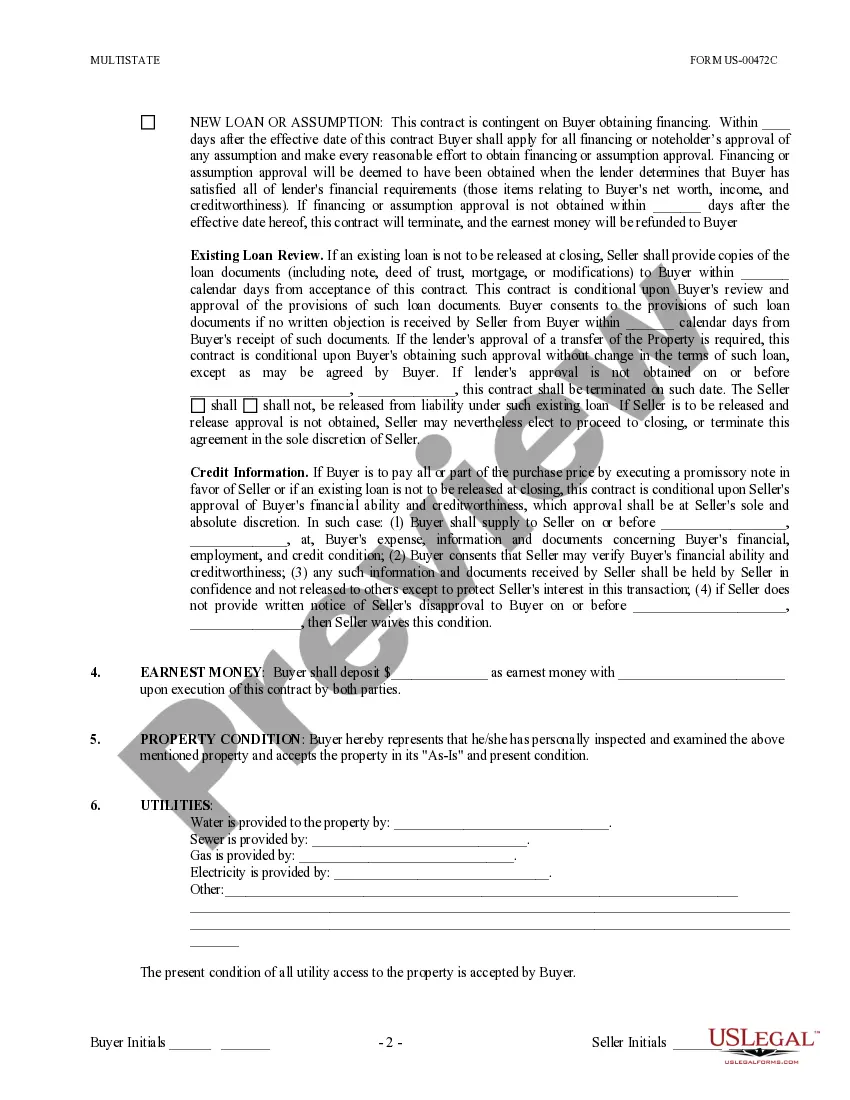

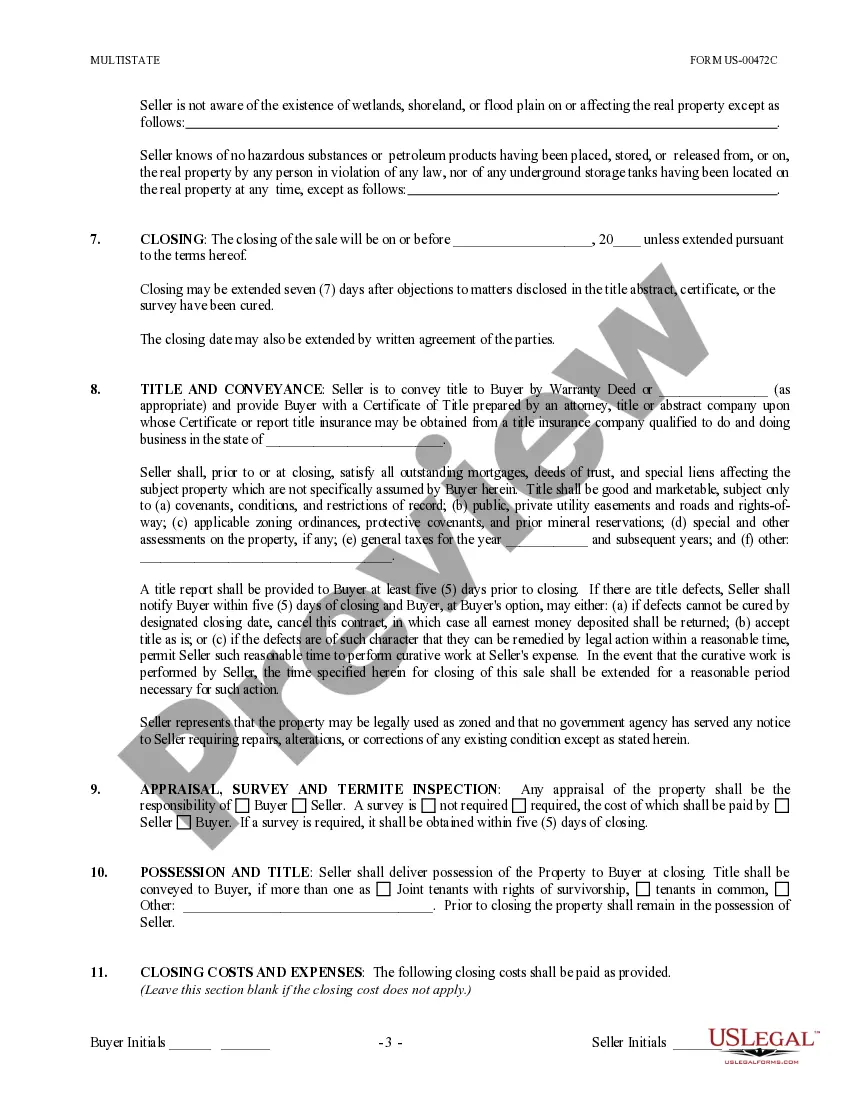

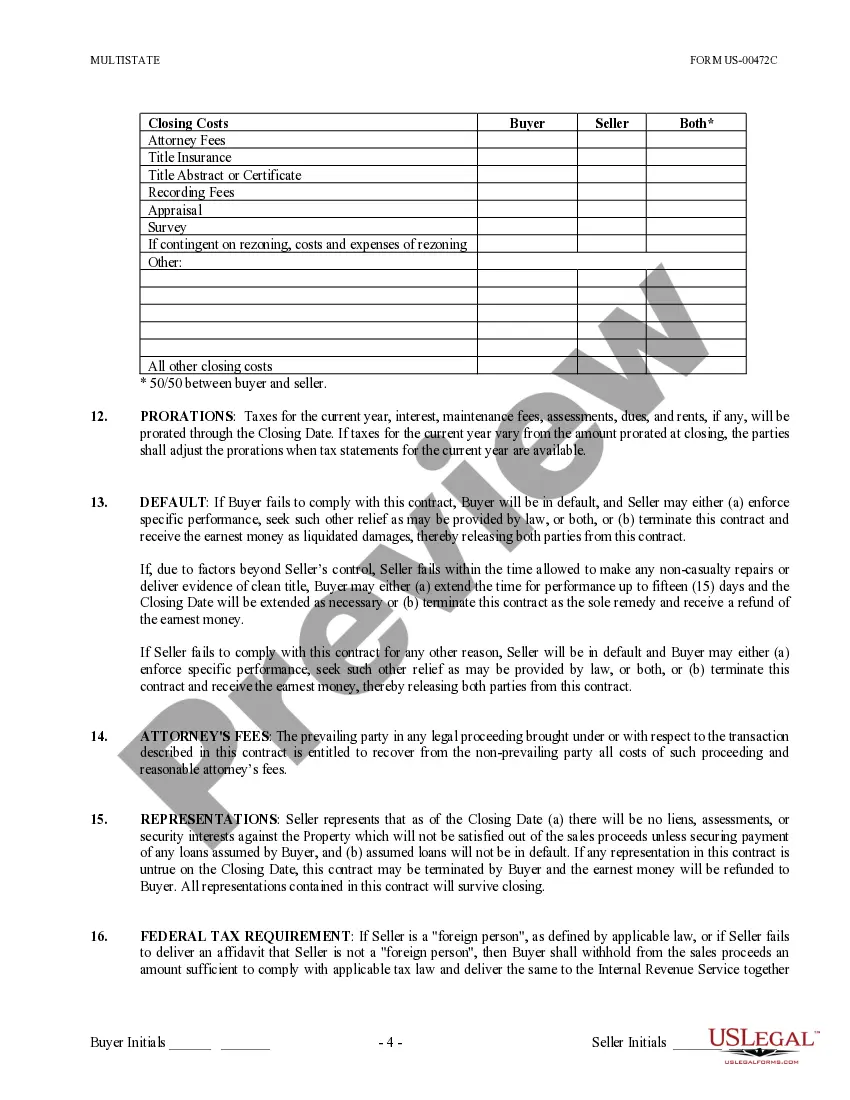

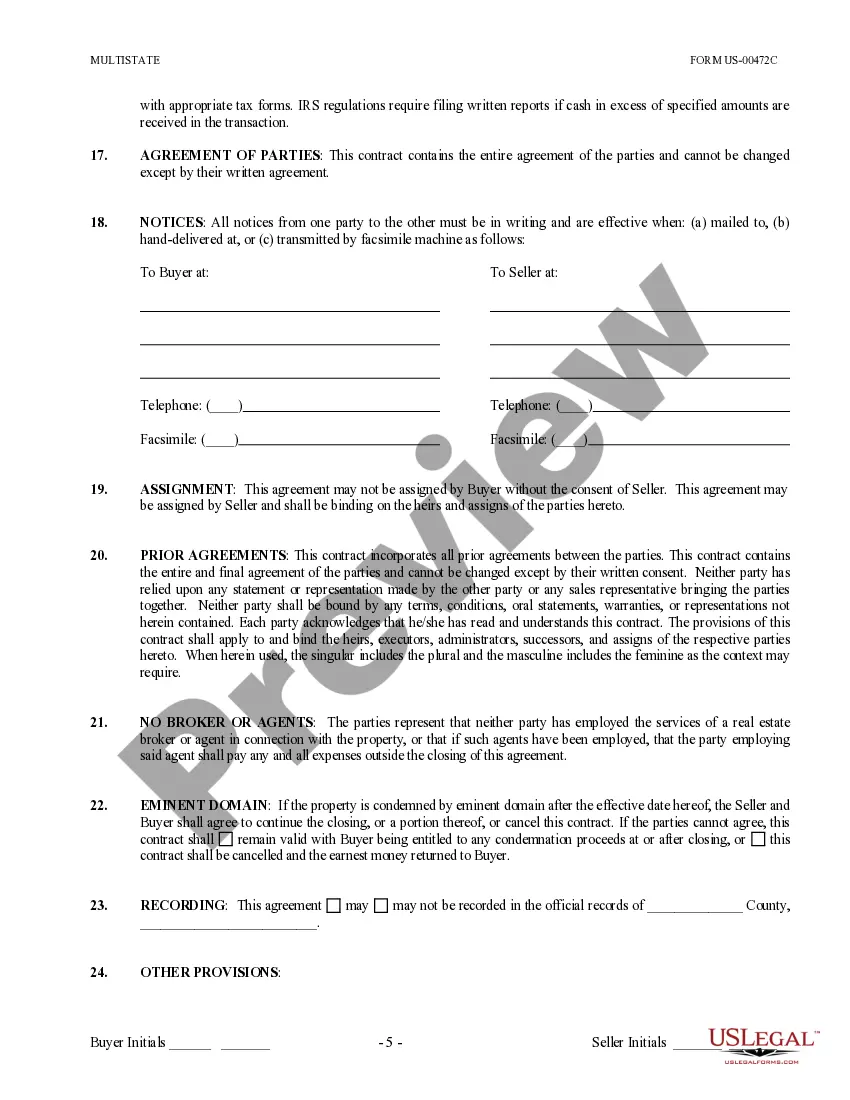

The Arkansas Contract for the Sale and Purchase of Real Estate NowNo Broke— - Commercial Lot or Land is a legally binding document that outlines the terms and conditions for the sale and purchase of a commercial lot or land in Arkansas. This contract is specifically designed for transactions that do not involve the services of a real estate broker. The contract includes various sections that cover all the essential aspects of the transaction. These sections typically include: 1. Parties: This section identifies the buyer(s) and seller(s) involved in the transaction, including their legal names, addresses, and contact information. 2. Property Details: This section provides a thorough description of the commercial lot or land being sold, including its physical address, legal description, and any applicable zoning or land use restrictions. 3. Purchase Price and Terms: This section outlines the agreed-upon purchase price for the property and the manner in which it will be paid, whether it is a lump sum or in installments. It may also specify the conditions for financing, if applicable. 4. Earnest Money: This section addresses the earnest money deposit, which is a sum of money provided by the buyer to demonstrate their serious intent to purchase the property. It includes the amount of the deposit, the deadline for its delivery, and conditions for its refund or forfeiture. 5. Due Diligence: This section outlines the timeframe and procedures for the buyer to conduct any necessary inspections, surveys, or assessments of the property to ensure its feasibility for the intended use. 6. Closing Procedure: This section specifies the date and location of the closing, which is the final stage of the transaction where ownership of the property is transferred from the seller to the buyer. It may also cover procedures for prorated taxes, deed preparation, and any other relevant closing costs. 7. Contingencies: This section includes any additional conditions that must be met before the sale can be completed. Contingencies may include obtaining financing, clear title, or necessary permits from local authorities. 8. Disclosures: This section requires the seller to disclose any known defects, encumbrances, or hazards associated with the property. It may also provide space for the buyer to acknowledge their awareness of these disclosures. Different versions of this contract may exist depending on the specific use of the commercial lot or land. For instance, there may be separate contracts for vacant land, planned developments, retail properties, or industrial real estate. Each contract may contain additional clauses tailored to address the unique considerations of the particular type of commercial property. It is important for both parties to carefully review the contract and seek legal advice if necessary to ensure their rights and obligations are accurately reflected and protected within the agreement.

Arkansas Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land

Description

How to fill out Arkansas Contract For The Sale And Purchase Of Real Estate - No Broker - Commercial Lot Or Land?

It is possible to commit hrs on-line looking for the legitimate record format that fits the state and federal specifications you require. US Legal Forms provides a large number of legitimate varieties that are evaluated by professionals. It is simple to download or printing the Arkansas Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land from your service.

If you already have a US Legal Forms accounts, you are able to log in and then click the Download key. Next, you are able to total, change, printing, or indication the Arkansas Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land. Each and every legitimate record format you purchase is your own property permanently. To obtain another copy for any acquired kind, check out the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms site the first time, stick to the simple guidelines under:

- First, make certain you have selected the proper record format for that area/town of your liking. Read the kind outline to ensure you have selected the proper kind. If available, utilize the Review key to check throughout the record format too.

- If you would like locate another version in the kind, utilize the Lookup area to get the format that meets your needs and specifications.

- When you have identified the format you need, just click Purchase now to proceed.

- Select the rates prepare you need, enter your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal accounts to cover the legitimate kind.

- Select the format in the record and download it for your gadget.

- Make modifications for your record if needed. It is possible to total, change and indication and printing Arkansas Contract for the Sale and Purchase of Real Estate - No Broker - Commercial Lot or Land.

Download and printing a large number of record web templates using the US Legal Forms Internet site, that provides the biggest variety of legitimate varieties. Use professional and express-particular web templates to tackle your small business or specific requirements.