Arkansas Construction Contract with Subcontractor

Description

How to fill out Construction Contract With Subcontractor?

Are you in a position where you need documents for possibly professional or personal purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, such as the Arkansas Construction Contract with Subcontractor, designed to meet state and federal requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Arkansas Construction Contract with Subcontractor at any time, if needed. Just select the required form to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Arkansas Construction Contract with Subcontractor template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct city/state.

- Use the Review button to examine the form.

- Check the information to ensure you have selected the correct form.

- If the form isn't what you're looking for, utilize the Lookup field to find the form that meets your needs.

- Once you find the appropriate form, click Buy now.

- Choose the payment plan you prefer, fill in the required details to complete your purchase, and place an order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

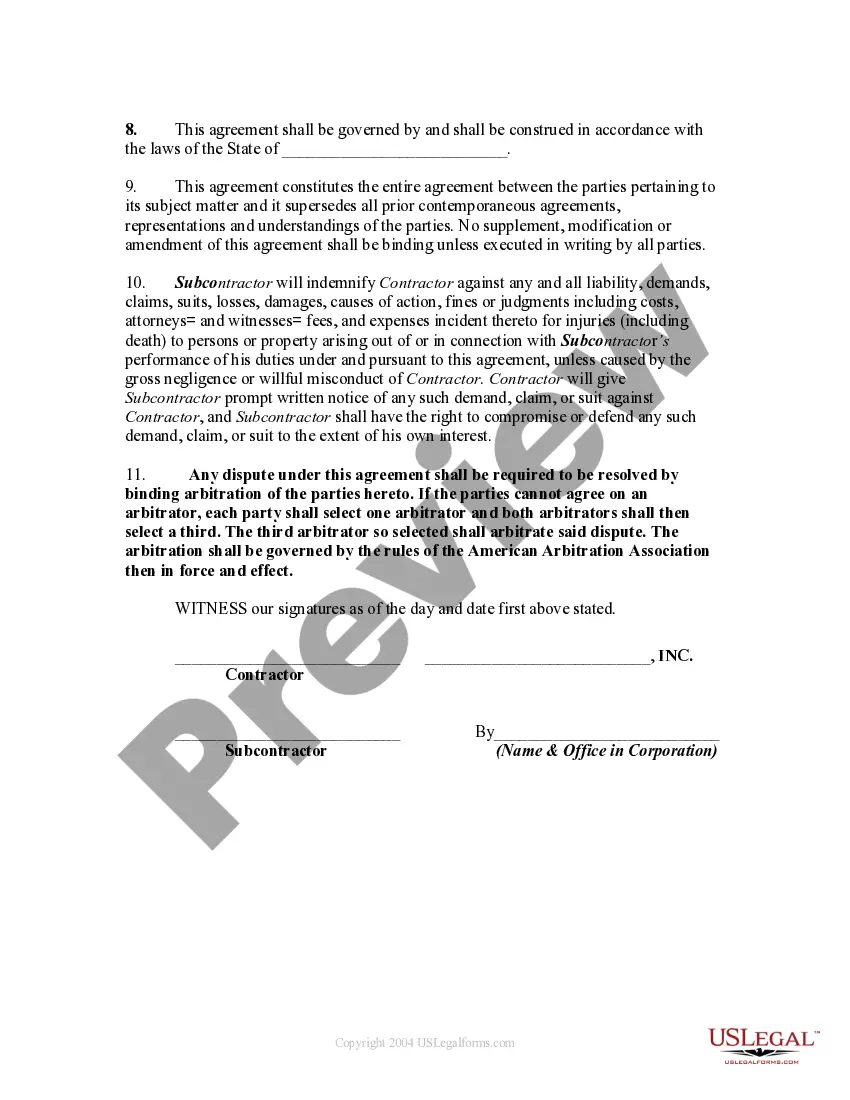

The two-year contractor rule in Arkansas generally refers to the statute of limitations for construction-related claims. Under this rule, any breach of contract claim must be filed within two years from the date of completion of the work. Understanding this timeline is crucial when entering into an Arkansas construction contract with subcontractor, as it affects your legal rights and remedies. Keeping accurate records and documentation can be beneficial in the event of a dispute.

Absolutely, contractors can and often do use subcontractors in Arkansas. Utilizing subcontractors can enhance project efficiency and enable you to handle more complex tasks. When drafting your Arkansas construction contract with subcontractor, clearly outline the roles and responsibilities to maintain accountability. This approach ensures that all parties are aware of their obligations, minimizing conflicts.

Yes, you can subcontract as an independent contractor in Arkansas. When doing so, ensure that your primary contract allows for subcontracting and define the scope of work clearly. Subcontracting allows you to take on larger projects and utilize specialized skills. Just remember to manage relationships and communications effectively to promote successful outcomes.

You can hire someone as a 1099 independent contractor, but it's essential to ensure that they meet the criteria set by the IRS. In the context of Arkansas construction contracts with subcontractors, hiring as a 1099 contractor means they are responsible for their taxes, insurance, and other liabilities. Clear communication regarding job expectations and payment terms in your contract will encourage a smooth working relationship.

Yes, an independent contractor can serve as a subcontractor in Arkansas. In fact, many independent contractors operate as subcontractors on larger projects, providing specialized services to the primary contractor. However, it's crucial to establish clear terms in your Arkansas construction contract with subcontractor to define roles, responsibilities, and payment structures. This clarity helps avoid misunderstandings down the line.

When dealing with Arkansas construction contracts with subcontractors, it's important to recognize that restrictions may vary. Generally, contracts should explicitly state whether subcontracting is allowed and under what conditions. Additionally, some construction projects may have licensing restrictions that contractors must adhere to. Always review your contract carefully to understand any limitations on subcontracting.

To write a simple construction contract, start by identifying the parties involved and the project details, including timelines and budget. Clearly describe the scope of work and include payment terms to avoid misunderstandings. When creating an Arkansas Construction Contract with Subcontractor, ensure you comply with local laws and regulations. Resources like uslegalforms can offer valuable templates to draft a comprehensive contract effortlessly.

Filling out a subcontractor agreement involves detailing the specific services the subcontractor will provide, along with payment schedules and timelines. Make sure to outline the responsibilities and expectations for both parties to prevent disputes. For those drafting an Arkansas Construction Contract with Subcontractor, it is vital to include legal requirements that reflect the scope of work. Consider using uslegalforms for convenient templates and guidance.

To fill out an independent contractor agreement, begin by clearly defining the scope of work, payment terms, and deadlines. Include clauses that cover confidentiality, dispute resolution, and termination conditions. If you are working with an Arkansas Construction Contract with Subcontractor, ensure that it aligns with state regulations and requirements. You can find templates on uslegalforms that can streamline this process.

When filling out a 1099 for a subcontractor, start by gathering the required information, including the subcontractor's name, address, and taxpayer identification number. Ensure you report the total payments made during the tax year accurately. This form is essential for proper tax reporting after you complete an Arkansas Construction Contract with Subcontractor. Utilizing platforms like uslegalforms can help simplify this process significantly.