign in to your account and navigate back to the form page.

- Locate the Download button close to the template you are reviewing.

- After downloading a template, you will find all your saved templates in the My documents section.

- If you lack a subscription, that’s not an issue.

- Simply follow the steps below to create your online account, acquire, and complete your Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate template.

- Verify and ensure that you are obtaining the correct state-specific form.

Form popularity

FAQ

You typically file a promissory note with the local county recorder's office where the property is located. This filing helps to establish public notice of the debt secured by the property. In the case of an Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, registering your note properly ensures transparency and protects your rights as a lender. It's recommended to consult with a legal professional to ensure compliance with local recording laws.

The format of a promissory note should be straightforward and include sections for the title, date, parties involved, amount, terms of payment, and signatures. Clear headings make it easier to navigate the document. When creating an Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it's important to structure it in a way that clearly communicates the obligations of both the borrower and lender.

A typical promissory note includes key elements such as the principal amount, interest rate, payment schedule, and maturity date. Additionally, it specifies the parties involved, the terms of repayment, and any collateral used. For an Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, clear clauses regarding the secured asset are essential to protect both parties involved.

Yes, promissory notes can be backed by collateral, which is often the case in commercial real estate transactions. In an Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the collateral usually consists of the property itself. This arrangement lends additional security to the lender, ensuring that they have a tangible asset to claim in case of default. As a result, it can lead to more favorable lending terms for the borrower.

Yes, a promissory note can indeed be secured by real property. In the context of an Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this means that the note is backed by a specific piece of real estate. This arrangement offers greater protection to the lender, as they can claim the property if the borrower defaults on the note. Thus, it provides a more secure investment.

Promissory notes can be sold by various finance entities, including banks, credit unions, and private lenders. Additionally, platforms like uslegalforms enable individuals and businesses to access templates and guidance for creating and managing promissory notes, like the Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. This can help you understand your options clearly.

Yes, a promissory note can be secured, meaning it is backed by collateral. This provides additional assurance for lenders that their investment is protected, especially in transactions involving significant assets such as commercial real estate. In the case of an Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this security can significantly enhance the trust in the borrowing relationship.

Yes, you can create your own promissory note tailored to your needs. However, make sure it includes all essential terms and complies with legal standards. The Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is one such example that can guide you in structuring a legally sound agreement.

Writing a promissory note involves clearly stating the amount borrowed, the repayment schedule, and any interest rates. Ensure you also include details about collateral, like the asset securing the note. For an Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, outlining these elements accurately protects both the lender and borrower.

Yes, Microsoft Word provides templates for creating promissory notes. This can simplify the process, allowing users to customize their documents as needed. Keep in mind that while templates can be helpful, it is important to ensure that your Arkansas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate meets all legal requirements specific to your situation.