Arkansas Bill of Sale of Mobile Home with or without Existing Lien

Description

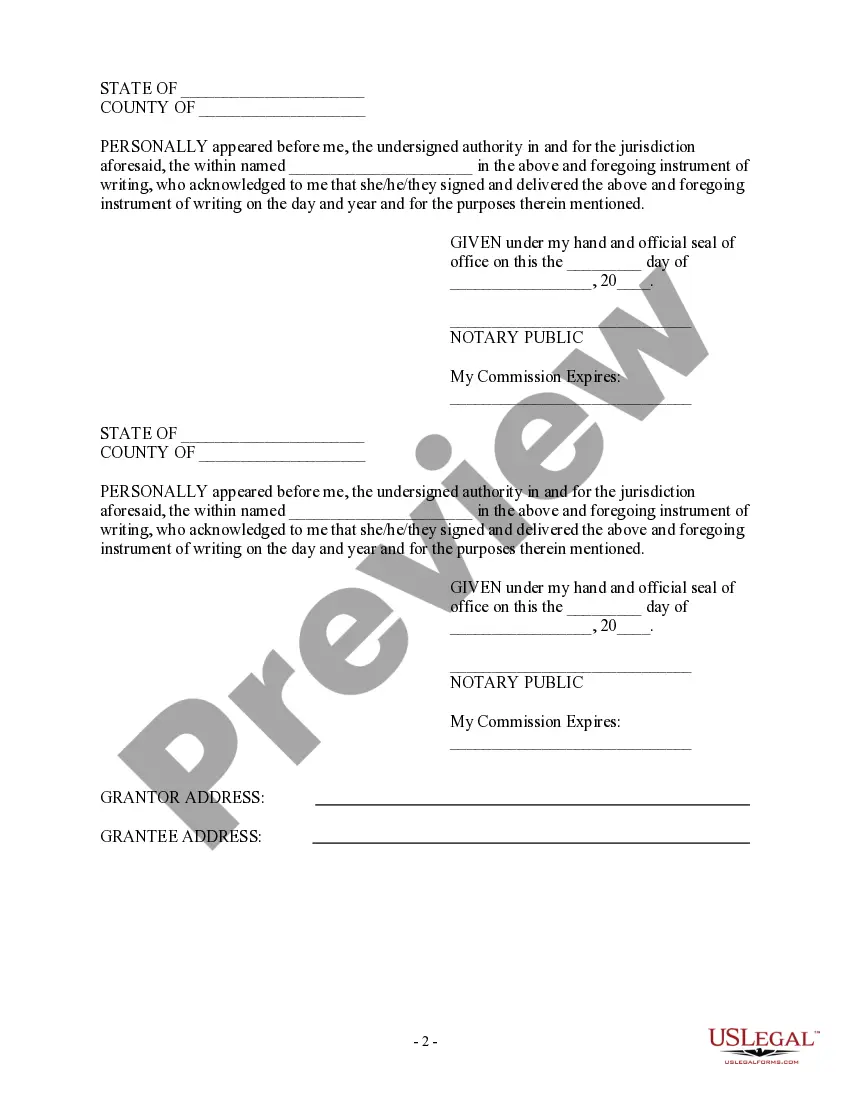

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

Selecting the appropriate legitimate document template can be a significant challenge.

It goes without saying that there are numerous templates available online, but how can you find the authentic version you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, such as the Arkansas Bill of Sale for a Mobile Home with or without an Existing Lien, suitable for both business and personal purposes.

If you are a new user of US Legal Forms, follow these simple instructions: First, ensure that you have chosen the correct form for your city/state. You can review the document using the Review option and examine the form summary to confirm it meets your needs. If the form does not satisfy your requirements, utilize the Search area to find the correct form. Once you are confident the form is accurate, click the Buy Now button to acquire it. Choose your pricing plan and enter the required information. Create your account and finalize your order using your PayPal account or credit card. Select the document format and download the legitimate document template to your device. Complete, modify, print, and sign the acquired Arkansas Bill of Sale for Mobile Home with or without Existing Lien. US Legal Forms holds the largest collection of legitimate forms where you can find an array of document templates. Utilize this service to obtain professionally crafted documents that meet state requirements.

- All templates are verified by professionals.

- Comply with federal and state regulations.

- If you are already registered.

- Log In to your account and select the.

- Download option to obtain the Arkansas Bill of Sale for Mobile Home with or without Existing Lien.

- Use your account to browse through the legitimate templates you have previously purchased.

Form popularity

FAQ

Yes, the West Virginia DMV typically requires a bill of sale when transferring vehicle ownership. While this specific process might differ for mobile homes, verifiable documentation provides legal protection for both parties. For matters related to Arkansas Bill of Sale of Mobile Home with or without Existing Lien, understanding the rules of your state can help each party fulfill all legal obligations.

To write a handwritten bill of sale for a car, start by including the date of the transaction and the details of both the buyer and seller. Clearly outline the car’s make, model, year, and Vehicle Identification Number (VIN). If applicable, when dealing with an Arkansas Bill of Sale of Mobile Home with or without Existing Lien, ensure you mention any existing liens that could affect ownership.

Yes, a title is essential for a bill of sale, especially when dealing with significant items such as a mobile home. In the context of an Arkansas Bill of Sale of Mobile Home with or without Existing Lien, having a proper title helps establish ownership and ensures that all legal requirements are met. If you're missing a title, consider contacting the local DMV for options on how to obtain one.

Yes, the name on a bill of sale should match the name on the title to avoid issues during the transfer of ownership. Any discrepancies can lead to complications when registering the mobile home. In the context of the Arkansas Bill of Sale of Mobile Home with or without Existing Lien, ensuring that names align helps prevent legal challenges and provides a clear path for ownership transfer. For assistance with drafting accurate documents, consider using uslegalforms for guidance.

A bill of sale is an important document, but it is not a replacement for a title. It acts as proof of the transaction and the parties' agreement but does not establish legal ownership on its own. When dealing with an Arkansas Bill of Sale of Mobile Home with or without Existing Lien, having the title ensures that the buyer receives complete ownership rights. Therefore, while a bill of sale is valuable, acquiring a title is essential for full legal recognition.

A mobile home title is often referred to as a certificate of title. This document serves as proof of ownership, detailing the mobile home's manufacturer, model, and year. In the case of an Arkansas Bill of Sale of Mobile Home with or without Existing Lien, the title is crucial for transferring ownership legally. Having a clear title helps ensure a smooth sale process.

Yes, an Arkansas Bill of Sale of Mobile Home with or without Existing Lien serves as proof of ownership after a sale is completed. This document provides evidence that a transaction occurred between the buyer and seller. However, while it establishes ownership transfer, for formal recognition, you should also register the title with the state. Having both the bill of sale and the title in place protects your interests and affirms your legal rights as an owner.

To transfer a mobile home title in Arkansas, fill out the back of the title with the new owner's information and sign it. You must then submit this updated title along with a completed application for a new title to the Arkansas Department of Finance and Administration. Utilizing an Arkansas Bill of Sale of Mobile Home with or without Existing Lien will make the process smoother by providing additional proof of the sale.

To transfer ownership of a mobile home in Arkansas, you need to complete the title transfer process, which includes signing over the title to the new owner. Along with the title, you should provide an Arkansas Bill of Sale of Mobile Home with or without Existing Lien to document the transaction. This combination ensures clear and legal ownership transfer.

In Arkansas, you generally cannot obtain a title using only a bill of sale. You must also provide certain documents, including an application for the title, proof of payment of any taxes, and sometimes a lien release if applicable. To simplify this process, consider using the Arkansas Bill of Sale of Mobile Home with or without Existing Lien as part of your complete documentation.