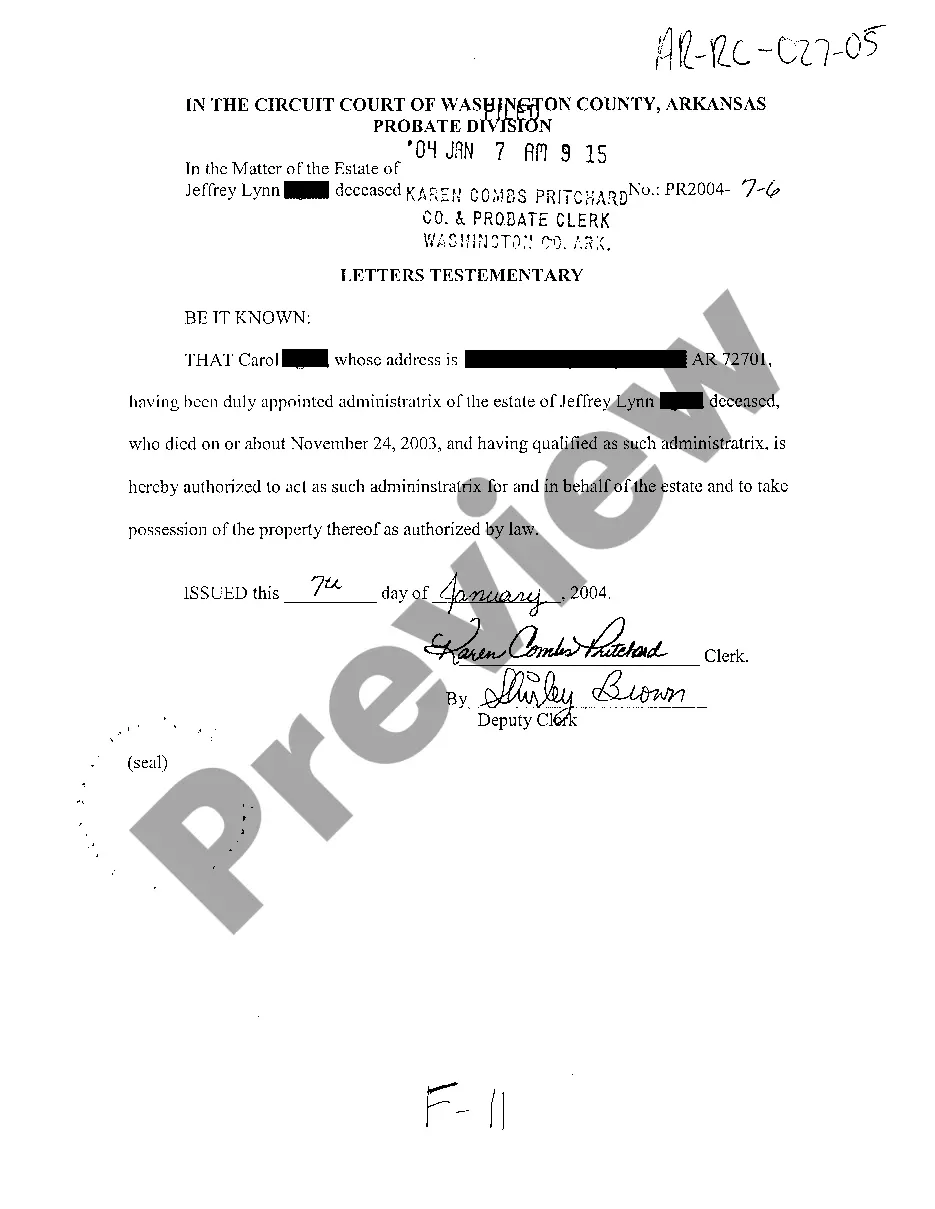

Arkansas Letters Testamentary

Description

How to fill out Arkansas Letters Testamentary?

Among numerous complimentary and paid instances available on the internet, you cannot be guaranteed regarding their dependability. For instance, who created them or whether they are sufficiently qualified to handle what you require them for.

Always remain composed and utilize US Legal Forms! Locate Arkansas Letters Testamentary templates drafted by skilled attorneys and avoid the costly and time-consuming process of searching for a lawyer and then compensating them to draft a document that you can easily locate yourself.

If you possess a membership, Log In/">Log In to your account and look for the Download button beside the file you’re after. You will also have the ability to retrieve your previously acquired templates in the My documents section.

Once you’ve registered and paid for your subscription, you can utilize your Arkansas Letters Testamentary as frequently as you need or as long as it remains valid in your state. Edit it in your preferred online or offline editor, fill it out, sign it, and produce a physical copy. Do much more for less with US Legal Forms!

- Ensure that the document you view is applicable in your jurisdiction.

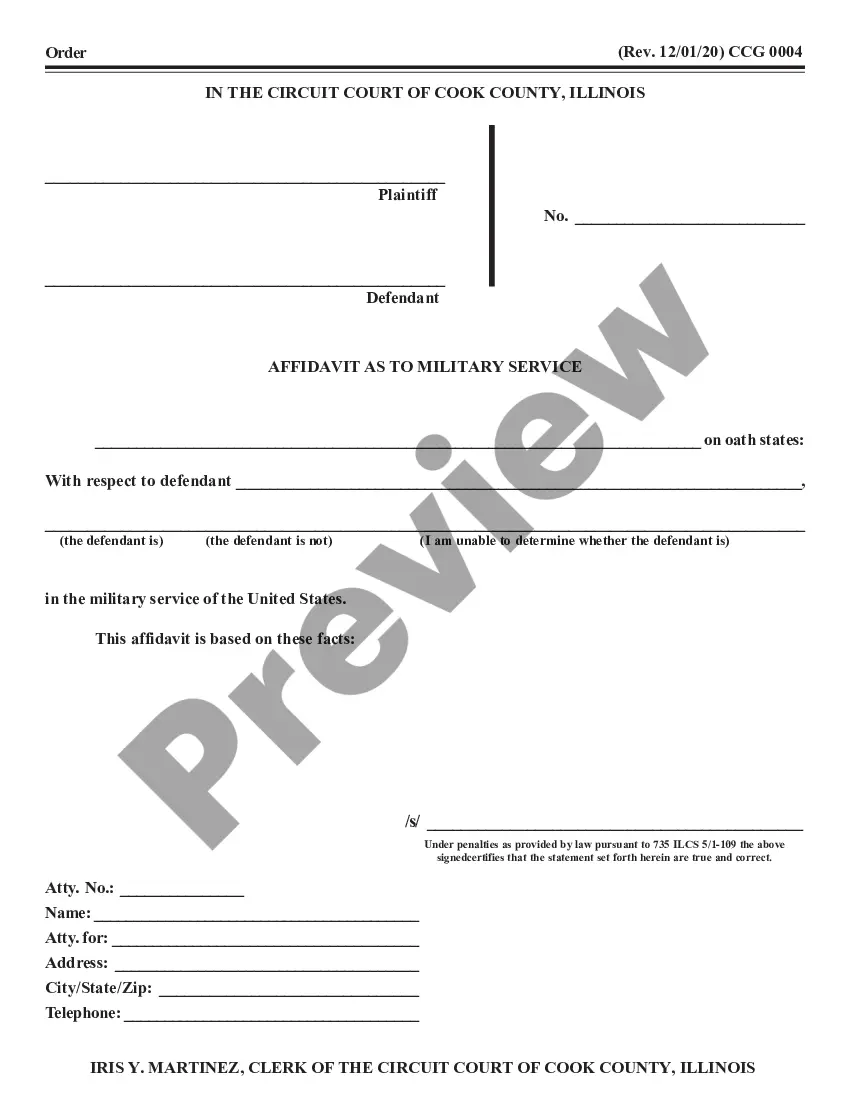

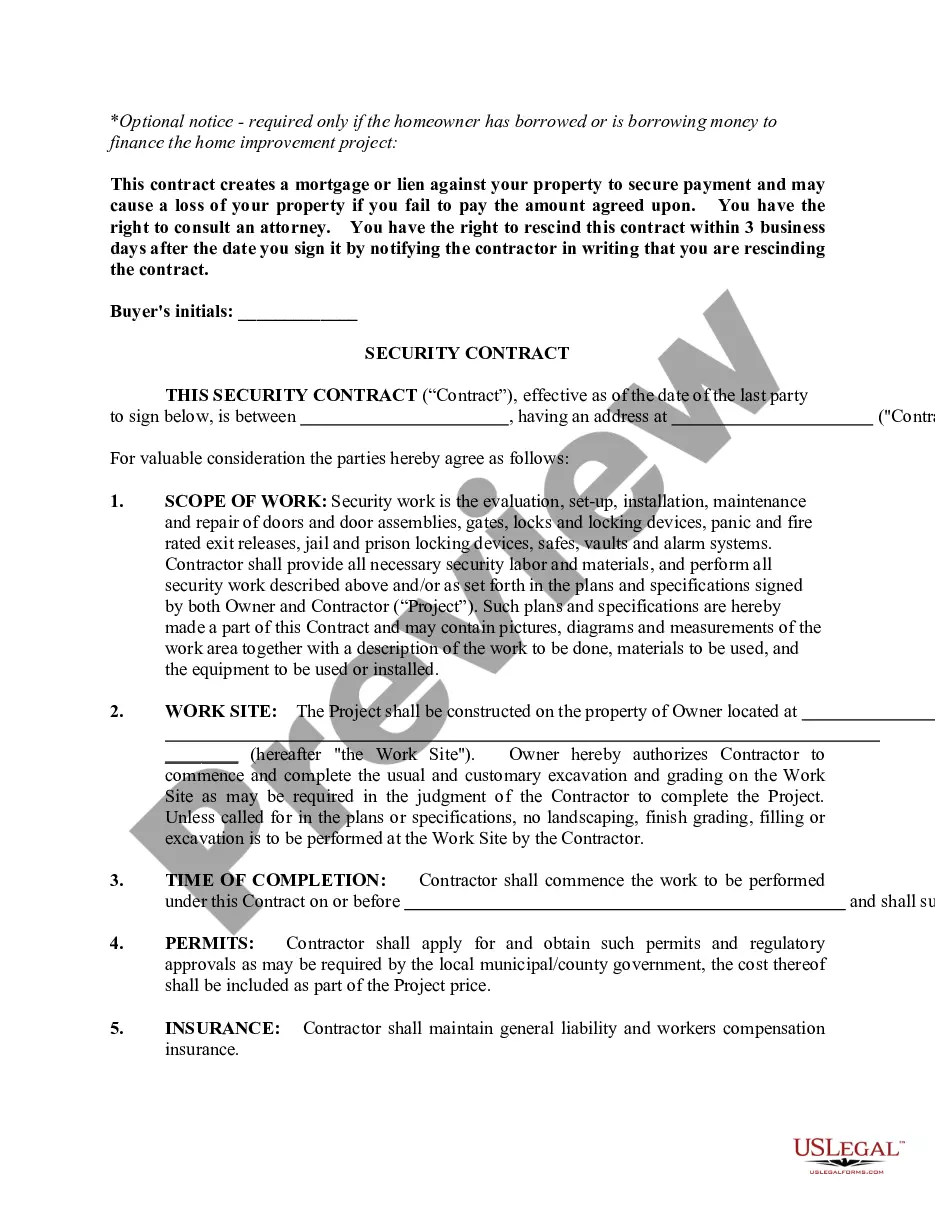

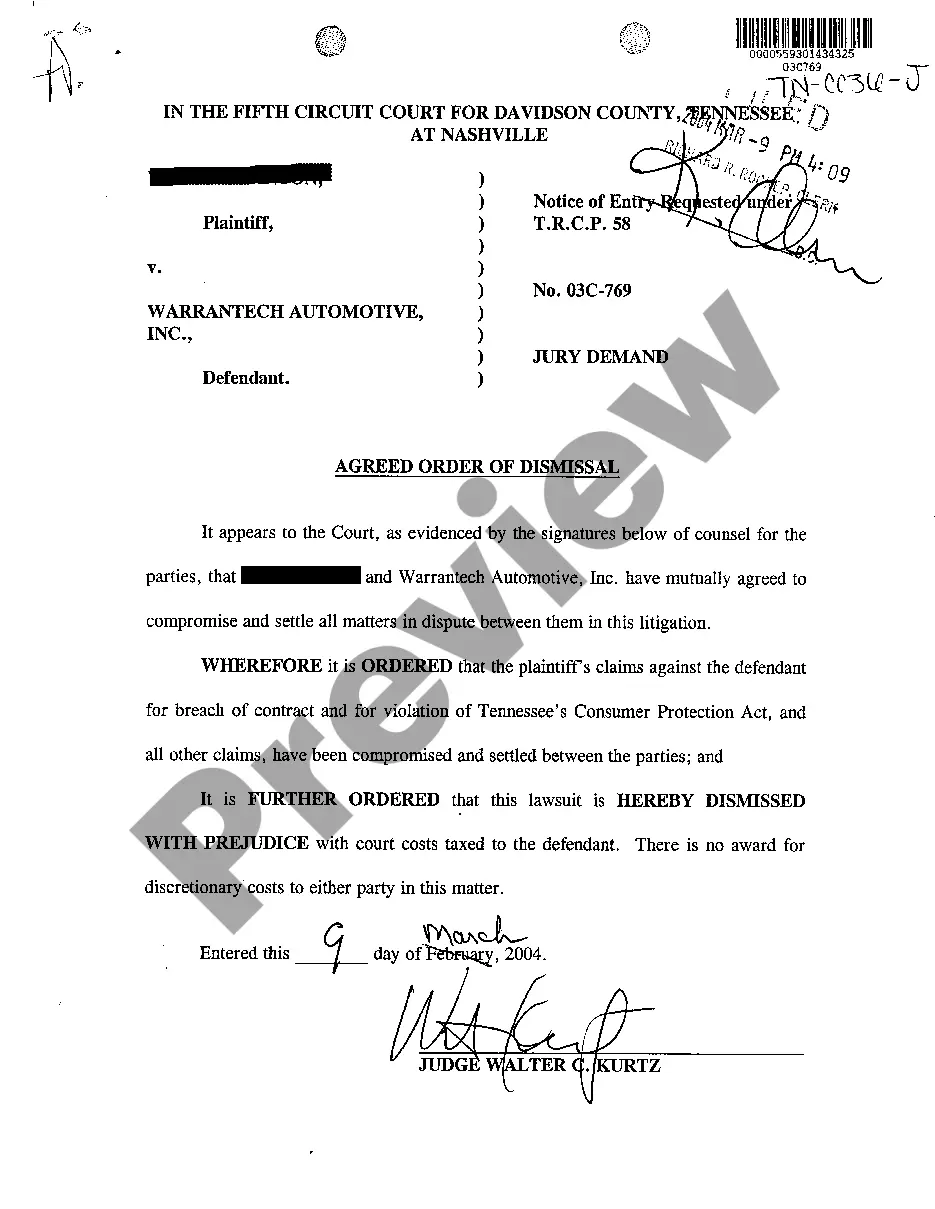

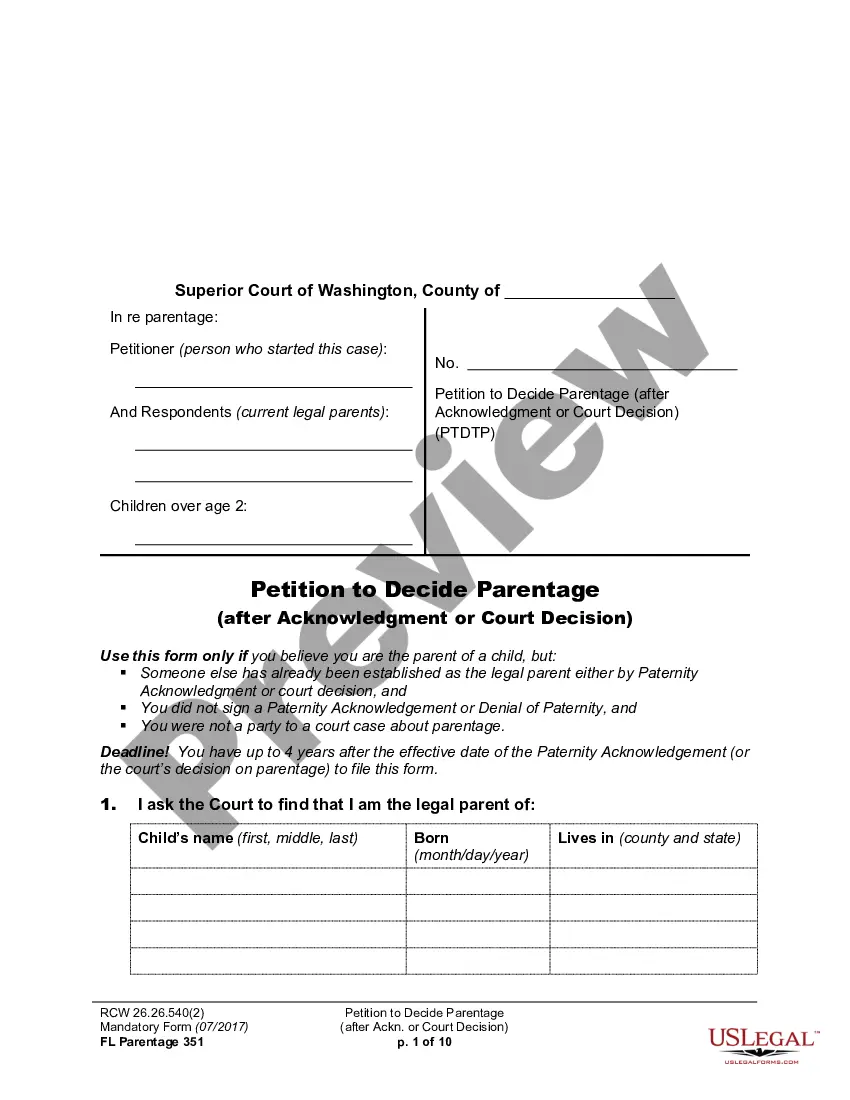

- Review the file by examining the details using the Preview option.

- Click Buy Now to commence the purchasing procedure or search for another example using the Search box located in the header.

- Choose a pricing plan and set up an account.

- Make the payment for the subscription using your credit/debit card or PayPal.

- Download the document in the required format.

Form popularity

FAQ

To obtain a small estate affidavit in Arkansas, you need to verify that the estate qualifies as a small estate under state regulations. Generally, this means assets valued below a certain threshold can be transferred without full probate. You can file for a small estate affidavit by filling out the necessary forms and submitting them to the court. For assistance and templates, consider using the US Legal Forms platform to simplify this process.

In Arkansas, assets exempt from probate typically include jointly owned property and payable-on-death accounts. Also, life insurance proceeds and property held in revocable trusts bypass the probate process. Knowing these exemptions allows you to plan your estate effectively and may minimize stress for your family. Arkansas Letters Testamentary are not necessary for these types of assets, making the distribution simpler.

Certain assets do not go through probate in Arkansas, including joint bank accounts, life insurance policies with named beneficiaries, and property held in trusts. These assets can be transferred directly to designated individuals without needing Arkansas Letters Testamentary. Understanding which assets are exempt helps streamline the estate settlement process. By organizing your assets accordingly, you can simplify future legal matters for your heirs.

Arkansas has specific rules governing probate, which include how to file a will and when to notify heirs. Generally, you must file for probate within five years of the deceased's death. Arkansas Letters Testamentary are crucial for executors, allowing them to manage the estate properly and adhere to state laws. These rules are designed to ensure a fair and organized distribution of assets.

Probate in Arkansas is triggered when a person passes away and leaves behind assets that need to be distributed. If the deceased person owned property in their name, you generally need to go through the probate process. This process also applies when there are Arkansas Letters Testamentary needed to administer the estate. It's essential to understand this process to ensure proper handling of the deceased’s estate.

Avoiding probate in Arkansas can be achieved through strategic estate planning. You might consider using joint ownership, establishing trusts, or designating beneficiaries for your accounts. Each of these options can help simplify the transfer of your assets without needing Arkansas Letters Testamentary. Utilizing services like US Legal Forms can help you navigate these options effectively.

In Arkansas, not all wills must go through probate. However, if you have assets solely titled in your name that require Arkansas Letters Testamentary, probate may become necessary. If the will includes specific provisions for administering the estate, the court will need to approve those terms. Always consult a legal professional to understand your obligations regarding probate.

Writing a testamentary document, such as a will, in Arkansas involves clearly stating your intentions regarding asset distribution after your death. This document should include your personal information, an enumeration of your assets, and the names of beneficiaries. For guidance and templates, consider using USLegalForms, which offers resources tailored to Arkansas law for crafting effective legal documents.

In Arkansas, there is no minimum asset value that requires probate. Any estate with significant debt or assets may necessitate probate to settle financial obligations. Even smaller estates can benefit from the probate process, as it provides clarity and legal oversight in distributing the deceased’s assets.

In Arkansas, you generally have three years from the date of death to file for probate. However, if the deceased had a will, it's recommended to file sooner to facilitate the proper distribution of assets. Keep in mind that delaying the probate process may lead to complications, notifying potential beneficiaries of their rights.