Arkansas Demand Bond is a type of financial instrument that serves as a guarantee or security for the payment of a debt or obligation owed by a party to another party. This bond is widely used in the state of Arkansas to ensure the fulfillment of various contractual agreements and protect the interests of the obliged. One key feature of Arkansas Demand Bond is its ability to be called or demanded by the obliged at any time, typically without prior notice. This means that the bond issuer must make the payment immediately upon request, ensuring quick resolution of any financial dispute or default. There are several types of Arkansas Demand Bonds, each designed for specific purposes and situations. These types may include: 1. Performance Bonds: These bonds are typically required in construction projects to guarantee the completion of the project according to agreed-upon terms. In the event of non-compliance or delays, the obliged can demand compensation from the bond issuer to cover the losses. 2. Payment Bonds: These bonds protect suppliers, subcontractors, and laborers by ensuring that they receive timely payment for their services or materials provided. If the principal fails to make the necessary payments, the bond can be demanded to cover these unpaid amounts. 3. Bid Bonds: When participating in public procurement processes like government contracts, contractors often need to submit bid bonds. These bonds guarantee that the winning bidder will enter into the contract and provide the required performance and payment bonds upon acceptance. 4. License and Permit Bonds: Certain professions or occupations in Arkansas require individuals or businesses to obtain licenses or permits. Demand bonds can be required as a condition for obtaining such licenses, ensuring compliance with applicable regulations. Arkansas Demand Bonds are often issued by insurance companies or financial institutions, known as sureties. These entities carefully assess the creditworthiness, financial stability, and track record of the bond applicant before providing the guarantee. The bond amount is typically determined by the nature of the obligation or contract being secured. Overall, Arkansas Demand Bonds play a crucial role in facilitating commerce and protecting the interests of parties involved in various contractual agreements. By providing a solid financial guarantee, these bonds promote confidence, mitigate risks, and ensure fair outcomes in a wide range of industries and sectors within the state of Arkansas.

Arkansas Demand Bond

Description

How to fill out Arkansas Demand Bond?

Choosing the best legitimate record web template can be a battle. Naturally, there are a lot of themes available online, but how can you get the legitimate develop you will need? Take advantage of the US Legal Forms web site. The assistance provides 1000s of themes, including the Arkansas Demand Bond, that you can use for enterprise and private needs. All of the kinds are inspected by pros and meet up with federal and state demands.

Should you be presently registered, log in to your account and then click the Acquire button to have the Arkansas Demand Bond. Utilize your account to search through the legitimate kinds you have acquired earlier. Visit the My Forms tab of your own account and obtain an additional backup of the record you will need.

Should you be a new user of US Legal Forms, listed below are straightforward instructions for you to follow:

- Initial, make sure you have chosen the right develop for your personal metropolis/county. It is possible to check out the shape while using Review button and study the shape description to make certain this is basically the right one for you.

- In the event the develop does not meet up with your needs, make use of the Seach field to obtain the right develop.

- Once you are certain that the shape would work, go through the Buy now button to have the develop.

- Pick the rates strategy you want and enter the essential information and facts. Design your account and pay for the order with your PayPal account or charge card.

- Select the submit file format and down load the legitimate record web template to your product.

- Full, edit and printing and sign the obtained Arkansas Demand Bond.

US Legal Forms is definitely the largest collection of legitimate kinds that you can find various record themes. Take advantage of the service to down load professionally-created papers that follow condition demands.

Form popularity

FAQ

Arkansas Law requires bail bond companies to charge and collect a ten percent premium on all bonds. It also provides there will be a $50.00 minimum on premium for any bond of $500.00 or less. The law also requires certain fees to be collected with every bond posted.

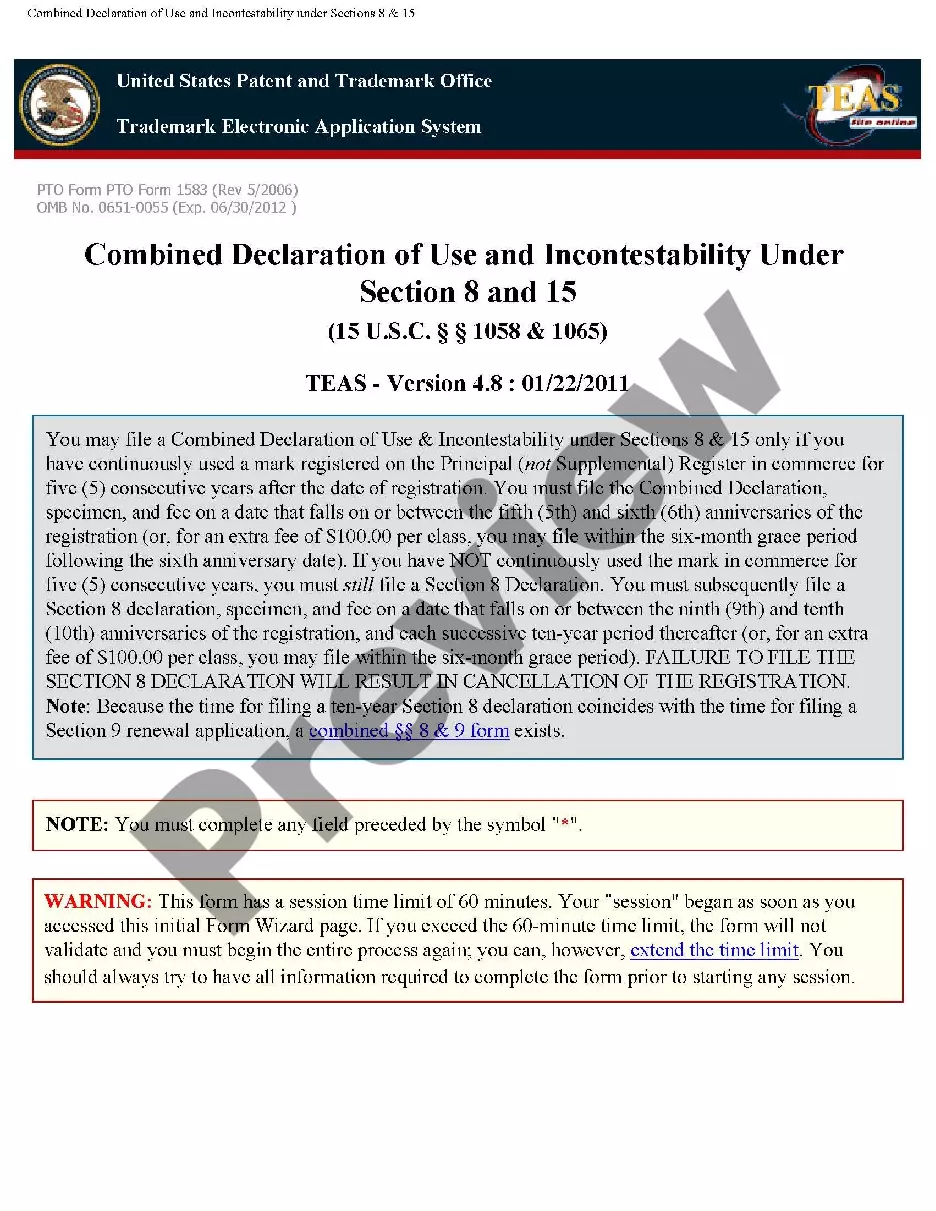

An on-demand bond is an unconditional bond or bank guarantee required of many contractors and sellers by overseas buyers to guarantee the tender (the actual form of money exchanged) as security against the value of advance payments under a contract, or to guarantee performance of the contract.

The essential difference between an 'on-demand' bond and a 'default' bond is that, under an 'on-demand' bond, the employer does not have to prove default.

Is the security an on-demand bond or guarantee? An on-demand security bond is an unconditional obligation to pay when a demand has been made. A surety bond or performance guarantee requires certain conditions to be met before payment is made. Some contracts provide standard form security documents.

The essential difference between an 'on-demand' bond and a 'default' bond is that, under an 'on-demand' bond, the employer does not have to prove default.

Paget's presumption applies where an instrument: Relates to an underlying transaction between the parties in different jurisdictions; Is issued by a bank1; Contains an undertaking to pay "on demand" (with or without the words "first" and/or "written"); and.

In the case of the Construction Industry, a Retention Bond is a type of Performance Bond that protects the client after the completion of the contract. This provides a guarantee that the contractor (the Principal) will fix any issues after the job / project has finished (even after full payment has been made).

The bond covers the whole duration of the project, as well as a maintenance period that is agreed on top. A letter of credit can be issued for any percentage of the project contract amount, but it's usually between 5-10%.