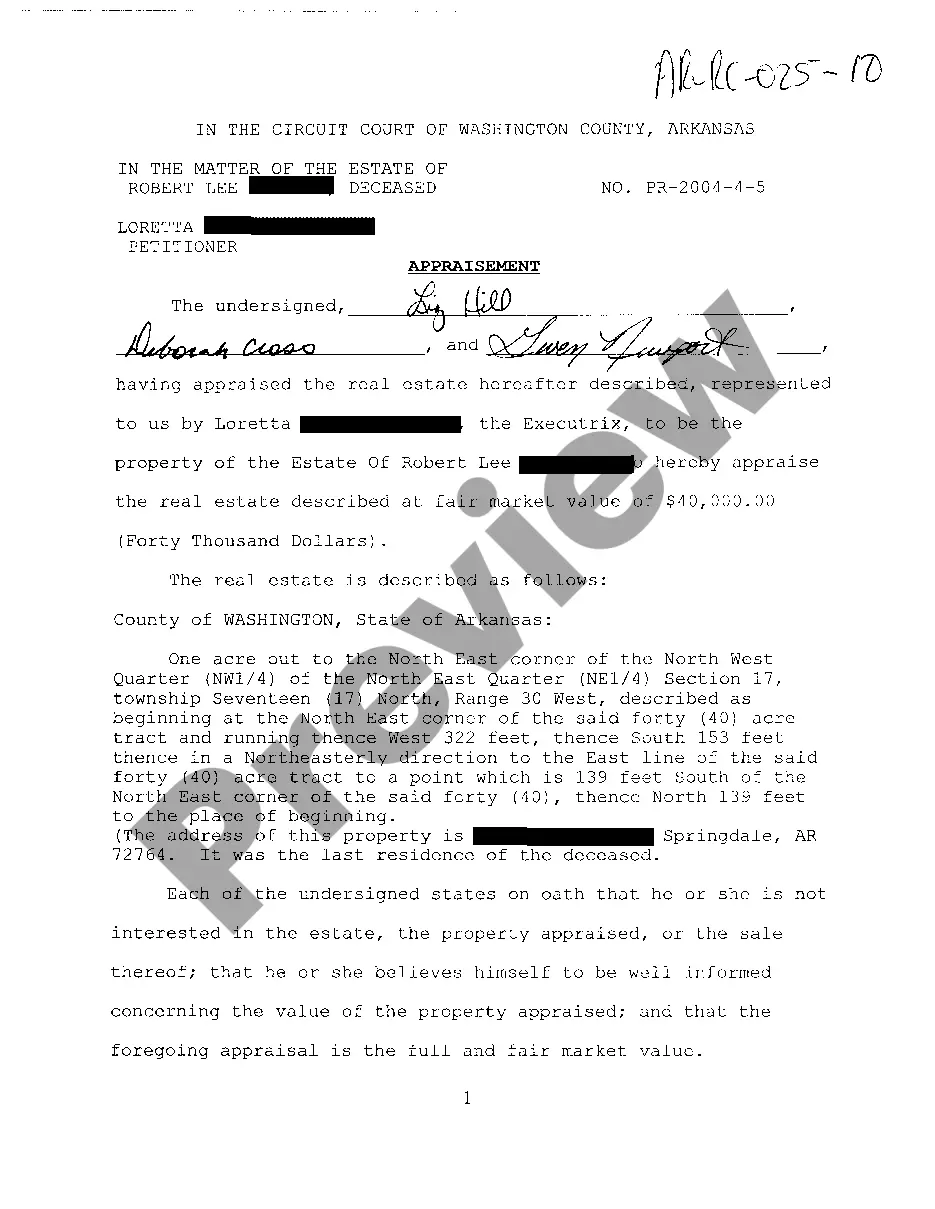

Arkansas Appraisement

Description

How to fill out Arkansas Appraisement?

Amid numerous complimentary and premium templates available online, you can't guarantee their precision and dependability.

For instance, who developed them or if they are sufficiently qualified to address your specific needs.

Always stay calm and utilize US Legal Forms! Find Arkansas Appraisal templates crafted by expert attorneys and avoid the costly and lengthy procedure of searching for a lawyer and then paying them to draft a document that you can find on your own.

Upon signing up and paying for your subscription, you can utilize your Arkansas Appraisal as many times as necessary or for as long as it remains valid in your area. Modify it in your preferred editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you have a membership, sign in to your account and find the Download button beside the form you need.

- You'll also have access to your previously downloaded files in the My documents section.

- If you're using our platform for the first time, follow the steps below to obtain your Arkansas Appraisal quickly.

- Ensure that the document you see is valid in your area.

- Review the file by reading the details using the Preview feature.

- Click Buy Now to initiate the payment process or search for another example using the Search bar located at the top.

Form popularity

FAQ

Arkansas does not have specific laws regarding dowries, and it does not operate under dowry customs. Instead, Arkansas laws focus on equitable distribution of marital property during divorce proceedings. For those interested in matters of property division, an Arkansas appraisement can help clarify the value of assets and ensure a fair resolution. If you have questions about property rights in Arkansas, USLegalForms offers resources to guide you.

Arkansas is best known for its rich natural beauty and diverse attractions. From the scenic Ozark Mountains to the vibrant Hot Springs National Park, the state offers various outdoor activities. Additionally, Arkansas is a hub for the history of the Civil Rights Movement and the birthplace of former President Bill Clinton. Understanding Arkansas through an Arkansas appraisement can provide deeper insights into its cultural and historical significance.

To establish residency in Arkansas, you must first physically reside in the state for a designated period. You can demonstrate your intent to stay by obtaining a local driver's license, registering to vote, and filing your taxes in Arkansas. Additionally, you might need to maintain a permanent address and prove your financial independence. Once you meet these requirements, you'll enjoy benefits like lower Arkansas appraisement rates and access to local services.

In Arkansas, you have up to three years from the date of death to file probate. However, it is advisable to initiate the process sooner to ensure proper management of the estate. Timely filing will also allow for accurate Arkansas Appraisement and quicker resolution of any estate-related matters. Acting promptly helps beneficiaries receive their inheritance without undue delay.

Probate is generally mandatory in Arkansas for estates that exceed the value limit or that require an official process to settle debts. While smaller estates may qualify for simplified procedures, larger estates must follow the full probate process. Understanding Arkansas Appraisement can assist in assessing whether the estate will need to go through probate, ensuring all legal requirements are met.

In Arkansas, any estate valued over $100,000 typically requires probate. This threshold applies to the total assets within the estate, excluding certain exemptions. Utilizing Arkansas Appraisement can provide a clear picture of the estate's worth, helping you determine if probate is necessary. It is wise to consult with a legal expert to navigate this process effectively.

Yes, Arkansas law imposes time limits on the probate process. Generally, you must file for probate within three years of the decedent's death. However, it is crucial to act sooner to facilitate the proper appraisal of the estate, especially through Arkansas Appraisement. Delays can complicate the distribution of assets to beneficiaries.

To file a claim against an estate in Arkansas, you must prepare and submit a written claim to the executor or administrator. This claim should detail the amount you are owed and the basis for your claim. Importantly, following the Arkansas Appraisement process can help establish the total value of the estate, making it easier to navigate claims. You should act promptly, as there are deadlines for submitting claims.

If you do not file probate in Arkansas, the estate may face several complications. Assets may remain in limbo, and beneficiaries could be left without their rightful inheritance. Additionally, debts of the deceased may go unpaid, as creditors cannot collect without a probate process. It is essential to understand the role of Arkansas Appraisement in evaluating the estate's assets to avoid these issues.

In Arkansas, the Associate Appraiser license requires the least amount of schooling compared to other appraisal licenses. To qualify, you need only 75 hours of approved education and to complete a certain amount of supervised experience. While it allows entry into the appraisal profession, your goal should be to accumulate more experience and education for higher-level credentials as you grow in your Arkansas appraisement career.