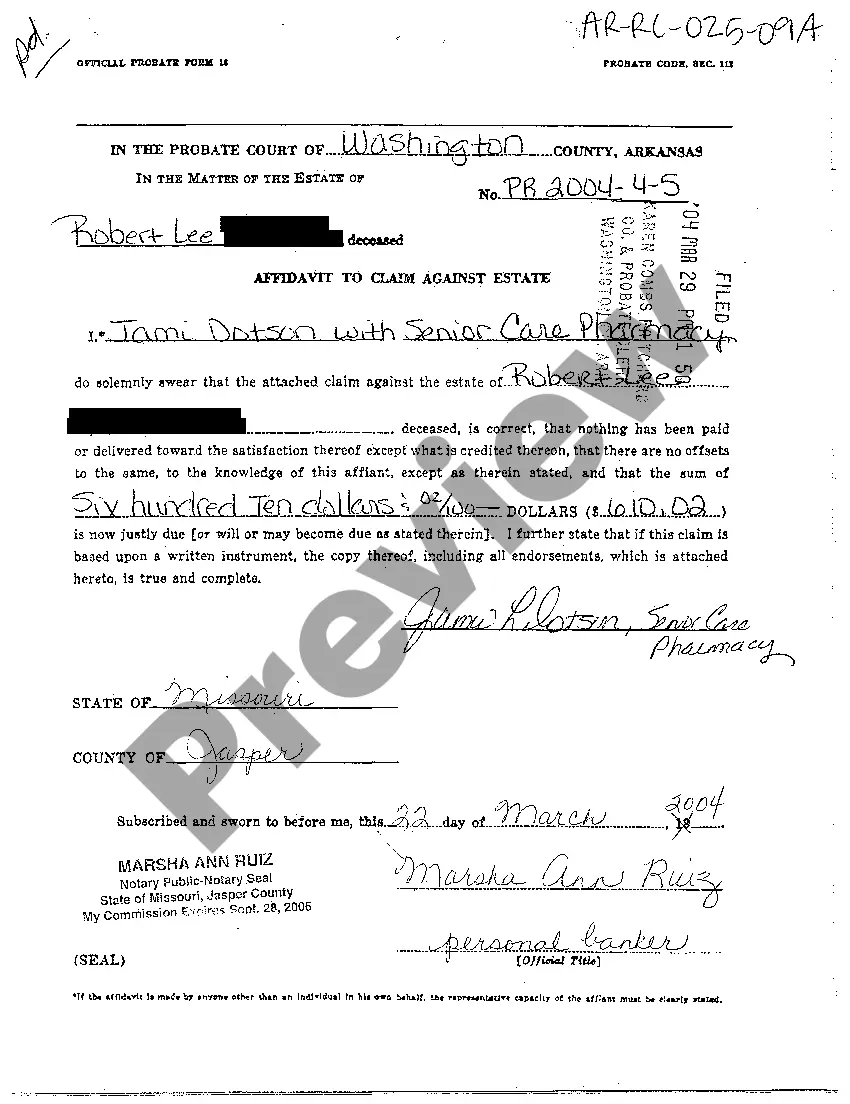

Arkansas Affidavit to Claim Against Estate

Description

How to fill out Arkansas Affidavit To Claim Against Estate?

Amid numerous complimentary and paid templates that you can discover online, you cannot be certain about their precision and dependability.

For instance, who authored them or if they possess the expertise needed to address your specific requirements.

Always remain calm and utilize US Legal Forms! Explore Arkansas Affidavit to Claim Against Estate examples crafted by experienced attorneys and avoid the expensive and time-consuming endeavor of searching for a lawyer and subsequently compensating them to draft a document for you that you can obtain independently.

Select a pricing plan, register for an account, process the payment via your credit/debit card or Paypal, and download the form in your desired file format. After registering and purchasing your subscription, you may utilize your Arkansas Affidavit to Claim Against Estate as many times as needed or as long as it remains valid in your region. Edit it with your chosen offline or online editor, complete it, sign it, and print a physical copy. Achieve more for less with US Legal Forms!

- If you already possess a subscription, Log In to your account and locate the Download button adjacent to the file you’re seeking.

- You will also be able to access your previously saved templates in the My documents section.

- If this is your first time using our website, follow the guidelines below to acquire your Arkansas Affidavit to Claim Against Estate effortlessly.

- Ensure that the document you see is valid in your jurisdiction.

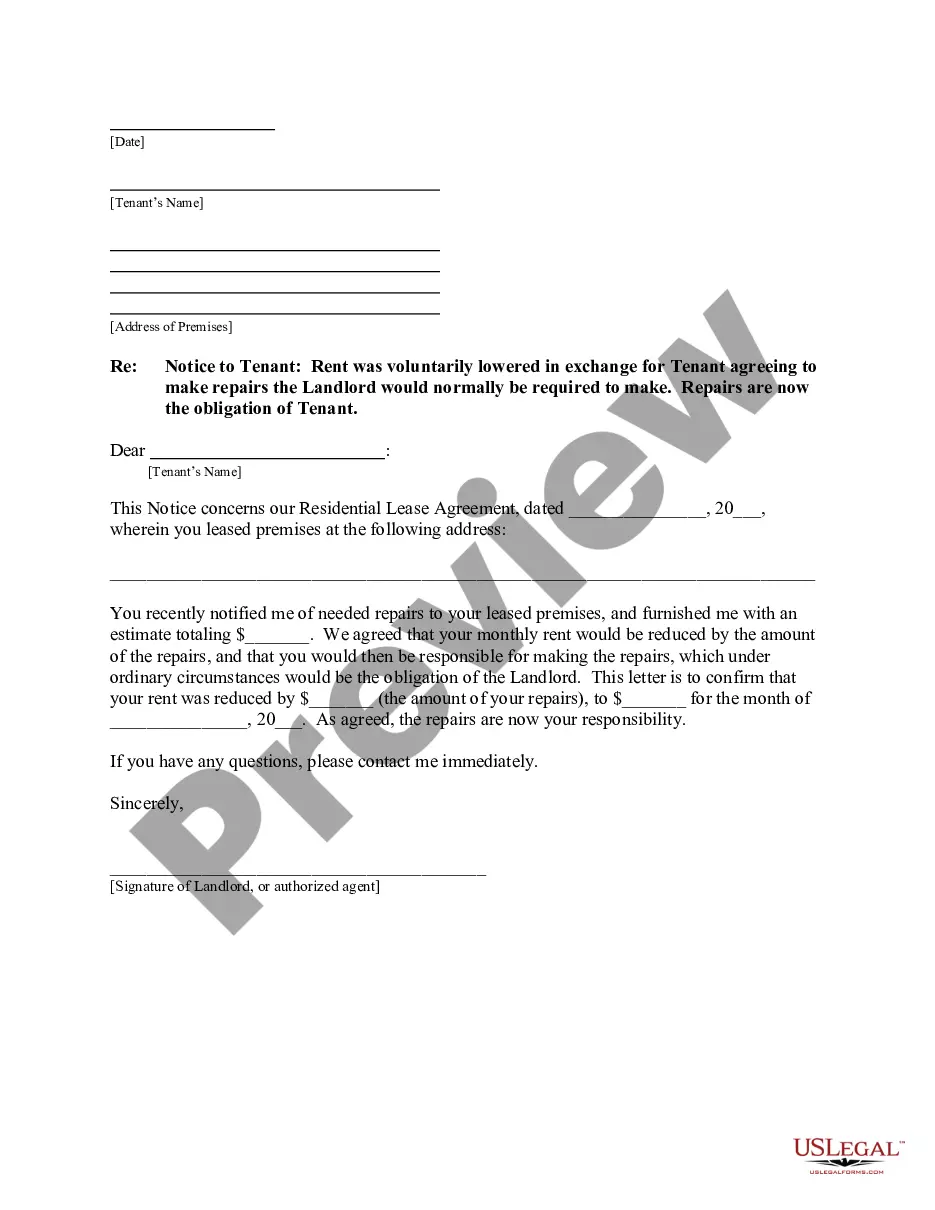

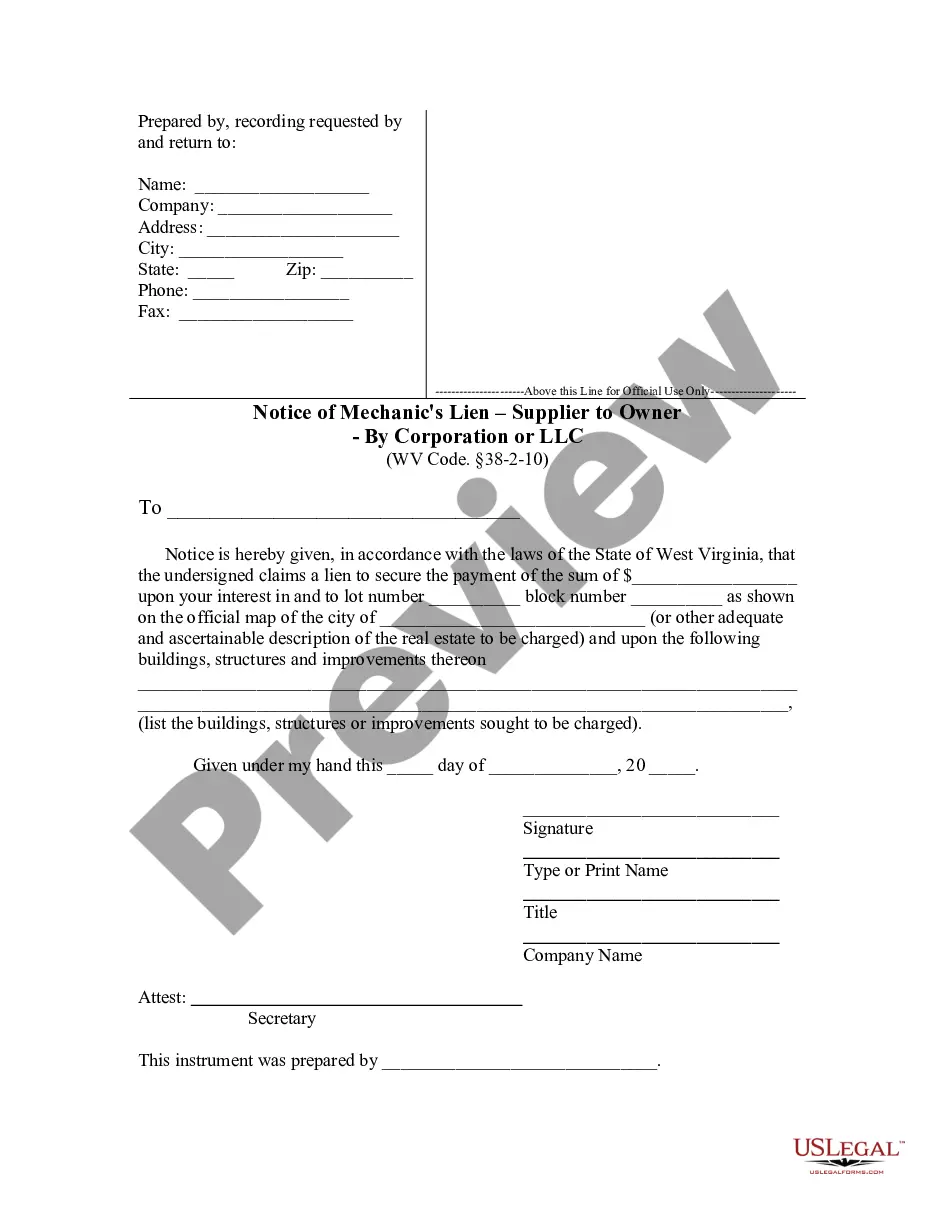

- Examine the template by reviewing the description using the Preview feature.

- Click Buy Now to initiate the purchasing process or search for another template using the Search field located in the header.

Form popularity

FAQ

In Arkansas, certain assets are exempt from the probate process, including life insurance policies with a named beneficiary, jointly owned assets, and retirement accounts. These exemptions can significantly ease the transfer of property after a person's passing, which can be especially relevant when considering the Arkansas Affidavit to Claim Against Estate. Utilizing resources like US Legal Forms can help you understand which of your assets may bypass probate effectively.

Contestants must file a written petition in the probate court to contest a will in Arkansas. This process requires you to demonstrate valid legal reasons for disputing the will, such as lack of capacity or undue influence. By doing so, you can present your standpoint effectively, particularly if concerns arise about the Arkansas Affidavit to Claim Against Estate. To streamline this process, you might find it beneficial to explore the services of US Legal Forms.

In Arkansas, creditors typically have a period of six months from the date of the decedent's death to submit their claims against the estate. This timeline is important because it means creditors must file an Arkansas Affidavit to Claim Against Estate within this timeframe. If they fail to do so, they may lose the right to collect their debts. To navigate these situations effectively, consider using the resources offered by US Legal Forms.

In Arkansas, you typically have three years from the date of death to file probate. However, it is wise to initiate the process as soon as possible to manage debts and distribute assets effectively. If you wait too long, you may lose the right to claim against the estate, including filing an Arkansas Affidavit to Claim Against Estate. Taking prompt action helps to ensure a smoother transition and preserves the wishes of the deceased.

If you don't file probate in Arkansas, the estate may remain unresolved, leading to complications for heirs and beneficiaries. Unsettled estates can cause disputes among family members, and debts may go unpaid, potentially impacting the value of the inheritance. Furthermore, without initiating an Arkansas Affidavit to Claim Against Estate, creditors might assert claims that complicate the distribution of assets. It’s advisable to file probate to safeguard your interests.

Estate administration in Arkansas refers to the process of managing the estate of a deceased person. This includes gathering assets, paying debts, and distributing property according to the will or state law. An Arkansas Affidavit to Claim Against Estate can be filed by creditors during this process to assert their claims and ensure they are considered before any asset distribution occurs. Proper administration is crucial to uphold the wishes of the decedent and to protect the rights of heirs.

To transfer a house after someone dies in Arkansas, you usually need to go through probate. The executor of the estate will manage this process, using an Arkansas Affidavit to Claim Against Estate when necessary to settle claims. This affidavit allows creditors to make their claims against the estate, helping to ensure all debts are resolved before any property transfers. It's important to have proper documentation and follow legal steps to avoid complications.

In Arkansas, an estate typically must exceed $100,000 in value for probate court involvement. If the estate’s worth falls below this limit, you can often utilize a small estate affidavit to settle claims. It's advisable to evaluate your situation early on to determine the best approach, possibly with assistance from US Legal Forms to simplify the filing process.

Avoiding probate in Arkansas can be achieved through several strategies, such as creating living trusts, joint ownership of property, or using payable-on-death accounts. Each option helps ensure that assets pass directly to beneficiaries without going through the probate process. By considering these tools early on, you can simplify future estate claims and enhance the effectiveness of the Arkansas Affidavit to Claim Against Estate.

To file as an administrator of an estate in Arkansas, you must submit a petition to the probate court along with requisite documentation, including the will (if available) and information about the deceased. The court will then review your application and issue letters of administration allowing you to manage the estate. For resources and forms, consider exploring US Legal Forms, where you can find guidance tailored to your needs.