Arkansas Group Self-Insurance Application

Description

How to fill out Arkansas Group Self-Insurance Application?

Utilizing Arkansas Application for Group Self-Insurance examples crafted by proficient attorneys helps you evade complications when filling out paperwork.

Simply download the example from our site, complete it, and consult a lawyer to review it.

By doing so, you will conserve significantly more time and effort than asking a legal expert to draft a document entirely from the beginning to cater to your requirements.

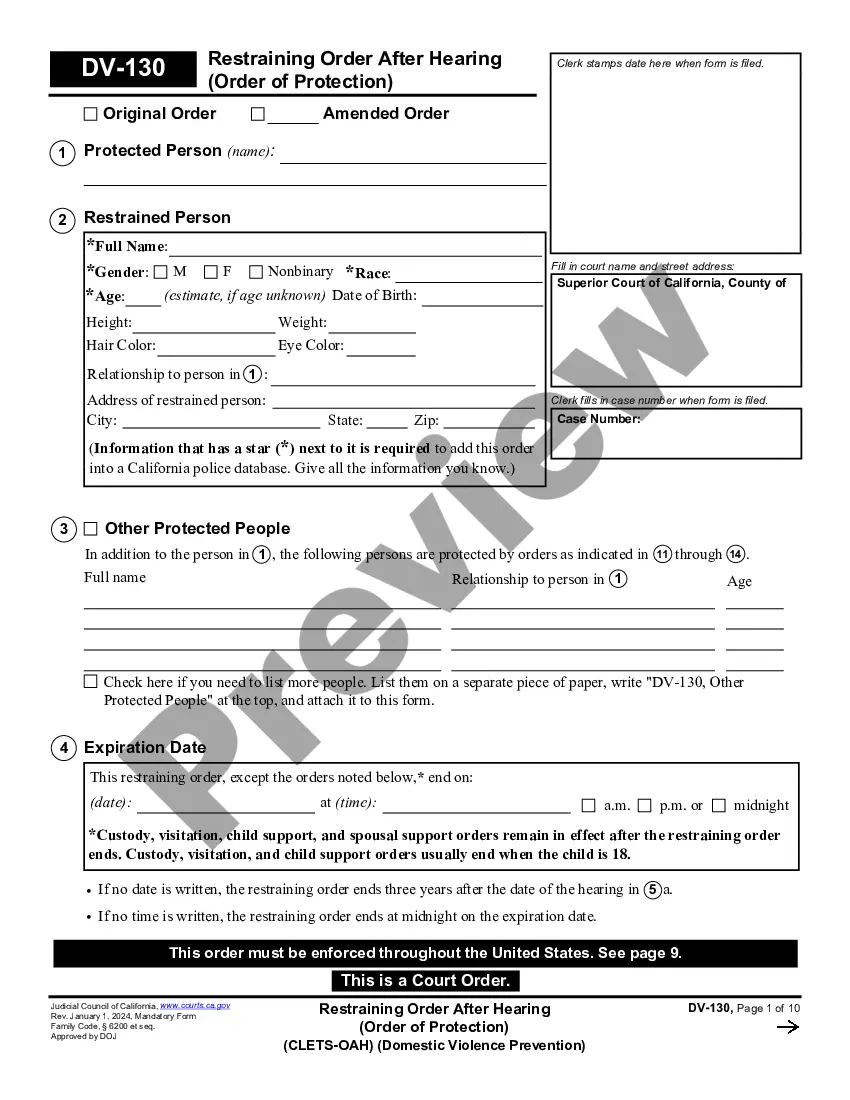

Employ the Preview feature and review the description (if available) to determine if you need this specific example; if so, click Buy Now. Then, find another template using the Search field if necessary. Choose a subscription that meets your requirements. Begin using your credit card or PayPal. Select a file format and download your document. After you have completed all aforementioned steps, you will have the option to fill out, print, and sign the Arkansas Application for Group Self-Insurance example. Remember to verify all entered information for accuracy before submitting or sending it out. Reduce the time you spend creating documents with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In/">Log In to your account and navigate back to the sample page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a document, all your saved samples will be found in the My documents section.

- If you lack a subscription, no worries.

- Just adhere to the guidelines below to create your account online, acquire, and complete your Arkansas Application for Group Self-Insurance template.

- Verify that you are downloading the correct state-specific form.

Form popularity

FAQ

In Arkansas, a single member LLC typically does not need to carry workers' compensation insurance unless it has employees. However, it is wise to consider coverage for personal protection against potential workplace injuries. If you choose to pursue coverage, using platforms like USLegalForms can offer support in navigating your Arkansas Group Self-Insurance Application.

The maximum compensation rate for workers' compensation in Arkansas is set annually based on the state's average weekly wage. As of the most recent updates, this rate can reach up to two-thirds of your average weekly earnings, with an established cap. Being aware of these limits can help you fill out your Arkansas Group Self-Insurance Application accurately.

To obtain a workers' comp waiver in Arkansas, you must first ensure your business meets specific criteria, including having fewer than three employees. Afterward, you can file a specific waiver form with the Arkansas Workers' Compensation Commission. Consulting resources like USLegalForms can simplify this process and guide you through your Arkansas Group Self-Insurance Application.

Several categories of workers may be exempt from workers' compensation in Arkansas. Common exemptions include certain agricultural workers, independent contractors, and small businesses with fewer than three employees. However, it is crucial to thoroughly check the specifics when filling out your Arkansas Group Self-Insurance Application to ensure compliance.

Self-insure means that a business takes on the financial responsibility for its own claims instead of relying on external insurance. This approach requires careful financial planning and risk management. By using the Arkansas Group Self-Insurance Application, you can assess whether self-insurance is right for your business and how to implement it.

insured group is a collective of businesses that join together to pool their risks and resources. This arrangement allows smaller firms to selfinsure collectively, reducing individual costs and improving overall protection. By utilizing the Arkansas Group SelfInsurance Application, you can find out how to join such a group.

insured captive is a specialized insurance company that your business owns to cover its risks. This captive operates like a traditional insurer, but you keep the profits and accommodate your specific needs. This can provide greater control over your claims and costs. The Arkansas Group SelfInsurance Application may include information about forming your captive.

To determine if you are self-insured, check whether you have filed the necessary paperwork with the Arkansas Workers’ Compensation Commission. Self-insured entities generally have sufficient financial stability to cover their own claims. If you're part of a group program, reviewing the Arkansas Group Self-Insurance Application can clarify your status.

Yes, workers' compensation insurance is generally required for most employers in Arkansas. This insurance provides coverage for medical expenses and lost wages for employees who sustain work-related injuries. However, some businesses may qualify for self-insured status, allowing them to manage their own claims. The Arkansas Group Self-Insurance Application can help you explore these options.

To file for workers' compensation in Arkansas, you must report the injury to your employer as soon as possible. Your employer will then provide you with the necessary forms to complete. Make sure to file your claim promptly to avoid delays in receiving benefits. For assistance, consider using platforms like USLegalForms, which can guide you through the Arkansas Group Self-Insurance Application process.