The Arkansas Bill of Sale for a Coin Collection is a legal document used for the sale or transfer of ownership of a coin collection in the state of Arkansas. This comprehensive document ensures a clear and transparent transaction between the seller and the buyer, outlining the specific details of the coin collection being sold. Keywords: Arkansas, Bill of Sale, Coin Collection, legal document, sale, transfer of ownership, state of Arkansas, clear, transparent transaction, seller, buyer, specific details. Different types of Arkansas Bill of Sale for a Coin Collection may include: 1. Simple Arkansas Bill of Sale for a Coin Collection: This type of bill of sale provides a basic outline of the coin collection being sold, including a description of the coins and their quantities, along with the agreed-upon purchase price and date of sale. 2. Detailed Arkansas Bill of Sale for a Coin Collection: This type of bill of sale includes a more comprehensive description of the coin collection, such as the year, denomination, condition, and any additional information about each individual coin. It may also include provisions for warranties or guarantees, if applicable. 3. Notarized Arkansas Bill of Sale for a Coin Collection: In certain cases, a bill of sale may require notarization to add an extra layer of authentication and ensure its validity. This type of bill of sale includes the signatures of both the seller and the buyer, which are then witnessed and notarized by a licensed notary public. 4. Arkansas Bill of Sale for a Coin Collection with Terms and Conditions: This type of bill of sale contains additional terms and conditions agreed upon by both parties, such as payment terms, delivery obligations, or any specific arrangements regarding the collection, like ongoing maintenance or assistance with future authentication. It is important to note that the specific types and variations of the Arkansas Bill of Sale for a Coin Collection may vary depending on individual circumstances, preferences, or any legal requirements within the state of Arkansas. It is advisable to consult with a legal professional to ensure the document accurately reflects the intentions and protects the rights and interests of both the seller and the buyer.

Arkansas Bill of Sale for a Coin Collection

Description

How to fill out Bill Of Sale For A Coin Collection?

Are you currently in a situation where you require documentation for either corporate or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers a wide array of form templates, such as the Arkansas Bill of Sale for a Coin Collection, which are designed to comply with both federal and state regulations.

Once you locate the correct form, click Get now.

Select the pricing plan you prefer, provide the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Arkansas Bill of Sale for a Coin Collection template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it corresponds to the correct city/region.

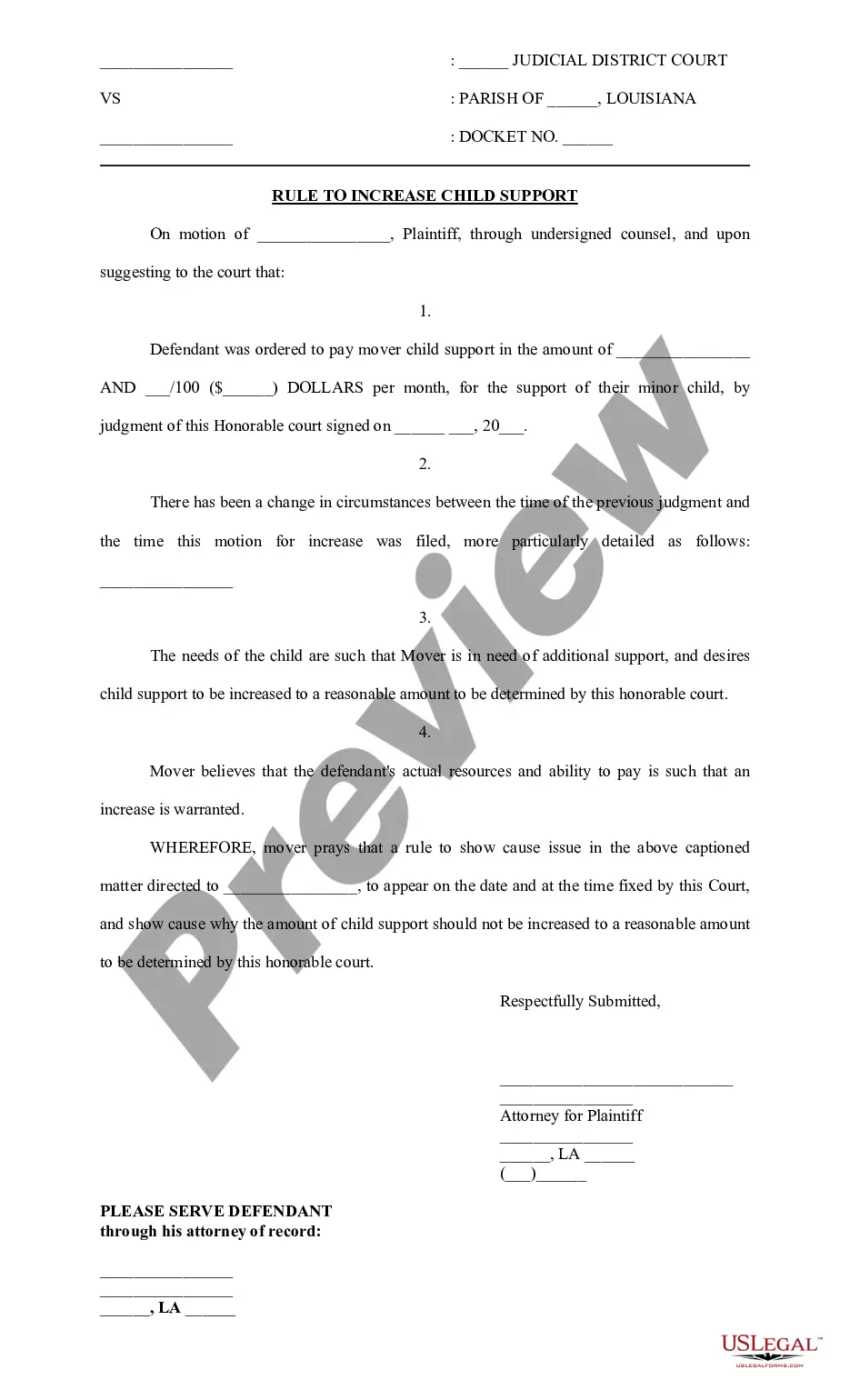

- Utilize the Review option to evaluate the form.

- Check the description to confirm that you have chosen the appropriate form.

- If the form does not meet your needs, use the Lookup field to find the form that suits your requirements.

Form popularity

FAQ

Yes, a bill of sale is legal even if it is not notarized. In Arkansas, you can create a valid Arkansas Bill of Sale for a Coin Collection without a notary's signature, provided both parties agree to its terms. However, adding a notary can add extra assurance and help prevent disputes. It's a good practice to use a form that meets all legal requirements.

In Arkansas, a bill of sale for a coin collection does not necessarily have to be notarized. However, having a notarized document can add an extra layer of authenticity and can help prevent disputes in the future. If you choose to have it notarized, that's a good option to ensure both parties agree on the sale terms. Consider using US Legal Forms to create a reliable bill of sale that meets your needs.

To categorize your coin collection, you can group your coins by different criteria such as historical period, geographical origin, or metal composition. Another effective method is to categorize coins based on their rarity or condition. Proper categorization not only makes your collection more manageable but also adds value when presenting it to potential buyers. When selling, an Arkansas Bill of Sale for a Coin Collection provides a formal record that enhances the credibility of your categorization.

To list your coin collection effectively, start by organizing your coins according to type, year, or value. Use a spreadsheet to record details such as the coin's name, mint mark, condition, and estimated value. This organized approach not only helps you keep track of your collection but also simplifies the process if you decide to sell. When you are ready, consider using an Arkansas Bill of Sale for a Coin Collection to ensure a smooth transaction.

If you find yourself without a bill of sale, you should consider generating one as soon as possible. This document serves as proof of ownership and helps avoid complications down the line. Utilize an Arkansas Bill of Sale for a Coin Collection template from US Legal Forms to simplify the process and ensure that the document contains all the necessary legal aspects to protect both parties involved.

A handwritten bill of sale can be legitimate as long as it includes all necessary details about the transaction. The key elements should involve the names of the buyer and seller, the item being sold, and the sale date. An Arkansas Bill of Sale for a Coin Collection can be easily drafted by hand, but ensure that both parties retain a copy for their records to avoid future disputes.

While Illinois does not universally require a bill of sale for every type of transaction, having one can be beneficial for record-keeping. For transactions involving valuable items, such as collectibles, an Arkansas Bill of Sale for a Coin Collection can serve to clarify ownership and protect both parties. It’s a good practice to create a bill of sale even when it’s not legally mandated, as it provides security in any exchange.

If you lack a bill of sale, it's important to document the transaction in some manner. You can create a new bill of sale by detailing the specifics of the transaction, including the buyer, seller, and item description. Using an Arkansas Bill of Sale for a Coin Collection template can help ensure that you include all necessary information. Additionally, you might want to reach out to the parties involved for their signatures to validate the transaction.

To make a handwritten bill of sale, grab a piece of paper and clearly write down the sale details, including the buyer's name, seller's name, and the description of the coin collection. Include the sale amount and the date of the transaction. While a handwritten bill can be effective, using US Legal Forms can provide a structured approach that ensures you cover all necessary elements, making your Arkansas Bill of Sale for a Coin Collection clear and reliable.

To make an Arkansas Bill of Sale for a Coin Collection, gather necessary information about the transaction, including buyer and seller details, item description, and sale date. You can use templates available online to ensure compliance with Arkansas laws. Consider employing services like US Legal Forms, which provide ready-to-use templates tailored for coin collections. This approach simplifies the creation process while enhancing the document's validity.