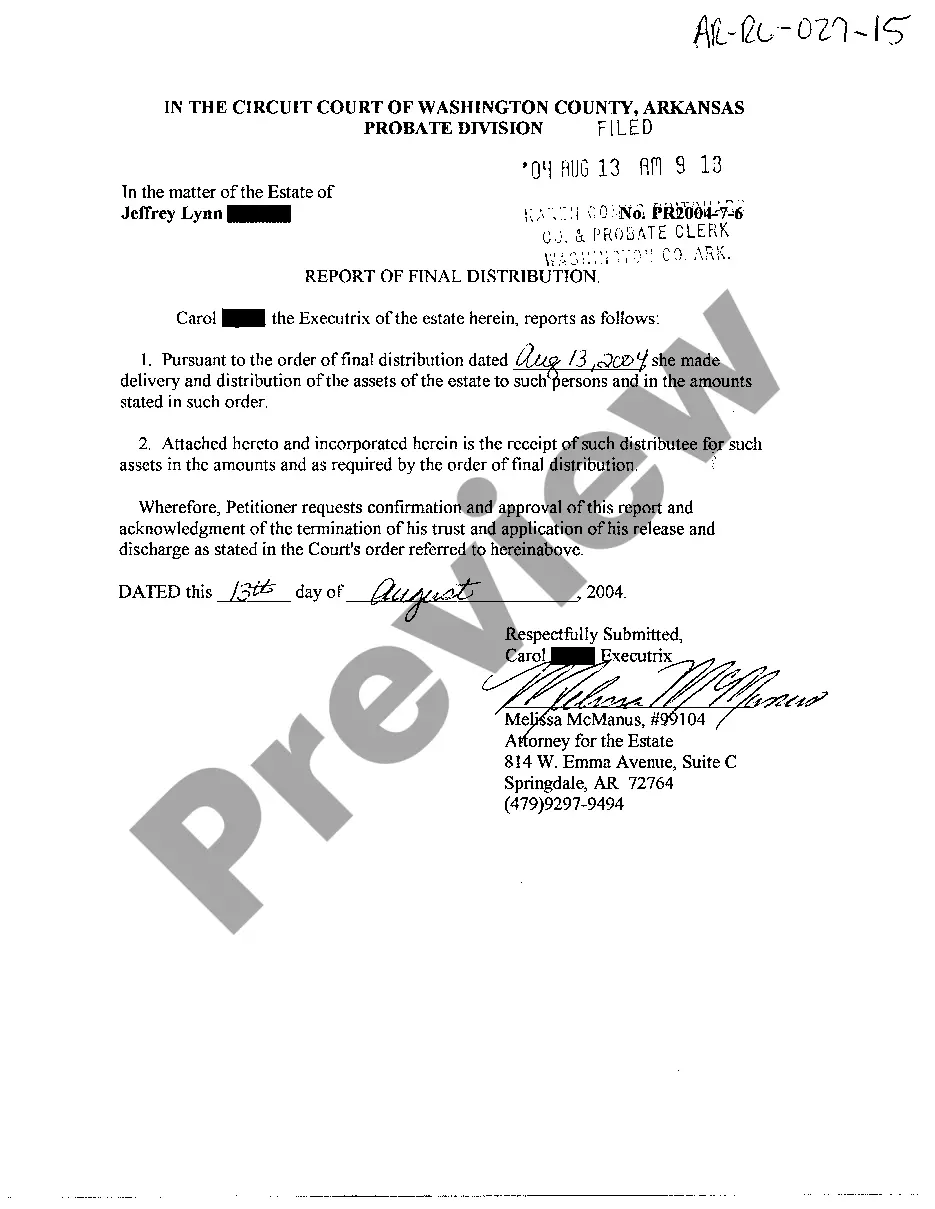

Arkansas Report of Final Distribution

Description

How to fill out Arkansas Report Of Final Distribution?

Among numerous paid and complimentary samples that you can locate online, you cannot guarantee their precision and dependability.

For instance, who developed them or if they are sufficiently competent to handle what you need from these individuals.

Stay calm and utilize US Legal Forms! Obtain Arkansas Report of Final Distribution templates crafted by experienced legal professionals and avoid the costly and laborious process of searching for an attorney and then paying them to draft a document for you that you can easily find yourself.

Select a pricing plan, register for an account, pay for the subscription with your credit/debit card or Paypal, and download the form in the desired format. Once you have registered and purchased your subscription, you can use your Arkansas Report of Final Distribution as many times as you need or for as long as it remains active in your state. Modify it in your preferred offline or online editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- If you already possess a subscription, Log In to your account and locate the Download button beside the form you are looking for.

- You will also have the ability to access all your previously saved templates in the My documents section.

- If you are using our service for the first time, follow the instructions below to acquire your Arkansas Report of Final Distribution swiftly.

- Ensure that the document you view is valid in your jurisdiction.

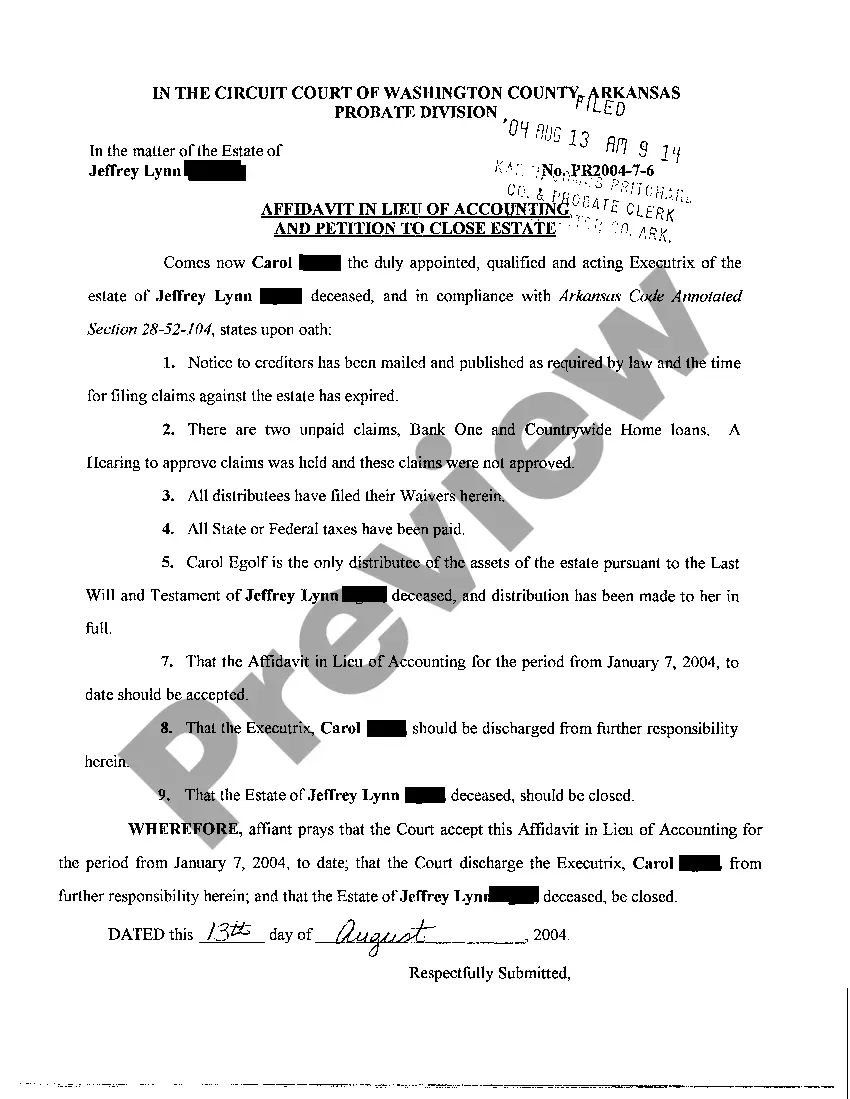

- Examine the file by reviewing the description using the Preview feature.

- Click Buy Now to initiate the purchasing process or find another sample using the Search box located in the header.

Form popularity

FAQ

In Arkansas, wills are not formally recorded until they go through probate. Once probated, they are filed in the circuit court in the county where the deceased resided. The Arkansas Report of Final Distribution is constructed based on the information within the will, providing a clear picture of how the assets were disbursed.

Probate proceedings in Arkansas do not have a strict time limit; however, they must generally commence within five years after a person's death. Delays can occur for various reasons, including disputes among heirs. To ensure a smooth process, utilize resources like UsLegalForms, which can help in preparing the Arkansas Report of Final Distribution efficiently.

In Arkansas, a spouse does not automatically inherit everything unless there is no will. If a valid will exists, the distribution depends on the terms outlined within it. The Arkansas Report of Final Distribution will provide clarity on how the estate is divided, considering both the will and marital rights.

To obtain a copy of a will in Arkansas, you can visit the probate court where the will was filed or contact the court clerk's office. Many courts also offer online access to records, making your search easier. The Arkansas Report of Final Distribution will use the contents of the will to summarize the final distribution of assets.

Arkansas Code 28-1-111 deals with the requirements for a will to be valid. It specifies the necessary elements such as being in writing, signed by the testator, and witnessed. Understanding this code is crucial for creating a will that successfully leads to the Arkansas Report of Final Distribution without legal issues.

In Arkansas, a will must be probated to be legally recognized, but it does not have to be recorded before the testator's death. Once probated, it becomes part of the public record. The Arkansas Report of Final Distribution will outline the distribution of assets as per the will, ensuring that beneficiaries receive their intended inheritances.

Yes, wills are recorded in Arkansas once filed with the probate court. This public record ensures that the will can be accessed and verified by interested parties. Recording a will sets the stage for the creation of the Arkansas Report of Final Distribution, which details the division of assets. Therefore, keeping your will on file is a wise choice for transparency and clarity.

To file a claim against an estate in Arkansas, you must submit a written claim to the estate's personal representative and the probate court. This claim should include relevant documentation such as the amount owed and the nature of the claim. If the claim is rejected, you may have the option to pursue legal action in court. The Arkansas Report of Final Distribution will ultimately reflect how claims against the estate are resolved.

Not all wills necessarily go through probate in Arkansas, but most do. If the assets of the deceased exceed certain limits or if any disputes arise, the will typically enters probate. This legal process helps ensure that the Arkansas Report of Final Distribution accurately reflects how the estate's assets are handled. Understanding this can help families prepare for what is ahead.

In Arkansas, the law requires that a will be filed with the probate court within 30 days after the testator's death. Failing to do so can lead to complications in the probate process and may delay the distribution of assets. Timely filing is essential for generating an Arkansas Report of Final Distribution to clarify the distribution of the estate. Therefore, acting promptly is crucial.