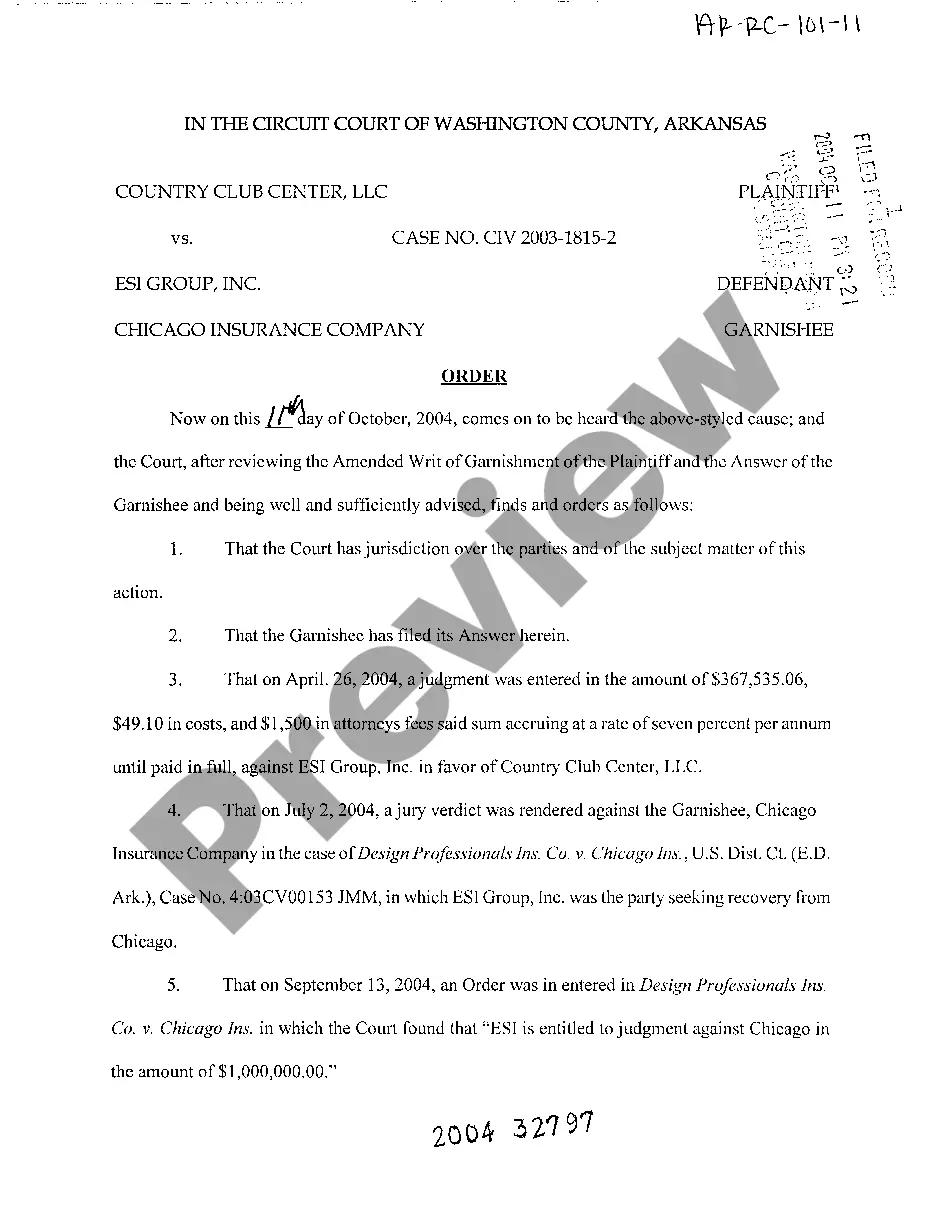

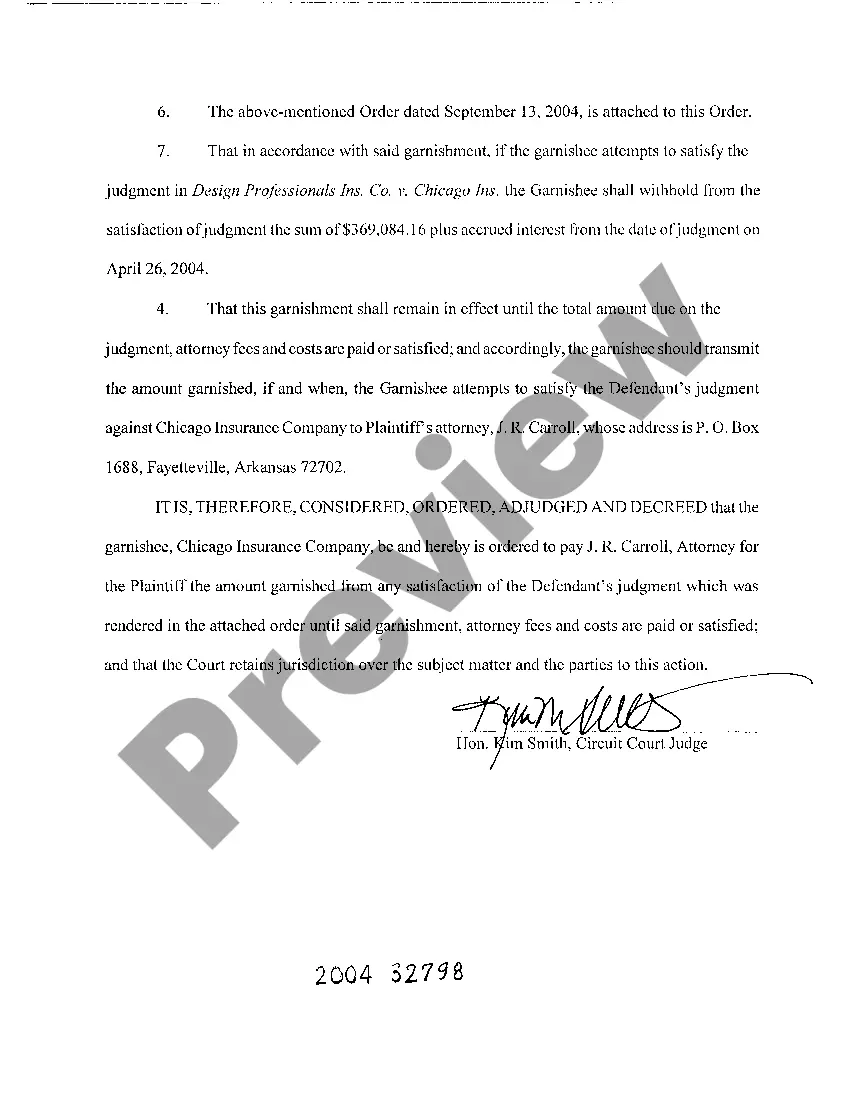

Arkansas Order on the Amended Writ of Garnishment

Description

How to fill out Arkansas Order On The Amended Writ Of Garnishment?

Among numerous complimentary and paid instances that you can discover on the web, you cannot ensure their precision and trustworthiness.

For instance, who created them or if they possess the expertise to manage the materials you require them for.

Remain calm and utilize US Legal Forms!

You will also have access to all of your previously obtained templates in the My documents section.

- Find Arkansas Order on the Amended Writ of Garnishment templates crafted by experienced attorneys.

- Avoid the expensive and lengthy procedure of searching for a lawyer.

- You won’t have to compensate them to draft a document for you that you can easily obtain yourself.

- If you hold a subscription, Log In/">Log In to your account.

- Locate the Download button adjacent to the form you are seeking.

Form popularity

FAQ

Yes, a garnishment can be reversed under certain conditions. If you can showcase that the garnishment was improperly granted or present compelling reasons, you can file for a reversal through the legal system. Keep in mind that navigating this process may require the support of a legal professional to ensure your rights are protected.

Reversing a wage garnishment order can be done by filing a motion with the court that issued the order. You will need to provide valid reasons aligned with the requirements of garnishment laws, and mention any applicable Arkansas Order on the Amended Writ of Garnishment. Consulting with a professional may enhance your understanding of the process and improve your case.

To appeal a writ of garnishment, you need to file a notice of appeal with the court that issued the original order. This process often requires submitting a written brief outlining your reasons for the appeal, including any supporting legal documents. Seeking assistance from a legal expert can help streamline this process and improve your chances of success.

To write a letter to stop wage garnishment, clearly state your intent and include details about your situation. Specify the court case number and mention the Arkansas Order on the Amended Writ of Garnishment that you are requesting. Make sure to provide any evidence supporting your claim and send the letter to the appropriate parties, including the court and creditor.

Stopping a garnishment can happen quite quickly, but it largely depends on how promptly you file the necessary legal documents. If you submit an Arkansas Order on the Amended Writ of Garnishment or a motion to stop the garnishment as soon as possible, you could see results within a few weeks. It is crucial to act immediately to minimize the financial impact.

To amend a garnishment, you must file an Arkansas Order on the Amended Writ of Garnishment with the court. This involves submitting a new writ that reflects your desired changes, along with relevant documentation. You may require legal assistance to ensure the amendment is processed correctly, avoiding further complications.

The maximum allowable amount your paycheck can be garnished depends on several factors, including your disposable income and applicable state laws. Generally, creditors may take a portion of your earnings, but they cannot leave you without sufficient funds for basic living expenses. Familiarizing yourself with the Arkansas Order on the Amended Writ of Garnishment can help you navigate this process effectively and ensure you are treated fairly.

A writ of garnishment in Arkansas is a legal order that allows a creditor to seize wages or other funds to satisfy a debt. Upon issuance of this writ, employers must comply and withhold the specified amount from an employee's paycheck. Understanding the implications of an Arkansas Order on the Amended Writ of Garnishment can provide necessary insights into your financial rights.

The maximum garnishment amount for an employee typically depends on federal and state laws, including guidelines established under the Arkansas Order on the Amended Writ of Garnishment. Employers must follow these regulations, which ensure that employees retain a certain amount of their wages. It's crucial to know these rules to protect your financial wellbeing and avoid potential hardship.

The IRS can garnish a portion of your wages based on your disposable income, which is your earnings after required deductions. Generally, they can take up to 25% of your disposable earnings. To better understand your rights and obligations regarding an Arkansas Order on the Amended Writ of Garnishment, it's wise to consult relevant legal resources or platforms like UsLegalForms.