A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

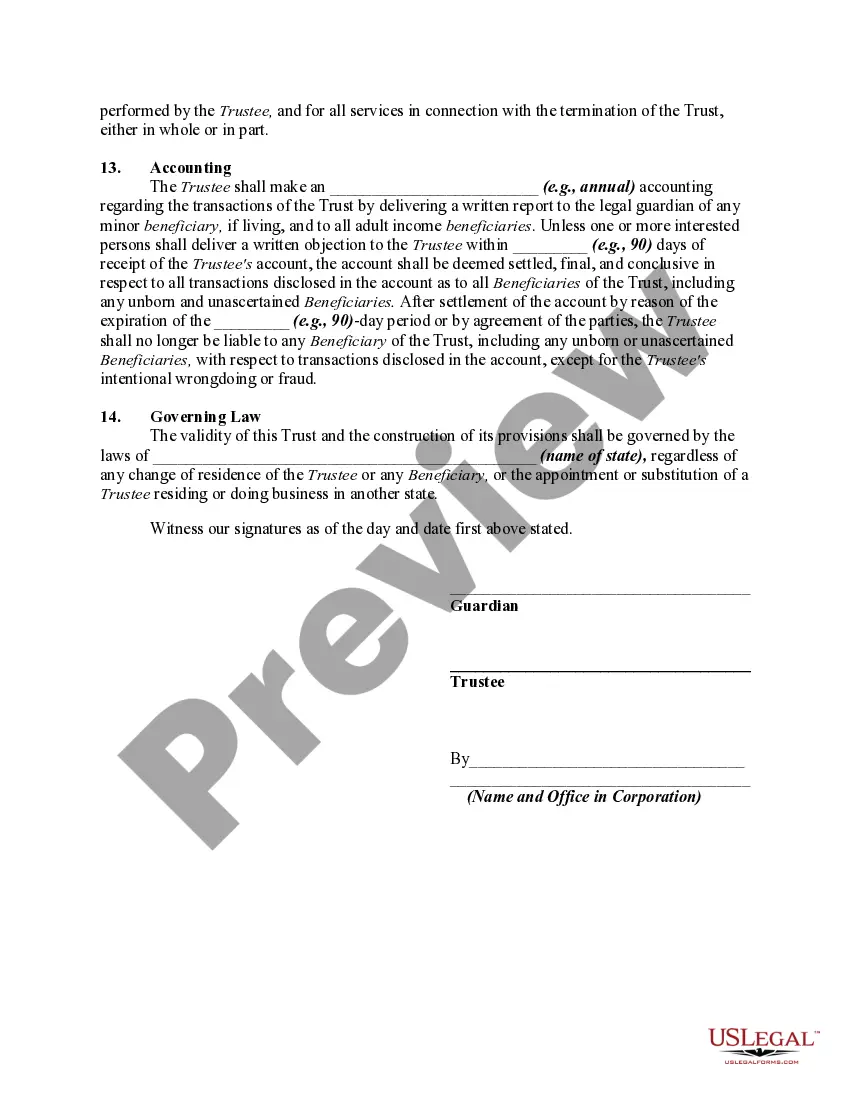

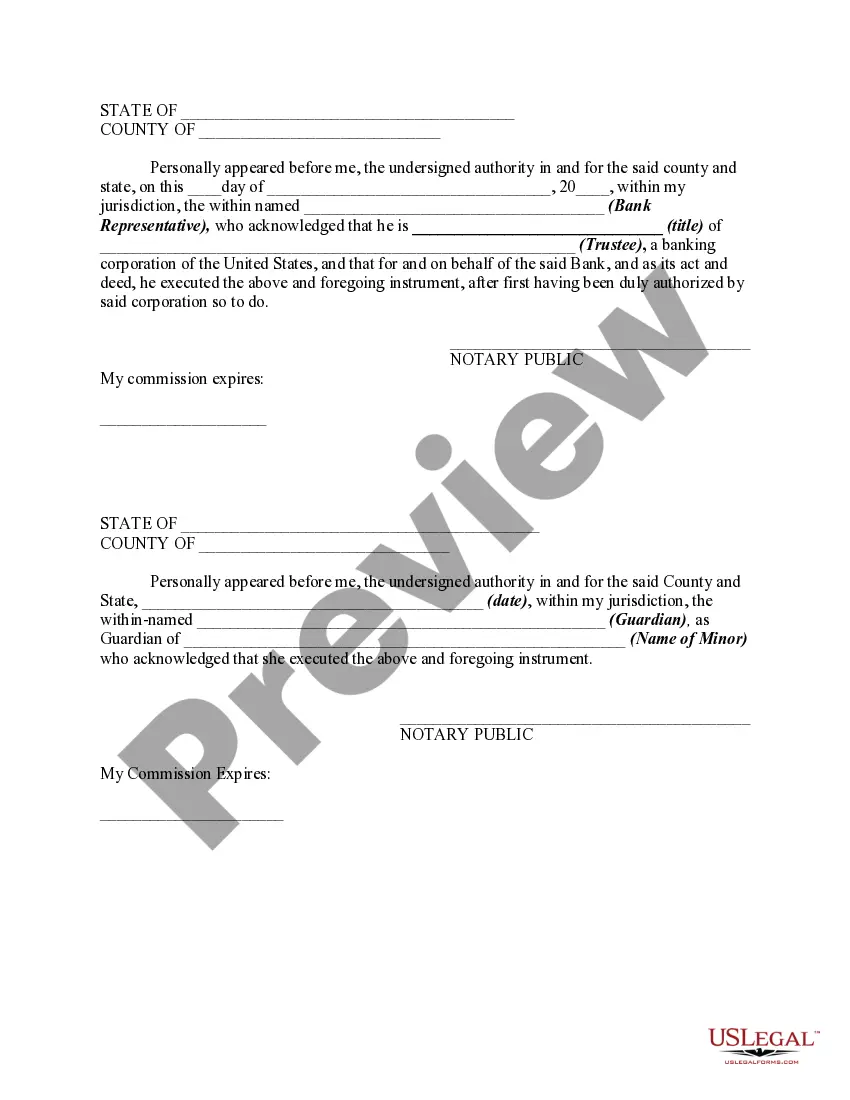

Arkansas Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor

Description

How to fill out Trust Agreement To Hold Funds For Minor Resulting From Settlement Of A Personal Injury Action Filed On Behalf Of Minor?

Selecting the appropriate legal document template can be a challenge. Naturally, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website. This service provides a vast array of templates, including the Arkansas Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, which you can use for both business and personal purposes. All documents are vetted by professionals and comply with state and federal regulations.

If you are already registered, sign in to your account and click the Download option to retrieve the Arkansas Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor. Use your account to review the legal forms you have previously purchased. Go to the My documents tab in your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review option and read the form description to confirm that it meets your needs. If the form does not fulfill your requirements, use the Search area to locate the appropriate form. When you are confident that the form is suitable, click the Get now option to retrieve the form. Select the pricing plan you prefer and enter the necessary information. Create your account and process the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Arkansas Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor.

- US Legal Forms is the largest repository of legal templates where you can find a variety of document formats.

- Use the service to download correctly designed documents that comply with state regulations.

- Ensure that all required information is filled out correctly during the purchase process.

- Always double-check the form to ensure it matches your requirements before downloading.

- Consult customer support if you encounter any issues during the registration or download process.

- Stay updated on any changes to forms by checking back regularly on the US Legal Forms website.

Form popularity

FAQ

Yes, you can place a settlement into a trust designed specifically for minors. An Arkansas Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor is ideal for this purpose. This type of trust ensures that the funds are managed and protected until the minor reaches adulthood. Using such a trust can help in safeguarding the settlement proceeds and providing for the minor’s future needs.

According to Nolo, Sutliff & Stout, and .com, an insurance adjuster will often make an extremely low first offer to determine whether you know how to negotiate or understand the value of your car. Even if the offer seems reasonable at first glance, you should always negotiate.

What is a Minor's Compromise? A Minor's Compromise is when an adult signs on behalf of a child so the child can receive money. The law does not allow the child to sign for him or herself until s/he becomes an adult.

You Can Sue a Minor for Causing Personal Injury You can sue them for negligence. But the kid's liability depends on their age and relative maturity. Generally speaking, the younger and more immature the child, the less likely a state will allow you to sue them for negligence.

Yes, your personal injury settlement could be garnished for unpaid child support. If you are behind on payments, the settlement award amount would be used to pay for that back child support amount.

Who Can Access a Child's Settlement Money? If a child's settlement award is less than $10,000, it can be received directly by the child's parents. Settlements are legal property of the minor, and they are often awarded under a set of particular provisions that determine how the money should be spent.

Money held within a special needs trust does not count towards assets, so it will not impact financial aid.

Here are three tips that can help you do that:Increase the Defendant's Risk. One of the best ways to increase the value of a settlement without going to trial is to increase the defendant's risk.Objectify the Plaintiff's Injuries.Establish Gross Negligence.What You can do to Help Your Client in the Meantime.

The answer to the question 'What happens to children's compensation? ', any compensation payment made to a child is placed in a trust fund where it is kept until the child's 18th birthday. This ensures that the compensation for child accident claims is used only by the claimant when required for their own needs.

Can You File a Case Against a Minor? Yes, you can file a case against a minor after an accident. Texas' civil laws give you the right to bring a cause of action against any individual or entity that negligently, carelessly, recklessly or intentionally caused your accident.