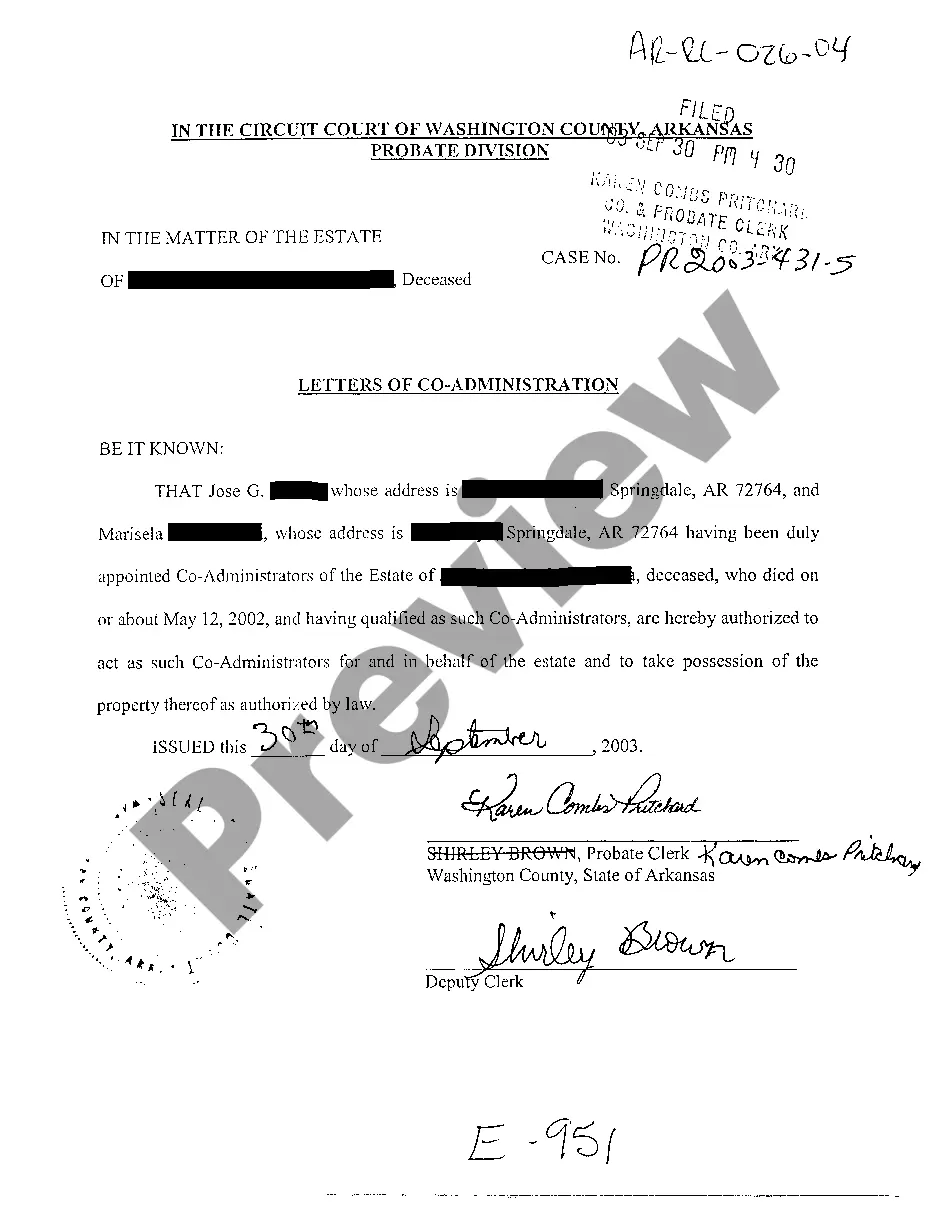

Arkansas Letters of Co-Administrators

Description

How to fill out Arkansas Letters Of Co-Administrators?

Among numerous paid and complimentary examples that you find online, you cannot guarantee their precision and dependability.

For instance, who produced them or if they are qualified enough to handle what you require them for.

Stay calm and utilize US Legal Forms!

Do more for less with US Legal Forms!

- Obtain Arkansas Letters of Co-Administrators templates crafted by experienced legal professionals and avoid the expensive and lengthy process of searching for a lawyer and then paying them to draft a document for you that you can locate yourself.

- If you already possess a subscription, sign in to your account and locate the Download button next to the form you need.

- You will also be able to view all your previously acquired documents in the My documents section.

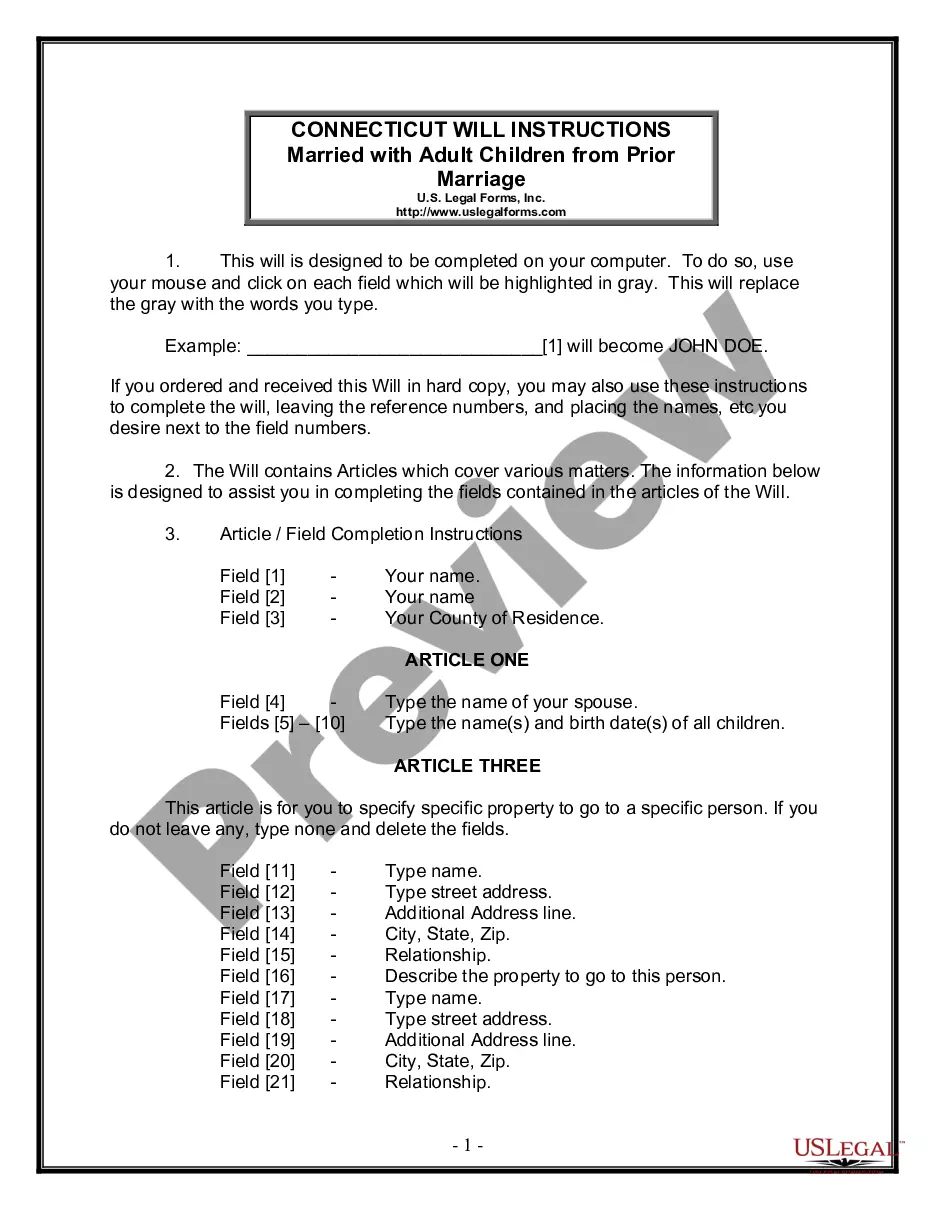

- If you are using our platform for the first time, follow the instructions below to obtain your Arkansas Letters of Co-Administrators swiftly.

- Ensure that the document you find is applicable in the state where you reside.

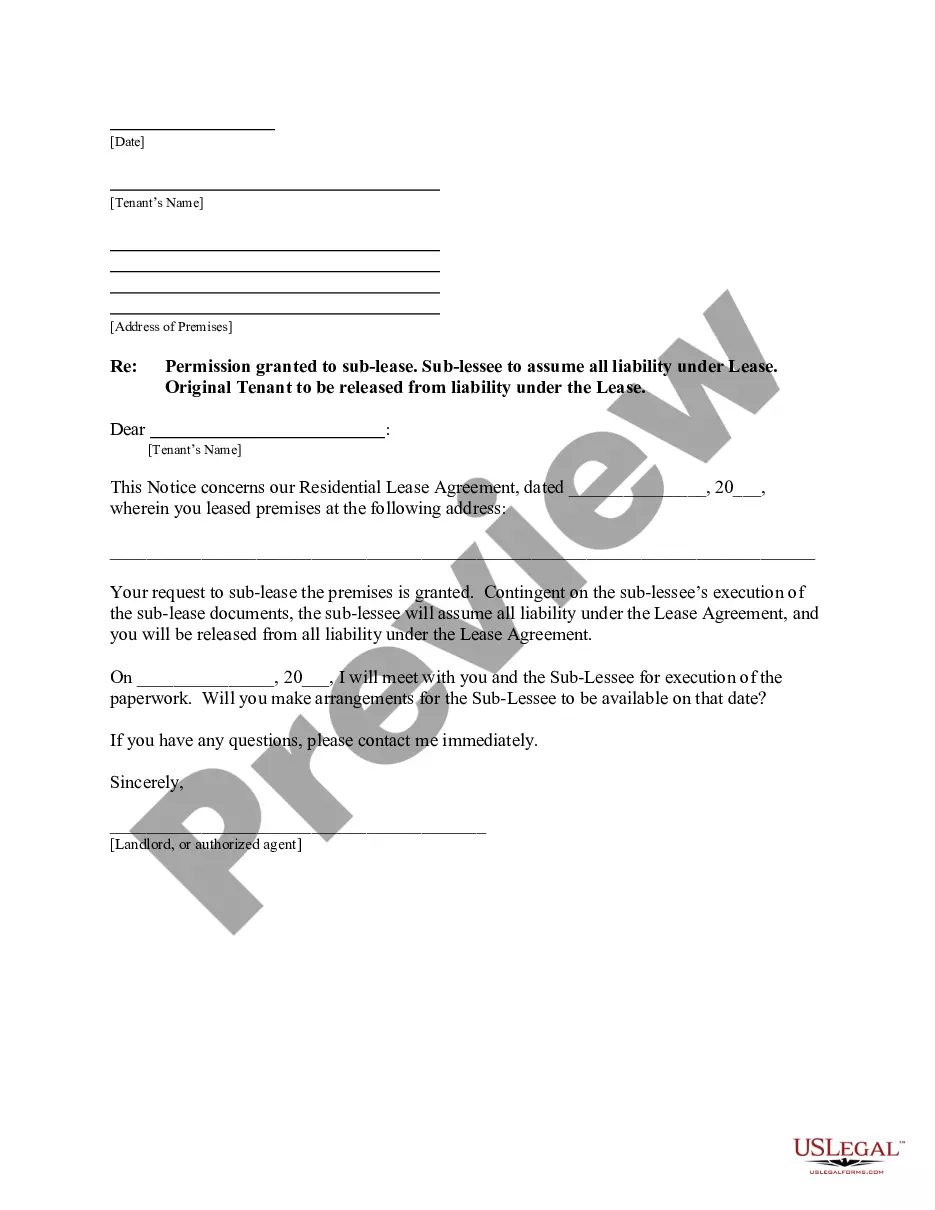

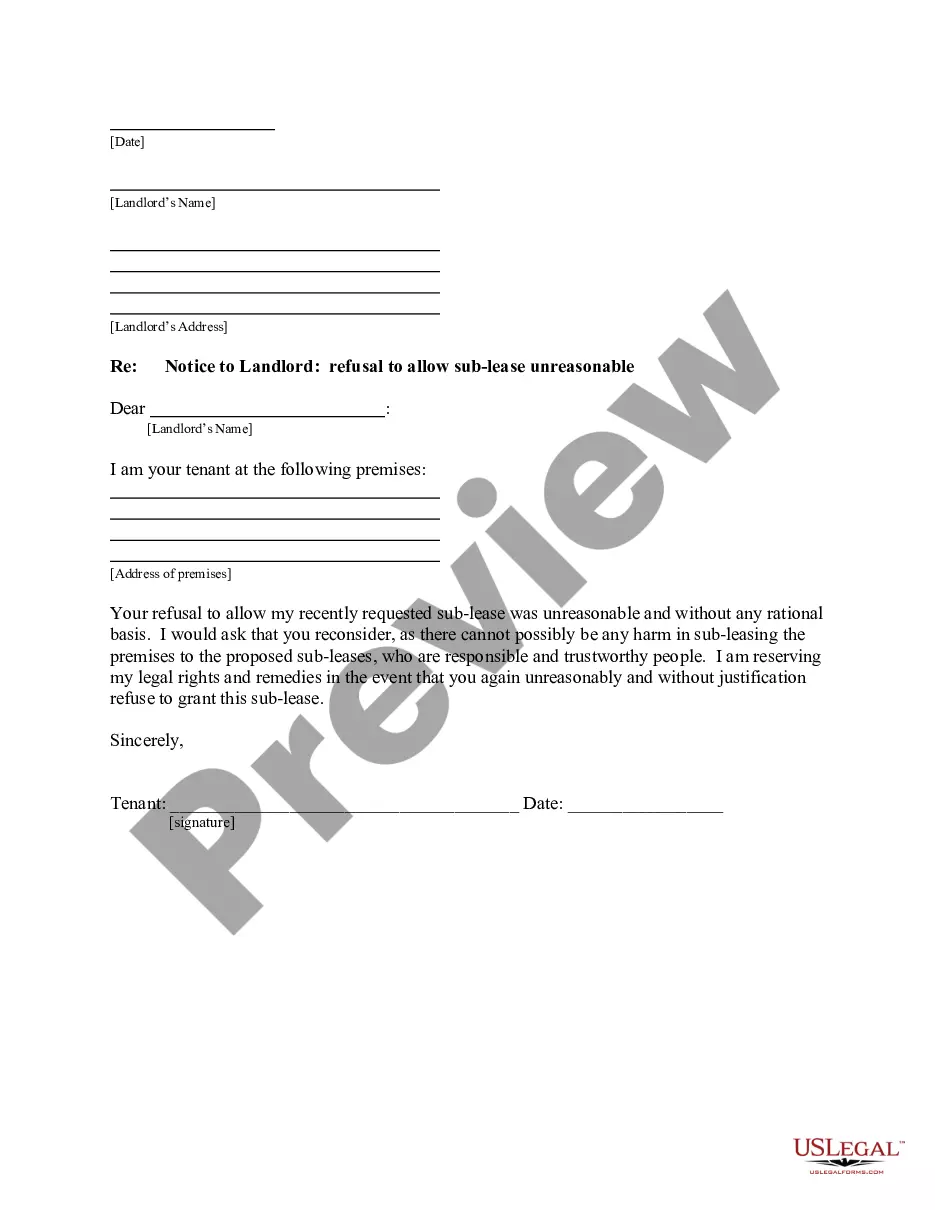

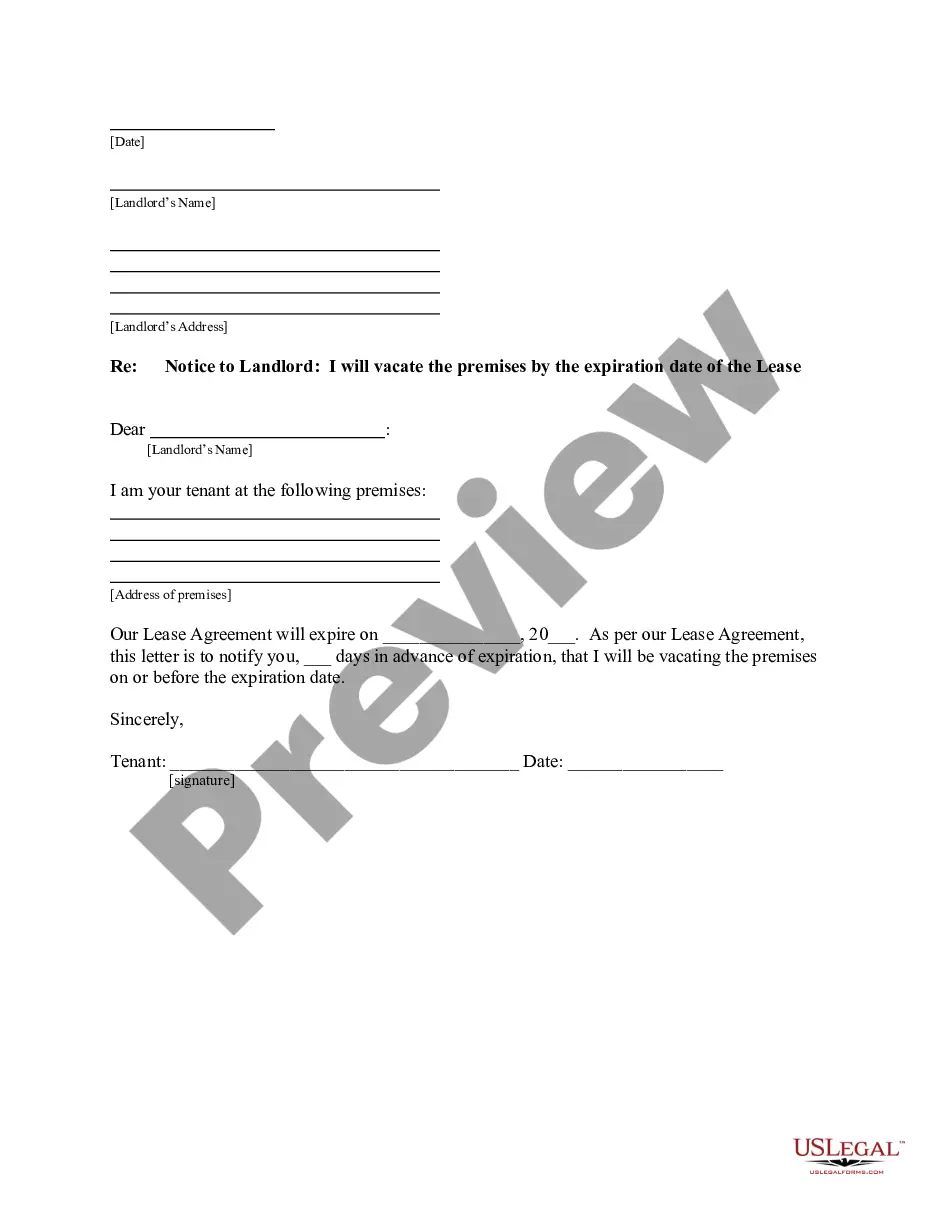

- Examine the template by reading the description using the Preview function.

Form popularity

FAQ

Not all estates in Arkansas must go through probate. If the estate is small enough or if it consists primarily of non-probate assets, it may bypass the process entirely. However, estates with larger values or certain asset types typically require probate. In instances where probate is necessary, Arkansas Letters of Co-Administrators can facilitate this process and ensure proper management of the estate.

In Arkansas, certain assets are exempt from probate, meaning they do not require a court process to transfer ownership. These include property held in joint tenancy, assets in a living trust, and accounts with payable-on-death designations. Knowing which assets are exempt allows for quicker access to your estate for your loved ones. If needed, Arkansas Letters of Co-Administrators can assist in navigating any remaining matters.

Non-probate assets in Arkansas include assets that pass directly to beneficiaries without going through probate. Common examples are life insurance policies, retirement accounts, and jointly owned property. These assets typically have designated beneficiaries who can claim them directly upon your passing. Understanding this can help you manage your estate more efficiently.

To avoid probate in Arkansas, you can take several steps. Consider establishing a living trust to hold your assets, as this can bypass the probate process. Additionally, you can name beneficiaries on your accounts and property, which allows these assets to transfer directly. Using Arkansas Letters of Co-Administrators can also streamline matters if probate is necessary.

In Arkansas, there is no specific minimum estate value that requires probate. However, if the estate includes real property or significant financial assets, it is advisable to go through the probate process. This allows for the appropriate handling of debts and asset distribution through Arkansas Letters of Co-Administrators. Consulting a legal professional or using services from USLegalForms can help clarify your situation.

If you don’t file probate in Arkansas, the deceased person's assets may not be distributed according to their wishes. This oversight can lead to legal complications, including potential claims from creditors. Additionally, without filing, you cannot obtain Arkansas Letters of Co-Administrators, which are needed to manage the estate. Taking proactive steps is crucial to navigate estate matters effectively.

To obtain a letter of testamentary in Arkansas, the executor must file a petition for probate with the local court. This petition must include a death certificate and the will, if one exists. Once the court approves the petition, you’ll receive the letter of testamentary, which authorizes you to administer the estate. Utilizing tools like USLegalForms can simplify the preparation of necessary documents.

In Arkansas, you typically have three years to file for probate after someone’s death. However, starting the probate process earlier is often advisable to avoid complications. Filing promptly allows you to secure Letters of Co-Administrators, which you need for managing the estate. Efficient and timely filing can ease a considerable amount of stress involved in estate management.

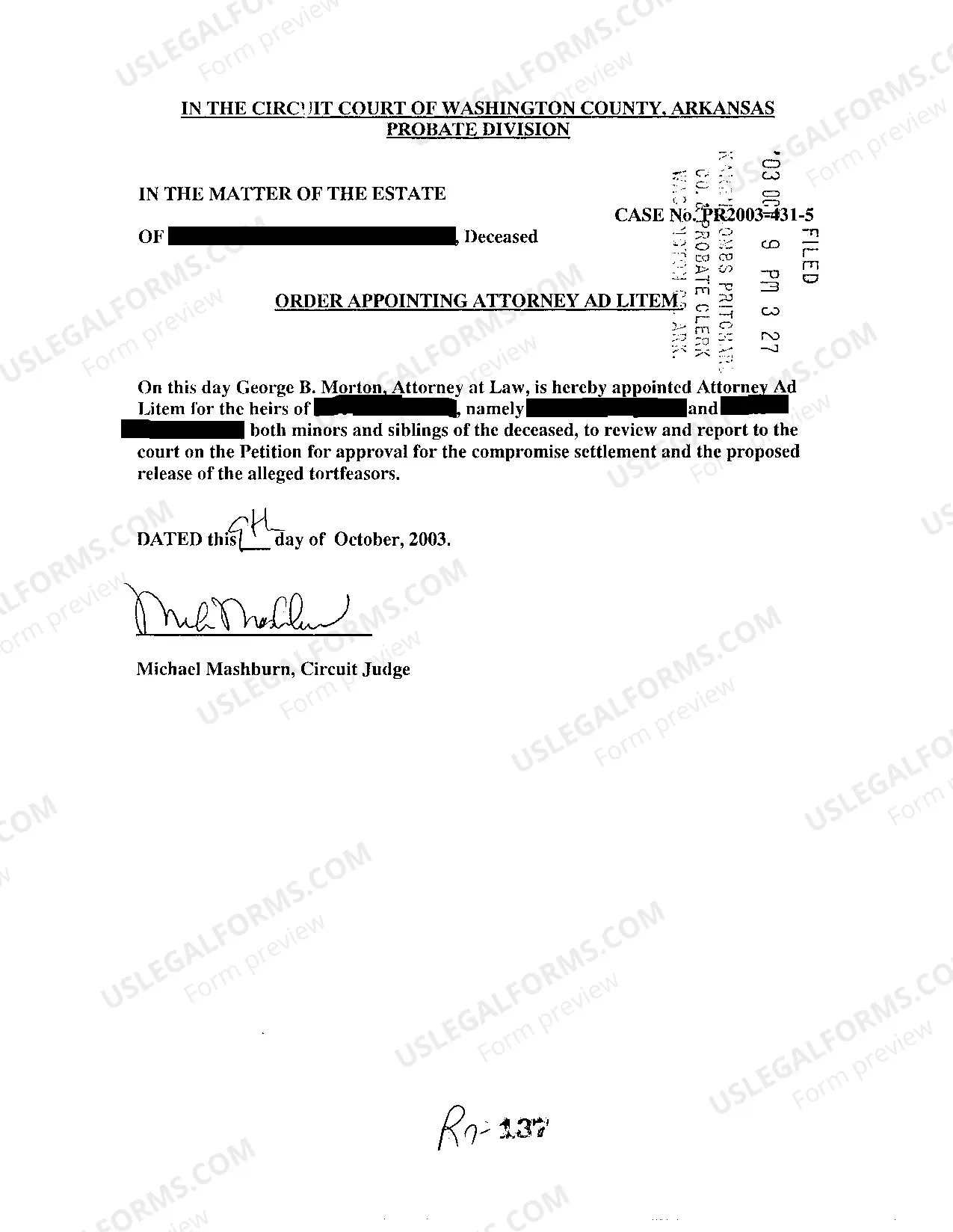

To file for the role of administrator of an estate in Arkansas, you need to submit a petition to the probate court. This petition must include various documents, including the death certificate and possibly a list of heirs. Once approved, you will receive Arkansas Letters of Co-Administrators, empowering you to manage the deceased’s estate. Consider using resources from USLegalForms for step-by-step guidance on the paperwork.

Estate administration in Arkansas involves managing and distributing a deceased person's assets after their passing. The appointed administrators handle debts, taxes, and the distribution of remaining assets to beneficiaries. It’s essential to obtain Arkansas Letters of Co-Administrators to ensure that this process operates smoothly. This legal approval allows you to act responsibly on behalf of the estate.