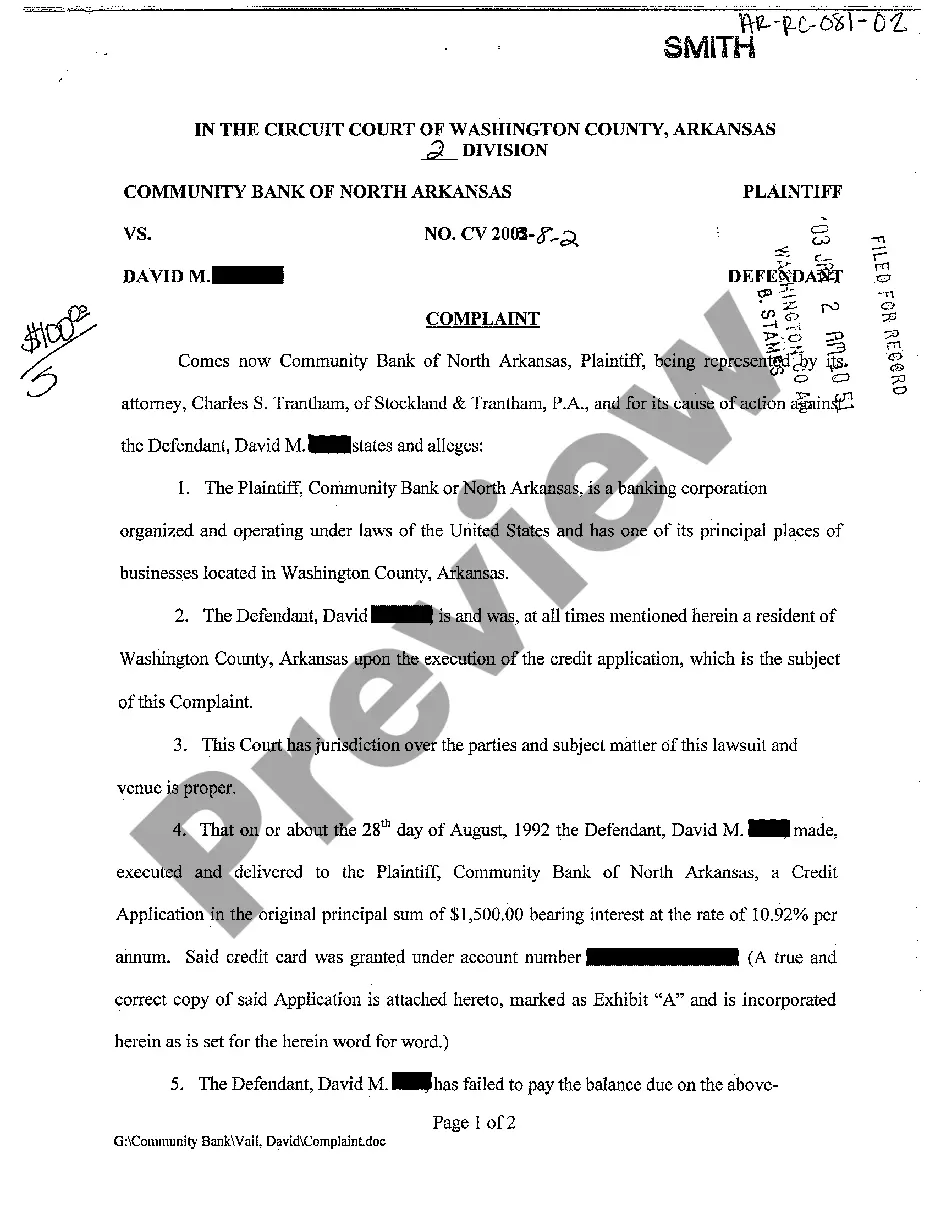

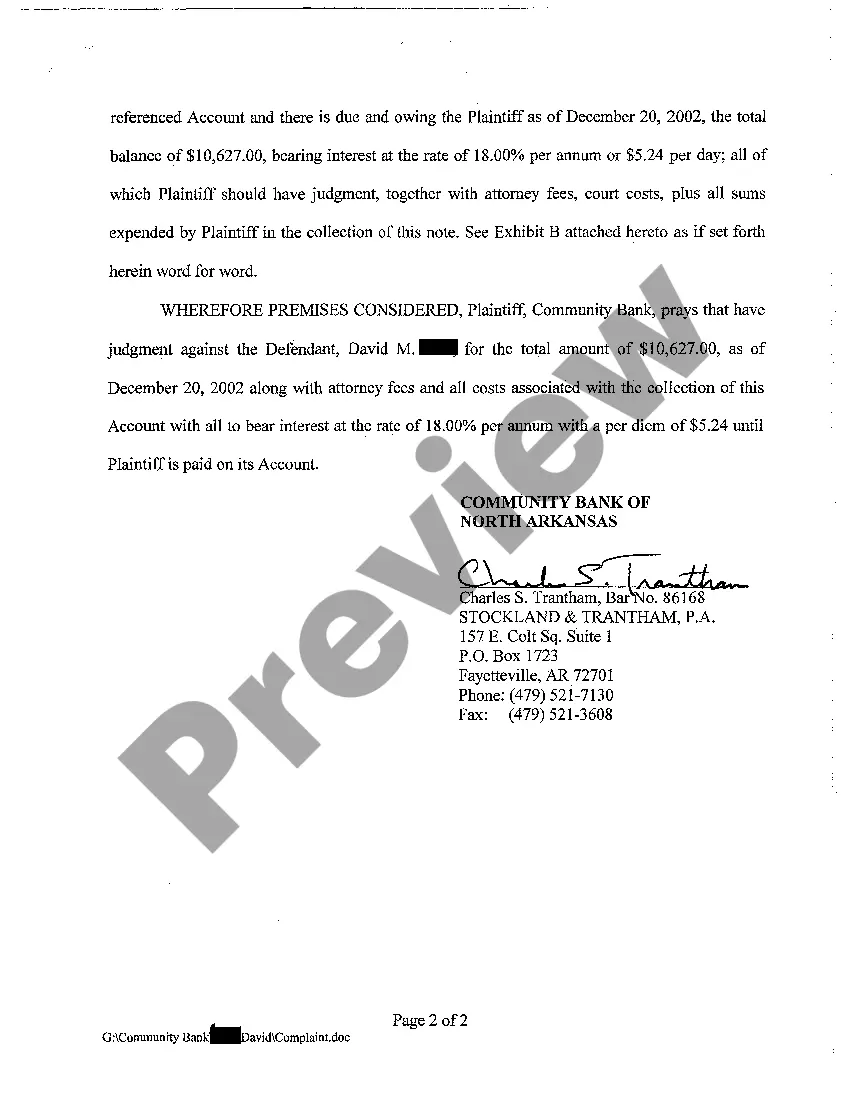

Arkansas Complaint for Collection of Debt

Description

How to fill out Arkansas Complaint For Collection Of Debt?

Among numerous paid and complimentary samples you can find online, you cannot be assured of their precision.

For instance, who developed them or if they possess the necessary qualifications to handle your requests.

Stay composed and utilize US Legal Forms!

Opt for a pricing plan, register for an account, make the payment for the subscription using your credit/debit card or Paypal, download the document in the desired file format. Once you have registered and paid for your subscription, you can use your Arkansas Complaint for Collection of Debt as often as necessary or for the duration it remains valid in your state. Edit it in your preferred online or offline editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Explore Arkansas Complaint for Collection of Debt templates crafted by experienced lawyers and bypass the costly and time-consuming process of searching for an attorney and then compensating them to draft documents that you can easily obtain yourself.

- If you own a subscription, sign in to your account and locate the Download button next to the form you seek.

- You will also have the ability to retrieve your previously stored documents in the My documents section.

- If you are using our service for the first time, adhere to the instructions below to quickly obtain your Arkansas Complaint for Collection of Debt.

- Ensure that the document you locate is legitimate in the state where you reside.

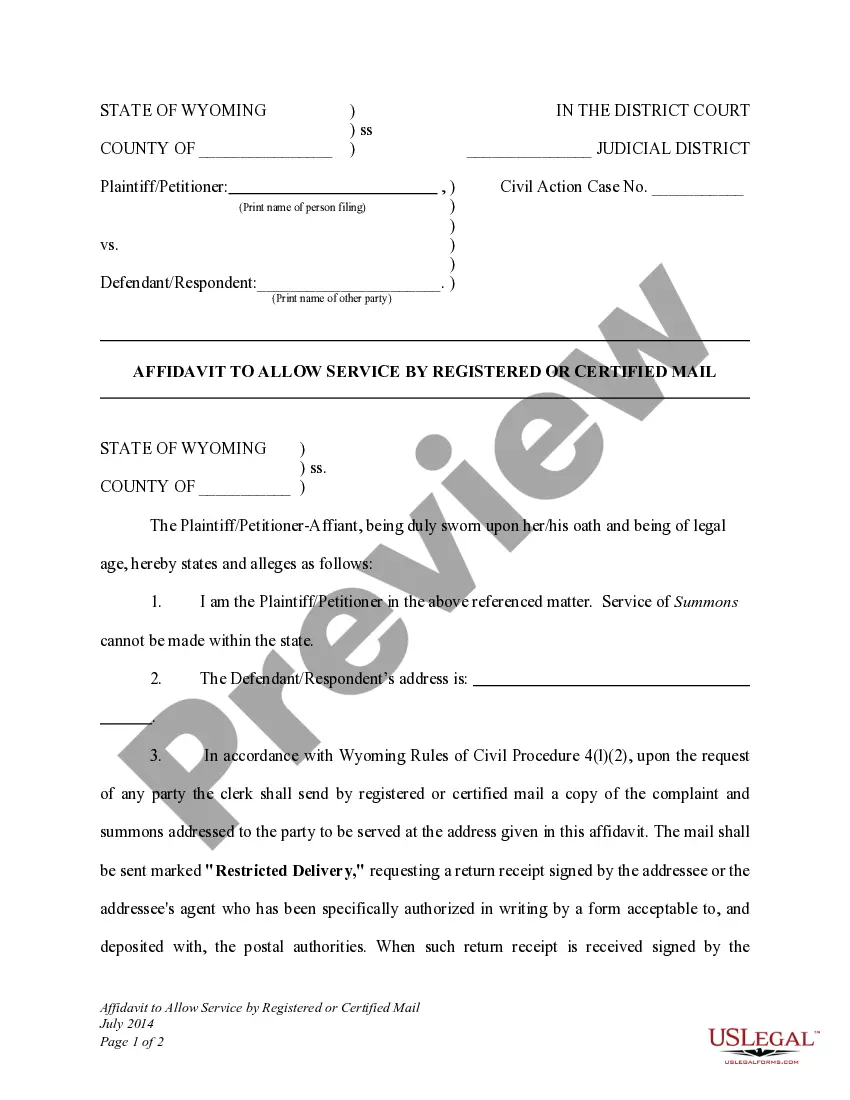

- Examine the document by reviewing the description using the Preview feature.

Form popularity

FAQ

The 777 rule is an important guideline for debt collectors, especially in Arkansas. This rule indicates that debt collectors should not contact you more than seven times in a seven-day period regarding a debt. Understanding the Arkansas Complaint for Collection of Debt is crucial, as it helps you recognize your rights when dealing with collectors. If you believe a collector is violating this rule, filing an Arkansas Complaint for Collection of Debt can help protect you from harassment.

To file a consumer complaint in Arkansas, you can start by gathering relevant information about your situation, including details about the debt and the collector. Next, visit the Arkansas Attorney General's website, where you can find forms and instructions for submitting your Arkansas Complaint for Collection of Debt. It is essential to provide accurate information to ensure that your complaint is processed efficiently. You may also consider utilizing uslegalforms to access templates specifically designed for filing complaints, streamlining your experience.

When speaking with debt collectors, say, 'I need to verify this debt first.' It establishes your need for clarity and legitimizes your request for validation. Avoid saying anything that admits liability, as it can be used against you. Remember, navigating the Arkansas Complaint for Collection of Debt can empower you in handling such situations.

The phrase, 'I do not owe this debt, please cease contact,' encapsulates the essence of your stand against collectors. This phrase asserts your position and indicates that you do not acknowledge the debt. If the communication continues, you may want to consider formal channels like the Arkansas Complaint for Collection of Debt to seek resolution.

In India, an effective phrase is not widely known like in other countries. However, focusing on your rights and informing collectors about disputes can help. Consider referring to established legal provisions to guide your communication. Moreover, addressing issues through the Arkansas Complaint for Collection of Debt can provide you with a structured approach.

You can say, 'I would like to dispute this debt and request validation.' This statement informs the collector you are aware of your rights under the Fair Debt Collection Practices Act. If you wish to cease communication, you can also state that you do not wish to discuss this further. Using the Arkansas Complaint for Collection of Debt, you can formally address any alleged collections.

To outsmart a debt collector, first understand your rights. You can request validation of the debt; this requires them to provide proof that you owe the amount. If they cannot validate it, you may have grounds to dispute the Arkansas Complaint for Collection of Debt. By staying informed and documenting all communication, you can protect yourself.

The Arkansas Debt Collection Act establishes legal standards that debt collectors must follow when trying to collect debts. It protects consumers against abusive practices while ensuring that they have a way to challenge an Arkansas Complaint for Collection of Debt. This law outlines consumer rights and outlines the responsibilities of collectors, promoting fair treatment in the debt collection process. Understanding this act can empower you during interactions with debt collectors.

To effectively fight debt collection in Arkansas, review all documents related to the Arkansas Complaint for Collection of Debt. Gather any evidence that supports your case and identify any inaccuracies in the debt claimed. You may also consider sending a dispute letter to the collector, stating your concerns and requesting validation of the debt. Seeking assistance from legal professionals can provide you with guidance tailored to your situation.

In Arkansas, debt collectors can attempt to collect a debt for a maximum of six years after the last payment. This timeline is important as it affects your rights when dealing with an Arkansas Complaint for Collection of Debt. After this period, consumers may defend against such claims in court due to the statute of limitations. It's wise to stay informed and consult legal resources when handling debt collection matters.