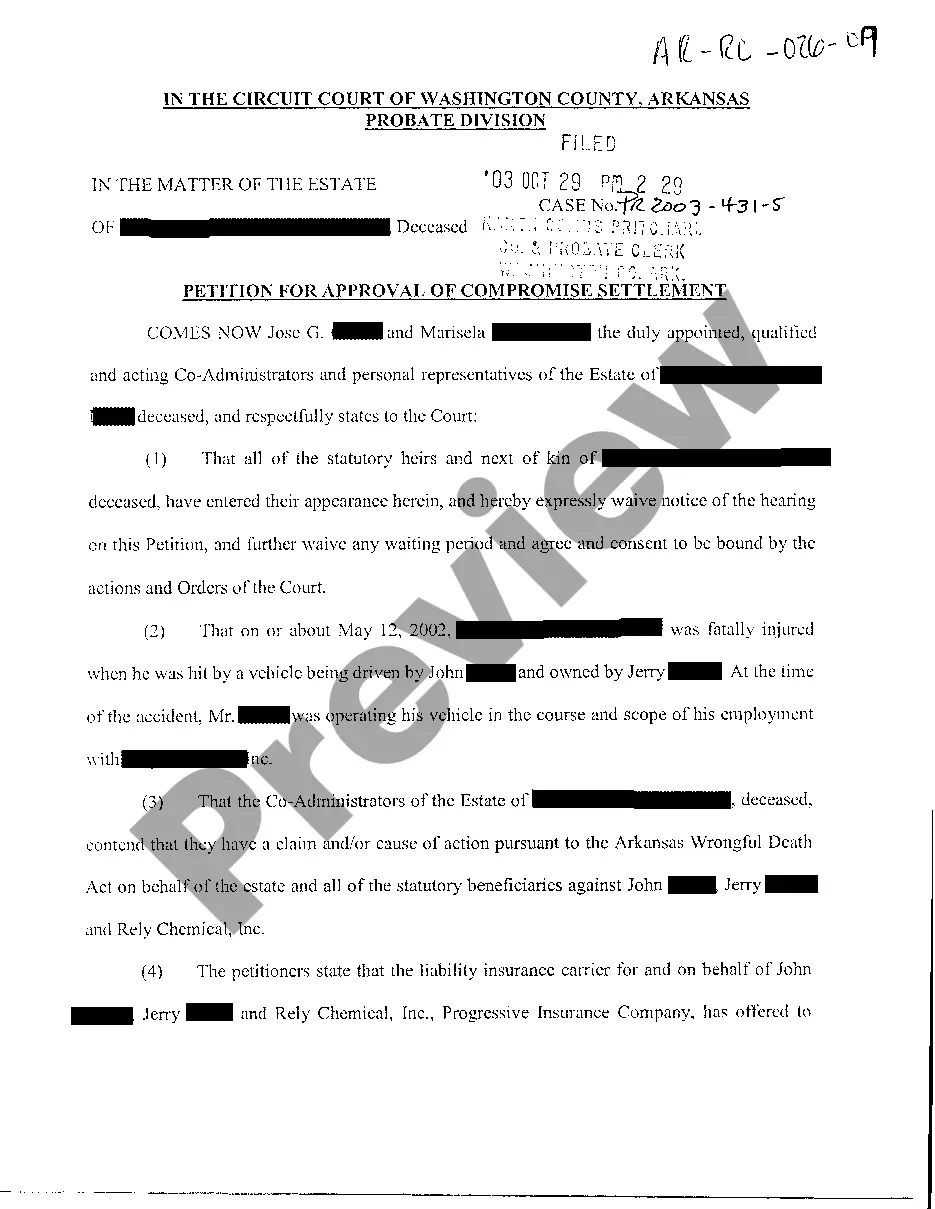

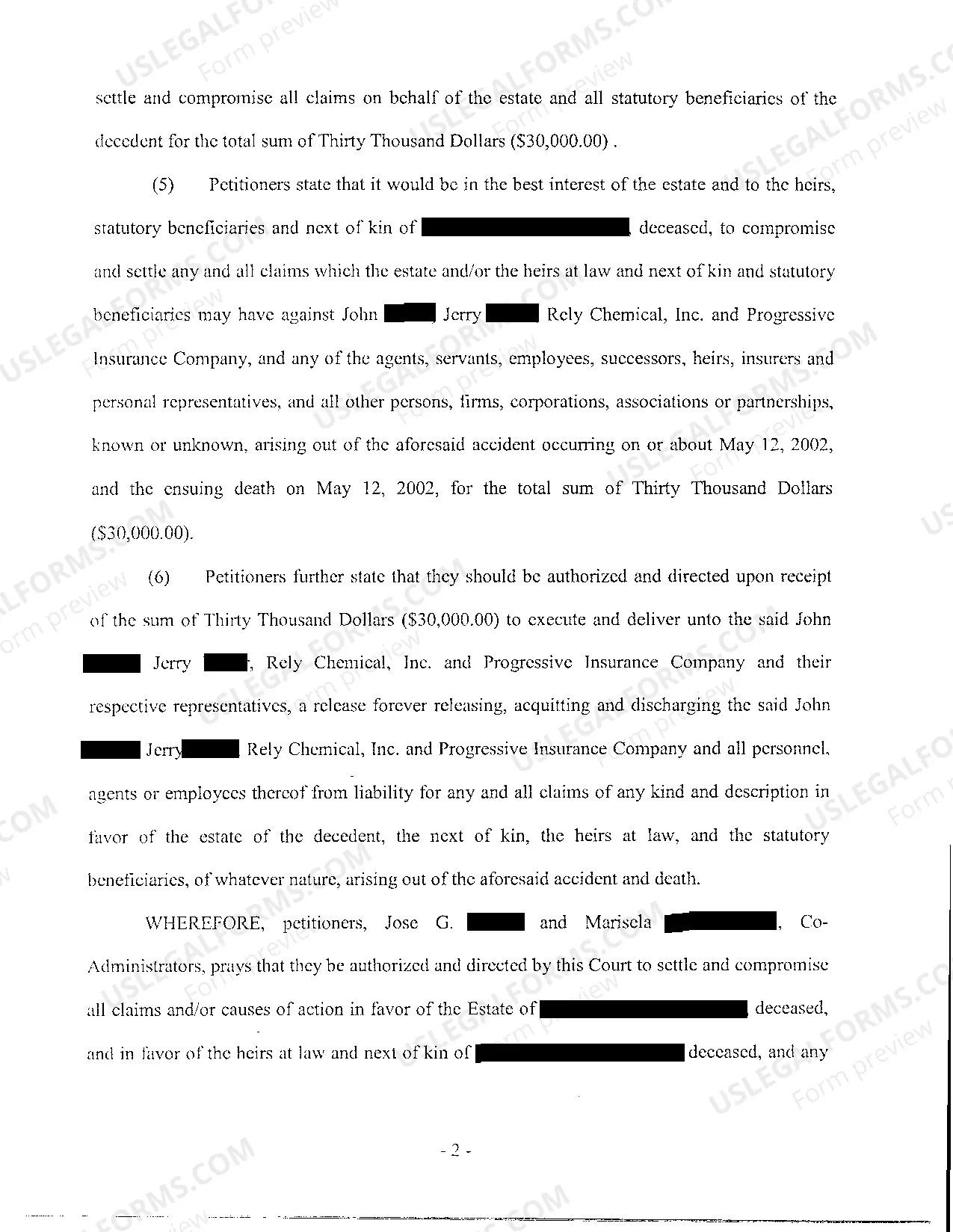

Arkansas Petition For Approval of Compromise Settlement

Description

How to fill out Arkansas Petition For Approval Of Compromise Settlement?

Among countless paid and complimentary templates available on the web, you can't guarantee their precision and dependability.

For instance, who designed them or if they possess enough qualifications to handle what you need from them.

Stay composed and make use of US Legal Forms! Uncover Arkansas Petition For Approval of Compromise Settlement samples crafted by skilled attorneys and evade the costly and lengthy process of searching for a lawyer and subsequently having to compensate them to draft a document that you can acquire on your own.

Once you have registered and made payment for your subscription, you can utilize your Arkansas Petition For Approval of Compromise Settlement as frequently as needed or for as long as it remains valid in your state. Modify it with your preferred offline or online editor, complete it, sign it, and print it. Achieve much more for less with US Legal Forms!

- If you hold a subscription, Log In to your account and locate the Download button adjacent to the form you are seeking.

- You will also be able to view your previously saved documents in the My documents section.

- If you are using our platform for the initial time, adhere to the guidelines listed below to obtain your Arkansas Petition For Approval of Compromise Settlement swiftly.

- Ensure that the document you observe is legitimate in your state.

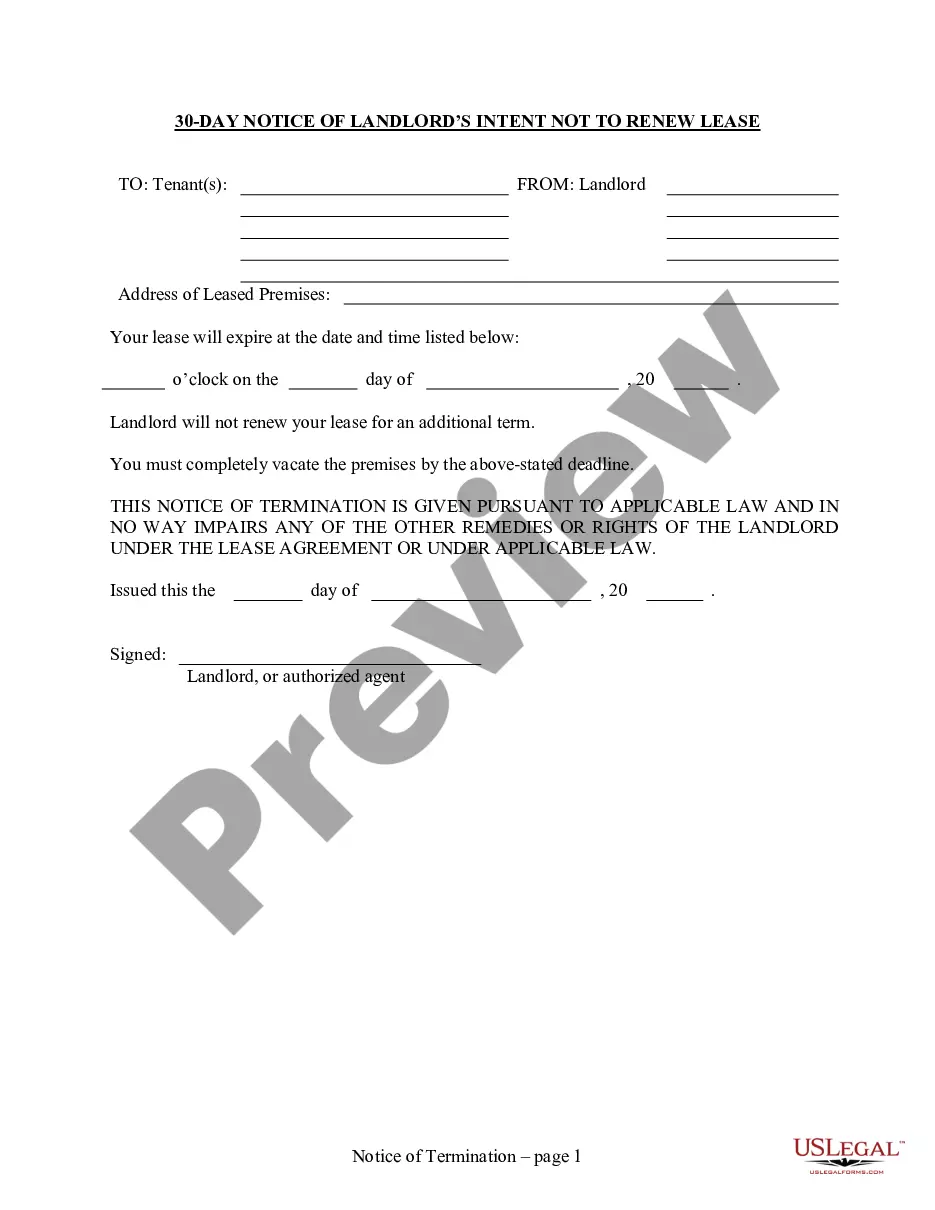

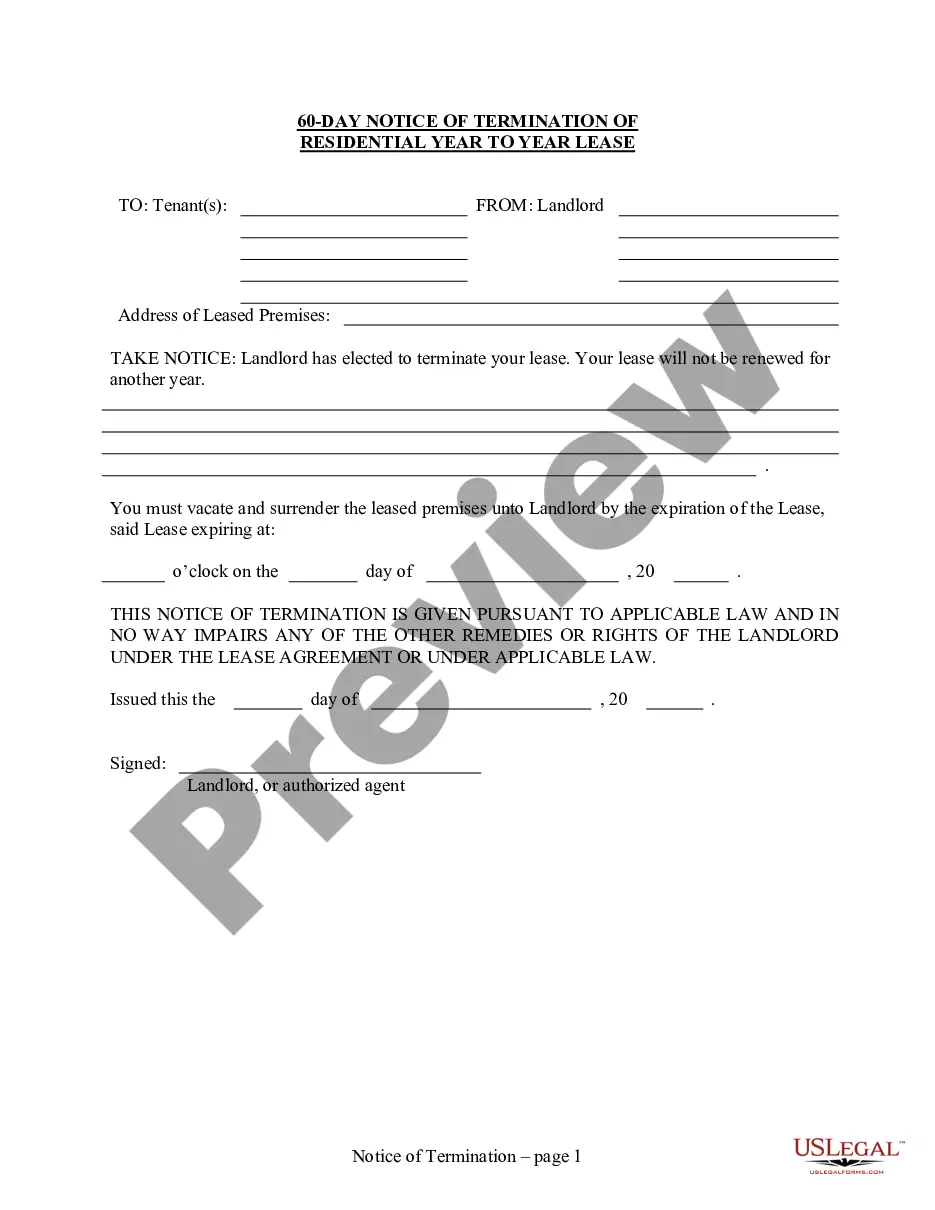

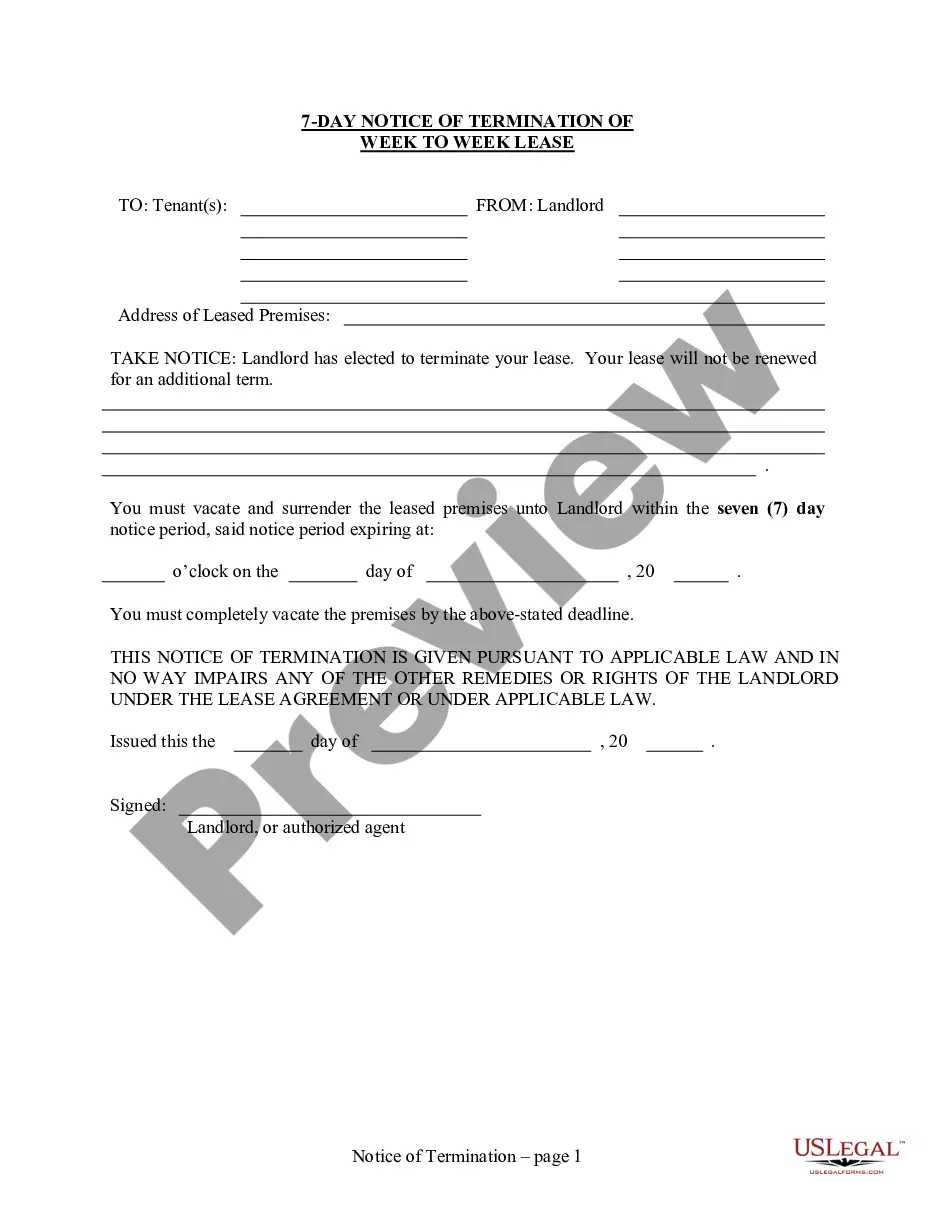

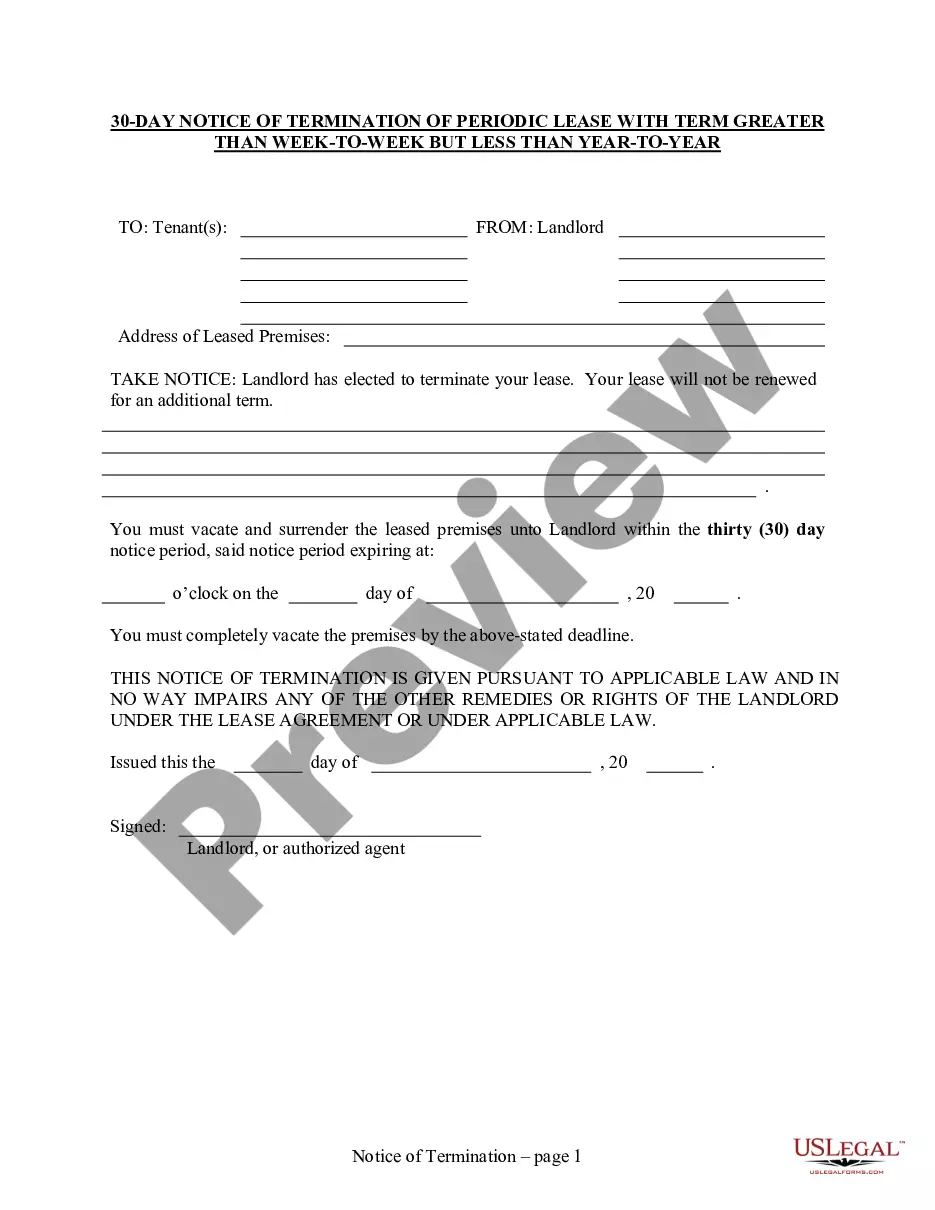

- Examine the file by reviewing the information for utilizing the Preview function.

- Click Buy Now to initiate the purchasing process or search for another template using the Search feature in the header.

Form popularity

FAQ

A writ of replevin in Arkansas is a court order that allows a person to reclaim possession of personal property that they own, which is being wrongfully held by another party. This legal action is crucial when ownership is disputed, ensuring rightful owners can recover their possessions. If you are considering an Arkansas Petition For Approval of Compromise Settlement, knowing about writs like replevin can enhance your ability to resolve disputes effectively.

A writ of possession in Arkansas authorizes the rightful landlord or property owner to regain possession of a property after a tenant has failed to comply with a lease agreement. This legal document is essential for ensuring that property owners can recover their asset efficiently. If you're involved in a case and have filed an Arkansas Petition For Approval of Compromise Settlement, understanding this process will be vital for securing your rights.

A petition to revoke in Arkansas allows a party to request the court to annul a previous order or ruling. This process is essential when significant changes occur in circumstances or if new evidence emerges that could affect the initial decision. If you have filed an Arkansas Petition For Approval of Compromise Settlement, understanding the petition revoke process may be crucial for your case.

To set up a payment plan for Arkansas state taxes, you should contact the Arkansas Department of Finance and Administration. They offer options to help you spread out payments based on your financial situation. Utilizing an Arkansas Petition For Approval of Compromise Settlement might also allow you to negotiate more favorable terms during this process.

Arkansas is primarily a tax lien state, but it does have tax deed sales for properties that have gone through the lien process without payment. In this scenario, the property can be sold to recoup the unpaid taxes. If you find yourself in this situation, submitting an Arkansas Petition For Approval of Compromise Settlement prior to the sale can be a beneficial step.

Yes, Arkansas operates as a tax lien state, meaning the government can place a lien on your property for unpaid taxes. This system allows the government to claim priority over other creditors. If faced with a tax lien, exploring an Arkansas Petition For Approval of Compromise Settlement can be an effective option to resolve your tax issues.

The statute of limitations for a tax lien in Arkansas is generally three years, but this period can vary depending on specific circumstances. Once this timeframe passes, the state can no longer enforce the lien, but it may remain public record. Understanding this timeline is crucial for property owners especially when considering options like the Arkansas Petition For Approval of Compromise Settlement.