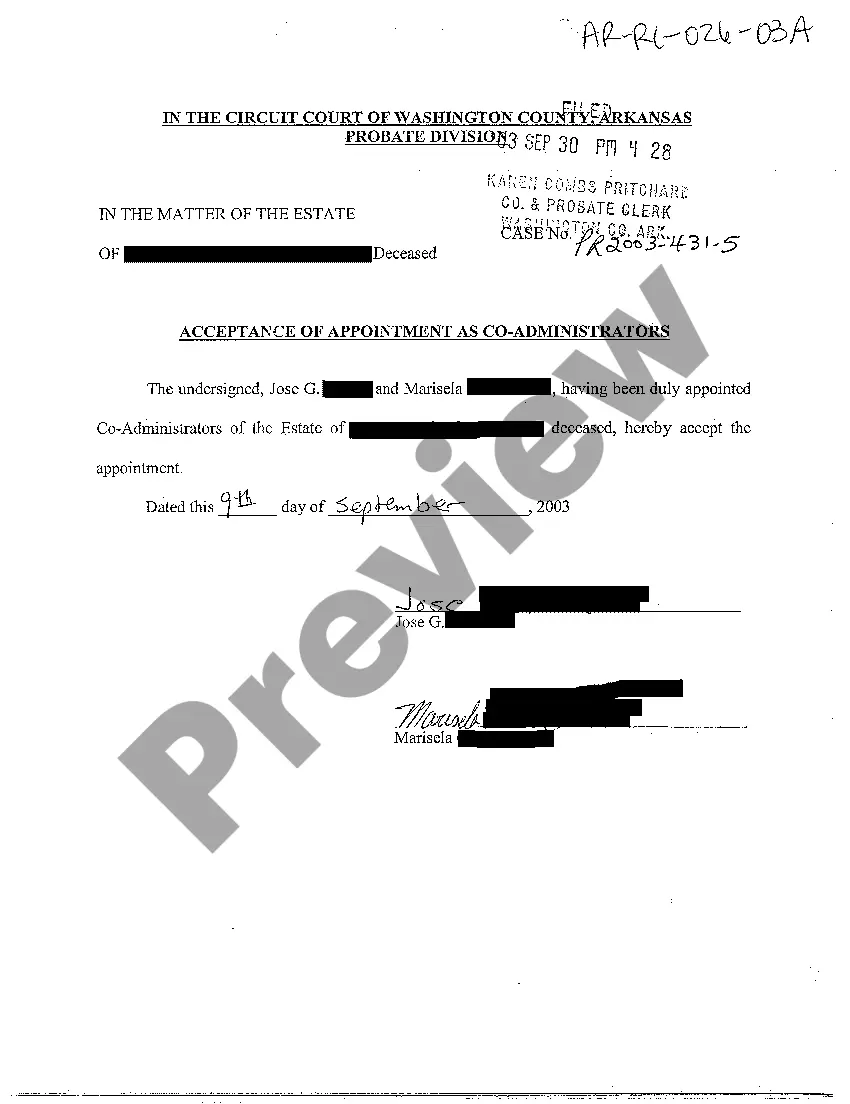

Arkansas Acceptance of Appointment as Co-Administrators

Description

How to fill out Arkansas Acceptance Of Appointment As Co-Administrators?

Among many complimentary and paid examples you discover online, you cannot guarantee their precision and dependability.

For instance, who produced them or if they are proficient enough to manage the task you require them for.

Always remain calm and make use of US Legal Forms!

Choose a payment plan, create an account, pay for the subscription using your credit/debit card or Paypal, download the form in the desired format. After you’ve registered and paid for your subscription, you can utilize your Arkansas Acceptance of Appointment as Co-Administrators as many times as you wish or as long as it remains valid in your state. Edit it with your chosen editor, complete it, sign it, and produce a printed version. Achieve more for less with US Legal Forms!

- Find Arkansas Acceptance of Appointment as Co-Administrators templates created by experienced lawyers and avoid the expensive and lengthy process of searching for an attorney and then compensating them to prepare a document for you that you can effortlessly locate yourself.

- If you have a membership, Log In to your account and locate the Download button adjacent to the form you are looking for.

- You will also have the ability to view your previously saved templates in the My documents section.

- If you are using our service for the first time, adhere to the instructions below to easily obtain your Arkansas Acceptance of Appointment as Co-Administrators.

- Ensure that the document you see is applicable in the state where you reside.

- Examine the template by reviewing the description using the Preview feature.

- Click Buy Now to initiate the purchasing process or search for another template using the Search box in the header.

Form popularity

FAQ

In Arkansas, an estate must generally be valued at over $100,000 to require probate. This threshold determines whether the court will oversee the distribution of assets. However, some smaller estates may qualify for simplified procedures, which can expedite the process. For those navigating these requirements, US Legal Forms offers resources to help understand Arkansas Acceptance of Appointment as Co-Administrators and ensure compliance.

To obtain a letter of testamentary in Arkansas, you must first file a petition for probate with the appropriate court. This document is essential for proving your authority to act on behalf of the decedent's estate. Once the court grants the petition, you will receive the letter, enabling you to manage estate affairs. Utilizing a platform like US Legal Forms can simplify this process by providing the necessary forms and guidance tailored for Arkansas Acceptance of Appointment as Co-Administrators.

Non-probate assets in Arkansas encompass assets that pass directly to beneficiaries without going through the probate process. This includes joint bank accounts, payable-on-death accounts, and properties held in trust. Utilizing the knowledge of Arkansas Acceptance of Appointment as Co-Administrators positions you to manage both probate and non-probate assets effectively, ensuring a smoother estate distribution.

Certain assets are exempt from probate in Arkansas. Common exempt assets include life insurance policies, retirement accounts with named beneficiaries, and properties held in joint tenancy. By understanding these exemptions, you can streamline the estate settlement process. Leveraging the Arkansas Acceptance of Appointment as Co-Administrators can also help manage these specific assets more efficiently.

In Arkansas, not every estate is required to go through probate. Generally, small estates with limited assets may qualify for simplified procedures that avoid the lengthy probate process. However, if the estate includes significant property or unresolved debts, then probate becomes necessary. Understanding the Arkansas Acceptance of Appointment as Co-Administrators can help you navigate this process effectively.

If you need to file for contempt of court in Arkansas without a lawyer, you can do so by preparing the proper forms and submitting them to the court. It involves clearly outlining how the other party has failed to adhere to the court's order. Being precise in your documentation is key to successfully filing. US Legal Forms can help you find and complete the necessary forms to streamline this process.

Statute 28-41-101 in Arkansas pertains to the general provisions regarding the appointment of personal representatives. It establishes the requirements and legal conditions under which individuals can accept appointments, including co-administrators. Knowing this statute is essential for any party involved in estate management. US Legal Forms provides comprehensive guidance and forms to help you navigate this process efficiently.

Arkansas Code 28 40 111 addresses the appointment of personal representatives for deceased estates. This code provides a legal framework for individuals seeking to manage estates, ensuring they were appointed correctly and in compliance with state law. Understanding this code facilitates a smoother appointment of co-administrators as needed. For more detailed assistance, check out US Legal Forms, which offers resources relevant to this code.

To file as an administrator of an estate in Arkansas, you must complete and submit the appropriate forms to the probate court in the county where the deceased resided. The process typically includes providing proof of the deceased's death, a petition for administration, and potentially posting bond. Making sure you are following the legal guidelines is vital for a smooth process, and US Legal Forms can assist you in obtaining the correct documentation.

In Arkansas, you do need to file a will with the court after the death of the testator. Filing the will initiates the probate process, allowing the estate to be administered properly. Even if you hold property jointly, filing the will is beneficial so that all aspects of the estate are handled in accordance with the deceased's wishes. Utilizing the US Legal Forms platform can help simplify this filing process.