Arkansas Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

Finding the appropriate legal document template can be challenging. Certainly, there is a multitude of designs available online, but how do you locate the legal form you need? Utilize the US Legal Forms website.

The platform offers a vast selection of templates, including the Arkansas Guaranty of Promissory Note by Individual - Corporate Borrower, which can be utilized for both business and personal purposes. All documents are verified by professionals and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to access the Arkansas Guaranty of Promissory Note by Individual - Corporate Borrower. Use your account to search through the legal documents you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

Complete, modify, print, and sign the obtained Arkansas Guaranty of Promissory Note by Individual - Corporate Borrower. US Legal Forms is the largest repository of legal documents, providing a variety of template formats. Use the service to acquire properly drafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

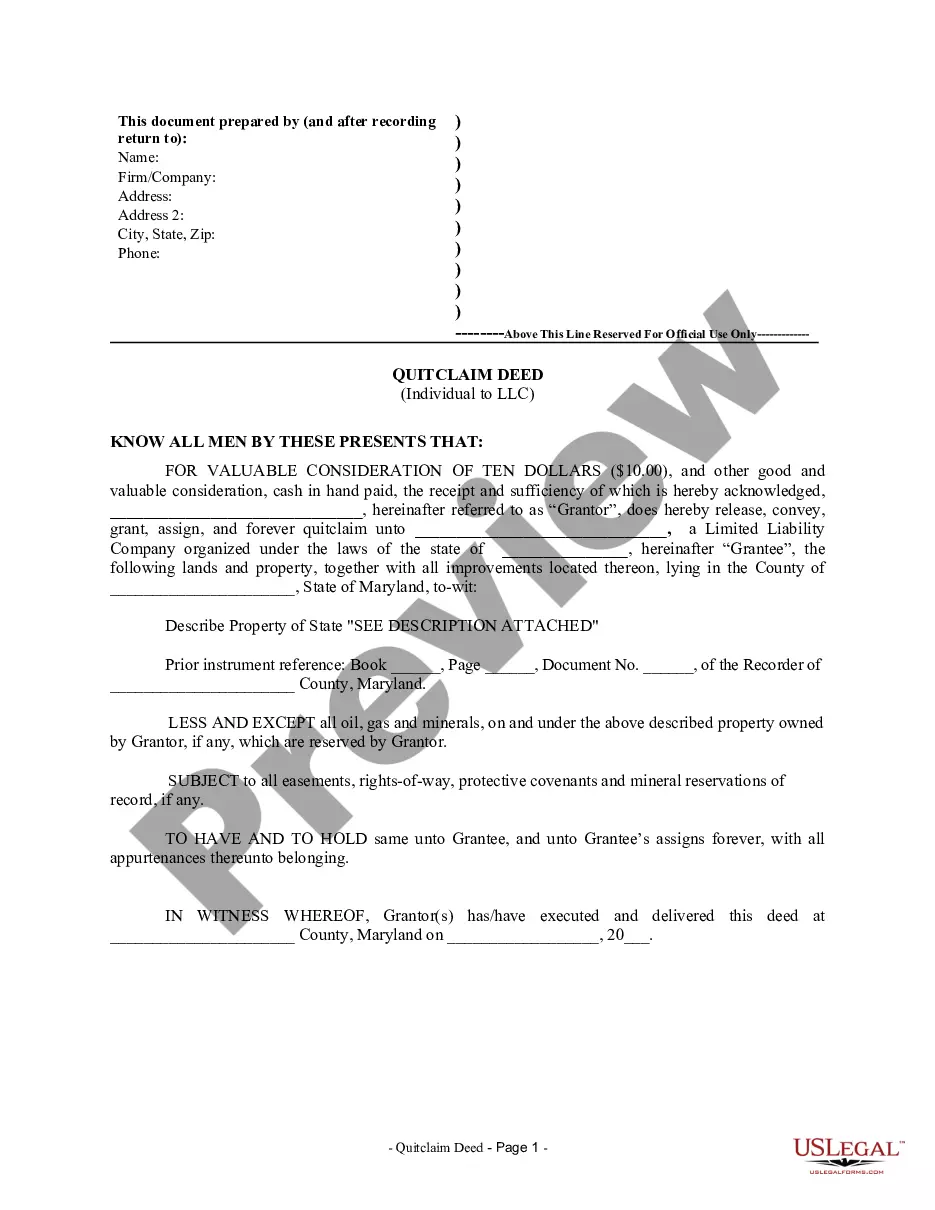

- First, confirm that you have selected the correct form for your city/state. You can view the document using the Preview button and check the form summary to ensure it meets your needs.

- If the form does not meet your requirements, use the Search box to find the right document.

- Once you are certain that the form is appropriate, click on the Buy Now button to obtain the document.

- Select the pricing plan you prefer and enter the required information. Create your account and process your purchase using your PayPal account or credit card.

- Choose the document format and download the legal template for your needs.

Form popularity

FAQ

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

Guaranteed promissory note means a written contract obligating a recipient to repay the funds received if the recipient does not fulfill the service obligation, which was a condition of the recipient's scholarship, or grant award.

Why Some Business Loans Require Personal Guarantees A personal guarantee is a legal promise made by an individual to repay credit issued to their business using their own personal assets in the event that the business is unable to repay the debt.

A personal guarantee is an agreement between a business owner and lender, stating that the individual who signs is responsible for paying back a loan should the business ever be unable to make payments.

Personal Guarantee: Taking Responsibility A promissory note alone may not be enough to secure the loan your business needs. That's why your promissory note could include a personal guarantee. Since a promissory note is basically just an IOU, a lender will want some kind of collateral to secure the loan.

A promissory note is a debt instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on-demand or at a specified future date.

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

The general rule is that no corporation has the power, by any form of contract or endorsement, to become a guarantor or surety or otherwise lend its credit to another person or corporation.

A personal guarantee is a written promise to guarantee the liability of one party for the debts of another party. Commonly, personal guarantees are given by directors and shareholders of companies to personally guarantee the payment of money or obligations on behalf of their company.