Arkansas Writ of Garnishment

Description Claim Of Exemption Form For Wage Garnishment

How to fill out Arkansas Writ Of Garnishment?

Among many paid and free samples that you can find online, you cannot be sure of their precision.

For instance, who created them or if they are qualified enough to handle the matter you need these individuals for.

Always stay calm and utilize US Legal Forms!

Click Buy Now to commence the buying process or search for another sample using the Search field located in the header.

- Explore Arkansas Writ of Garnishment examples crafted by experienced legal professionals and avoid the expensive and lengthy process of searching for a lawyer and then needing to compensate them to draft a document for you that you can easily obtain yourself.

- If you possess a subscription, Log In to your account and find the Download button next to the file you’re looking for.

- You will also have the opportunity to access all your previously downloaded files in the My documents section.

- If you’re utilizing our service for the first time, follow the guidelines below to obtain your Arkansas Writ of Garnishment swiftly.

- Ensure that the document you find is legitimate in your location.

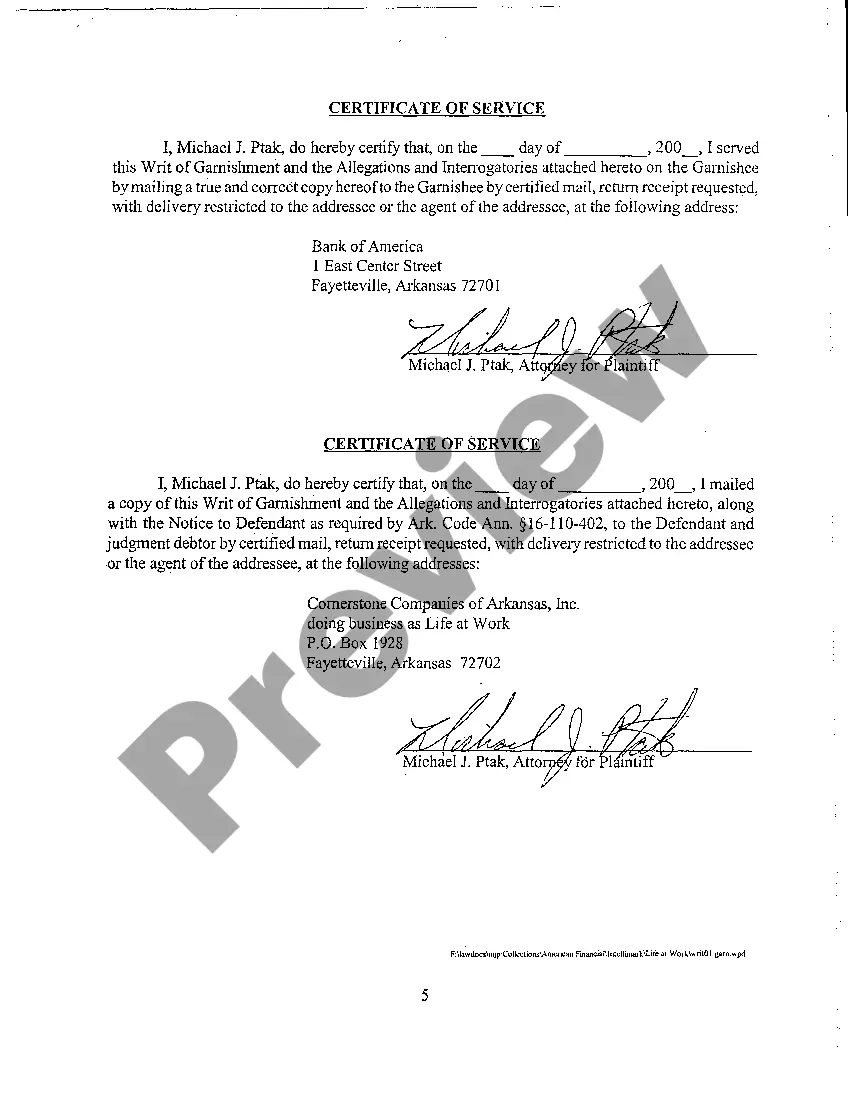

- Review the file by examining the description using the Preview feature.

Writ Of Garnishment Form Form popularity

Wage Garnishment Hardship Form Other Form Names

FAQ

In Arkansas, certain exemptions apply to wage garnishments. These exemptions can include a portion of income, depending on your financial situation and family obligations. The Arkansas Writ of Garnishment must adhere to these legal limits when determining the amount that can be garnished from your wages. To ensure that your rights are protected, consider consulting resources like USLegalForms to understand your exemptions and rights.

The best way to stop wage garnishment is often through negotiation with your creditor or by filing a motion with the court. If you can reach a settlement with your creditor, they may accept a payment plan instead of continuing with the Arkansas Writ of Garnishment. Furthermore, exploring your legal options with a professional can provide clarity on the steps to take. Platforms like USLegalForms can supply you with the necessary documentation for this process.

The speed at which a garnishment can be stopped in Arkansas varies. If the court approves your motion to stop the Arkansas Writ of Garnishment, it may take a few days to process the request. Timing also depends on court schedules and the particular circumstances of your case. Acting promptly is crucial, and USLegalForms can assist in expediting your submission.

To stop a wage garnishment in Arkansas, you can file a motion with the court that issued the Arkansas Writ of Garnishment. This motion should explain why the garnishment should be halted. Additionally, you may need to demonstrate a change in circumstances, such as financial hardship. Using resources like USLegalForms can help you navigate this process and find the right forms to submit.

Stopping garnishment in Arkansas requires you to file a motion with the court that issued the writ. You may present evidence that disputes the garnishment's validity or demonstrate that you are exempt from such actions. Many find that accessing resources through platforms like USLegalForms simplifies the process of addressing concerns related to the Arkansas Writ of Garnishment.

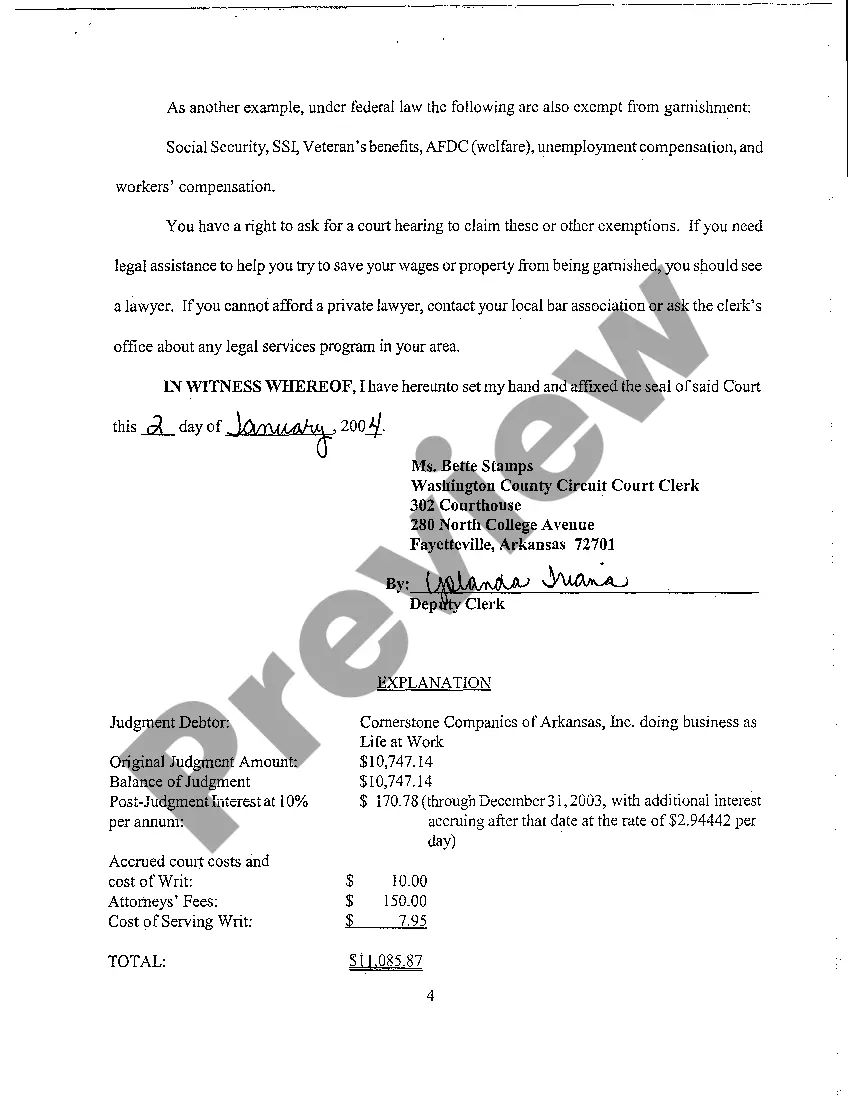

To collect a judgment in Arkansas, you may need to utilize tools such as garnishment, liens, or levies against the debtor’s assets. Begin by obtaining the necessary documentation and understanding your legal rights regarding the Arkansas Writ of Garnishment. With the right approach, you can effectively pursue what is owed to you.

In Arkansas, the amount that can be garnished is generally limited to 25% of your disposable income. However, certain exemptions may apply, such as when dealing with child support or federal debts, where more could be taken. Consulting the Arkansas Writ of Garnishment guidelines can help clarify your specific situation.

To file a writ of garnishment in Arkansas, start by obtaining a judgment against the debtor. Next, complete the necessary paperwork and submit it to the court, along with any required fees. The Arkansas Writ of Garnishment process can be complex, so consider using platforms like USLegalForms to streamline your filing and ensure compliance with state regulations.

The garnishment statute in Arkansas outlines the legal framework regarding the attachment of wages and bank accounts. Under Arkansas law, creditors can seek a writ of garnishment to collect on debts owed, provided specific procedures are followed. Familiarizing yourself with the Arkansas Writ of Garnishment statute can empower you to navigate these legal waters.

In Arkansas, the maximum amount that can be garnished from your paycheck varies, but typically, it does not exceed 25% of your disposable earnings. This means that after mandatory deductions like taxes, the remaining amount is subject to garnishment. Understanding the rules around the Arkansas Writ of Garnishment can help you manage your finances more effectively.