Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

If you require to complete, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift in just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay proactive and download, and print the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct region/state.

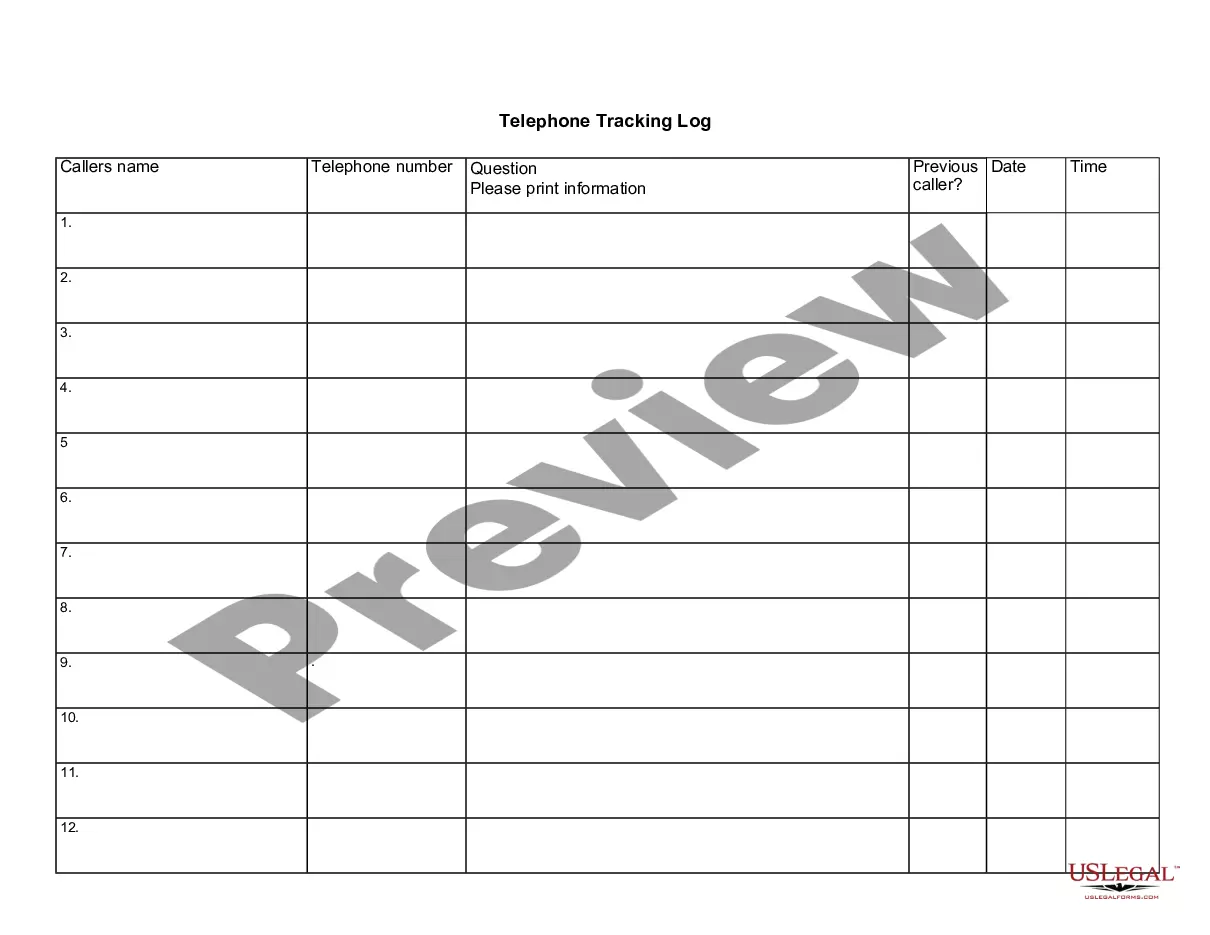

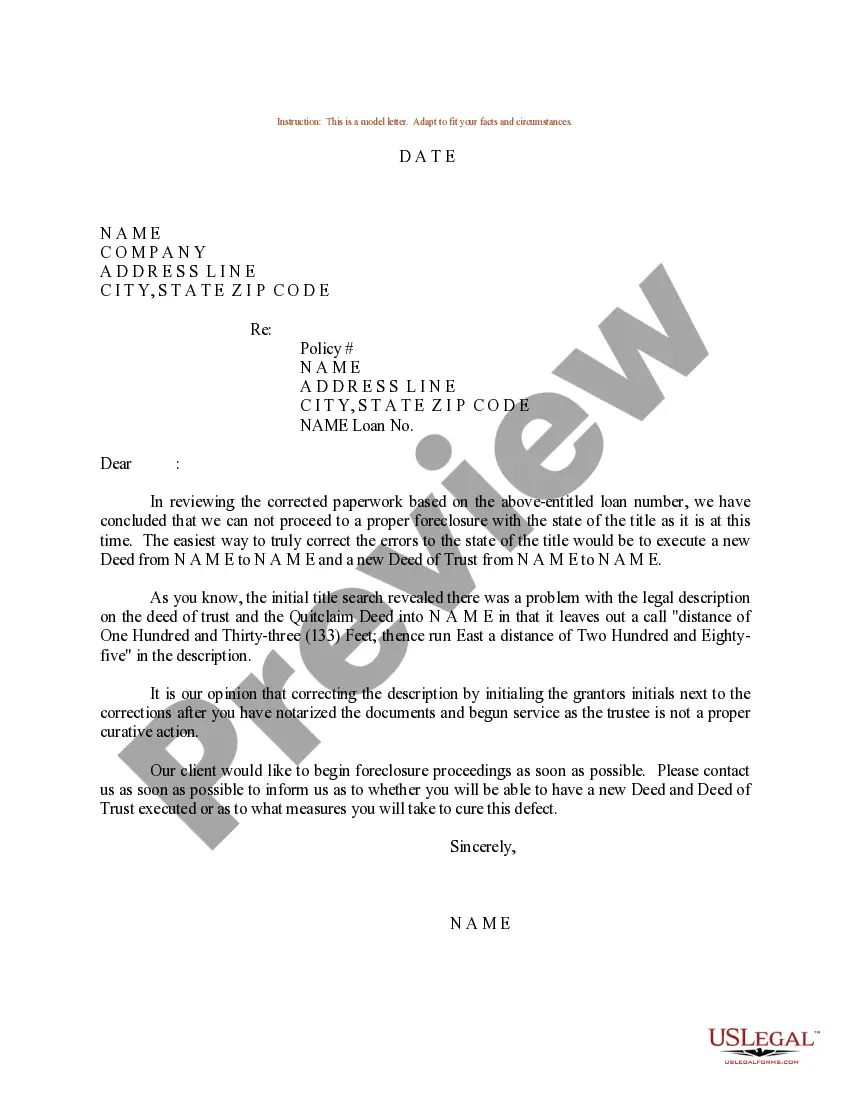

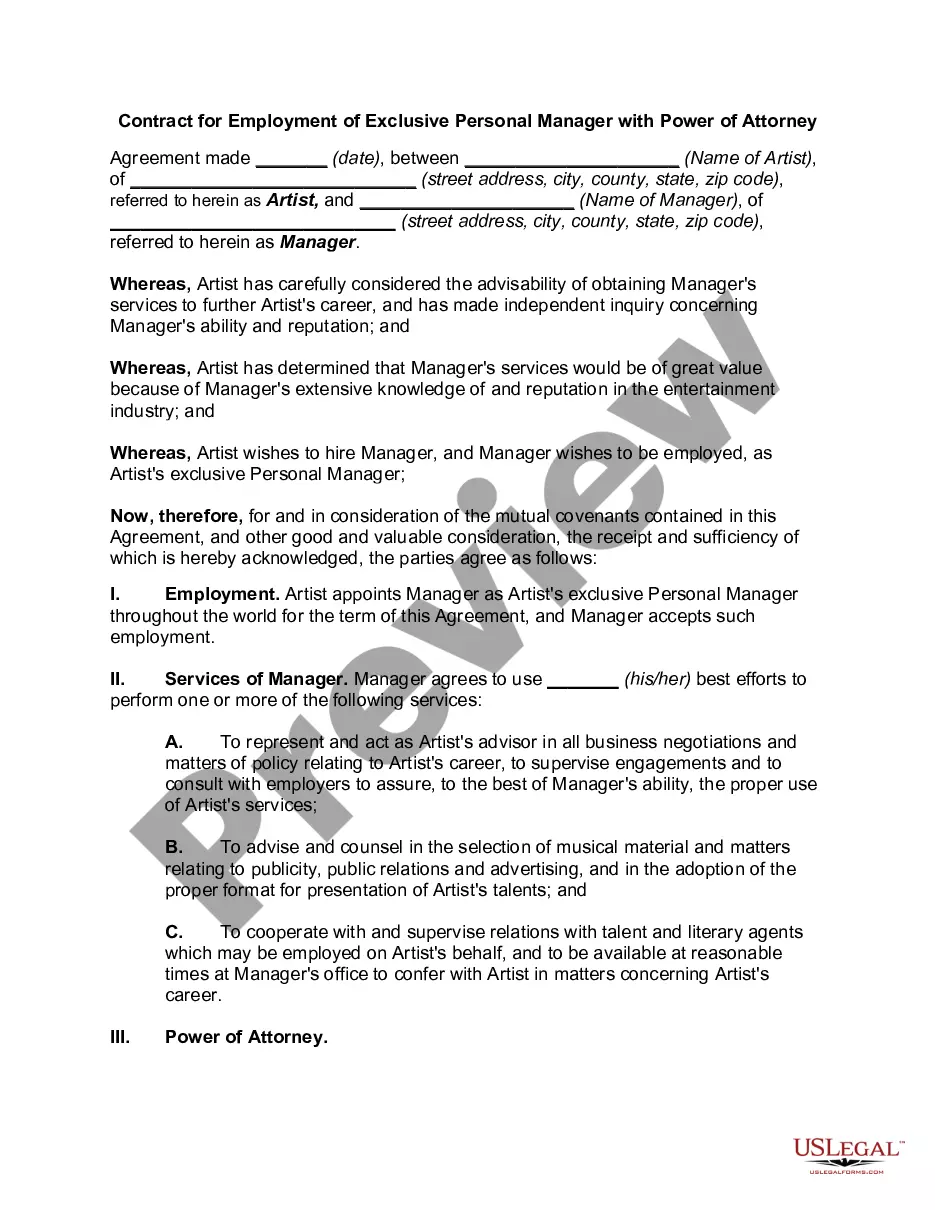

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Form popularity

FAQ

A gift acknowledgment is a formal record provided by a charitable or educational institution that confirms the receipt of a donation. It serves as proof for the donor, allowing them to claim tax deductions for their contributions. The Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift is essential for maintaining transparency and accountability in the donation process. Using platforms like US Legal Forms can simplify the creation and management of these acknowledgments, ensuring compliance with legal standards.

To acknowledge the receipt of a donation, promptly send a written acknowledgment to the donor. This acknowledgment should include the organization’s details, the donor's information, the donation date, and a description of the contribution. Additionally, state whether any goods or services were provided in return. Utilizing our platform, US Legal Forms, can help streamline this process, ensuring that your acknowledgment meets the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift requirements.

An example of a written acknowledgment could be a simple letter stating, 'Dear Donor's Name, Thank you for your generous gift of describe the gift on date. Your support helps us mention how it will be used. No goods or services were provided in exchange for your contribution.' This format aligns with the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift and makes the donation process smoother.

A contemporaneous written acknowledgment of a charitable gift must include specific details to meet IRS regulations. It should contain the name of the donor, the date of the contribution, and a description of the gift. Importantly, it must also clarify whether any goods or services were provided in return for the gift. This documentation is crucial for the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

To fill out a donation receipt effectively, start by including your organization’s name, address, and tax identification number. Next, clearly state the donor’s name and address, followed by the date of the donation. Be sure to describe the gift, its fair market value, and include a statement indicating whether any goods or services were provided in exchange for the donation. This ensures compliance with the Arkansas Acknowledgment by Charitable or Educational Institution of Receipt of Gift.