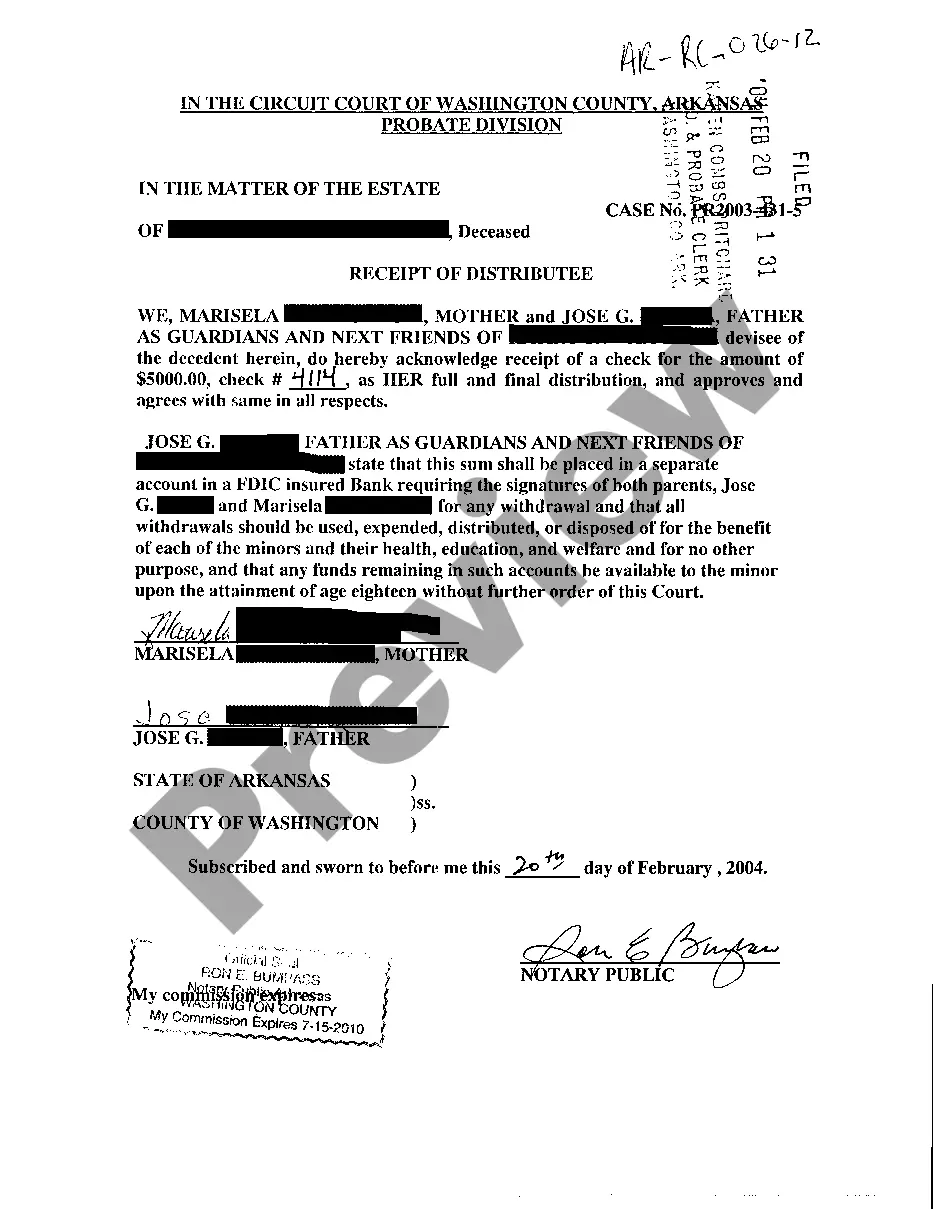

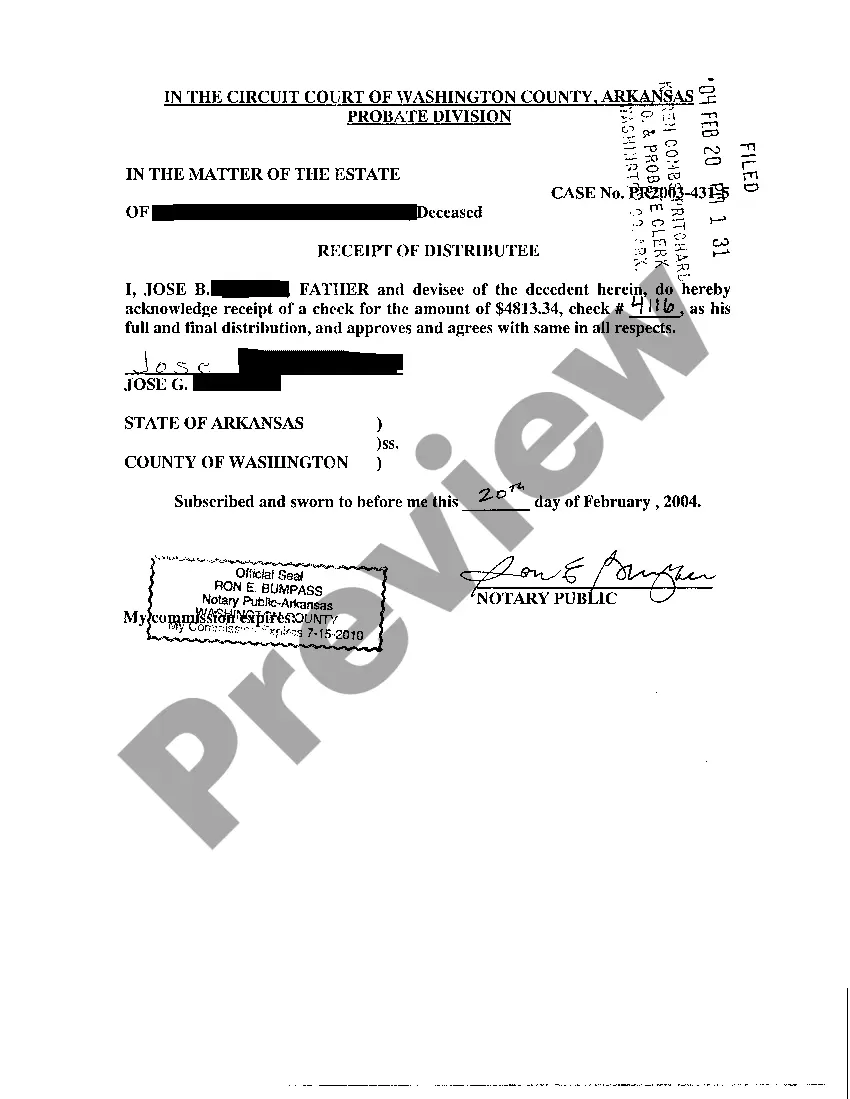

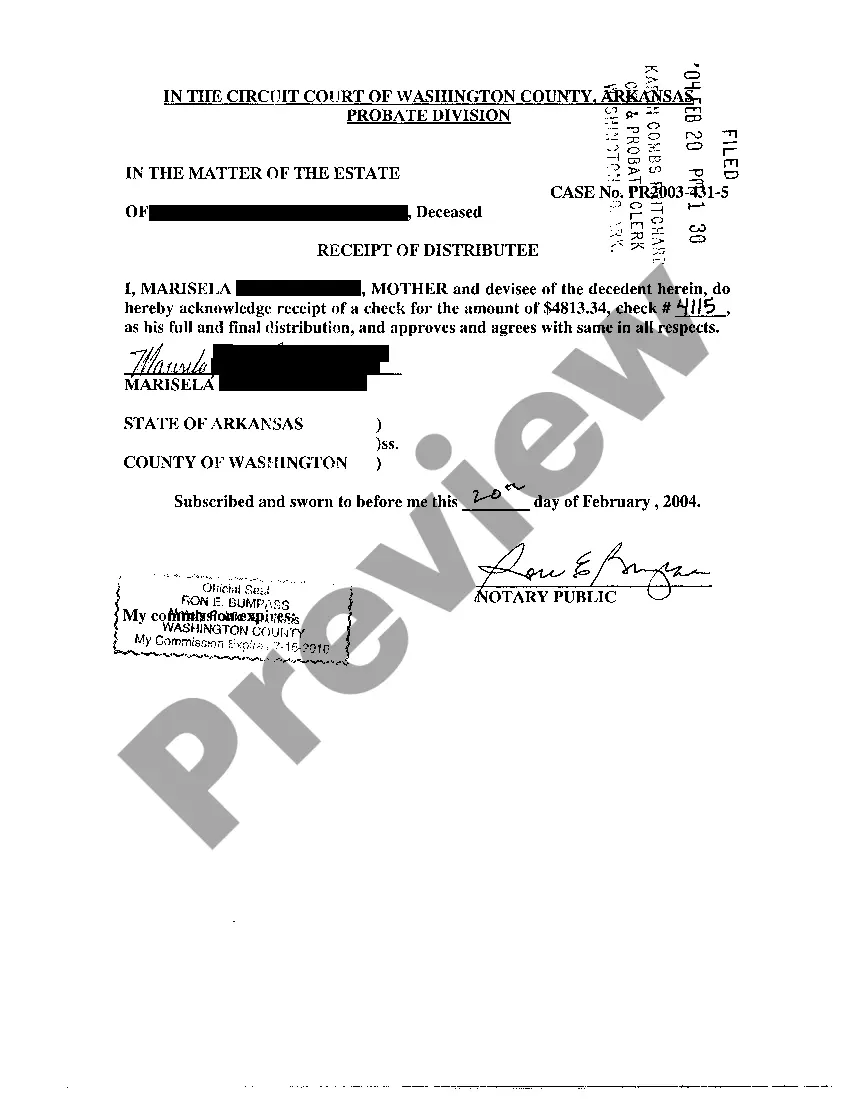

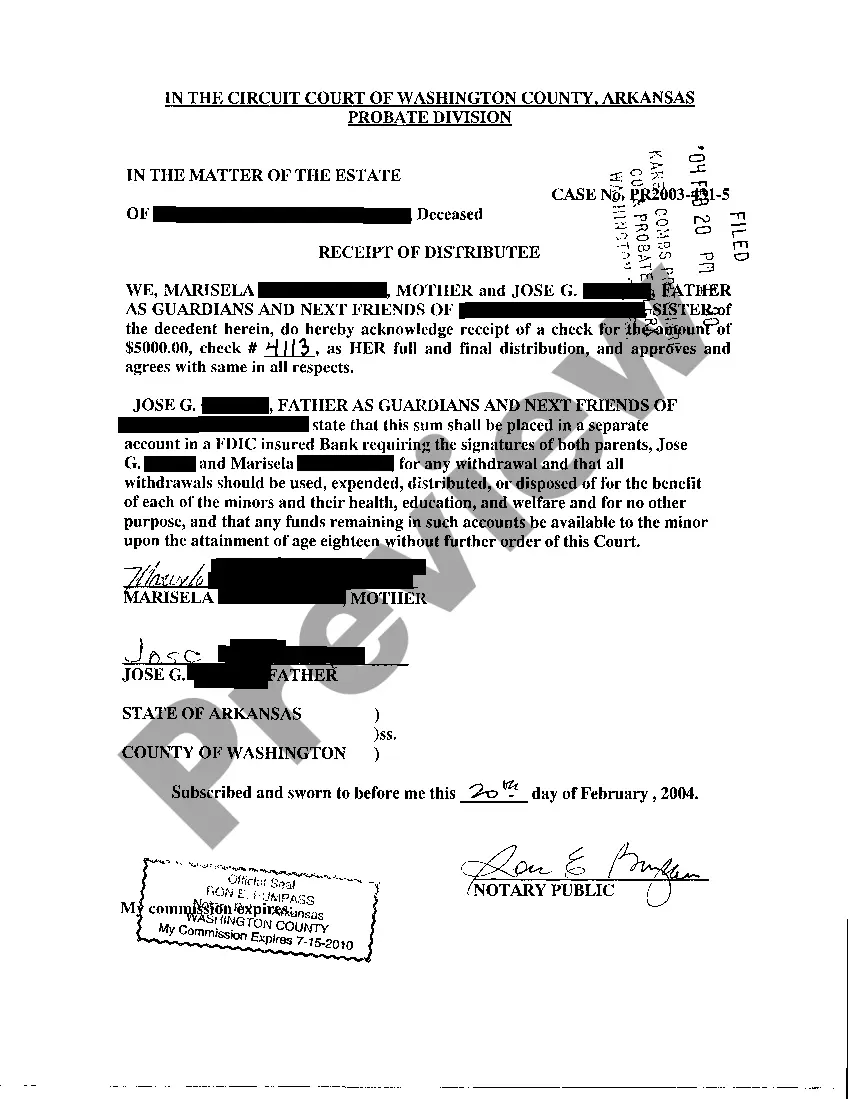

Arkansas Receipt of Distributee

Description

How to fill out Arkansas Receipt Of Distributee?

Among countless paid and complimentary templates available online, you cannot be assured of their trustworthiness.

For instance, who created them or whether they possess the qualifications necessary to assist with your needs.

Remain composed and utilize US Legal Forms!

If you already have a subscription, Log In/">Log In to your account and locate the Download button beside the document you are looking for. You will also have the ability to access all your previously acquired documents in the My documents section.

- Obtain Arkansas Receipt of Distributee templates crafted by experienced attorneys.

- Avoid the costly and time-consuming task of searching for a lawyer.

- Skip the step of paying them to prepare documents that you can manage yourself.

Form popularity

FAQ

To obtain a small estate affidavit in Arkansas, you first need to gather the necessary documentation, including information about the deceased's assets and heirs. After collecting this information, you can complete the appropriate small estate affidavit form. Consider using the US Legal Forms platform, which provides templates and guides to simplify the process. Once you have your affidavit ready, file it with the probate court to receive an Arkansas Receipt of Distributee for the estate distribution.

To avoid probate in Arkansas, consider strategies like establishing revocable living trusts, naming beneficiaries on financial accounts, and holding property jointly. These arrangements can help bypass the probate process, ensuring quicker and more direct asset distribution. Utilizing resources like US Legal Forms can provide you with the necessary documents and guidance to navigate these options effectively, especially in relation to the Arkansas Receipt of Distributee.

Not all wills require probate in Arkansas. A will must be probated only if it pertains to assets that need court oversight. This distinction is important for individuals planning their estates, as familiarizing oneself with the terms related to the Arkansas Receipt of Distributee is beneficial for informed decision-making.

In Arkansas, there’s no specific dollar amount that mandates the need for probate. However, if the estate includes assets requiring legal intervention, probate will likely be necessary regardless of the estate’s value. Understanding the nuances of estate value and probate requirements is essential for an effective estate plan that aligns with the Arkansas Receipt of Distributee.

Probate is triggered in Arkansas when an individual passes away and leaves behind assets that require court supervision for distribution. This includes instances where a valid will exists or when distributions are necessary under state intestacy laws. Understanding what triggers probate allows individuals to prepare in advance and know when to seek guidance regarding the Arkansas Receipt of Distributee.

Typically, the person who creates the will, known as the testator, retains the original copy until their passing. However, the original will may also be kept by the attorney who drafted it, or filed with the local probate court. It’s vital to ensure the original document is accessible when needed, as it plays a crucial role in the probate process and the issuance of the Arkansas Receipt of Distributee.

In Arkansas, several assets are exempt from probate, including life insurance policies with named beneficiaries, jointly owned property, and retirement accounts. Exempt assets can simplify the estate settlement process and allow for quicker distribution to the rightful heirs. Familiarity with these exemptions can help individuals plan their estates more efficiently, especially in context of the Arkansas Receipt of Distributee.

In Arkansas, probating a will is necessary if the estate holds assets that require legal processing. While not every situation demands a full probate, certain circumstances will require it to validate the will and facilitate distribution. Individuals must recognize that navigating the probate process can be complex, and understanding the Arkansas Receipt of Distributee is crucial for proper estate management.

If you don't file probate in Arkansas, your deceased loved one's assets may become difficult to access or transfer. This can lead to complications, especially if there are debts or disputes among heirs. Without probate, the process of receiving assets becomes unclear, potentially causing delays and additional stress for those involved. It is essential to understand the Arkansas Receipt of Distributee to ensure a smooth transition of assets.

In Arkansas, there is no state inheritance tax, so heirs can inherit assets without worrying about state taxes on their inheritance. However, federal estate taxes may apply, depending on the estate's value. It is important to consider these factors when planning your estate or understanding inheritances. The Arkansas Receipt of Distributee can also provide useful information on potential tax implications related to inheritances.