Arkansas Consulting Agreement - with Former Shareholder

Description

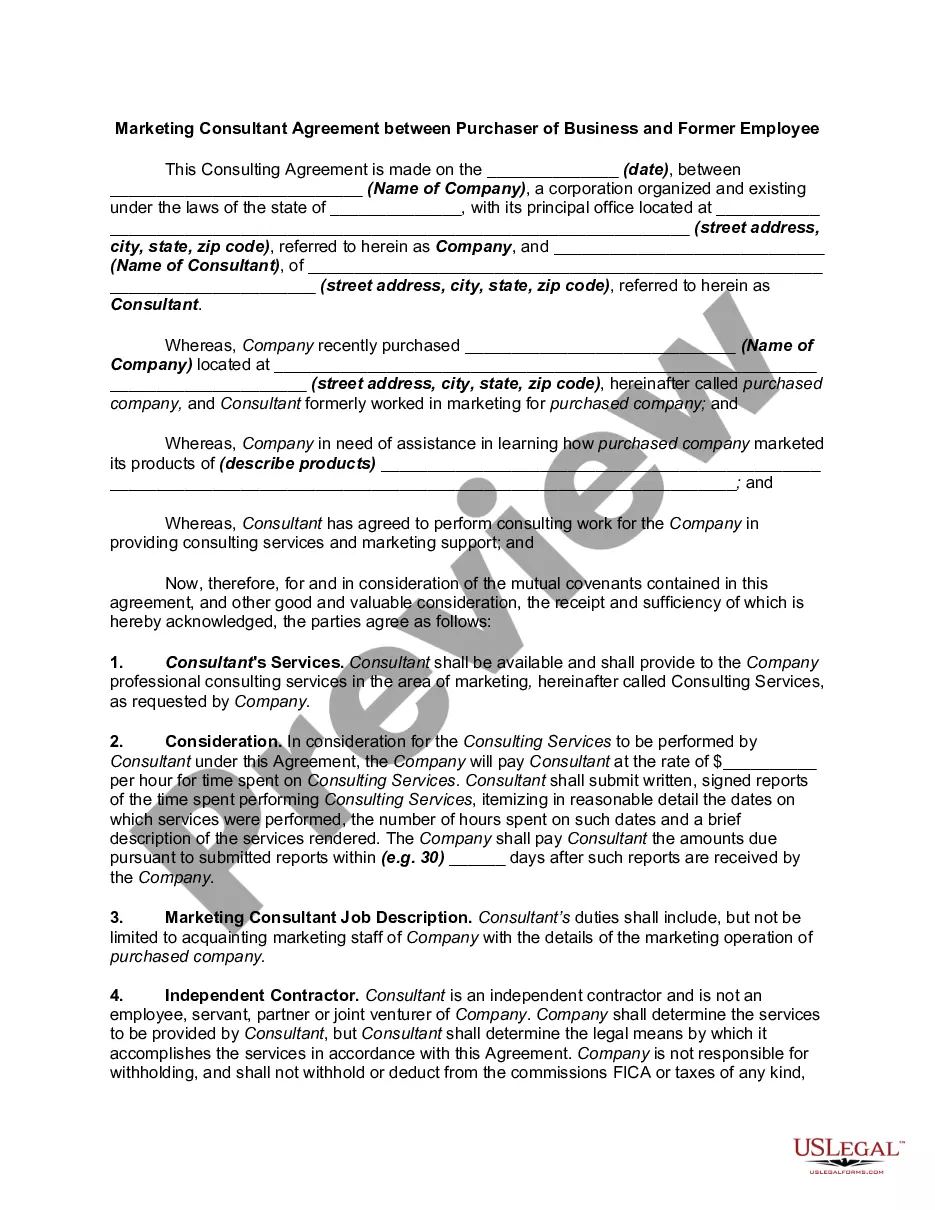

How to fill out Consulting Agreement - With Former Shareholder?

If you need to finalize, retrieve, or generate valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly and convenient search feature to find the documents you require.

A selection of templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to register for the account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finish the purchase.

- Use US Legal Forms to locate the Arkansas Consulting Agreement - with Former Shareholder in just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click on the Download button to access the Arkansas Consulting Agreement - with Former Shareholder.

- You can also access forms you previously saved from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to find alternate versions of the legal form template.

Form popularity

FAQ

A consulting agreement after a business sale typically outlines the ongoing relationship, responsibilities, and compensation for the former owner who may offer expertise. This helps to ensure a smooth transition and continued success for the new ownership. Using an Arkansas Consulting Agreement - with Former Shareholder can guide you through drafting this crucial document.

While a consulting agreement is a form of contract, it is not interchangeable with the term 'contract' at large. A consulting agreement specifically details the terms of consulting services, making it a specialized contract. To create a clear and solid document, the Arkansas Consulting Agreement - with Former Shareholder can be your go-to solution.

Yes, there is a nuanced difference. An agreement is simply a mutual understanding between parties, whereas a contract is a legally binding agreement enforceable in court. For effective documentation, utilizing an Arkansas Consulting Agreement - with Former Shareholder ensures you're on solid legal ground.

A consulting agreement is a type of contract focused specifically on consulting services. While all consulting agreements are contracts, not all contracts are consulting agreements; contracts can cover a variety of transactions. For effective contracts tailored to your needs, the Arkansas Consulting Agreement - with Former Shareholder can serve you well.

A consulting agreement outlines the specific services provided by the consultant, including terms and scope. In contrast, a Master Services Agreement (MSA) serves as an overarching contract that governs multiple transactions, creating a broader framework. If you need clarity on your agreements, consider exploring an Arkansas Consulting Agreement - with Former Shareholder.

Writing a simple contract agreement starts with identifying the parties involved and detailing the specific terms of the agreement. You should address payment terms, deliverables, and conditions for termination clearly. For those needing assistance, a streamlined Arkansas Consulting Agreement - with Former Shareholder template from US Legal Forms can simplify this process and ensure clarity.

Writing a consulting contract agreement involves drafting an outline that specifies the services offered, payment terms, and duration of the project. Include sections on confidentiality and dispute resolution to protect both parties. US Legal Forms provides customizable templates for an Arkansas Consulting Agreement - with Former Shareholder, making the process straightforward and compliant.

To fill out a limited liability company operating agreement, start by stating the LLC's name and addressing its purpose. Clearly outline the ownership shares of members, management structure, and distributions of profits. For further guidance, consider utilizing a template for an Arkansas Consulting Agreement - with Former Shareholder from US Legal Forms to ensure your agreement includes all necessary legal components.

A consulting agreement should include key elements such as the scope of services, payment details, and timelines. Additionally, consider adding clauses addressing confidentiality, intellectual property rights, and termination conditions. Using a well-structured Arkansas Consulting Agreement - with Former Shareholder template from US Legal Forms can help you cover all important aspects effectively.

To write a simple consulting contract, start by clearly defining the scope of work and the responsibilities of both parties. Include payment terms, confidentiality provisions, and the duration of the agreement. You can use resources like US Legal Forms to find templates specifically tailored for an Arkansas Consulting Agreement - with Former Shareholder, ensuring you meet all legal standards.