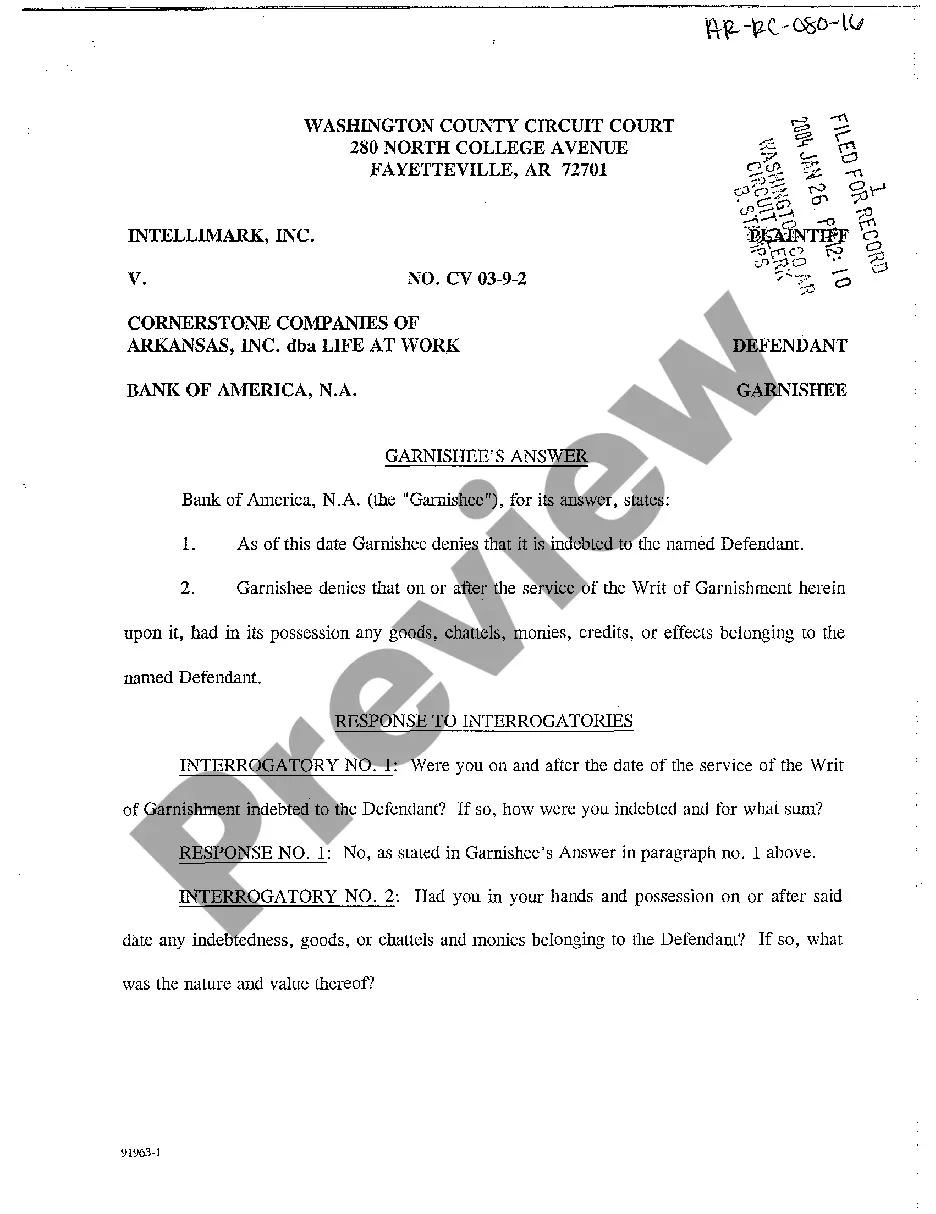

Arkansas Garnishee's Answer to Writ of Garnishment

Description Letter To Stop Wage Garnishment

How to fill out Answer To Writ Of Garnishment Template?

In the sea of numerous paid and complimentary samples available online, their trustworthiness cannot be guaranteed.

For instance, the identity of the creators or their competence in handling your requirements might be in question.

Always maintain your composure and take advantage of US Legal Forms! Explore Arkansas Garnishee's Answer to Writ of Garnishment templates crafted by expert attorneys to avoid the costly and time-consuming ordeal of searching for a lawyer and subsequently compensating them to draft a document that you can procure independently.

Select a pricing plan, register for an account, and process the payment for the subscription using your credit/debit card or PayPal. Download the form in your desired format. Once you’ve registered and secured your subscription, you may utilize your Arkansas Garnishee's Answer to Writ of Garnishment as frequently as you like or as long as it remains valid in your area. Modify it in your chosen offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you hold a subscription, Log In to your account and locate the Download button adjacent to the file you are pursuing.

- You will also have the ability to revisit all your previously downloaded samples in the My documents section.

- If you are using our website for the first time, adhere to the instructions below to retrieve your Arkansas Garnishee's Answer to Writ of Garnishment swiftly.

- Verify that the document you find is relevant to your jurisdiction.

- Examine the file by assessing the details using the Preview function.

- Click Buy Now to initiate the purchasing process or search for another sample utilizing the Search field located in the header.

Writ Of Garnishment Washington State Form popularity

Garnishment Letter To Employer Other Form Names

Arkansas Judgement Laws FAQ

To stop a wage garnishment in Arkansas, you must take action promptly after receiving notice of the garnishment. You can negotiate a payment plan with the creditor or file a motion with the court to dispute the garnishment. Filing an exemption based on financial hardship may also be a valid approach. Tools available on US Legal Forms simplify the process of addressing your Arkansas garnishee's answer to writ of garnishment, helping you achieve a favorable outcome.

In Arkansas, the statute of limitations determines how long a creditor can collect a debt, typically set at three to ten years depending on the type of debt. When this period expires, the debt becomes uncollectible, meaning creditors cannot enforce payment through the courts. However, it's essential to understand that this does not erase the debt. Using resources like the US Legal Forms platform can help you navigate the complexities of your Arkansas garnishee's answer to writ of garnishment.

Filing an exemption for wage garnishment in Arkansas begins with understanding your rights. You can claim exemptions if your income meets certain criteria or if your earnings are below a specific threshold. To formally file, you must submit a written claim to the court handling your garnishment case. The US Legal Forms platform provides templates and guidance, making the process of filing your Arkansas garnishee's answer to writ of garnishment easier.

To file a writ of garnishment in Arkansas, you must first obtain a judgment against the debtor. After securing the judgment, you can complete the necessary forms to request a writ of garnishment. It's important to submit these forms to the court and serve them to the garnishee. For assistance, consider using the US Legal Forms platform which offers guided resources for filing an Arkansas garnishee's answer to writ of garnishment.

Arkansas Code 16-110-402 outlines the legal procedures related to garnishment, including how garnishments must be initiated and executed. This code ensures that both creditors and debtors understand their rights and obligations under the law. For further clarification on this statute and how the Arkansas Garnishee's Answer to Writ of Garnishment plays a role, consult resources like USLegalForms for comprehensive insights.

Yes, Arkansas law requires employers to notify employees of any garnishment order they receive. This means you should be informed about the garnishment through your employer, allowing you to understand the situation. Being aware of the Arkansas Garnishee's Answer to Writ of Garnishment can equip you to respond appropriately to any garnishment that affects your income.

The state of Arkansas limits garnishment to 25% of your disposable income per paycheck. Disposable income is the amount left after legally required deductions. If you need further assistance understanding how the Arkansas Garnishee's Answer to Writ of Garnishment applies to your situation, platforms like USLegalForms can guide you through the process.

In Arkansas, the law allows a maximum of 25% of your disposable earnings to be garnished from your paycheck. It’s important to understand that this amount can vary based on specific circumstances, such as the type of debt. Therefore, you should be aware of the implications of the Arkansas Garnishee's Answer to Writ of Garnishment, as it affects your paycheck significantly.

To stop a writ of garnishment in Arkansas, you can file a motion to quash the garnishment, asserting that it is invalid or improper. Additionally, you can negotiate a payment plan with the creditor to settle the debt. It’s important to understand your rights in this situation, and US Legal Forms can provide you with the necessary forms and instructions to navigate this process effectively.

To effectively respond to a writ of garnishment in Arkansas, you must file an Arkansas Garnishee's Answer to Writ of Garnishment with the court. This document must be submitted within 30 days of receiving the writ, and it should include details about the debtor's account or any property you may hold. If you are unsure about the process, consider consulting a legal service like US Legal Forms, which offers templates and clear guidance for filing your answer.