Arkansas Equipment Lease - General

Description

How to fill out Equipment Lease - General?

Are you in a situation where you frequently require documents for either professional or personal purposes almost every business day.

There is a selection of legal document templates accessible online, but finding forms you can trust isn’t easy.

US Legal Forms offers thousands of form templates, including the Arkansas Equipment Lease - General, which are designed to comply with both state and federal regulations.

If you find the appropriate form, click on Get now.

Select the pricing plan you want, enter the required information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arkansas Equipment Lease - General template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

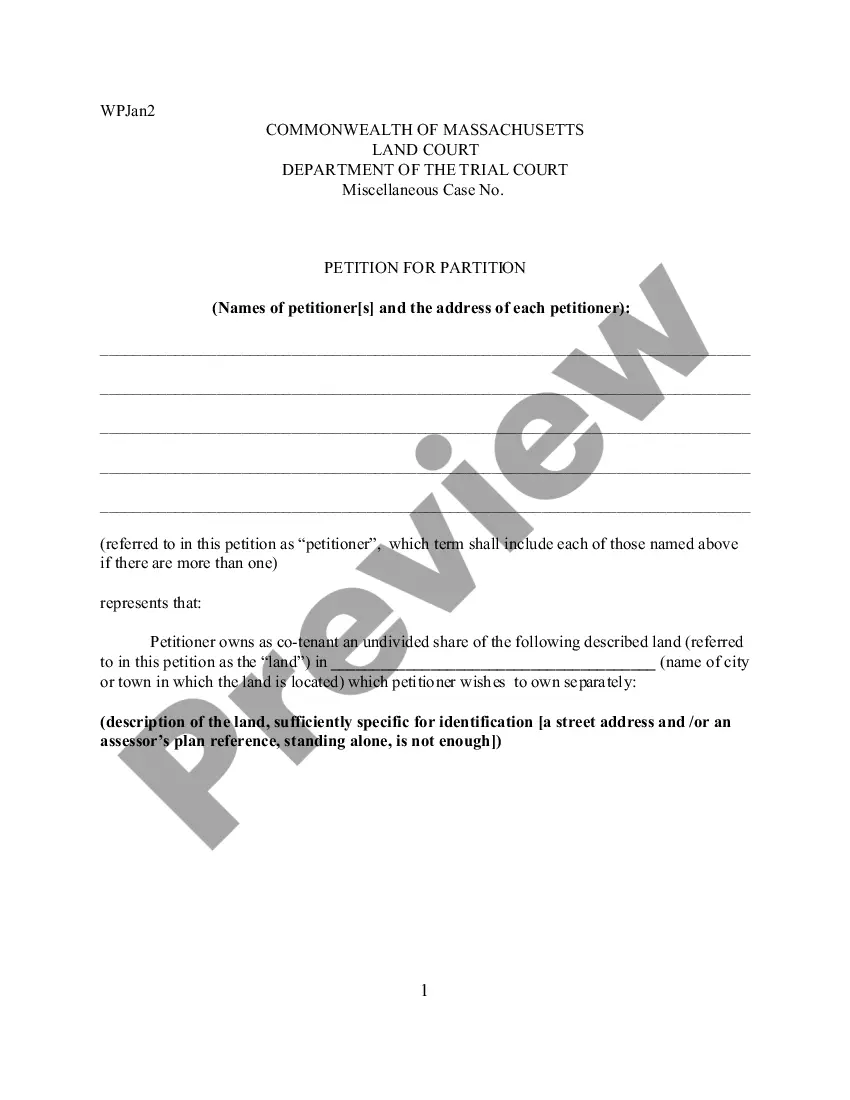

- Find the form you need and ensure it is for the correct city/county.

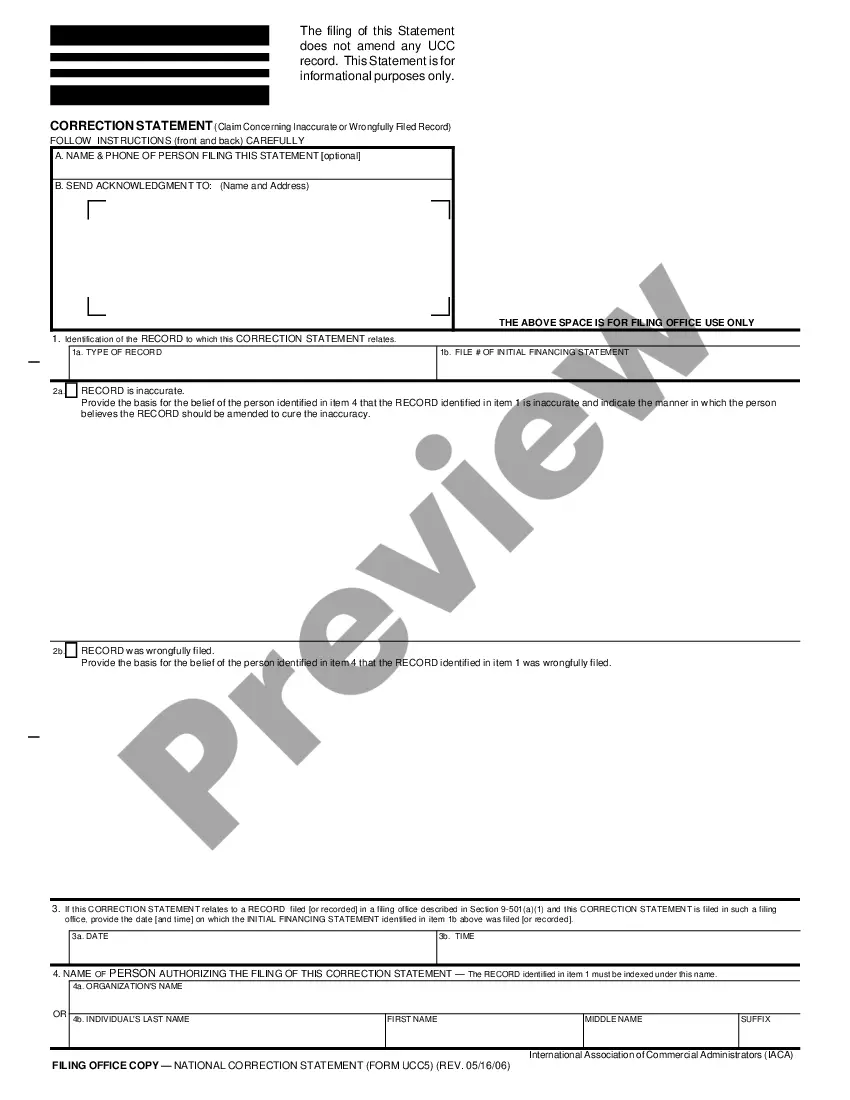

- Use the Review button to examine the document.

- Read the description to confirm you have selected the right form.

- If the document is not what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The lease rate factor is a decimal used to calculate monthly equipment lease payments based on the total amount financed. For Arkansas equipment leases, this factor often ranges from 0.005 to 0.025. A lower factor typically indicates a more affordable lease. By utilizing the uslegalforms platform, you can easily compute this factor and understand how it impacts your overall leasing costs.

The average interest rate on equipment financing in Arkansas typically ranges from 6% to 12%. This variance can depend on several factors, including the type of equipment, your business's financial health, and current market conditions. To obtain the best rate, it's essential to compare offers and understand your options. The uslegalforms platform can help you navigate these complexities effectively.

The typical lease interest rate for Arkansas equipment leases can vary depending on the type of equipment and lessee creditworthiness. Generally, you can expect rates to fall between 4% and 10%. However, factors like the length of the lease and the equipment's value also play significant roles. Consider using the uslegalforms platform for personalized lease rate information tailored to your specific needs.

Arkansas does offer several exemptions to sales tax, which can apply during an Arkansas Equipment Lease - General. Items that are used in manufacturing, certain agricultural equipment, and specific types of machinery can be exempt. To benefit from these exemptions, you may need to provide the necessary documentation proving the purpose of the equipment. For personalized guidance, consider using the resources available on USLegalForms to navigate these tax questions effectively.

Yes, rentals are typically taxable in Arkansas, including those under an Arkansas Equipment Lease - General. This means that when you lease equipment, you should expect to include sales tax in your calculations. However, certain exceptions might exist for specific types of equipment. It's wise to verify your specific circumstances with state tax regulations to ensure compliance.

When engaging in an Arkansas Equipment Lease - General for equipment rental, it is important to understand the tax implications. Generally, renting equipment in Arkansas is subject to sales tax. However, tax exemptions may apply depending on the specific use of the equipment. It is advisable to consult with a tax professional or refer to state guidelines for clarity on your situation.

An Arkansas Equipment Lease - General generally retains asset classification as long as it meets finance lease criteria. However, lease payments are considered operating expenses that can affect your profit and loss statements. Understanding the distinction is crucial for proper accounting, and utilizing platforms like U.S. Legal Forms ensures you manage these classifications effectively.

To record an Arkansas Equipment Lease - General in accounting, first determine whether the lease qualifies as an operating or finance lease. For finance leases, the asset and liability must appear on your balance sheet. Also, recognize lease payments as expenses on your income statement. Using accounting software like U.S. Legal Forms can simplify this process, ensuring your records remain accurate and compliant.

The two basic types of leases, especially relevant to the Arkansas Equipment Lease - General landscape, are operating leases and capital leases. Understanding the distinction between them enables you to navigate leasing effectively. Operating leases offer flexibility, while capital leases provide the opportunity for ownership and long-term use. By selecting the right option, you can optimize your resources and align them with your business strategy.

In the context of Arkansas Equipment Lease - General, you might encounter several types of equipment leases, such as operating leases, capital leases, and finance leases. Each type serves different needs; for instance, operating leases usually provide flexibility for short-term use, while capital leases are designed for long-term investments. Knowing these options empowers you to make informed decisions tailored to your business requirements.