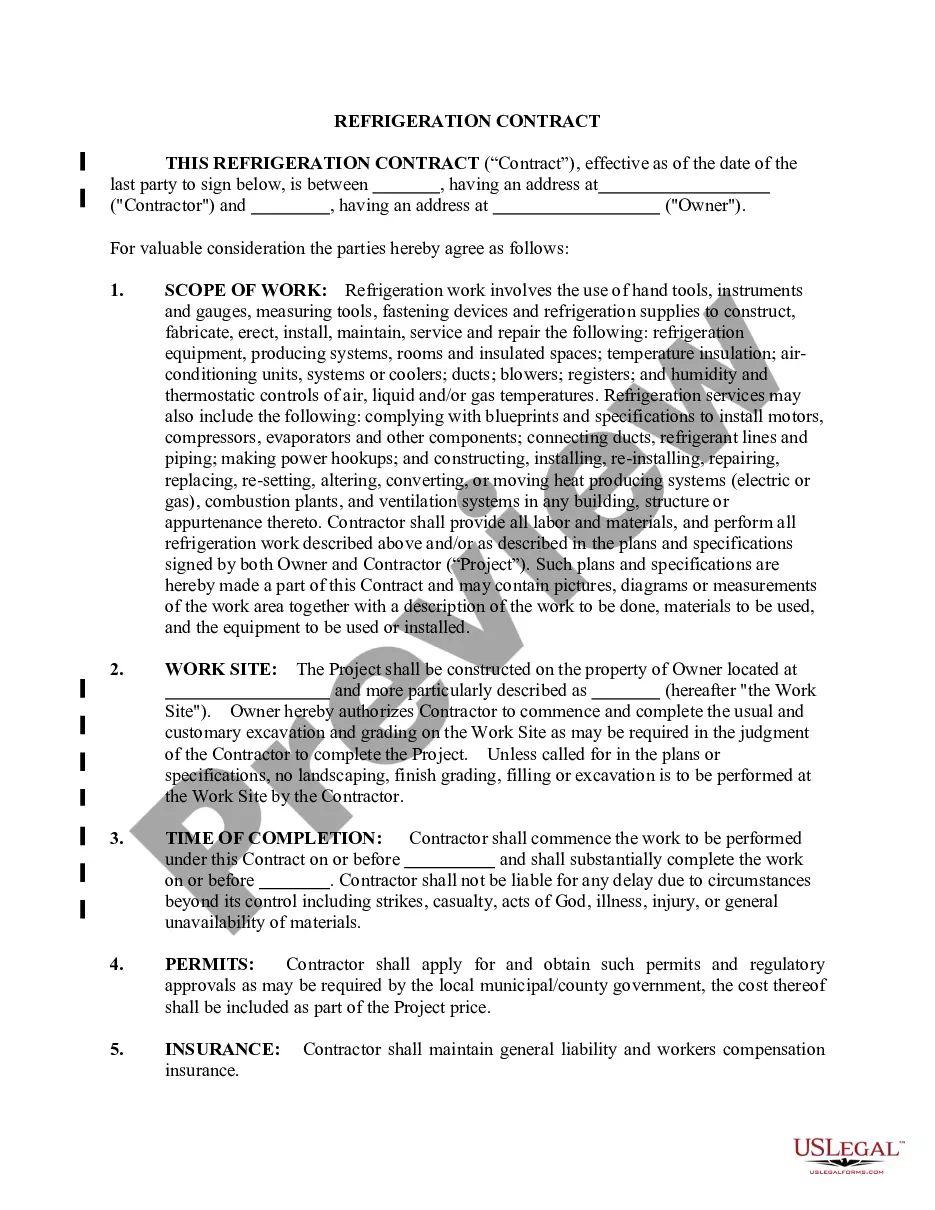

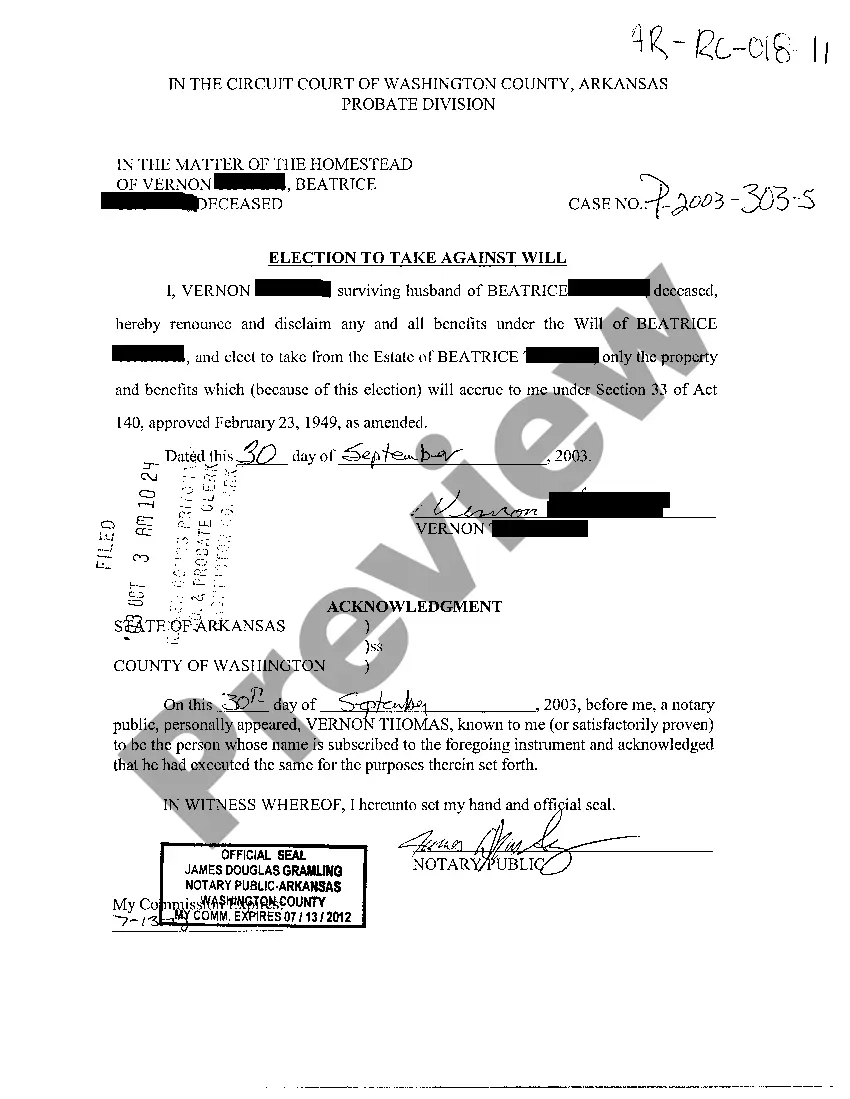

Arkansas Election To Take Against Will

Description

How to fill out Arkansas Election To Take Against Will?

Among countless premium and complimentary templates available online, you cannot guarantee their dependability.

For instance, one might question who developed them or if they possess the necessary expertise to meet your requirements.

Stay calm and utilize US Legal Forms!

If you are an existing subscriber, Log In to your account and find the Download option next to the form you’re seeking. You will also have the ability to access your previously obtained templates in the My documents section.

- Explore Arkansas Election To Take Against Will samples crafted by experienced legal professionals.

- Avoid the pricey and prolonged task of searching for an attorney and then compensating them to create a document for you that you can effortlessly locate yourself.

Form popularity

FAQ

One way to avoid probate is to own property jointly with someone else. When you die with a right of surviorship, your share passes to the other owner automatically. What is on the deed or account controls and any statement in your will is ignored.

In Arkansas, the probate process is mandatory for any contested estate, if there are creditors (including a mortgage) and for any estate larger than $100,000. If a person provides written grounds for contest to the court, the will goes through the probate process.

A will generally names an executor to administer the estate. If the decedent's estate has no valid will, you must file a petition with the probate court to administer the estate, and other folks who feel they're just as qualified may file a petition as well.

There is a predetermined fee schedule for executors, based on the value of the estate that is passing through probate. The schedule in Arkansas is as follows: 10% of the first $1,000. 5% of the next $4,000, and.

In Arkansas, you can use the small estate procedure if the total value of all personal property does not exceed the amount to which the surviving spouse and children are entitled to by law or the value of the property is $100,000 or less, not counting the homestead and the statutory allowance for the benefit of a

Dying Without a Will in ArkansasIf there isn't a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the estate of the decedent.

Ohio, Arkansas and Kentucky are the only states that retain dower rights. Dower rights generally kick in after someone has died. A dower rights law entitles a surviving spouse to at least one-third of a deceased spouse's real property when they die.

The probate process typically takes anywhere from six to nine months to complete. This process can take longer when there are unusual assets requiring special attention.

Arkansas is one state that still uses the principles of dower and curtesy. In this state, the amount of dower or curtesy is one-third of a life estate in any real property. The surviving spouse is entitled to one-third of the income generated from any real property during his or her life.