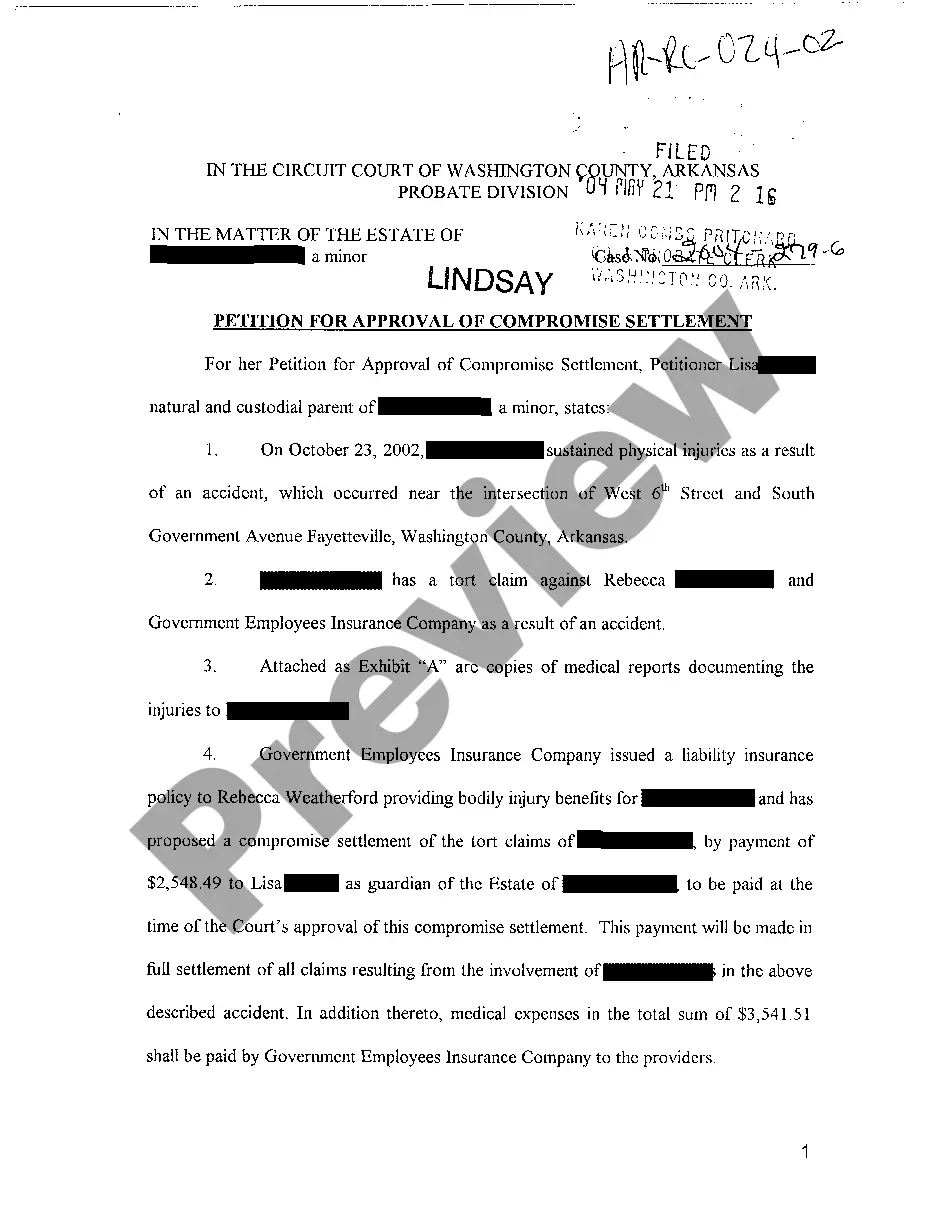

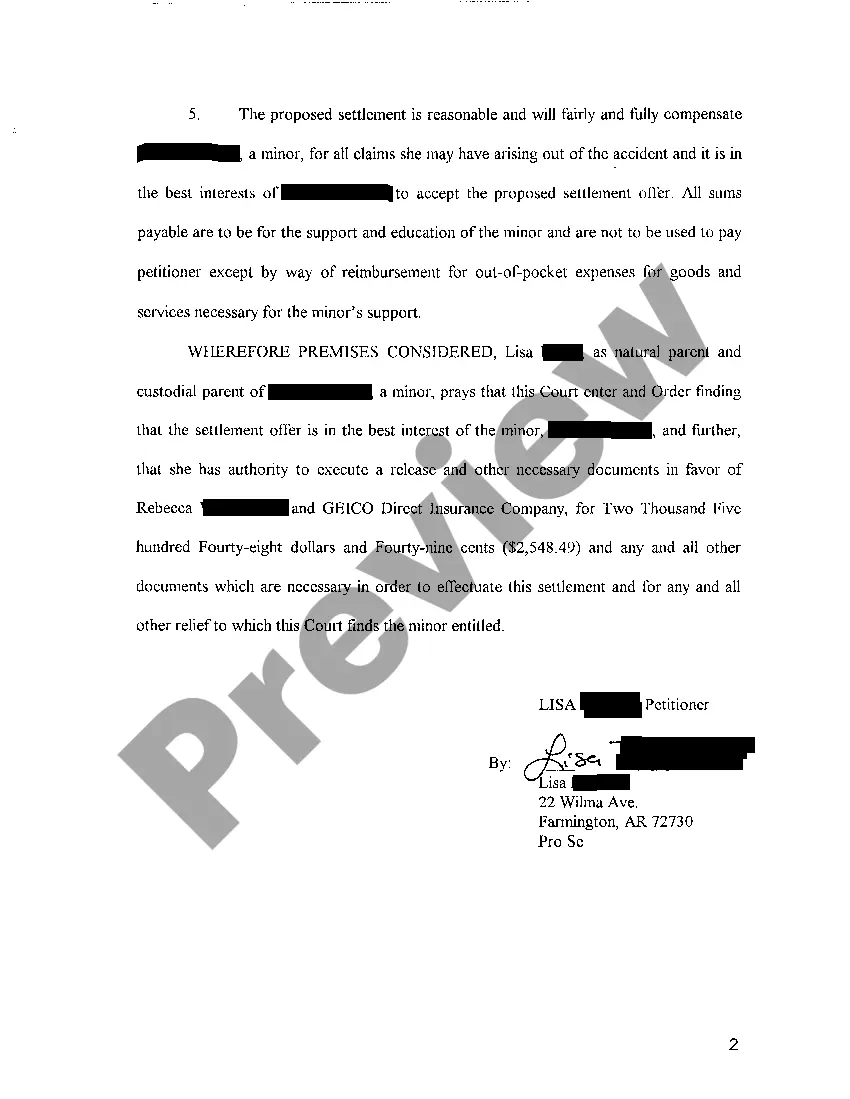

Arkansas Petition For Approval of Compromise Settlement

Description

How to fill out Arkansas Petition For Approval Of Compromise Settlement?

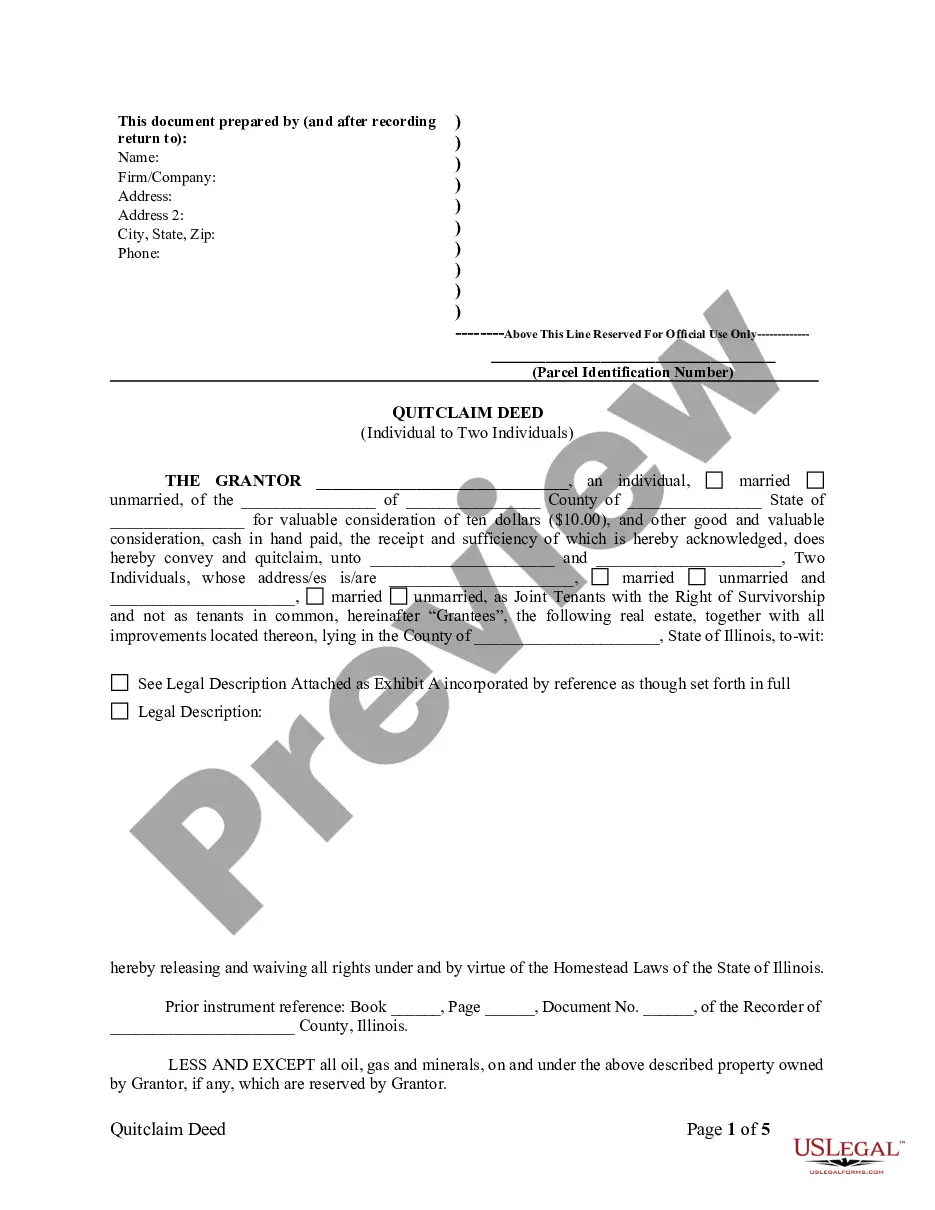

Among numerous complimentary and paid templates available on the web, you cannot be sure about their precision and dependability.

For instance, who created them or if they possess the necessary skills to fulfill your requirements.

Always remain composed and utilize US Legal Forms!

Proceed to click Buy Now to initiate the purchasing process or search for another sample using the Search box located in the header.

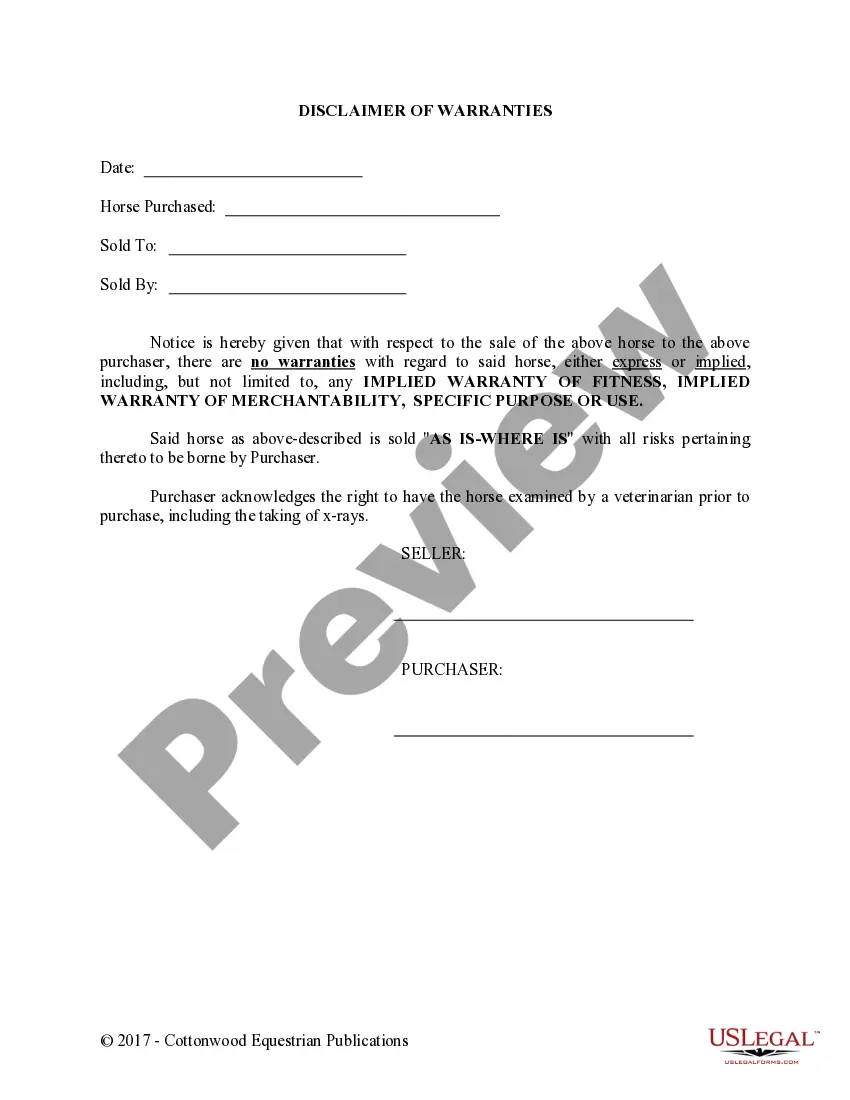

- Uncover Arkansas Petition For Approval of Compromise Settlement templates crafted by qualified legal professionals and sidestep the expensive and laborious process of searching for a lawyer and then compensating them to create a document that you can effortlessly locate on your own.

- If you already hold a subscription, sign in to your account and locate the Download button adjacent to the file you’re seeking.

- You will also be able to view your previously obtained documents in the My documents section.

- If you are using our platform for the first time, adhere to the instructions below to quickly acquire your Arkansas Petition For Approval of Compromise Settlement.

- Verify that the document you find is applicable in the state where you reside.

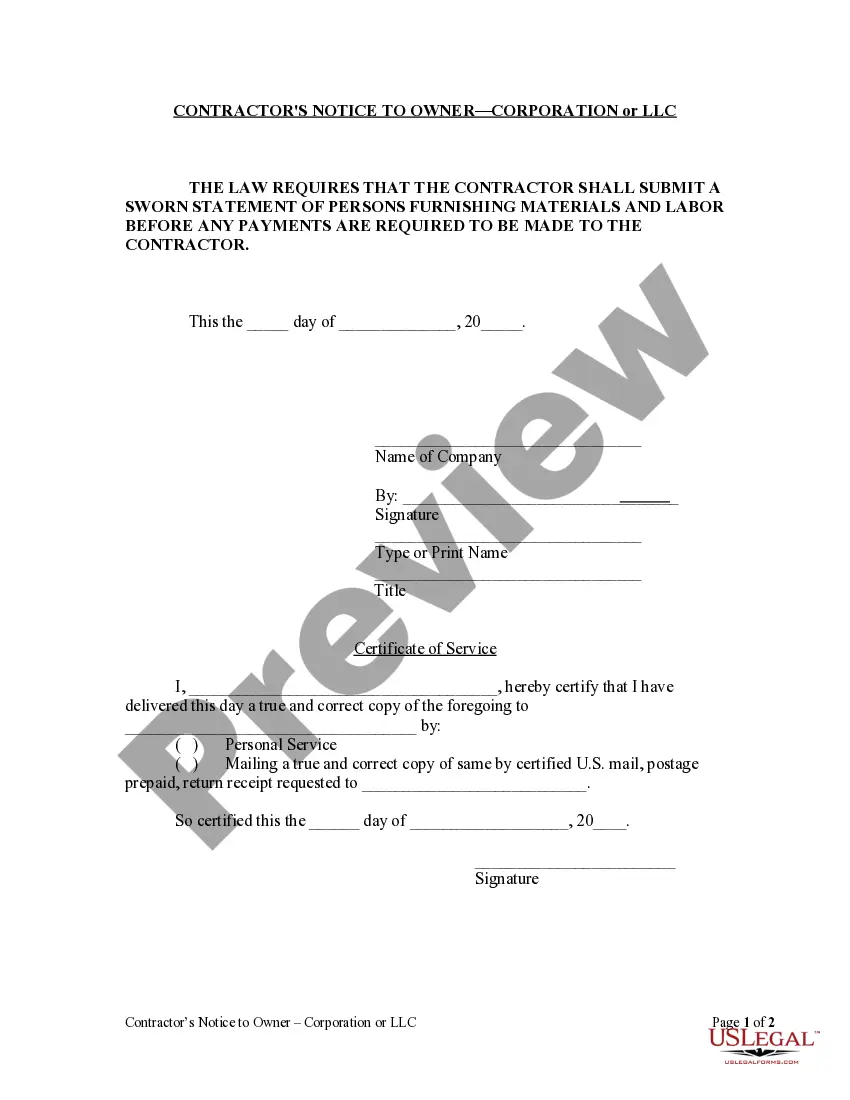

- Examine the template by reading the description using the Preview feature.

Form popularity

FAQ

A writ of garnishment in Arkansas is a legal process used to collect a debt from a debtor's wages or bank account. This writ allows a creditor to access funds directly to satisfy a court judgment. If you’re involved with an Arkansas Petition For Approval of Compromise Settlement, understanding garnishment can be critical in negotiating the terms. Consider leveraging the resources available through USLegalForms for comprehensive legal support in these matters.

A petition to revoke in Arkansas is a request to cancel a previous court order or legal decision. This mechanism is important for individuals who seek to change a ruling that may no longer reflect their circumstances. When preparing an Arkansas Petition For Approval of Compromise Settlement, it is essential to recognize how revocation might affect your case. Utilizing platforms like USLegalForms can clarify this process and provide the necessary documentation.

A writ of possession in Arkansas is a court order that allows a landlord or property owner to regain control of property after a tenant has been evicted. This writ enforces the eviction process and can also assist property owners in reclaiming their assets. If you're involved in an Arkansas Petition For Approval of Compromise Settlement, knowing about a writ of possession can help you understand your rights. The right legal resources can support you through this complex situation.

A writ of replevin in Arkansas is a legal order that allows a party to reclaim personal property that is wrongfully taken or held. This process is crucial when the rightful owner cannot retrieve their belongings without assistance. In the context of an Arkansas Petition For Approval of Compromise Settlement, understanding replevin is vital, as it could impact the settlement terms. Legal guidance can ensure you navigate these proceedings effectively.

In Arkansas, tax liens serve to secure unpaid taxes owed on properties. Once a lien is placed, it remains until the tax is settled or the property is sold. If you find yourself facing a tax lien, filing an Arkansas Petition For Approval of Compromise Settlement can assist in negotiating a resolution, potentially reducing your tax liability.

In Arkansas, the general statute of limitations on debt collection is five years. This period starts from the time the debt becomes due. Knowing this can assist you in making informed decisions, and filing an Arkansas Petition For Approval of Compromise Settlement might help negotiate or settle debts effectively.

The statute of limitations on taxes in Arkansas is typically three years from the tax due date. However, this can vary based on specific circumstances. If you find yourself facing tax issues, seek to file an Arkansas Petition For Approval of Compromise Settlement, which may offer an avenue to alleviate your burden.

In Arkansas, the statute of limitations on a tax lien is generally three years. This timeline begins from the date the tax becomes due. If you are dealing with a tax lien, consider filing an Arkansas Petition For Approval of Compromise Settlement to resolve the issue effectively.