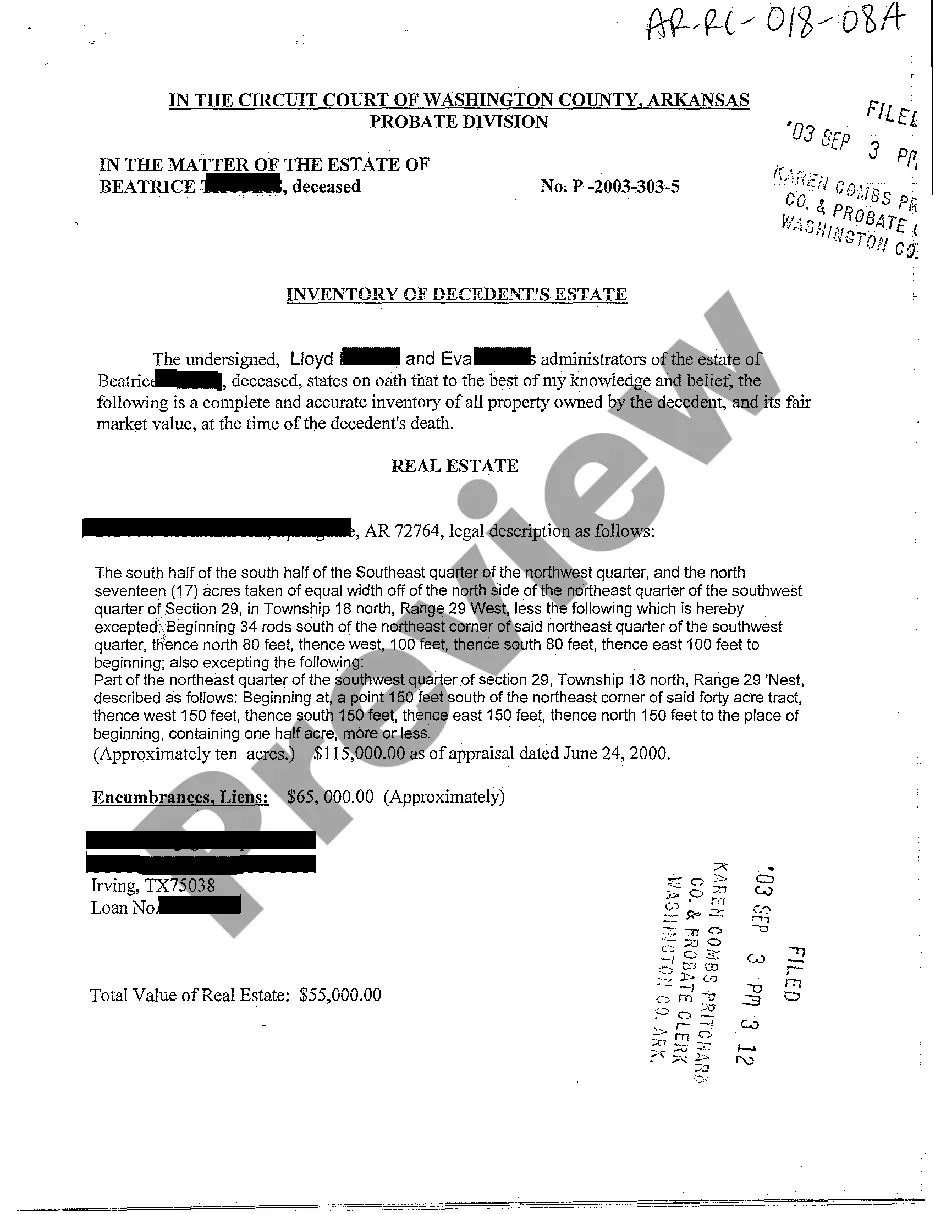

Arkansas Inventory of Decedent's Estate

Description

How to fill out Arkansas Inventory Of Decedent's Estate?

Amid numerous complimentary and paid templates available online, you cannot guarantee their precision.

For instance, who developed them or if they possess the necessary expertise to cater to your requirements.

Always remain composed and take advantage of US Legal Forms!

Execute more for less with US Legal Forms!

- Discover Arkansas Inventory of Decedent's Estate samples crafted by proficient legal experts and steer clear of the costly and time-consuming endeavor of searching for an attorney and subsequently compensating them to create a document that you can obtain yourself.

- If you possess an existing subscription, Log In to your account and locate the Download button alongside the document you seek.

- You'll also gain access to all your previously saved documents in the My documents section.

- If you’re utilizing our service for the first time, adhere to the directions below to obtain your Arkansas Inventory of Decedent's Estate effortlessly.

- Verify that the document you find is effective in your residing state.

- Examine the template by reviewing the details provided through the Preview function.

Form popularity

FAQ

To make an inventory list, begin by cataloging all the assets of the estate and assigning values to each item. You can use spreadsheets or inventory software to organize this information clearly. This systematic approach not only aids in the probate process but also creates a detailed Arkansas Inventory of Decedent's Estate that is easy to reference for all parties involved.

Preparing an inventory of assets involves listing all items owned by the decedent, along with their estimated values. Start by conducting a thorough review of the decedent's financial documents and estate holdings. Using a structured approach will result in a comprehensive Arkansas Inventory of Decedent's Estate, which can also serve as a critical document in the probate process.

To create a list of assets, begin by gathering relevant documentation, such as titles, account statements, and appraisals. Next, organize the information into categories, including real property, financial accounts, and personal belongings. An efficient Arkansas Inventory of Decedent's Estate will help streamline this process, ensuring that all valuable items are properly recorded.

Dividing items in an estate can be accomplished through mutual agreement among heirs, or by following the decedent's wishes outlined in a will. If disagreements arise, mediation or court involvement may be necessary to ensure that the division is fair and just. An accurate Arkansas Inventory of Decedent's Estate can facilitate this process by providing a clear list of assets to be divided.

When preparing an Arkansas Inventory of Decedent's Estate, you should include all assets that the decedent owned at the time of death. This typically encompasses real estate, personal property, bank accounts, stocks, and other investments. Additionally, you should also account for any debts or obligations that may affect the net worth of the estate.

To file as an administrator of an estate in Arkansas, you must submit a petition to the probate court in the county where the decedent lived. This petition will typically need to include the death certificate, a list of heirs, and information about the decedent's debts. Once the court approves your petition, you can begin the process of creating an Arkansas Inventory of Decedent's Estate.

To create an inventory list for an estate, start by gathering all financial documents, property deeds, and personal belongings. List each asset, noting its estimated value and location. This list will serve as a key component of the Arkansas Inventory of Decedent's Estate, guiding the settlement process. Tools and templates offered on UsLegalForms can assist you in organizing this critical information efficiently.

In Arkansas, an estate must typically be worth at least $100,000 in order to require probate. However, if the estate is below this threshold, it may qualify for a small estate affidavit process. Knowing the value of your estate is crucial for determining the necessary next steps. The Arkansas Inventory of Decedent's Estate can guide you in assessing the total value of your assets.

Certain assets are exempt from probate in Arkansas, including joint tenancy properties and accounts with a designated beneficiary. Additionally, up to $100,000 in personal property may be exempt under specific conditions. These exemptions can help expedite the transfer of assets. To effectively organize your estate, you can reference the Arkansas Inventory of Decedent's Estate to understand what qualifies as exempt.

In Arkansas, non-probate assets include those that pass directly to beneficiaries, such as life insurance policies, retirement accounts, and assets held in trust. These assets do not require probate court involvement for transfer. Understanding non-probate assets is essential when compiling your Arkansas Inventory of Decedent's Estate. Utilizing UsLegalForms can simplify the process of categorizing your estate.