Arkansas Letter to Creditors notifying them of Identity Theft

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft?

Choosing the best authorized record web template can be quite a battle. Obviously, there are a lot of themes available online, but how can you get the authorized develop you will need? Make use of the US Legal Forms internet site. The service provides 1000s of themes, including the Arkansas Letter to Creditors notifying them of Identity Theft, that can be used for business and personal requires. All the forms are inspected by experts and fulfill state and federal requirements.

When you are presently registered, log in to your bank account and click the Acquire button to get the Arkansas Letter to Creditors notifying them of Identity Theft. Make use of bank account to look through the authorized forms you have ordered previously. Go to the My Forms tab of your respective bank account and get yet another duplicate of the record you will need.

When you are a fresh consumer of US Legal Forms, here are simple recommendations that you should stick to:

- First, ensure you have selected the right develop for the town/state. You may examine the shape utilizing the Preview button and look at the shape outline to make sure this is basically the best for you.

- In case the develop does not fulfill your expectations, take advantage of the Seach discipline to get the appropriate develop.

- Once you are certain the shape would work, click on the Purchase now button to get the develop.

- Choose the rates program you would like and type in the needed information. Design your bank account and pay for an order with your PayPal bank account or Visa or Mastercard.

- Pick the submit file format and acquire the authorized record web template to your device.

- Full, modify and print out and signal the attained Arkansas Letter to Creditors notifying them of Identity Theft.

US Legal Forms will be the biggest catalogue of authorized forms in which you can see numerous record themes. Make use of the service to acquire professionally-made paperwork that stick to express requirements.

Form popularity

FAQ

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.

(1) Except as provided in subdivision (e)(2) of this section, financial identity fraud is a Class C felony. (2) Financial identity fraud is a Class B felony if the victim is an elder person or a disabled person.

If you believe you or a loved one are the victim of a scam or identity theft, report it immediately to your local police or sheriff's department, or contact the Office of the Attorney General by calling (501) 682-2007 or visit the website here.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Report the Crime to the Police Ask the police to issue a police report of identity theft. Give the police as much information on the theft as possible. One way to do this is to provide copies of your credit reports showing the items related to identity theft. Black out other items not related to identity theft.

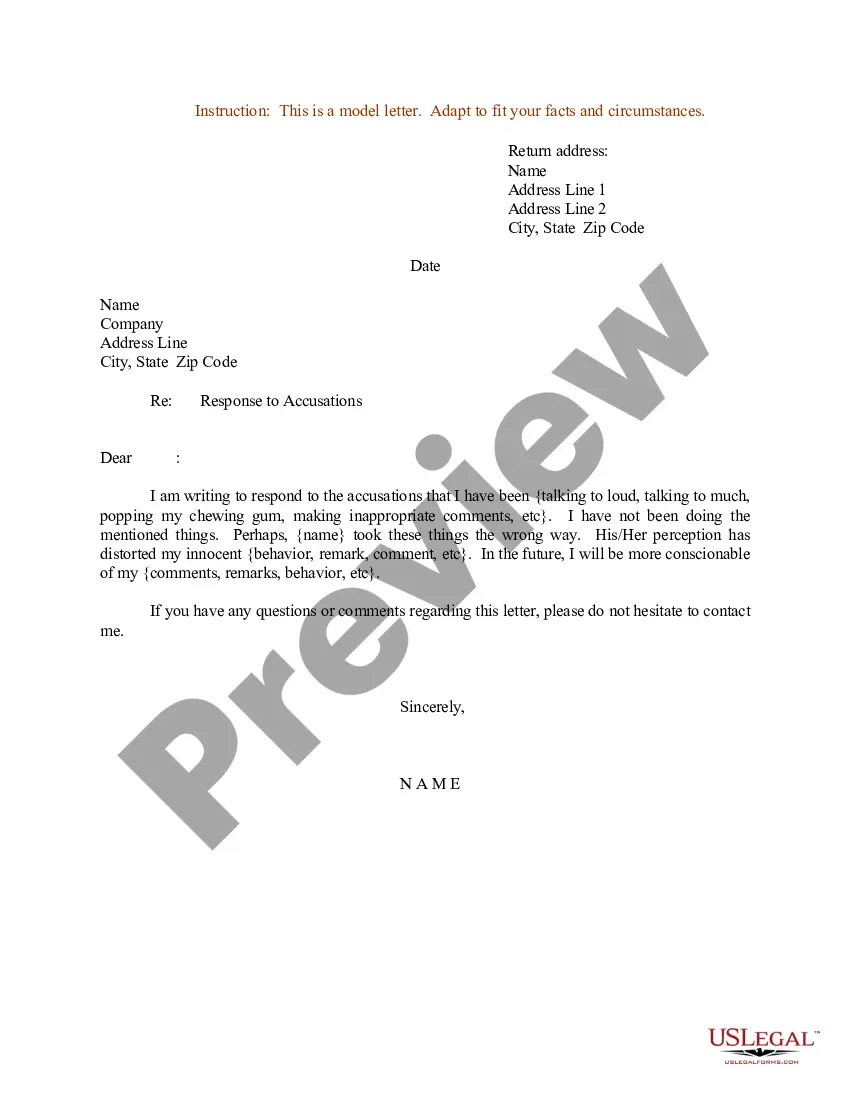

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.