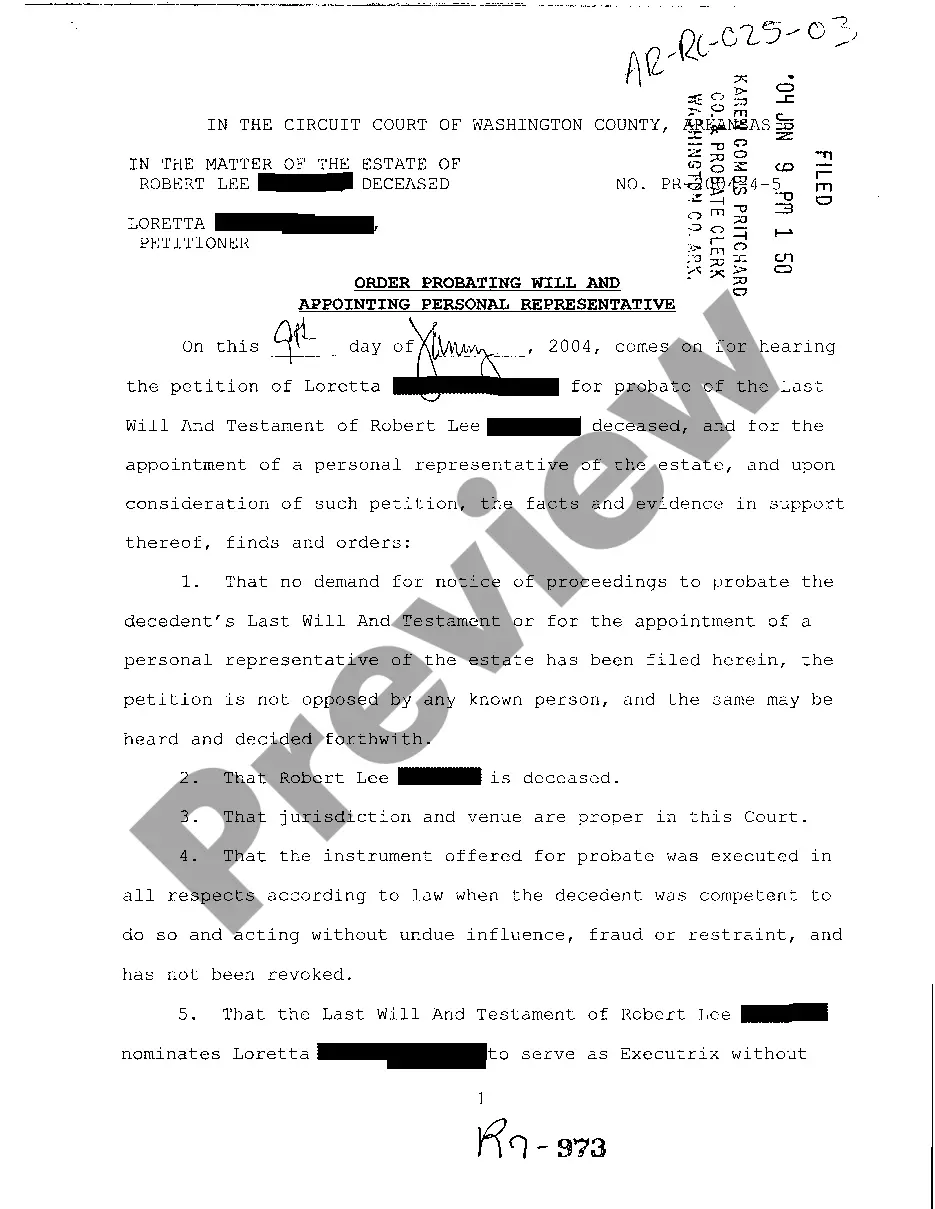

Arkansas Order Probating Will and Appointing Personal Representative

Description

How to fill out Arkansas Order Probating Will And Appointing Personal Representative?

Among numerous paid and complimentary samples available online, you cannot be assured of their trustworthiness.

For instance, who crafted them or whether they possess the necessary skills to address your requirements.

Stay calm and utilize US Legal Forms!

Do more for less with US Legal Forms!

- Explore Arkansas Order Probating Will and Appointing Personal Representative templates developed by expert attorneys.

- Avoid the costly and time-intensive task of finding a lawyer and then compensating them to draft a document that you can obtain independently.

- If you hold a subscription, Log In/">Log In to your account to locate the Download button adjacent to the form you are searching for.

- You will also have access to all your previously downloaded templates through the My documents menu.

- If you are using our service for the first time, adhere to the steps below to effortlessly acquire your Arkansas Order Probating Will and Appointing Personal Representative.

- Ensure that the file you find is applicable in your state.

Form popularity

FAQ

Certain assets are exempt from probate in Arkansas, such as accounts held in a payable-on-death form or property held in a trust. These exemptions allow for a smoother transition of assets, avoiding the formal probate process. Familiarizing yourself with the Arkansas Order Probating Will and Appointing Personal Representative can provide you with essential insights into preserving your estate's efficiency.

Non-probate assets in Arkansas include life insurance policies, retirement accounts, and jointly owned property with survivorship rights. These assets pass directly to designated beneficiaries without going through probate. Understanding the Arkansas Order Probating Will and Appointing Personal Representative can clarify which assets you can count as non-probate and simplify estate planning.

In Arkansas, the threshold for requiring probate typically involves estates valued over $100,000. However, specific assets may also influence this requirement, as some types of property necessitate probate regardless of the estate's value. Knowing how the Arkansas Order Probating Will and Appointing Personal Representative applies can assist you in understanding when probate is necessary.

You can avoid probate in Arkansas through various strategies such as creating a living trust, holding assets jointly, or designating beneficiaries for certain accounts. These methods keep property outside of probate, allowing for a more straightforward transfer of assets upon death. Familiarity with the Arkansas Order Probating Will and Appointing Personal Representative can help you consider your options effectively.

If you do not file for probate in Arkansas when it is required, the estate may remain unresolved, causing delays in asset distribution and the settlement of debts. Additionally, heirs may not have legal access to the estate's assets, which can create financial hardships. It's vital to understand the importance of the Arkansas Order Probating Will and Appointing Personal Representative to avoid these complications.

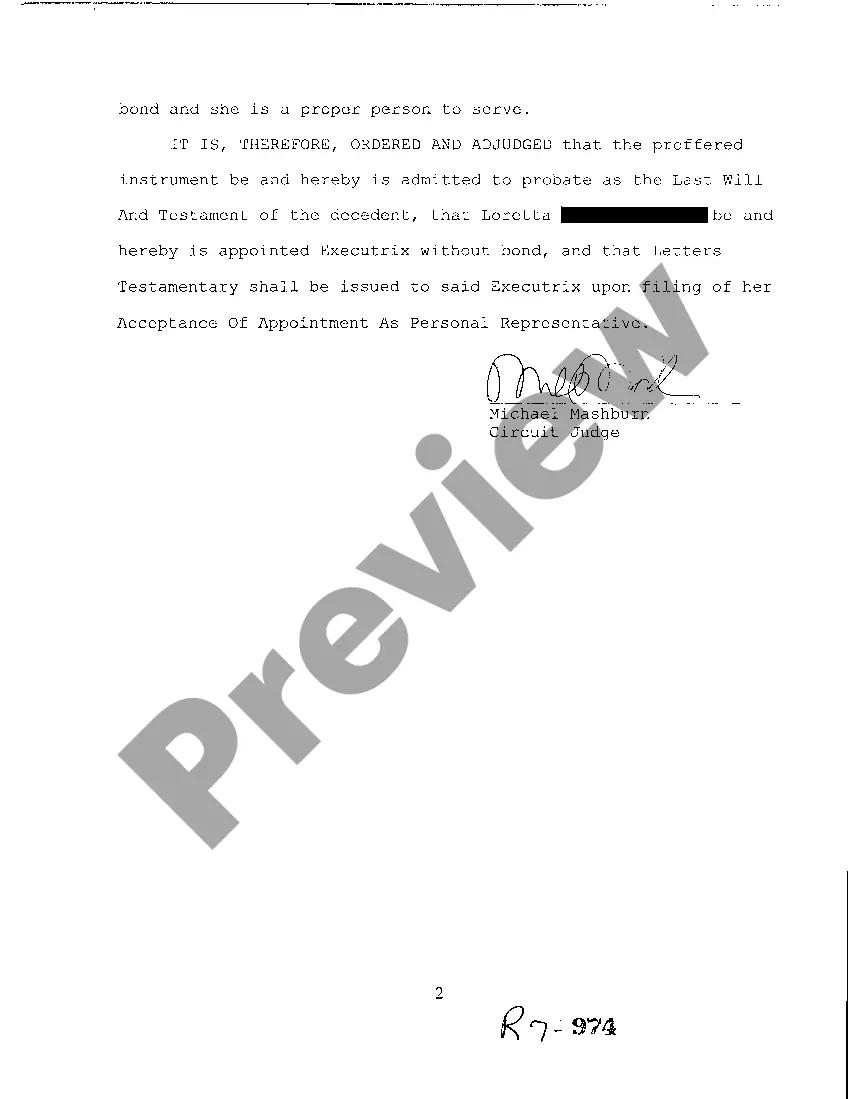

A personal representative in Arkansas is the individual appointed by the probate court to manage the estate. This person is responsible for settling debts, distributing assets, and ensuring that the estate is administered according to the will. Being a personal representative can be a complex role, and familiarizing yourself with the Arkansas Order Probating Will and Appointing Personal Representative can help streamline the tasks involved.

To probate a will in Arkansas, you generally start by filing the will with the probate court in the county where the deceased person lived. You must also submit a petition for probate and notify heirs and beneficiaries. Once the court validates the will, it will appoint a personal representative to manage the estate. This process is guided by understanding the Arkansas Order Probating Will and Appointing Personal Representative.

In Arkansas, not every estate must go through probate. Generally, probate is required for estates that exceed a certain value or include specific assets. If an estate falls below that threshold or holds assets that are non-probate, the process may be simplified or avoided altogether. Understanding the Arkansas Order Probating Will and Appointing Personal Representative is crucial to navigating this process.

The time required to probate an estate in Arkansas can vary, but typically it takes several months. An Arkansas Order Probating Will and Appointing Personal Representative is a crucial first step in this process. Delays can occur due to various factors, such as the complexity of the estate or disputes among heirs. Using resources like US Legal Forms can help streamline this process, ensuring that you complete the necessary documents efficiently and correctly.

A personal representative is the individual designated to administer the estate according to the will, while a successor is generally the next person in line to inherit assets if the initial heir cannot or does not wish to accept the inheritance. In the context of the Arkansas Order Probating Will and Appointing Personal Representative, the personal representative carries out specific duties and responsibilities, whereas successors benefit from the estate's final distribution. Understanding these roles is crucial for a smooth probate process.