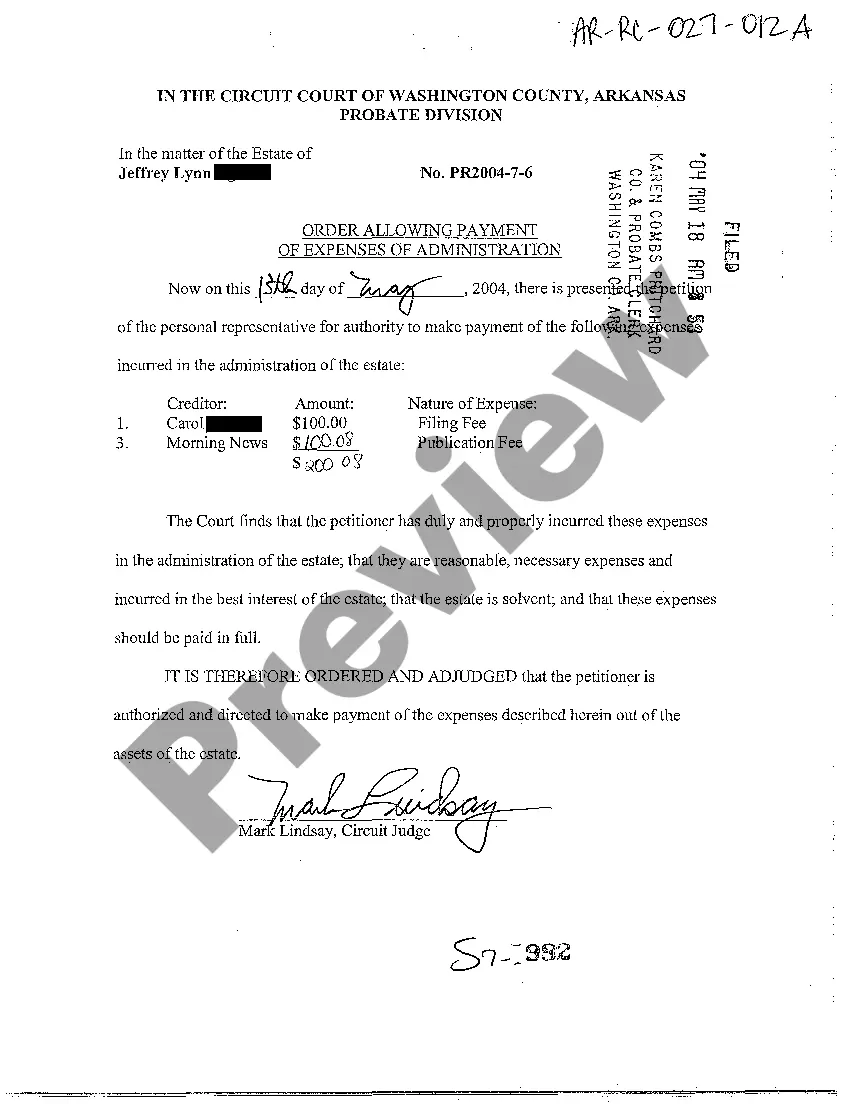

Arkansas Order Allowing Payment of Expenses of Administration

Description

How to fill out Arkansas Order Allowing Payment Of Expenses Of Administration?

Among numerous paid and free examples available online, you cannot guarantee their trustworthiness. For instance, the identity of their creators or their qualifications to handle what you need them for may be uncertain.

Always remain composed and utilize US Legal Forms! Obtain Arkansas Order Allowing Payment of Expenses of Administration templates crafted by expert attorneys and avoid the costly and lengthy process of searching for a lawyer and subsequently paying them to draft a document for you that you can easily find yourself.

If you possess a subscription, Log In to your account and locate the Download button adjacent to the document you desire. You’ll also gain access to all your previously downloaded documents in the My documents section.

Once you have registered and purchased your subscription, you can use your Arkansas Order Allowing Payment of Expenses of Administration as many times as required or for as long as it remains valid in your area. Alter it with your chosen online or offline editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Ensure that the document you locate is applicable in your state.

- Examine the template by reviewing the description via the Preview function.

- Click Buy Now to commence the purchasing process or find another template using the Search field located in the header.

- Choose a pricing plan and register for an account.

- Complete the payment for the subscription using your credit/debit card or Paypal.

- Download the document in your desired format.

Form popularity

FAQ

Arkansas state tax forms can be obtained directly from the Arkansas Department of Finance and Administration's website. They offer downloadable PDFs for all tax-related needs, ensuring easy access for taxpayers. You can also request paper forms if necessary. If you need assistance navigating these forms, the Arkansas Order Allowing Payment of Expenses of Administration may provide essential information on financial best practices.

For disabled children in Arkansas, parents or guardians can use the Arkansas Individual Income Tax Form to report any claim for the disabled child tax credit. Eligibility depends on specific criteria, including the nature of the disability and the household income. Make sure that all required documentation is attached to the form when filing to avoid delays. The Arkansas Order Allowing Payment of Expenses of Administration may guide you through related expenses as well.

The disabled tax credit in Arkansas is a financial benefit for individuals with disabilities. This credit helps reduce the amount of state taxes owed and can be a significant relief for eligible taxpayers. It's crucial to review the guidelines for eligibility, which often include an emphasis on income levels and disability verification. Ensuring all paperwork, including the Arkansas Order Allowing Payment of Expenses of Administration, is in order can facilitate claiming this credit.

The primary tax form for reporting disability income in Arkansas is the Arkansas Individual Income Tax Form. If you received Social Security or other benefits, these should be included in your annual income reporting. It’s vital to consult the tax instructions closely to ensure proper reporting of all forms of income. The Arkansas Order Allowing Payment of Expenses of Administration details may provide further clarity on any related deductions.

In Arkansas, disability benefits may be taxable depending on the source of the funds. For instance, Social Security disability benefits are usually not taxed at the state level. However, income from private disability insurance could be subject to taxation. Being informed about the implications can help you manage potential taxes effectively and ensure you remain compliant, especially under guidelines like the Arkansas Order Allowing Payment of Expenses of Administration.

Individuals who reside or earn income in Arkansas must file a state tax return if they meet specific income thresholds. This requirement includes both residents and non-residents who have Arkansas-sourced income. Additionally, even if your income falls below these thresholds, you may still want to file to claim credits such as the Arkansas Order Allowing Payment of Expenses of Administration. Always check current guidelines to ensure compliance.

The $150 tax credit in Arkansas is a benefit designed to reduce the tax burden for eligible taxpayers. It typically applies to individuals who meet certain income criteria. This credit can be claimed on your state tax return, easing financial responsibilities. When filing, ensure you reference the Arkansas Order Allowing Payment of Expenses of Administration for proper documentation.

The backing statute in Arkansas typically refers to regulations that authorize certain actions or decisions in the probate process. This may include statutes that provide legal support for the administration of estates, including the payment of expenses. Understanding these backing statutes ensures that executors and administrators act within legal parameters. The Arkansas Order Allowing Payment of Expenses of Administration provides a pathway for handling these responsibilities confidently.

Yes, Arkansas has specific statutes of limitations that apply to various legal claims. These timeframes dictate how long individuals have to file a lawsuit or claims related to estate matters. Typically, for probate claims, you may have up to three years after the estate is closed. Awareness of these limitations can help you navigate the legal landscape effectively, especially when considering the Arkansas Order Allowing Payment of Expenses of Administration.

The anti-lapse statute in Arkansas is codified in Arkansas Code § 28-25-106. This statute ensures that if a beneficiary predeceases the testator, the gift will go to their heirs instead of lapsing or becoming invalid. It upholds the testator's wishes more closely and prevents unintended consequences. Understanding the anti-lapse statute is important, particularly during estate administration under the Arkansas Order Allowing Payment of Expenses of Administration.