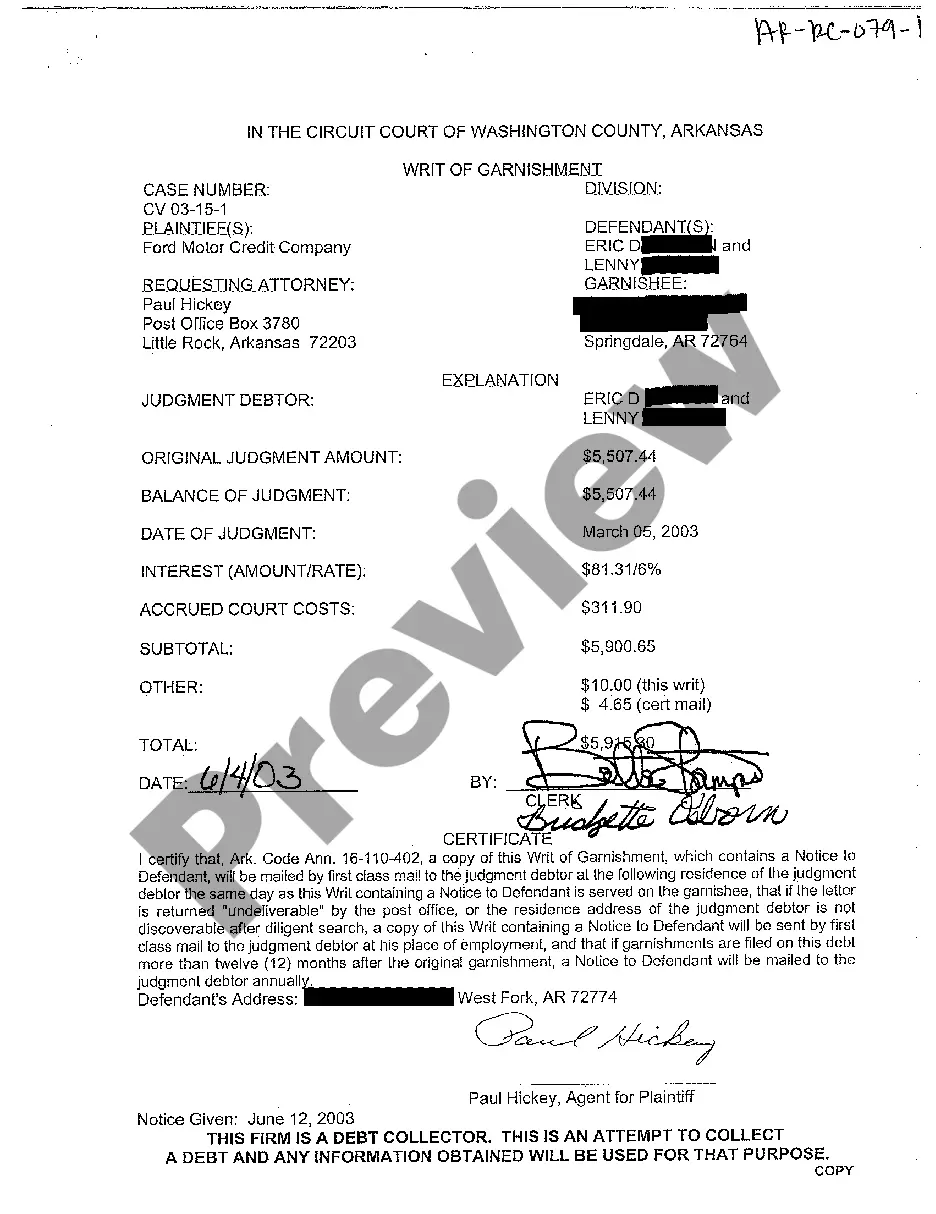

Arkansas Writ of Garnishment

Description Writ Of Garnishment Arkansas

How to fill out Garnishment In Arkansas?

Amid numerous complimentary and premium examples available online, you cannot guarantee their precision and dependability.

For instance, who authored them or if they possess the necessary qualifications to address your requirements.

Stay calm and utilize US Legal Forms! Uncover Arkansas Writ of Garnishment documents crafted by proficient legal experts and avoid the expensive and tedious task of searching for a lawyer and subsequently compensating them to prepare a document for you that you might find on your own.

After you have registered and completed your subscription payment, you may utilize your Arkansas Writ of Garnishment as often as needed or as long as it remains active in your state. Modify it in your preferred offline or online editor, fill it out, sign it, and print it. Achieve more for less with US Legal Forms!

- If you have a membership, sign in to your profile and locate the Download button adjacent to the file you are looking for.

- You will also have access to all your previously downloaded documents in the My documents section.

- If it is your first time using our site, follow the steps outlined below to obtain your Arkansas Writ of Garnishment effortlessly.

- Ensure that the document you find is valid in the state where you reside.

- Examine the document by reviewing the details using the Preview feature.

- Click Buy Now to initiate the purchase process or search for another example using the Search bar located in the header.

- Select a pricing option and create an account.

- Complete the subscription payment using your credit/debit card or PayPal.

- Download the form in the required format.

A Writ Of Garnishment Form popularity

Writ Of Garnishment Washington State Other Form Names

Arkansas Writ Of Garnishment Form FAQ

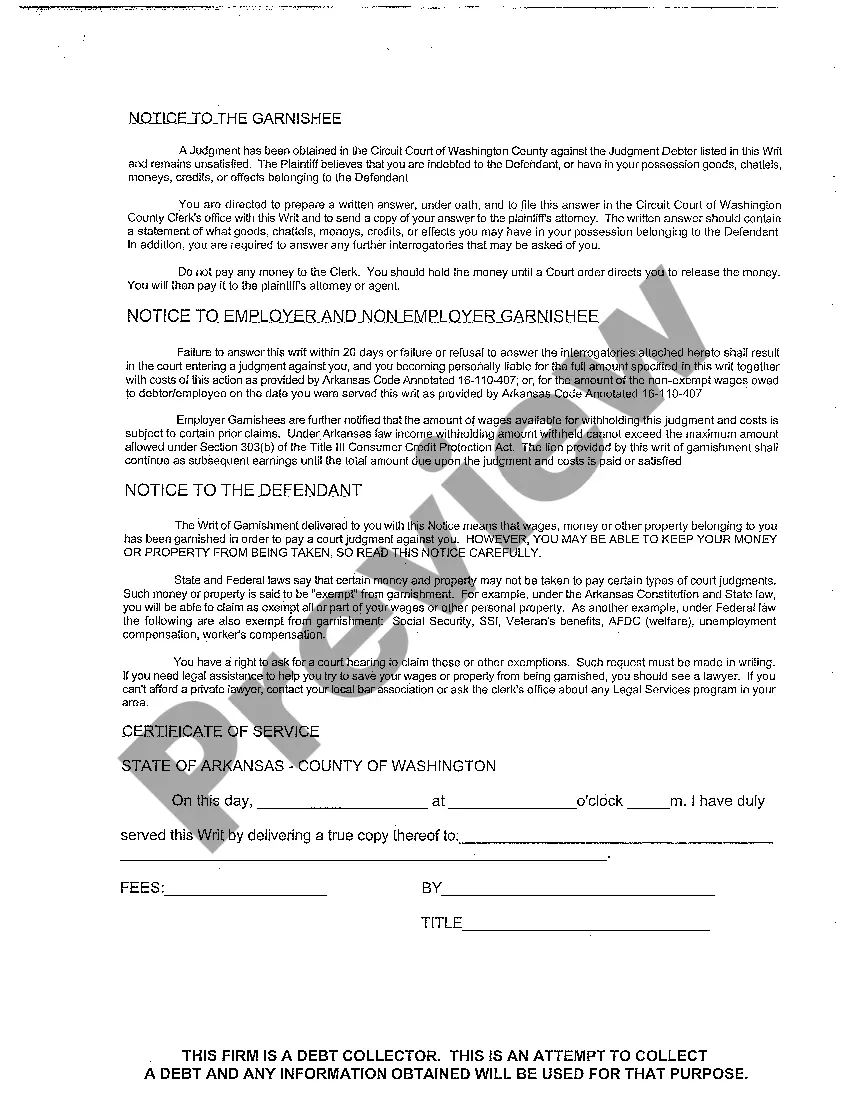

In Arkansas, the maximum amount that can be garnished from your wages under an Arkansas Writ of Garnishment typically varies by the type of debt. For most consumer debts, the limit is set at 25% of disposable income. Understanding the laws surrounding garnishment can be complex, and it may be helpful to seek assistance from platforms like US Legal Forms for clarity and support.

The IRS can take a portion of your paychecks under an Arkansas Writ of Garnishment, but there are limits. Generally, they cannot garnish more than 25% of your disposable earnings in a week. However, if you earn less than a certain threshold, the IRS may not garnish at all. It is essential to understand your rights and consult with legal experts if you face garnishment.

In Arkansas, the statute of limitations on most types of debt is typically six years. This means that creditors have six years from the date of the last payment to file a lawsuit to collect a debt. After this period, the debt becomes unenforceable in court. Being aware of this timeline can provide you with a clearer understanding of your rights and obligations related to an Arkansas writ of garnishment.

To file an exemption for wage garnishment in Arkansas, you need to submit a formal claim to the court that issued the garnishment. This claim must demonstrate that your income is protected under Arkansas law. It's vital to provide supporting documentation, along with your request. Utilizing platforms like USLegalForms can simplify this process by providing necessary templates and guidance.

Arkansas Code 16-110-402 pertains to the procedures for obtaining a garnishment order in Arkansas. It outlines how creditors can request this type of relief and the specific requirements they must meet. Understanding this code helps both creditors and debtors navigate the legal landscape surrounding garnishments. Resources like USLegalForms can help clarify these regulations for you.

The garnishment statute in Arkansas outlines the legal framework for garnishing a debtor’s wages or bank accounts. It details the procedures creditors must follow to obtain a writ of garnishment and the rights of debtors. Familiarizing yourself with this statute is crucial when considering an Arkansas writ of garnishment, as it provides essential protections for both parties involved.

In Arkansas, the amount that can be garnished from your wages is generally limited to 25% of your disposable earnings. Disposable earnings represent your income after taxes and other mandatory deductions. However, the exact amount may vary depending on the type of debt and the court’s decision. Understanding these limits can help you navigate an Arkansas writ of garnishment more effectively.

Stopping a wage garnishment in Arkansas requires a written request to the court that issued the garnishment. You may also file an exemption claim if you qualify under Arkansas law. This legal process can be complicated, but resources like USLegalForms can assist you in understanding your rights and preparing the necessary documents. It’s important to act promptly to protect your earnings.

To collect a judgment in Arkansas, you can use an Arkansas writ of garnishment. This legal tool allows you to intercept funds owed to the debtor from a third party, such as a bank or an employer. Consider gathering all necessary documentation, such as the judgment order, and then filing the writ with the court. It's recommended to consult with a legal professional to ensure you follow proper procedures.

As mentioned earlier, Arkansas restricts the garnishment amount to either 25 percent of your disposable income or the amounts that exceed 30 times the federal minimum wage. It is vital to ensure this regulation is followed by your employer. Knowledge of these allowances under the Arkansas Writ of Garnishment empowers you to monitor your financial health actively.