Arkansas Loan Assumption Agreement is a legal document that allows a buyer to assume an existing loan instead of obtaining a new mortgage for the purchase of a property in the state of Arkansas. This agreement is commonly used when the buyer agrees to take over the responsibility of repaying an existing loan, typically after a real estate transaction. In an Arkansas Loan Assumption Agreement, the buyer becomes legally responsible for the outstanding mortgage balance, including interest and fees, which the original borrower owed to the lender. This agreement requires the lender's approval, as the lender must verify the new buyer's creditworthiness and ability to repay the loan. Once approved, the buyer assumes the current terms and conditions of the loan, including the interest rate, repayment schedule, and any potential prepayment penalties. It is important to note that before entering into an Arkansas Loan Assumption Agreement, both the buyer and the seller should thoroughly review the terms of the existing loan to ensure its compatibility with their financial circumstances and goals. The buyer should consider factors such as the loan's interest rate, remaining balance, maturity date, and potential adjustments in future payments. There are a few types of Arkansas Loan Assumption Agreements, depending on the nature of the loan: 1. Conventional Loan Assumption: This type involves the assumption of a conventional mortgage, usually provided by a private lender or bank, where the buyer and seller agree to transfer the loan obligations. 2. Federal Housing Administration (FHA) Loan Assumption: In this case, the buyer assumes an existing FHA-insured loan. The buyer must meet certain eligibility criteria set by the FHA, and the lender will assess the buyer's creditworthiness and financial stability. 3. Veterans Affairs (VA) Loan Assumption: This type applies to loans guaranteed by the U.S. Department of Veterans Affairs. If the buyer is a qualified veteran or an eligible spouse, they can assume a VA loan and benefit from its favorable terms. It is essential for all parties involved in an Arkansas Loan Assumption Agreement to consult with legal and financial professionals to ensure compliance with all state and federal regulations. Additionally, thorough documentation of the agreement, including the terms and conditions, is crucial to protect the rights and obligations of the buyer, seller, and lender.

Arkansas Loan Assumption Agreement

Description

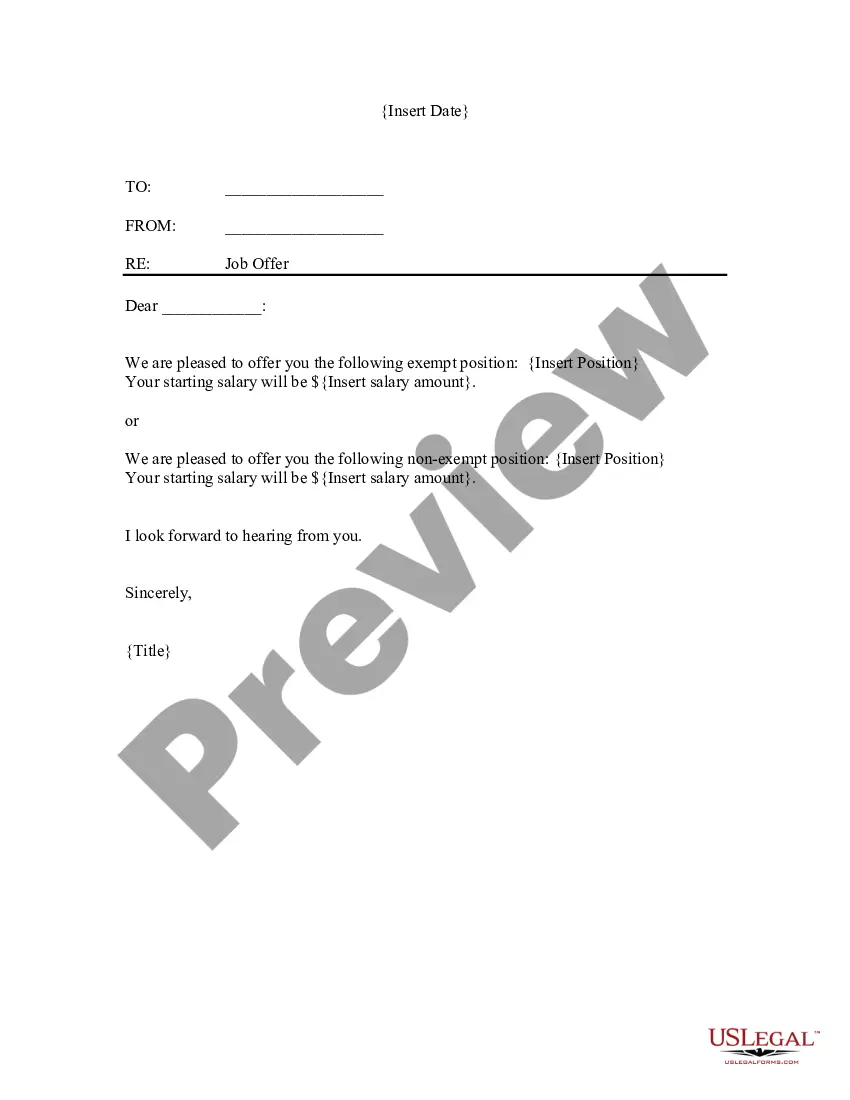

How to fill out Arkansas Loan Assumption Agreement?

Finding the right legal document template can be quite a have a problem. Of course, there are a variety of web templates accessible on the Internet, but how would you get the legal kind you need? Utilize the US Legal Forms site. The service gives 1000s of web templates, such as the Arkansas Loan Assumption Agreement, which you can use for company and personal demands. Every one of the types are checked by professionals and meet up with federal and state specifications.

When you are already registered, log in for your profile and then click the Download switch to have the Arkansas Loan Assumption Agreement. Use your profile to look from the legal types you may have purchased in the past. Check out the My Forms tab of your profile and get one more copy of the document you need.

When you are a whole new customer of US Legal Forms, allow me to share simple recommendations so that you can follow:

- Initial, be sure you have selected the correct kind for your town/county. You can examine the shape using the Preview switch and read the shape explanation to guarantee it is the right one for you.

- In case the kind fails to meet up with your preferences, take advantage of the Seach field to find the appropriate kind.

- When you are certain that the shape would work, click the Buy now switch to have the kind.

- Opt for the prices plan you want and type in the required information. Build your profile and buy the order making use of your PayPal profile or credit card.

- Pick the submit formatting and download the legal document template for your device.

- Full, revise and printing and signal the obtained Arkansas Loan Assumption Agreement.

US Legal Forms may be the most significant catalogue of legal types for which you can see different document web templates. Utilize the service to download skillfully-manufactured files that follow express specifications.

Form popularity

FAQ

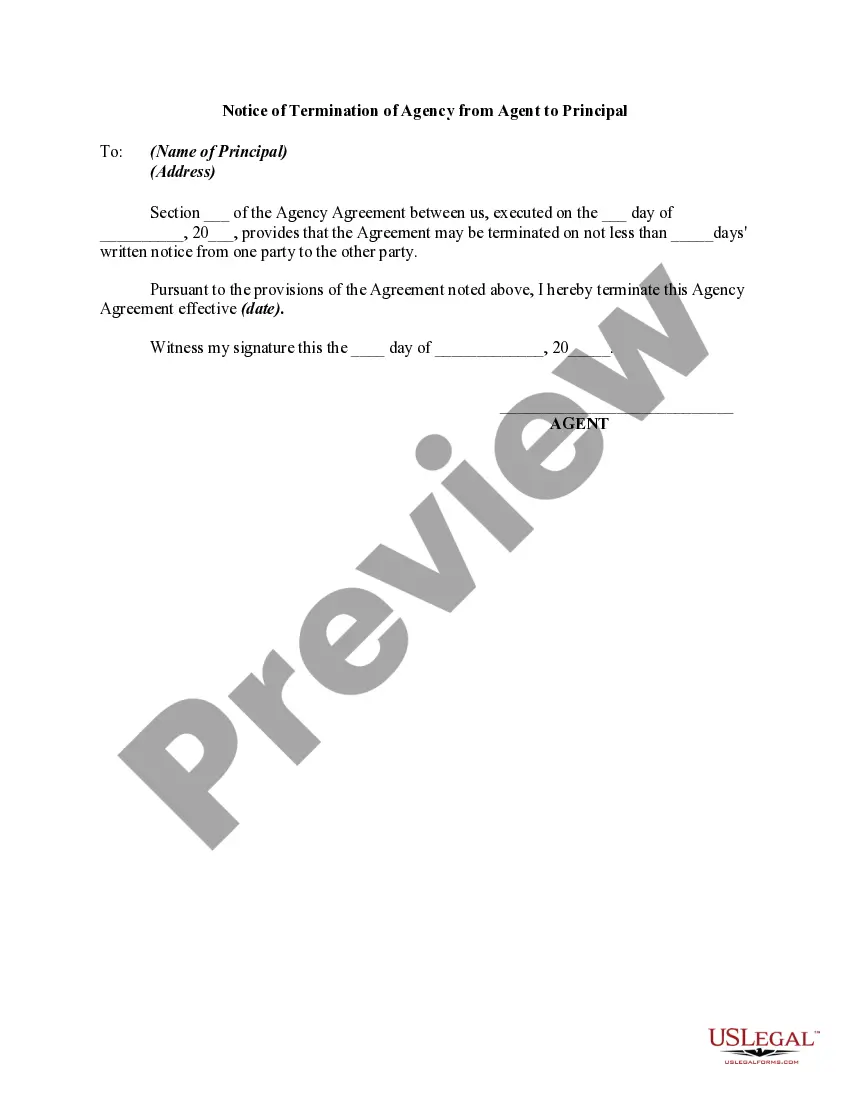

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

How does the loan assumption process work? Getting approved to assume a loan is similar to getting approved for a new mortgage. You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved.

An assumable mortgage allows a home buyer to not just move into the seller's former house, but to step into the seller's loan, too. This means that the remaining balance, repayment schedule and rate will be taken over by the new owner.

"Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility. The word "assumption" is used when a buyer assumes personal liability for an existing debt.

A seller is still responsible for any debt payments if the mortgage is assumed by a third party unless the lender approves a release request releasing the seller of all liabilities from the loan. If approved, the title of the property is transferred to the buyer who makes the required monthly repayments to the bank.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.

How does the loan assumption process work? Getting approved to assume a loan is similar to getting approved for a new mortgage. You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved.

Lenders must typically approve an assumable mortgage. If done without approval, sellers run the risk of having to pay the full remaining balance upfront. Sellers also risk buyers missing payments, which can negatively impact their credit score.