Arkansas Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Shareholder Agreement To Sell Stock To Other Shareholder?

US Legal Forms - one of the largest repositories of legal templates in the country - provides a diverse selection of legal document formats that you can download or print.

By using the website, you can access numerous forms for business and personal purposes, categorized by type, state, or keywords.

You can find the most up-to-date versions of documents such as the Arkansas Shareholder Agreement to Sell Stock to Other Shareholder in mere seconds.

If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

Once you are content with the form, confirm your choice by clicking the Get now button. Then, choose the payment plan you prefer and enter your information to create an account.

- If you are already a subscriber, Log In to access the Arkansas Shareholder Agreement to Sell Stock to Other Shareholder from the US Legal Forms archive.

- The Download button will be visible on each form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are some straightforward steps to help you begin.

- Ensure you have selected the correct form for your city/county.

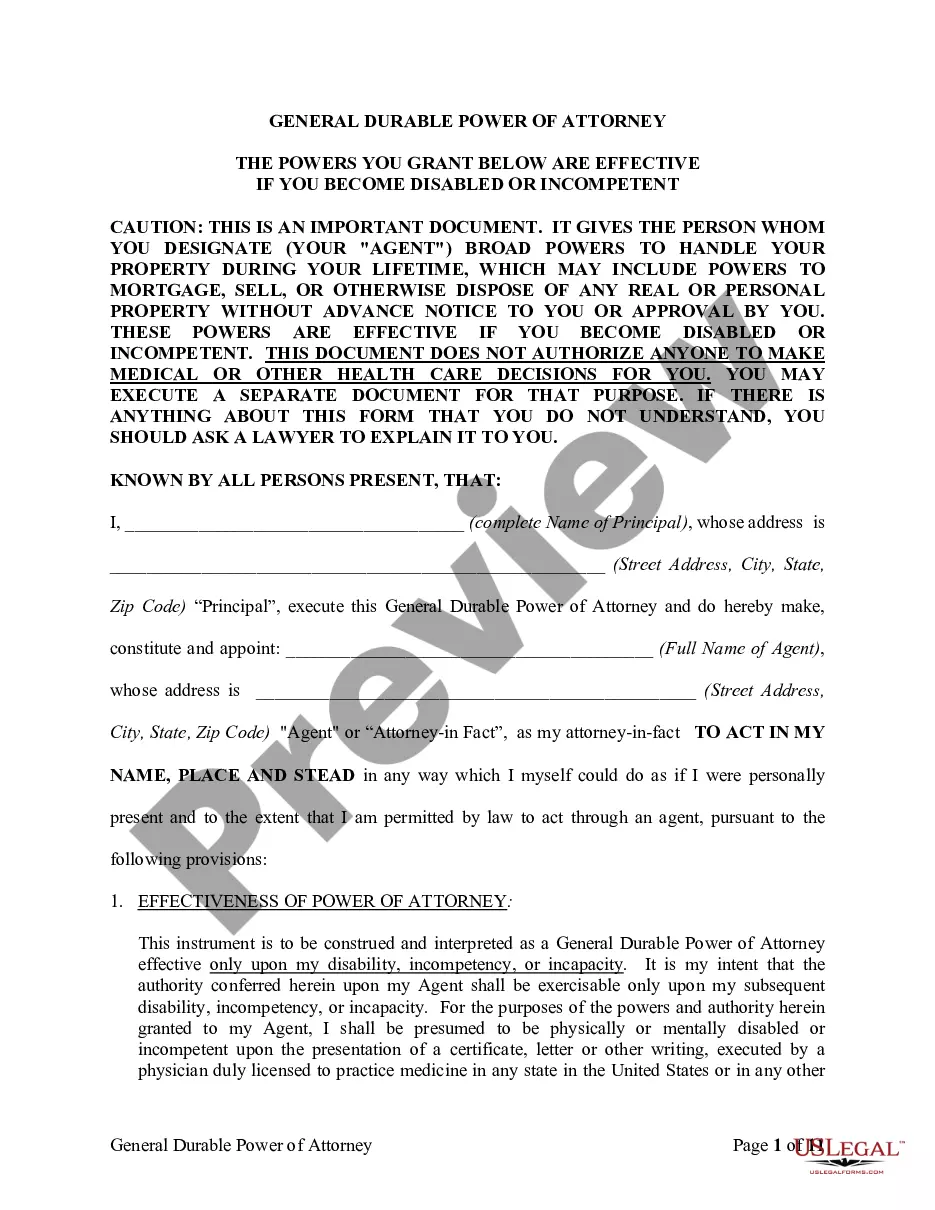

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Yes, you can sell your shares to someone else, subject to any restrictions in your company’s operating agreement. An Arkansas Shareholder Agreement to Sell Stock to Other Shareholder can specify terms for such transactions, ensuring a smooth transfer. It is beneficial to consult the uslegalforms platform for assistance in drafting an agreement that protects both parties.

Yes, a shareholder can sell shares to another shareholder, as permitted by the company's agreements and state law. Including this provision within an Arkansas Shareholder Agreement to Sell Stock to Other Shareholder can streamline the process and set clear expectations. Utilizing uslegalforms can help you draft a robust agreement that effectively covers these transactions.

In most cases, you cannot force a shareholder to sell their shares. However, an Arkansas Shareholder Agreement to Sell Stock to Other Shareholder may include buy-sell provisions that can facilitate the process under agreed conditions. It is essential to have clear terms documented in your agreement to avoid disputes and misunderstandings.

Yes, you can privately sell stocks to individuals, as long as you follow the appropriate legal guidelines. When forming an Arkansas Shareholder Agreement to Sell Stock to Other Shareholder, ensure that your agreement outlines the conditions under which these transactions can take place. Engaging a legal professional can help clarify these aspects and ensure compliance.

Yes, you can write your own shareholders agreement, including an Arkansas Shareholder Agreement to Sell Stock to Other Shareholder. However, it is crucial to ensure that the agreement complies with Arkansas state laws and addresses your specific needs. Consider seeking legal advice or using a reputable platform like uslegalforms to create a comprehensive and enforceable agreement.

Yes, a shareholder can transfer shares to another person, but this transfer is usually subject to the stipulations in the Arkansas Shareholder Agreement to Sell Stock to Other Shareholder. This agreement often includes provisions such as restrictions on transfers or requirements for approval from other shareholders. It is important to follow these guidelines to ensure that the share transfer is valid and does not breach any agreements.

When shareholders sell their shares, this can affect the company's ownership structure and possibly its governance. The implications are often outlined in the Arkansas Shareholder Agreement to Sell Stock to Other Shareholder, which may include changes in voting power and decision-making authority. Understanding these consequences is vital for maintaining harmony among shareholders and ensuring compliance with the agreement.

Yes, you typically need shareholder approval to sell shares, especially if specified in your Arkansas Shareholder Agreement to Sell Stock to Other Shareholder. This agreement will guide the approval process, whether by vote or consent. By adhering to the agreed terms, you can avoid disputes and ensure a smooth transaction.

Not necessarily all shareholders must agree for a sale to occur, but the Arkansas Shareholder Agreement to Sell Stock to Other Shareholder often stipulates which approvals are needed. Usually, the approval of a majority or specified percentage of shareholders suffices. Checking your specific agreement is critical to understanding the sale process thoroughly and ensuring compliance.

In Arkansas, a 50 shareholder may not be able to sell shares to anyone without restrictions. Typically, an Arkansas Shareholder Agreement to Sell Stock to Other Shareholder outlines the specific terms and conditions regarding share transactions. This agreement often includes rights of first refusal and may require approval from other shareholders. Therefore, reviewing your agreement is essential before proceeding.