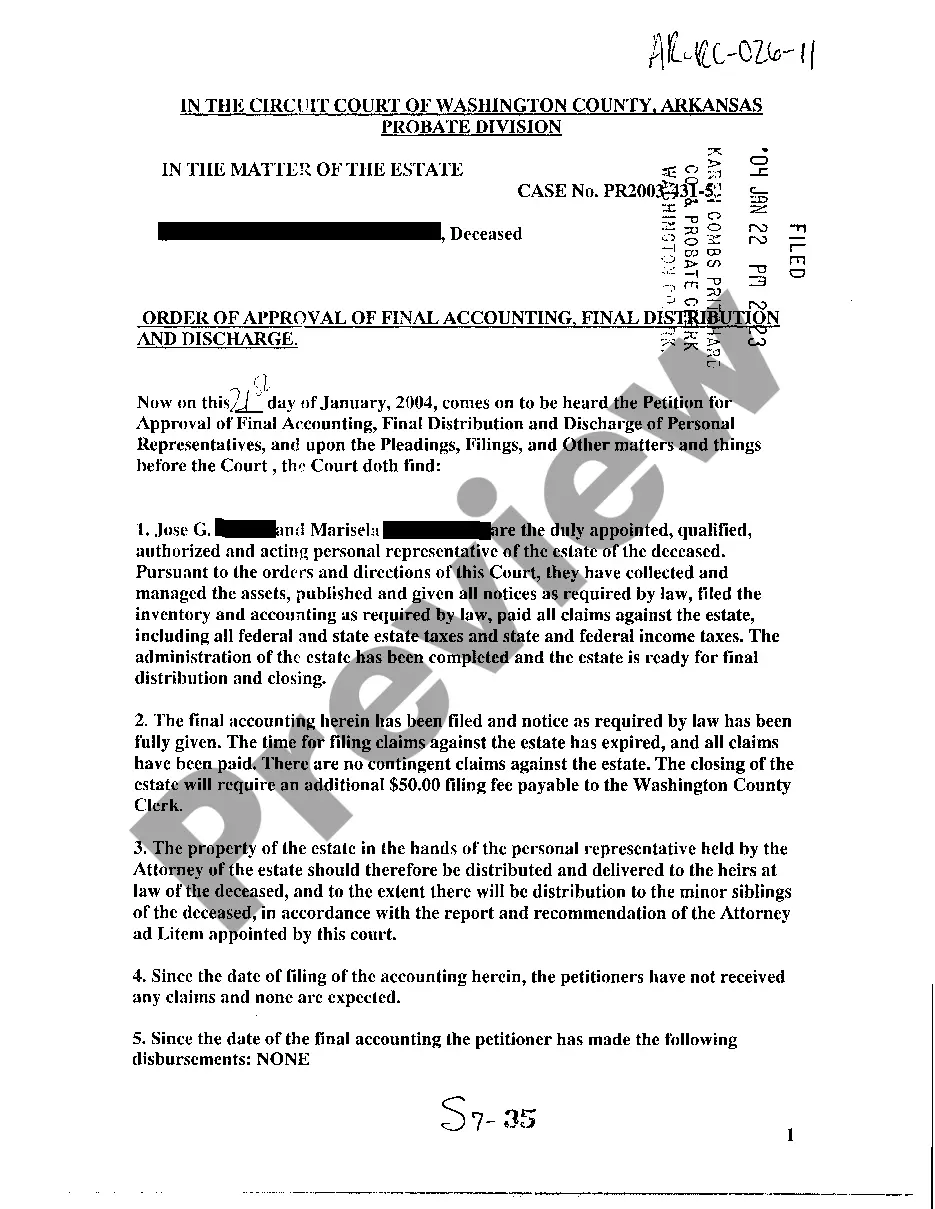

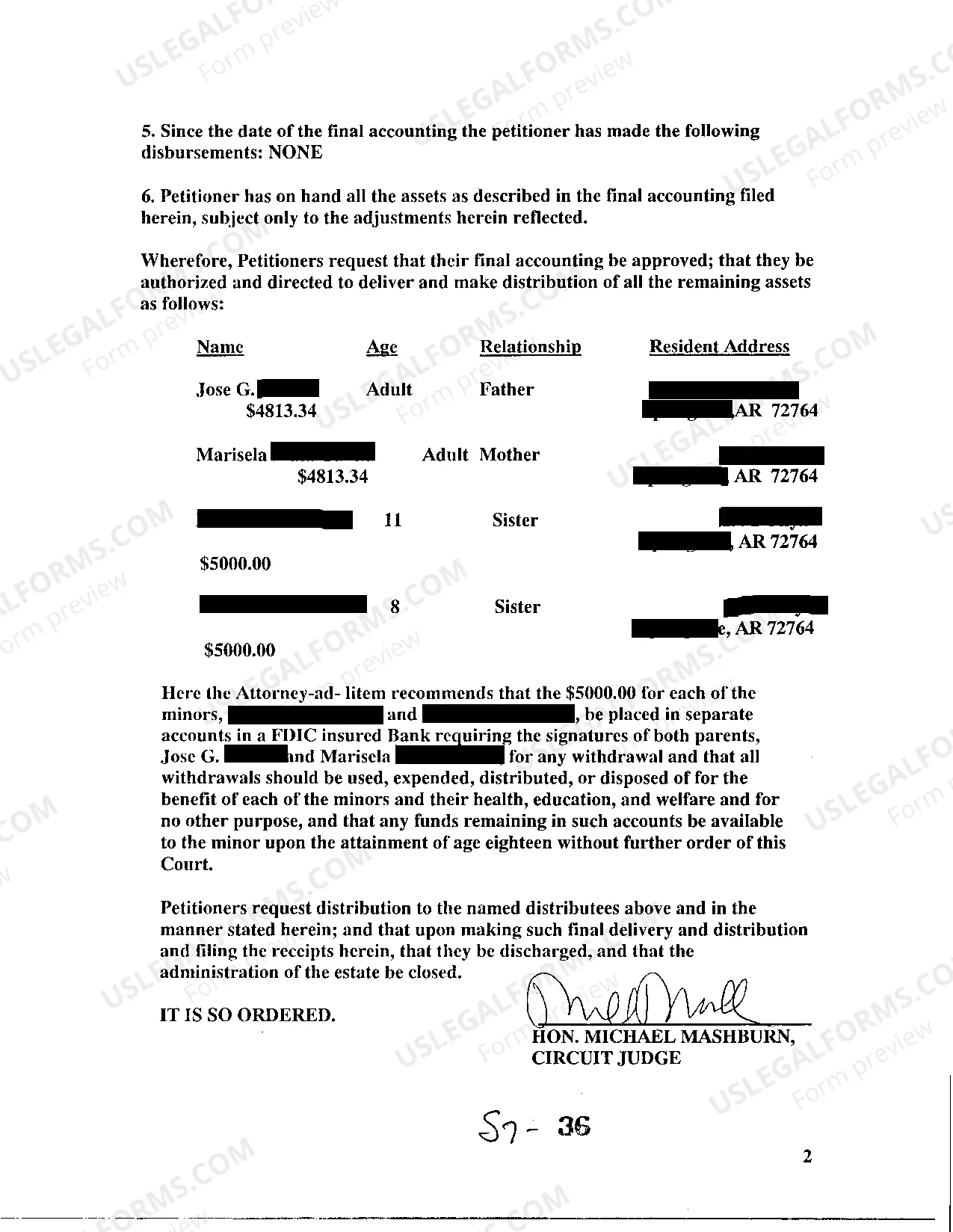

Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge

Description

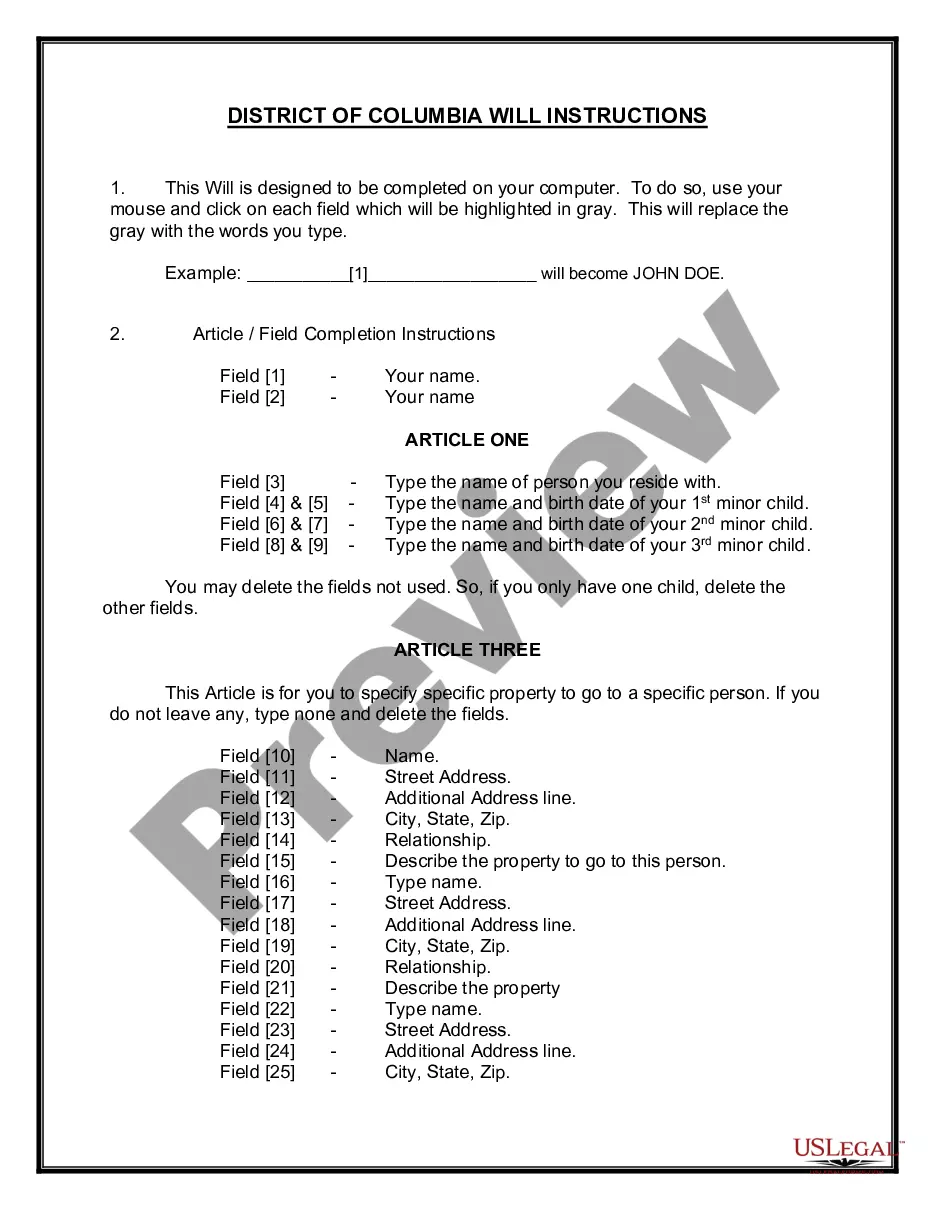

How to fill out Arkansas Order Of Approval Of Final Accounting, Final Distribution And Discharge?

Amid numerous paid and complimentary samples available online, you cannot authenticate their trustworthiness. For instance, who produced them or whether they possess sufficient qualifications to address your requirements.

Stay calm and make use of US Legal Forms! Obtain Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge templates crafted by experienced attorneys and steer clear of the costly and time-consuming task of searching for a lawyer and subsequently compensating them to draft documents that you can easily retrieve yourself.

If you have a membership, Log In/">Log In to your account and locate the Download button adjacent to the document you are seeking. You will also be able to access your previously downloaded templates in the My documents section.

Once you’ve registered and acquired your subscription, you can utilize your Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge as often as you need or for as long as it remains valid in your state. Modify it in your desired editor, fill it out, sign it, and create a physical copy of it. Accomplish more for less with US Legal Forms!

- Ensure the document you select is recognized in your state.

- Examine the template by reviewing the details through the Preview function.

- Click Buy Now to initiate the purchasing process or seek another sample using the Search bar at the top.

- Choose a subscription plan and establish an account.

- Complete the payment for the membership using your credit/debit card or Paypal.

- Download the form in the required file format.

Form popularity

FAQ

To avoid probate in Arkansas, consider creating a living trust, designating beneficiaries on accounts, and holding assets jointly with another person. These strategies can simplify the transfer of assets at death and help keep your estate out of probate court. Understanding the implications of the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge can further enhance your estate planning efforts.

Non-probate assets in Arkansas include property held in joint tenancy, assets in living trusts, and payable-on-death accounts. These assets will not go through the probate process and can be transferred directly to beneficiaries. Knowing the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge can assist in managing these assets effectively.

Certain assets are exempt from probate in Arkansas, including life insurance policies with designated beneficiaries, retirement accounts, and jointly-owned property. These assets pass directly to the named beneficiaries without the need for probate. Understanding the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge can help clarify what remains during probate.

In Arkansas, not every will must go through the probate process, but most do. If you have a valid will, it typically needs to be probated to ensure legal distribution of assets. The Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge will finalize these proceedings professionally.

Not all estates in Arkansas are required to go through probate. If an estate is below a certain value or contains only non-probate assets, it may be possible to avoid probate altogether. Utilizing the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge can help streamline the process when probate is necessary.

In Arkansas, an estate typically must exceed $100,000 in total value for the probate process to be necessary. However, some specific situations may require probate regardless of the estate's size. The Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge plays a crucial role in concluding the probate process efficiently.

In Arkansas, probate proceedings usually need to commence within five years after the person's death. However, to ensure compliance with all legal requirements, including the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge, it’s beneficial to start the process as soon as possible. Timely action helps avoid further complications and facilitates a smoother distribution of the estate.

Yes, you must file a will in Arkansas if the deceased has left one. This process initiates the probate proceedings and is crucial for obtaining the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge. Filing the will promptly ensures compliance with the state's probate laws and can ease the estate settlement process.

Arkansas Code 28 40 111 describes the process for the distribution of an estate's assets. This code is integral to achieving the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge properly. Following these guidelines ensures all heirs receive their fair share of the estate while fulfilling all legal requirements.

Statute 28 41 101 provides guidelines on the duties of personal representatives in the estate administration process. This includes how to appropriately achieve the Arkansas Order of Approval of Final Accounting, Final Distribution and Discharge. By understanding this statute, representatives can fulfill their responsibilities effectively and maintain transparency throughout the estate settlement.