An Arkansas Office Space Lease Agreement refers to a legal document that outlines the terms and conditions of renting or leasing office space in the state of Arkansas. This agreement is signed between the landlord (property owner) and the tenant (individual or business entity) and serves as a binding contract governing the use, occupation, and maintenance of the leased office space. The Arkansas Office Space Lease Agreement typically includes several key elements. These include the names and contact information of both the landlord and tenant, a detailed description of the leased office space (such as location, size, and any specific limitations or permitted uses), the duration of the lease (usually specified in months or years), and the rental amount to be paid by the tenant. Additionally, the agreement outlines the responsibilities and obligations of both parties. For instance, it may include provisions regarding the payment of utilities, property maintenance, insurance, and any additional charges (such as common area maintenance fees or property taxes) that the tenant may be responsible for. Furthermore, the lease agreement may also address issues related to the security deposit, late payment penalties, termination or renewal options, subleasing or assignment rights, and dispute resolution procedures. It is crucial for both the landlord and tenant to thoroughly review and understand all terms and conditions before signing the agreement to avoid potential disputes or legal issues in the future. There may be different types of Arkansas Office Space Lease Agreements, depending on the specific needs and circumstances of the parties involved. Some common variations may include Standard Commercial Leases, Gross Leases, Net Leases, Triple Net Leases, Modified Gross Leases, and Sublease Agreements. Each type may have specific clauses or provisions that cater to different aspects of the lease arrangement, such as the allocation of expenses, repairs and maintenance responsibilities, and tenant improvements. In conclusion, Arkansas Office Space Lease Agreements are essential legal documents that define the rights, obligations, and terms of renting or leasing office space in Arkansas. These agreements help establish a clear understanding between the landlord and tenant, promoting a harmonious and mutually beneficial relationship throughout the lease term.

Arkansas Office Space Lease Agreement

Description

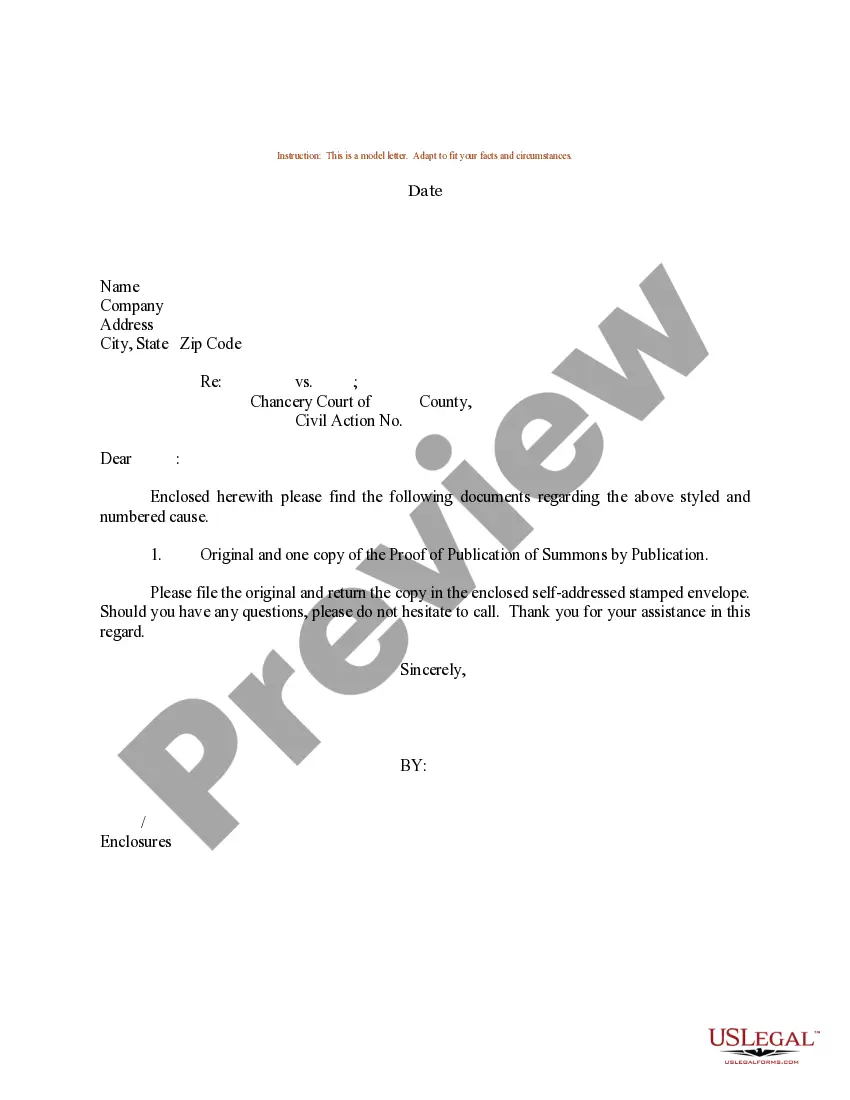

How to fill out Arkansas Office Space Lease Agreement?

Are you presently in a role that requires documentation for both business and personal purposes nearly every time.

There are numerous legal document templates accessible online, yet finding versions you can rely on is not easy.

US Legal Forms provides thousands of form templates, such as the Arkansas Office Space Lease Agreement, which are designed to meet state and federal requirements.

Once you discover the suitable form, click Buy now.

Choose the pricing plan you prefer, input the necessary information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Arkansas Office Space Lease Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you want and ensure it corresponds to the correct city/region.

- Utilize the Preview button to review the form.

- Check the description to confirm that you have picked the right form.

- If the form does not meet your expectations, use the Search field to locate the form that suits your needs and requirements.

Form popularity

FAQ

Generally, to be legally valid, most contracts must contain two elements: All parties must agree about an offer made by one party and accepted by the other. Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

A commercial lease is a form of legally binding contract made between a business tenant - your company - and a landlord. The lease gives you the right to use the property for business or commercial activity for a set period of time. In return for this, you will pay money to the landlord.

Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Here are some of the most important items to cover in your lease or rental agreement.Names of all tenants.Limits on occupancy.Term of the tenancy.Rent.Deposits and fees.Repairs and maintenance.Entry to rental property.Restrictions on tenant illegal activity.More items...?

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. The introductory paragraph should also include the address of the property being leased, as well as the start and end dates of the lease.

A written lease agreement must contain:The names and addresses of both parties;The description of the property;The rental amount and reasonable escalation;The frequency of rental payments, i.e. monthly;The amount of the deposit;The lease period;The notice period for termination of contract;More items...

How to create a lease agreementCollect each party's information.Include specifics about your property.Consider all of the property's utilities and services.Know the terms of your lease.Set the monthly rent amount and due date.Calculate any additional fees.Determine a payment method.Consider your rights and obligations.More items...

These are eight clauses that a landlord should include in a lease agreement in California:Security Deposits.Specific Payment Requirements.Late Rent Fees.Rent Increases.Notice of Entry.Rental Agreement Disclosures.Gas and Electricity Disclosure.Recreational Marijuana and Rentals.

The Binding Effect, sometimes referred to as "Successors and Assigns," says that the agreement to which it pertains benefits all of the parties involved and legally binds them to the agreement.

File a copy of the signed lease agreement with the Office of the County Registrar (known as the County Recorder or Deed Registry in some states) in the county where the rental property resides. The office may charge a nominal filing fee for registration, which you must pay at the time of filing.

Interesting Questions

More info

Area no fees broker for commercial real estate brokers find your dream location home office space buy with confidence Search Commercial real estate broker marketplaces brokers for commercial real estate Marketplaces commercial real estate search.