Arkansas Financial Statement Form - Individual

Description

How to fill out Financial Statement Form - Individual?

Are you in a situation where you require documents for potential business or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the Arkansas Financial Statement Form - Individual, designed to meet state and federal standards.

Select a convenient document format and download your version.

You can access all the form templates you have purchased in the My documents section. You can retrieve another version of the Arkansas Financial Statement Form - Individual at any time, if necessary. Simply select the required form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Arkansas Financial Statement Form - Individual template.

- If you do not have an account and want to start using US Legal Forms, follow these procedures.

- Find the form you need and ensure it is for the correct city/area.

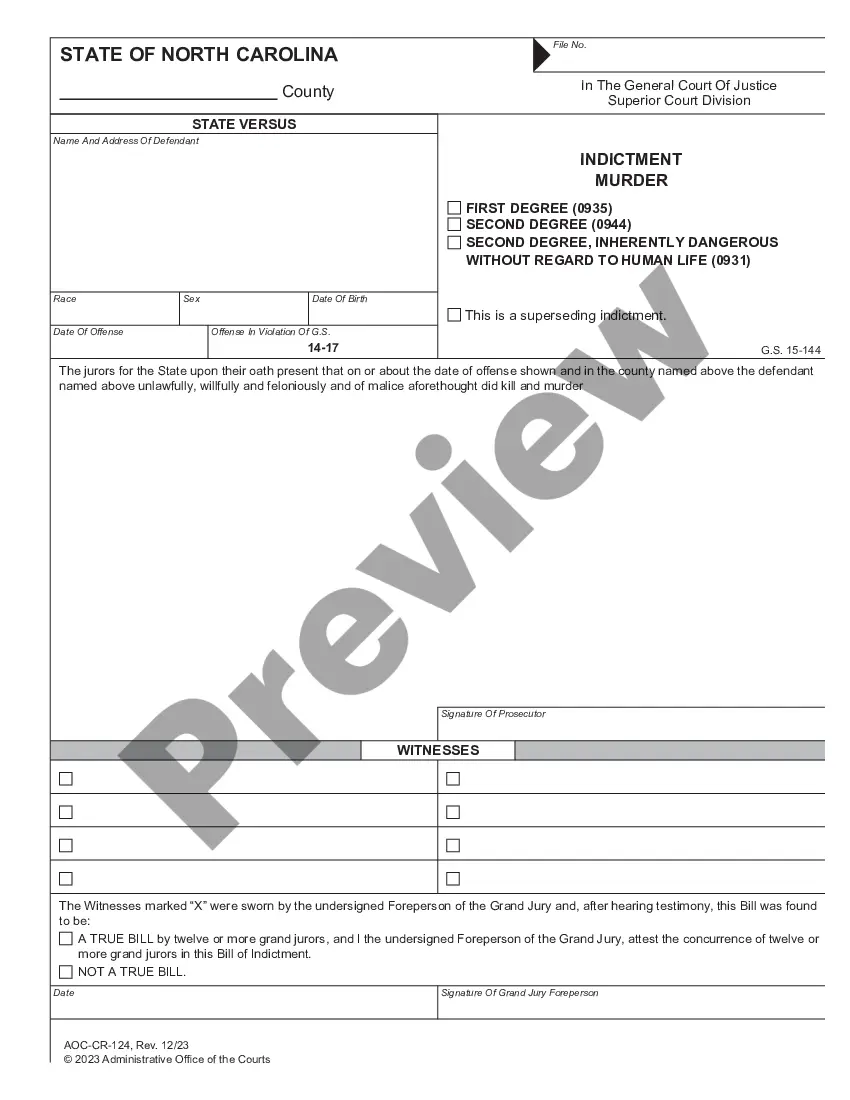

- Use the Review button to view the form.

- Check the information to be sure you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs and criteria.

- When you obtain the correct form, click on Acquire now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

Yes, individuals can absolutely use financial statements for various purposes. The Arkansas Financial Statement Form - Individual is a crucial document that helps individuals track their income, expenses, assets, and liabilities. This form is especially beneficial when applying for loans, rental agreements, or financial planning. Utilizing this form simplifies the financial reporting process, making it easier for individuals to present their financial situations clearly and effectively.

You can mail Arkansas tax forms to the Department of Finance and Administration. The specific address depends on the type of form you are submitting, but generally, the main office is the destination. Make sure to include your Arkansas Financial Statement Form - Individual with all necessary documentation. Double-check the mailing address to ensure your forms arrive promptly and accurately.

The part year resident form for Arkansas is designed for individuals who have lived in the state for part of the year. This form is essential for accurately reporting your income earned while residing in Arkansas. When completing your Arkansas Financial Statement Form - Individual, ensure that you include all relevant details regarding your residency period. This clarity helps in calculating your tax obligations correctly.

Yes, you can file Arkansas state taxes online. The process is streamlined and efficient, allowing you to submit your Arkansas Financial Statement Form - Individual directly through various online platforms. Utilizing these resources ensures you meet all deadlines while maintaining accuracy in your submissions. It’s a convenient way to manage your tax obligations without the stress of paper filing.

Filling out a balance statement involves listing your assets on one side and your liabilities on the other. Using the Arkansas Financial Statement Form - Individual as a template helps you present your financial position clearly and accurately. This balance statement is essential for understanding your net worth and making informed financial decisions.

To make a financial statement for an individual, start by listing all sources of income, debts, and assets. Utilize the Arkansas Financial Statement Form - Individual to format your statement consistently, making it easier to present to lenders or financial advisors. This approach not only simplifies the creation of your statement but also allows for better financial planning.

Filling out an individual financial statement requires compiling your personal financial details, including assets, liabilities, income, and expenses. The Arkansas Financial Statement Form - Individual provides a structured format to guide you through the process. By organizing your information clearly, you enhance your ability to assess and manage your personal finances.

To fill out a financial statement, start by listing all necessary financial information such as income, expenses, and investments. Employing the Arkansas Financial Statement Form - Individual helps ensure you cover all essential categories. This structured approach simplifies the process, making it easier for you to evaluate your financial situation.

Filling in a financial statement involves collecting current financial information and structuring it methodically. The Arkansas Financial Statement Form - Individual serves as a perfect guide, outlining required sections like income, liabilities, and assets. Be thorough in your entries to give a complete picture of your finances.

To create a financial statement for your small business, start by gathering all relevant financial data, including income, expenses, and assets. You can utilize the Arkansas Financial Statement Form - Individual to ensure you capture necessary information accurately. By organizing this data clearly, you can provide a comprehensive overview of your business’s financial health.