Arkansas Notice To Surviving Spouse

Description

How to fill out Arkansas Notice To Surviving Spouse?

Among numerous paid and complimentary templates available online, you can't guarantee their precision and dependability.

For instance, who created them or if they possess the expertise necessary to fulfill your requirements.

Always remain composed and utilize US Legal Forms!

Click Buy Now to commence the purchasing process or search for another sample using the Search field positioned in the header.

- Explore Arkansas Notice To Surviving Spouse samples crafted by skilled legal professionals and avoid the expensive and tedious process of searching for an attorney and subsequently compensating them to draft a document that you can easily obtain yourself.

- If you already hold a subscription, Log In to your account and locate the Download button adjacent to the file you are seeking.

- You will also be able to access all of your previously stored documents in the My documents menu.

- If you are using our website for the first time, adhere to the instructions below to quickly acquire your Arkansas Notice To Surviving Spouse.

- Confirm that the file you see is valid in your area.

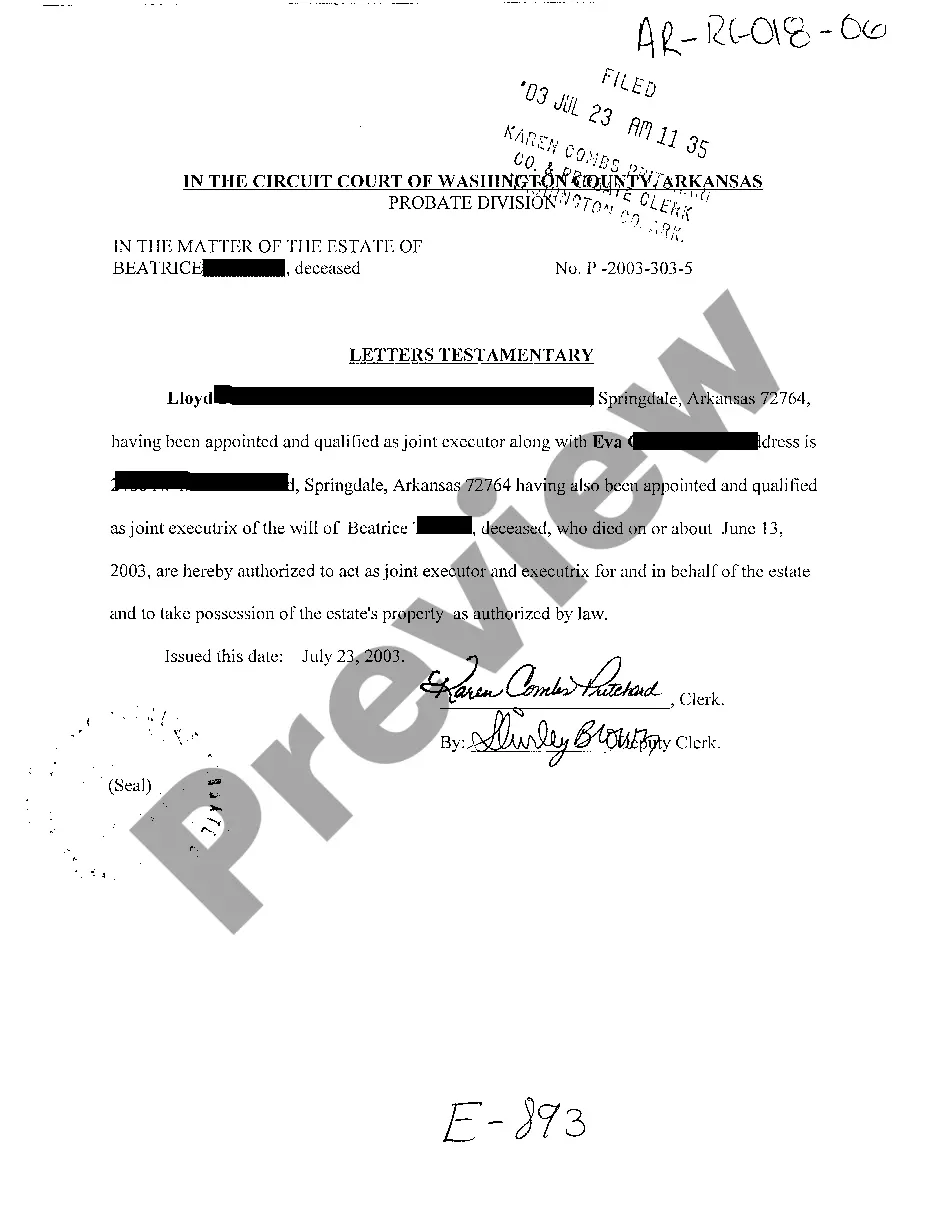

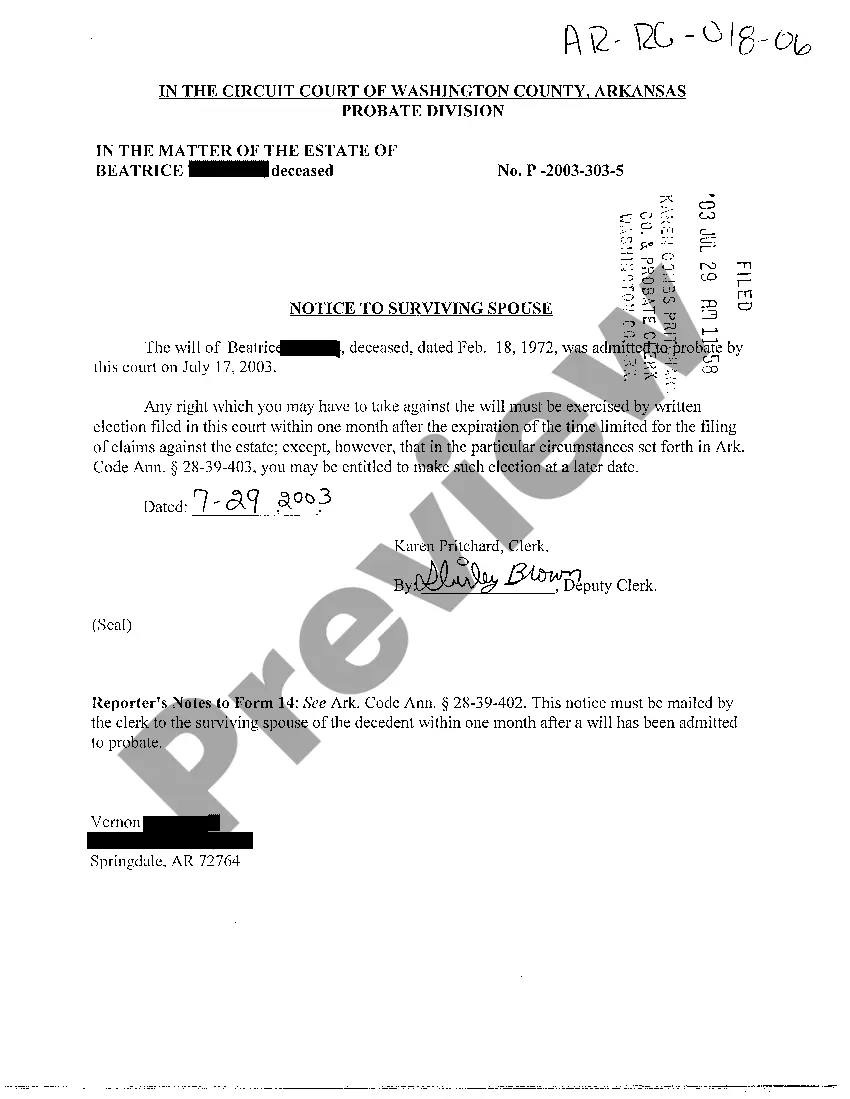

- Review the file by examining its description using the Preview function.

Form popularity

FAQ

In Arkansas, there is no specific minimum value for an estate to require probate because it depends on the types of assets involved. Generally, estates with real property or significant personal assets will likely go through probate, regardless of the total value. The Arkansas Notice To Surviving Spouse can help clarify the deceased's intentions, especially concerning the distribution of assets. Consulting with a legal professional can give you an accurate assessment based on your situation.

To initiate the probate process in Arkansas, you need to file a petition with the probate court in the county where the deceased lived. Gathering required documents, such as the will, death certificate, and Arkansas Notice To Surviving Spouse, is essential. Having these documents ready can streamline the process and reduce delays. Seeking guidance from a legal expert can also provide clarity on the steps involved.

If you do not file for probate in Arkansas, the estate may remain unsettled, leading to complications for the heirs. Assets could become stuck in legal limbo, delaying the distribution to rightful beneficiaries. Additionally, the Arkansas Notice To Surviving Spouse serves to protect the rights of surviving spouses, ensuring they receive proper notice and claim to the estate. It is crucial to address this promptly to avoid further issues.

Yes, it is possible to avoid probate in Arkansas under certain conditions. For instance, assets held in joint tenancy or those with designated beneficiaries can bypass the probate process. Implementing an Arkansas Notice To Surviving Spouse can also ensure that your spouse receives their rightful inheritance without unnecessary delays. Utilizing trusts may serve as an effective alternative to avoid probate as well.

Probate is often necessary in Arkansas when a deceased person leaves behind assets. The Arkansas Notice To Surviving Spouse plays a crucial role in this process, notifying the surviving spouse of their rights. However, not all estates will go through probate, depending on specific circumstances such as asset types and values. Consulting with a legal professional can help clarify if your situation requires probate.

To avoid probate in Arkansas, you can consider establishing joint ownership of property, setting up a trust, or designating beneficiaries on financial accounts. Each of these options can help ensure that assets pass directly to the intended parties without going through the probate court. Using services like US Legal Forms can provide the necessary documents and guidance, especially in relation to the Arkansas Notice To Surviving Spouse, adding clarity to your estate planning.

Yes, Arkansas law requires probate to be initiated within three years after the person's death. However, the exact timeline can vary depending on the complexity of the estate and any potential disputes among heirs. Familiarizing yourself with how the Arkansas Notice To Surviving Spouse plays into these timeframes can help you make informed decisions about estate management.

To obtain a letter of testamentary in Arkansas, you must first file the deceased person's will with the probate court and submit a petition to be appointed as the executor. Once appointed, the court will issue the letter, granting you authority to manage the estate. It’s vital to understand how the Arkansas Notice To Surviving Spouse might affect your responsibilities as the executor during this process.

In Arkansas, probate generally starts when a person passes away and leaves behind assets that need to be distributed. If there is a will, the executor must file it with the probate court, initiating the process. If there is no will, the state laws will determine how to distribute the assets. Understanding the Arkansas Notice To Surviving Spouse can help you know how your surviving spouse may be impacted by the probate process.

To avoid probate in Arkansas, individuals can use estate planning tools such as trusts, joint ownership arrangements, and designated beneficiaries. These strategies can help ensure a smoother transition of assets without the lengthy probate process. For tailored guidance on these options, consider looking into the Arkansas Notice To Surviving Spouse as a valuable resource.