Arkansas Individual Self-Insurer Application

Description

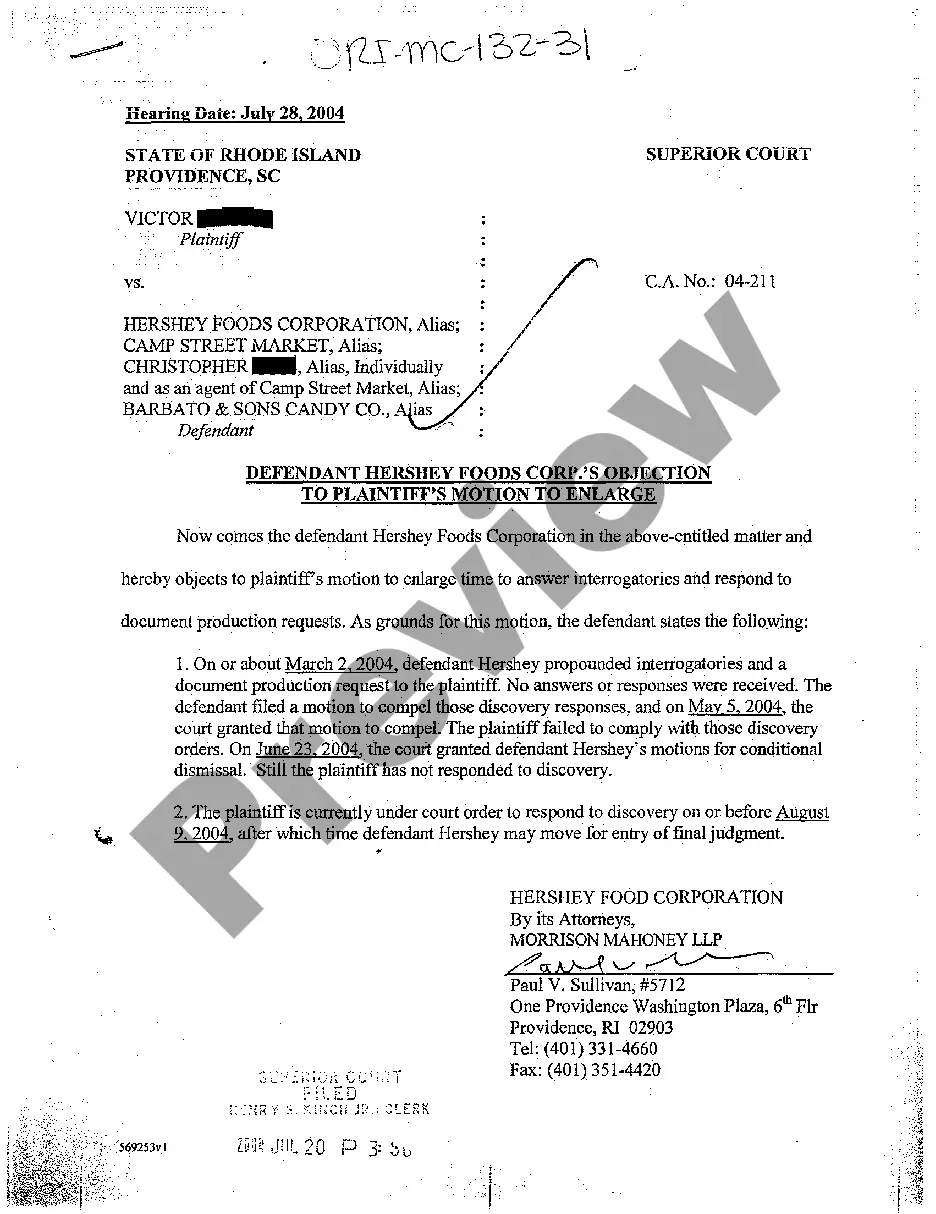

How to fill out Arkansas Individual Self-Insurer Application?

Utilizing Arkansas Individual Self-Insurer Application forms crafted by expert attorneys enables you to avert complications when filing documents.

Simply acquire the example from our site, complete it, and request a lawyer to validate it.

This approach can save you significantly more time and energy than having a legal expert compose a document from scratch for you.

Use the Preview function and review the description (if available) to determine if you need this particular template and if so, simply click Buy Now.

- If you have already obtained a US Legal Forms subscription, just Log In to your account and revisit the sample web page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a file, you will find your saved samples in the My documents section.

- If you lack a subscription, don't worry.

- Simply adhere to the instructions below to register for an account online, acquire, and complete your Arkansas Individual Self-Insurer Application template.

- Ensure you are downloading the appropriate state-specific form.

Form popularity

FAQ

Individual self insurance allows individuals or businesses to set aside funds for potential liabilities instead of purchasing traditional insurance coverage. In the context of the Arkansas Individual Self-Insurer Application, it enables you to have control over your risk management strategy while meeting the legal requirements in Arkansas. By opting for self insurance, you can customize your coverage to better suit your specific needs and financial goals. This can ultimately lead to significant savings, while also ensuring you remain compliant with state regulations.

The weekly workers' compensation rate in Arkansas for 2024 varies based on the employee’s average wage and the nature of their injuries. The state adjusts these rates annually to reflect economic changes and ensure fair compensation. If you are considering self-insurance, the Arkansas Individual Self-Insurer Application provides a pathway to manage your workers' compensation responsibilities effectively. Stay informed about the latest updates to guarantee compliance.

The maximum payment for workers' compensation in Arkansas depends on the type of injury and the employee's average weekly wage. Arkansas law sets limits to ensure fair compensation while maintaining a sustainable insurance system. If your business opts for self-insurance through the Arkansas Individual Self-Insurer Application, you may have additional flexibility in coverage. Always consult with legal experts to understand these figures better.

In Arkansas, employers may seek a workers' compensation waiver by applying for it with the state. To be eligible, you must meet specific guidelines and demonstrate that you have alternative coverage in place. Completing the Arkansas Individual Self-Insurer Application is crucial for businesses looking to self-insure their workers' compensation. Always follow legal standards to secure this waiver successfully.

To obtain an Arkansas insurance license, you must complete the required pre-licensing education and pass the licensing exam. Afterward, you can submit your application to the Arkansas Department of Insurance. When applying, consider the Arkansas Individual Self-Insurer Application if you are looking to manage your own workers' compensation insurance. Ensure you meet all legal requirements to operate effectively within the state.

In Arkansas, workers' compensation provides financial support to employees injured during their job. Employers are required to obtain coverage, either through an insurance provider or by filing an Arkansas Individual Self-Insurer Application. This system ensures that injured workers receive medical care and compensation for lost wages. Understanding this process helps create a safer workplace for everyone.

Workman's Compensation in Arkansas provides medical and wage-loss benefits for workers injured on the job. After filing a claim, which includes the Arkansas Individual Self-Insurer Application details, your employer's insurance will assess your case. This system ensures that you receive necessary medical care and compensation during your recovery. Understanding this process can help you navigate your rights and responsibilities effectively.

In Arkansas, you must report a work injury to your employer within 30 days. This timely reporting is crucial for your application concerning the Arkansas Individual Self-Insurer Application. Failing to notify your employer within this period may affect your ability to receive benefits. It's best to keep a record of your injury details and the date you report it.

Challenges of self-insurance include the need for significant upfront capital, the complexity of accurately forecasting potential losses, and managing claims effectively. Additionally, businesses must ensure compliance with state regulations and maintain adequate reserves for unforeseen events. By understanding these challenges, you can leverage the Arkansas Individual Self-Insurer Application to create a more structured self-insurance plan.

OSIP stands for Owner Controlled Insurance Program. This type of insurance allows project owners to manage and cover their own liability and risk associated with construction or large projects. While OSIP can streamline insurance for multiple contractors, it requires thorough understanding too. The Arkansas Individual Self-Insurer Application can assist project owners in navigating similar options.