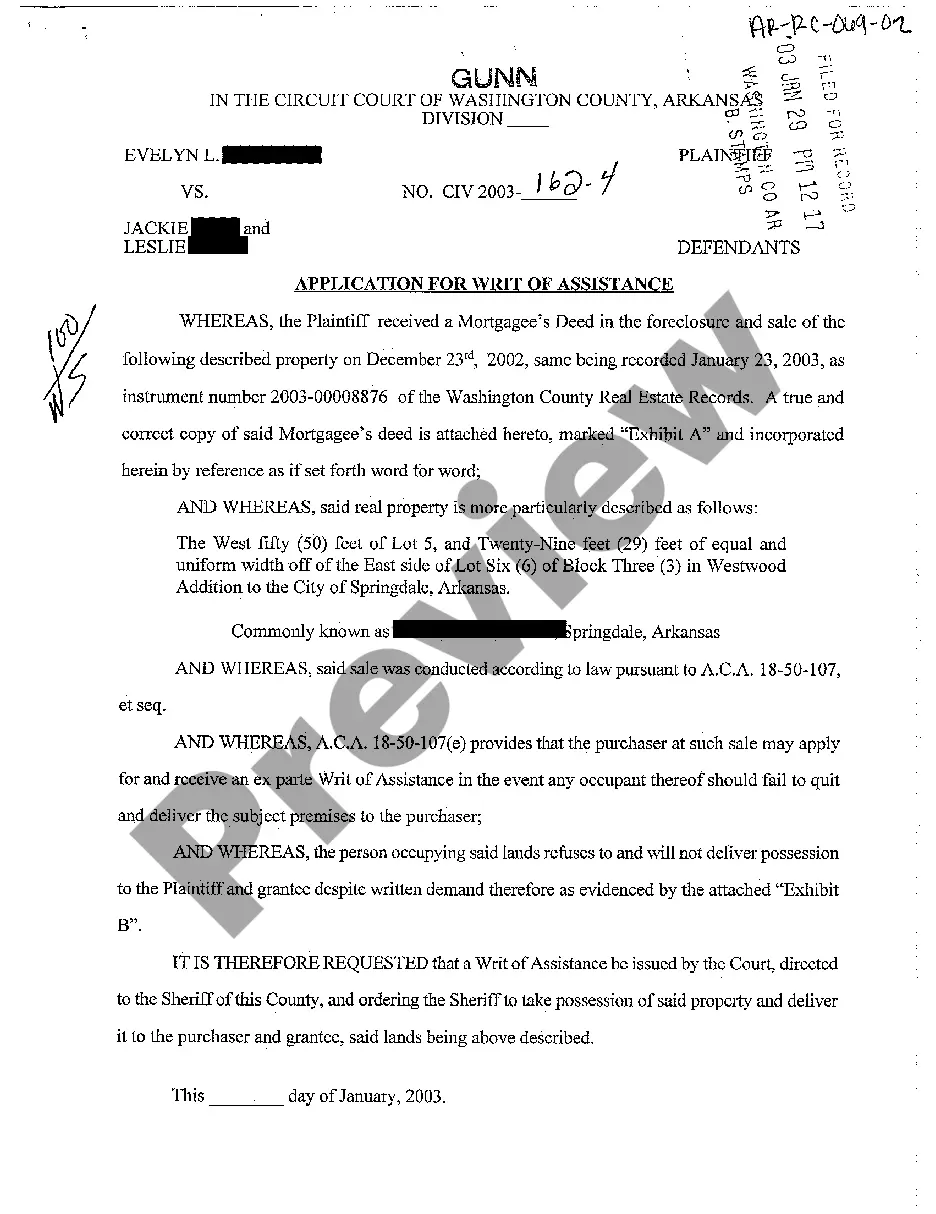

Arkansas Application for Writ of Assistance

Description Writs Of Assistance Definition

How to fill out What Were Writs Of Assistance?

Amidst numerous complimentary and paid examples that you discover online, you cannot guarantee their dependability.

For instance, who crafted them or whether they possess sufficient expertise to handle the matter for which you require them.

Always remain composed and utilize US Legal Forms!

Click Buy Now to initiate the acquisition process or search for another template via the Search bar located in the header. Select a pricing plan, register for an account, pay for the subscription using your credit/debit card or Paypal, and download the form in the desired file format. Once you've registered and paid for your subscription, you may use your Arkansas Application for Writ of Assistance as many times as necessary or for as long as it stays active in your state. Modify it with your chosen editor, complete it, sign it, and make a physical copy. Achieve more for less with US Legal Forms!

- Obtain Arkansas Application for Writ of Assistance templates created by experienced legal professionals and escape the expensive and lengthy process of searching for an attorney and subsequently compensating them to draft a document for you that you can locate yourself.

- If you already hold a membership, Log In/">Log Into your account and locate the Download button adjacent to the form you are looking for.

- You will also have access to all of your previously downloaded templates in the My documents section.

- If this is your first time utilizing our website, adhere to the instructions below to swiftly acquire your Arkansas Application for Writ of Assistance.

- Ensure that the document you find is valid in the state you reside in.

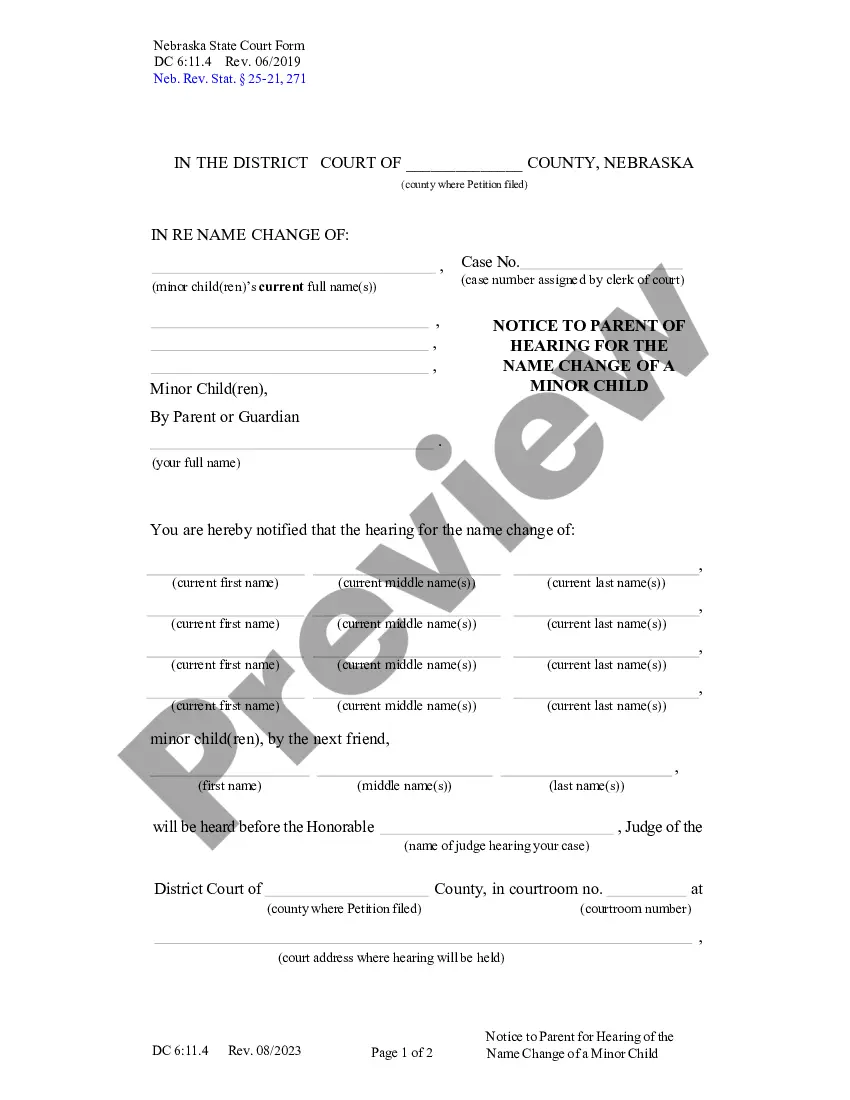

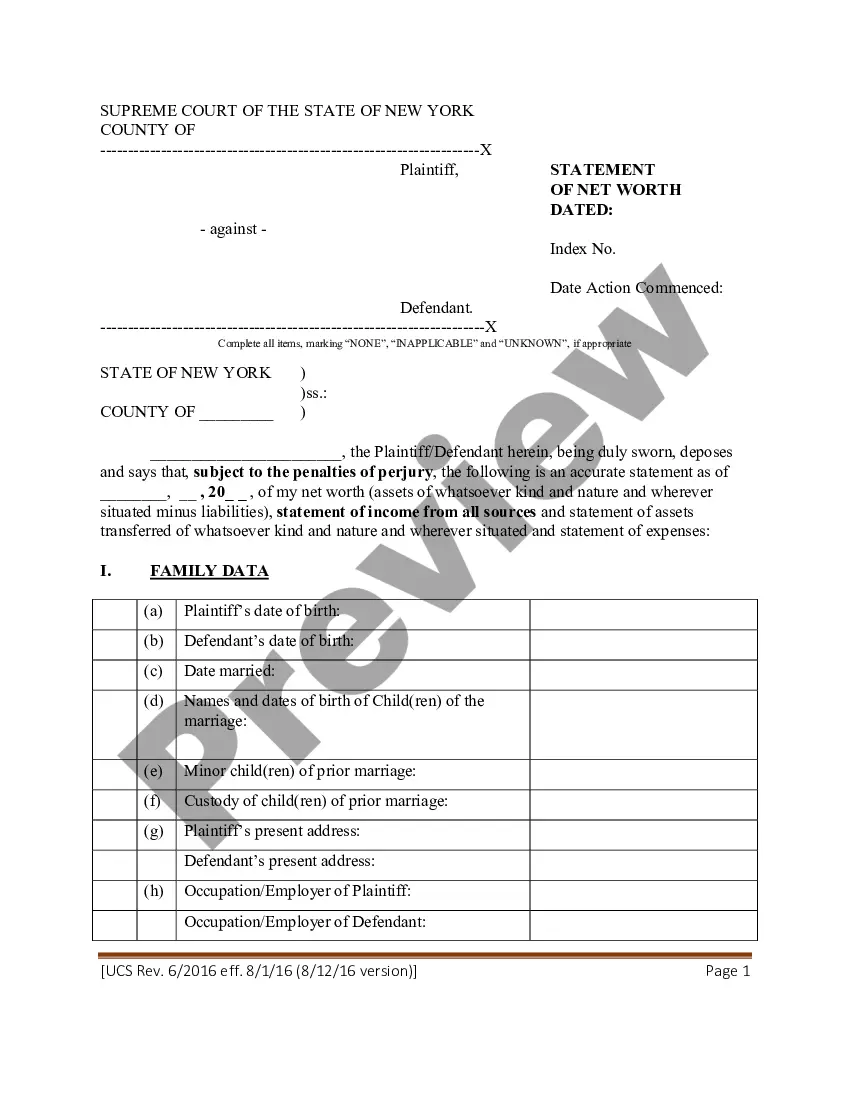

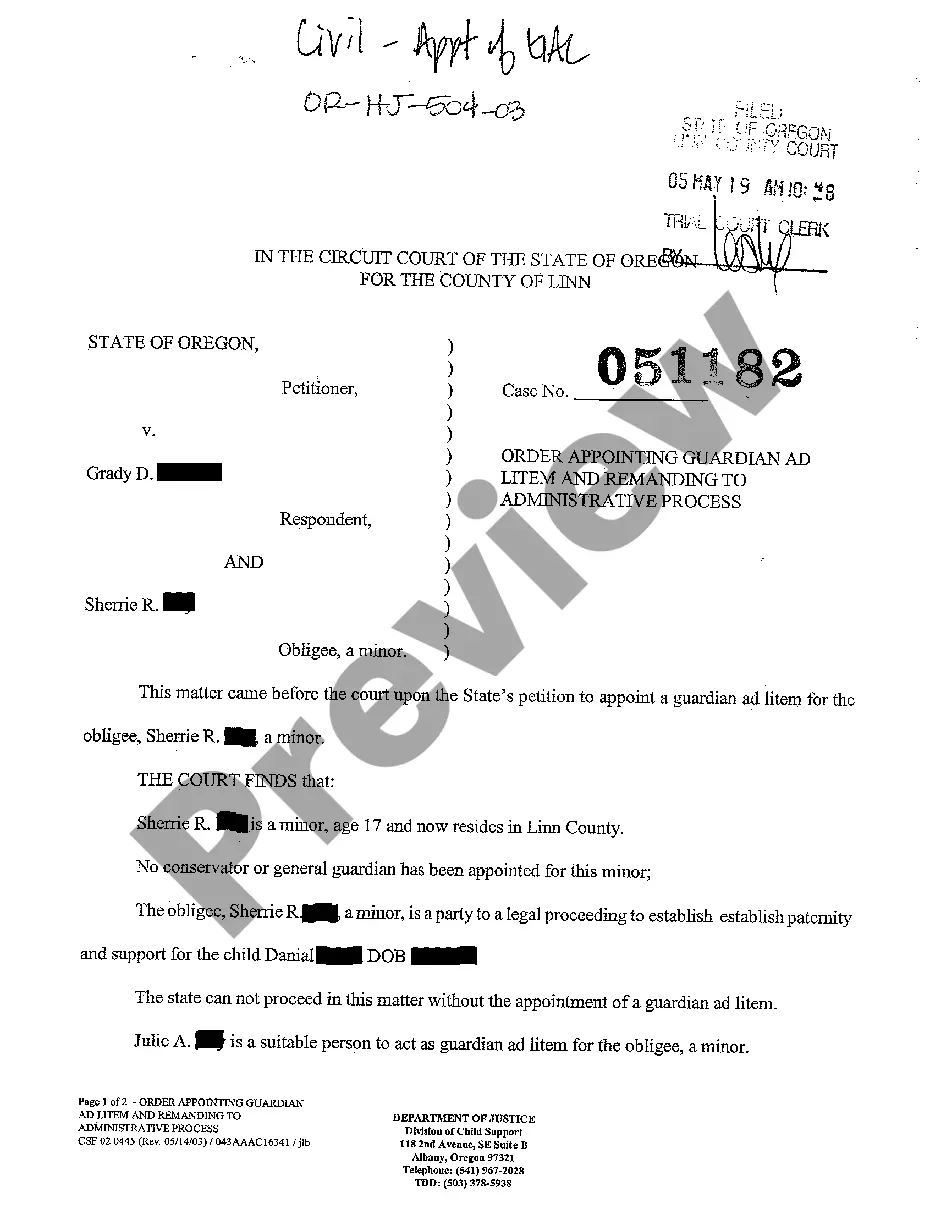

- Examine the document by reviewing the description using the Preview feature.

When Were The Writs Of Assistance Passed Form popularity

What Is Writ Of Assistance Other Form Names

When Was Writs Of Assistance FAQ

A writ of assistance in Indiana is a legal document that authorizes law enforcement to assist in enforcing a court order. This can involve the recovery of property or ensuring compliance with a court's ruling. If you require help navigating the intricate details related to court orders, exploring your options for an Arkansas Application for Writ of Assistance through our platform could be beneficial.

A writ of attachment in Indiana is a court order that allows a creditor to seize a debtor's property to secure a judgment. This legal tool helps in safeguarding the creditor's interests until the case concludes. If you're considering an Arkansas Application for Writ of Assistance, understanding this context may improve your approach to legal resolutions.

In Indiana, a writ of attachment typically remains valid until it is executed, or until the court vacates it. Generally, the duration is not specifically limited, but you should be mindful of potential court rules that may apply. If you need clarity on how this process can relate to an Arkansas Application for Writ of Assistance, our platform can provide the guidance you seek.

A writ of possession in Arkansas is a court order that allows a landlord or property owner to regain possession of property after a legal judgment. This document is essential when a tenant or occupant refuses to vacate the premises. Once obtained, the writ enables law enforcement to assist with the eviction process. Using the Arkansas Application for Writ of Assistance can guide you through this legal procedure more smoothly.

In Arkansas, the law permits creditors to garnish wages up to 25% of a debtor's disposable income. However, certain exemptions protect a portion of wages, which ensures that individuals can meet their basic needs. Knowing the garnishment limits is vital as it can significantly impact your financial situation. Utilizing the Arkansas Application for Writ of Assistance can assist in navigating these laws.

The garnishment statute in Arkansas governs the procedures and limits concerning the garnishment of wages and bank accounts. This statute ensures that certain protections remain in place for debtors, including caps on the percentage of income that can be garnished. Understanding this statute is crucial for both creditors and debtors. For more clarity, exploring the Arkansas Application for Writ of Assistance can be beneficial.

To collect a judgment in Arkansas, start by identifying the debtor's assets. You may utilize an Arkansas Application for Writ of Assistance to initiate additional legal actions, such as garnishment or liens. You can also engage a collection agency if you encounter difficulties. Remember, staying informed about your rights is important in the judgment collection process.

Serving someone in Arkansas typically involves personally delivering legal documents to the individual. You can accomplish this through a process server or the sheriff's department. If you require assistance, consider using the Arkansas Application for Writ of Assistance to ensure you're following the correct protocols. Accurate service is crucial, as it helps protect your legal claims.

In Arkansas, the maximum amount that can be garnished from your paycheck is generally 25% of your disposable income. This is clearly outlined under state garnishment laws. Additionally, federal regulations may limit deductions, both of which aim to protect your financial stability while still allowing debt recovery. Understanding these limits is important as you navigate financial obligations.

Answering a summons in Arkansas without an attorney is certainly possible, but it requires thorough understanding of court rules. You must file a written response with the court and serve a copy to the opposing party within the specified time. USLegalForms can provide guidance and templates that simplify this process, especially when dealing with the Arkansas Application for Writ of Assistance.