Arkansas Articles Of Dissolution Of A Non-Profit Corporation is a document that must be filed by the board of directors in order to legally dissolve a non-profit corporation in the state of Arkansas. This filing must be completed in accordance with the Arkansas Non-Profit Corporation Act and the Arkansas Secretary of State’s office. The Articles of Dissolution must include the name of the corporation, the address of the registered agent, the name and address of the incorporated, the date of dissolution, and the signatures of the board of directors. There are two types of Arkansas Articles of Dissolution Of A Non-Profit Corporation: voluntary dissolution and involuntary dissolution. Voluntary dissolution occurs when the board of directors of the non-profit corporation agrees to dissolve the entity, while involuntary dissolution happens when the Arkansas Secretary of State's office revokes the entity's charter.

Arkansas Articles Of Dissolution Of A Non-Profit Corporation

Description

How to fill out Arkansas Articles Of Dissolution Of A Non-Profit Corporation?

How much time and resources do you frequently allocate to preparing formal documentation.

There’s a superior alternative to obtaining such forms than employing legal professionals or dedicating hours searching the internet for an appropriate template.

Another advantage of our library is that you can access previously acquired documents that you securely store in your profile under the My documents tab. Retrieve them anytime and re-complete your forms as many times as needed.

Conserve time and energy completing formal paperwork with US Legal Forms, one of the most dependable online solutions. Sign up with us today!

- Browse through the form details to ensure it aligns with your state requirements. To do this, review the form description or utilize the Preview option.

- If your legal template doesn't fulfill your requirements, locate another using the search option at the top of the page.

- If you are already signed up for our service, Log In/">Log In and download the Arkansas Articles of Dissolution of a Non-Profit Corporation. If not, continue to the subsequent steps.

- Click Buy now once you find the appropriate document. Select the subscription plan that best suits you to access our library’s complete service.

- Create an account and pay for your subscription. You can complete the transaction using your credit card or through PayPal - our service is entirely trustworthy for that.

- Download your Arkansas Articles of Dissolution of a Non-Profit Corporation onto your device and fill it out on a printed version or electronically.

Form popularity

FAQ

Steps to dissolving a nonprofit File a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

Dissolving a 501(c)(3) is the process of disbanding an organization and ending its non- profit status. Regardless of the reasons for dissolving its 501(c)(3) status, an organization must follow a series of steps with the state and the Internal Revenue Service (IRS) for the action to officially occur.

The Arkansas Nonprofit Corporation Act of 1993 governs nonprofit corporations incorporated on or after January 1, 1994 or those incorporated prior to that date that have elected to be governed under the 1993 Act in amendments to their articles of incorporations.

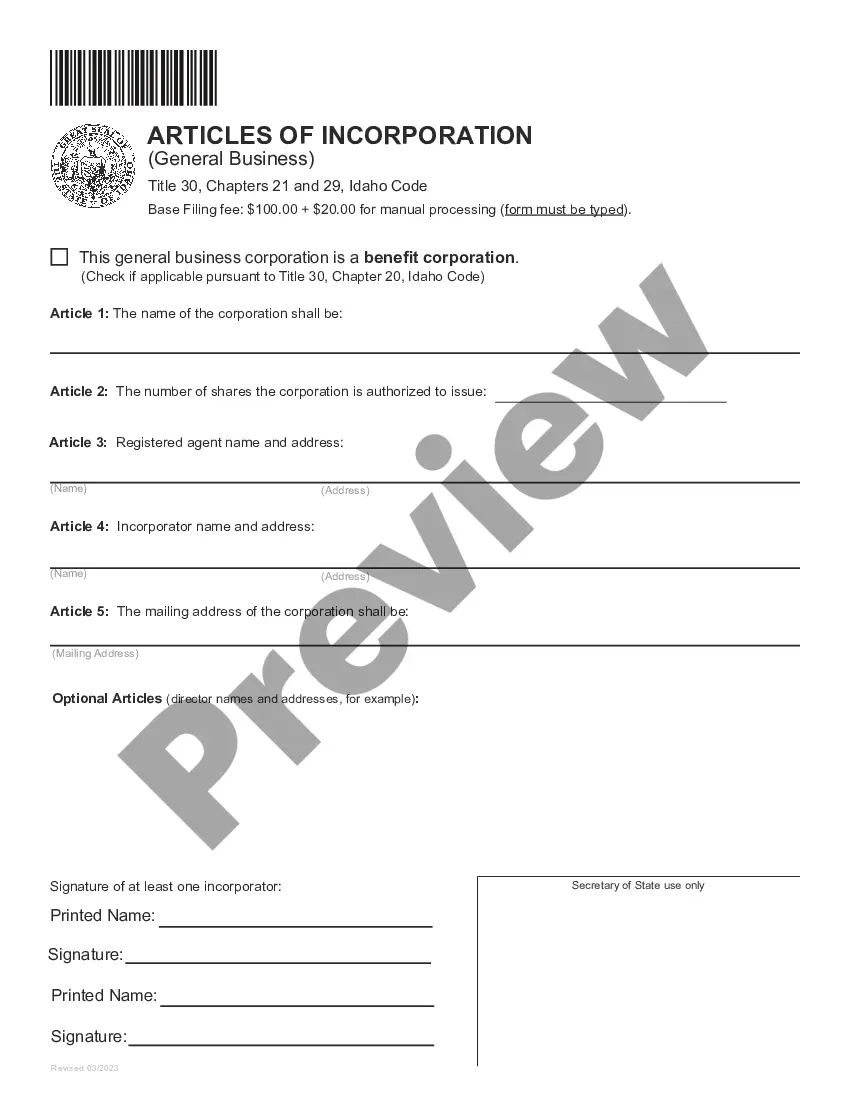

The Articles of Incorporation Arkansas must be filed with the Secretary of State in order to start a corporation and it does not have to be a complex document. The Articles of Incorporation Arkansas must be filed with the Secretary of State in order to start a corporation.

What does dissolution of a business mean? Business dissolution can be caused in many ways, including the failure to file annual reports or pay certain taxes in the state of incorporation, bankruptcy, or voluntary dissolution by business owners.

How do you dissolve an Arkansas Corporation? To dissolve your Arkansas corporation, submit a completed dissolution form to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file Arkansas articles of dissolution online.

If the leadership of the organization decides that winding down is the best option, the organization will need a ?plan of dissolution.? A plan of dissolution is essentially a written description of how the nonprofit intends to distribute its remaining assets and address its remaining liabilities.

As required by law, a nonprofit organization that is ceasing existence is required to transfer all remaining assets to another tax-exempt organization or to the government. It is unlawful to give any property away to individuals ? including board members, volunteers, staff, or beneficiaries.