Arkansas Letter to Credit Card Companies and Financial Institutions Notifying Them of Death is a crucial document that individuals may need to send to credit card companies and financial institutions upon the unfortunate passing of a loved one. This letter serves the purpose of informing these entities about the death of the account holder and provides necessary instructions on handling their accounts and assets. It is advisable to include relevant keywords in the letter to ensure clarity and effectiveness. Keywords: Arkansas, letter, credit card companies, financial institutions, notifying, death, account holder, accounts, assets, instructions. Types of Arkansas Letters to Credit Card Companies and Financial Institutions Notifying Them of Death: 1. Arkansas Death Notification Letter to Credit Card Companies: This type of letter specifically addresses credit card companies operating in Arkansas. It notifies them of the account holder's death, providing essential information such as the account holder's name, account number, and date of death. The letter requests the closure of the deceased person's credit card account, stopping any further charges or transactions. 2. Arkansas Death Notification Letter to Financial Institutions: Financial institutions include banks, credit unions, and other similar entities. This letter informs them about the death of the account holder and provides relevant information required for the account's management and settlement. It typically includes the deceased individual's name, account numbers, date of death, and instructions regarding freezing or closing the accounts. 3. Arkansas Instructions for Handling Deceased Account Holder's Assets: This type of letter focuses primarily on the deceased person's assets held by financial institutions. It provides specific instructions for the institutions on properly handling these assets, including bank accounts, investments, insurance policies, and retirement accounts. The letter may request the liquidation of assets, transferring them to designated beneficiaries or heirs, or holding them until probate is completed. 4. Arkansas Estate Administration Letter to Financial Institutions: This letter is sent by the appointed executor or administrator of the deceased's estate. It serves as an official notification to financial institutions about the individual's passing and their role in the estate administration process. The letter includes information about the estate representative's appointment, relevant legal documents, and instructions for transferring or closing the deceased's accounts. Overall, Arkansas Letter to Credit Card Companies and Financial Institutions Notifying Them of Death is an essential communication tool for managing the financial affairs of a deceased individual. By using appropriate keywords and addressing different types of letters, individuals can effectively communicate their intentions and ensure a seamless transition of accounts and assets.

Arkansas Letter to Credit Card Companies and Financial Institutions Notifying Them of Death

Description

How to fill out Arkansas Letter To Credit Card Companies And Financial Institutions Notifying Them Of Death?

Are you in a place where you need papers for either organization or specific uses just about every working day? There are a lot of legitimate document themes available online, but discovering kinds you can depend on isn`t effortless. US Legal Forms provides thousands of form themes, such as the Arkansas Letter to Credit Card Companies and Financial Institutions Notifying Them of Death, that happen to be published to satisfy state and federal demands.

When you are currently acquainted with US Legal Forms web site and get your account, simply log in. Afterward, it is possible to obtain the Arkansas Letter to Credit Card Companies and Financial Institutions Notifying Them of Death design.

If you do not have an accounts and want to start using US Legal Forms, adopt these measures:

- Obtain the form you want and ensure it is for the right town/region.

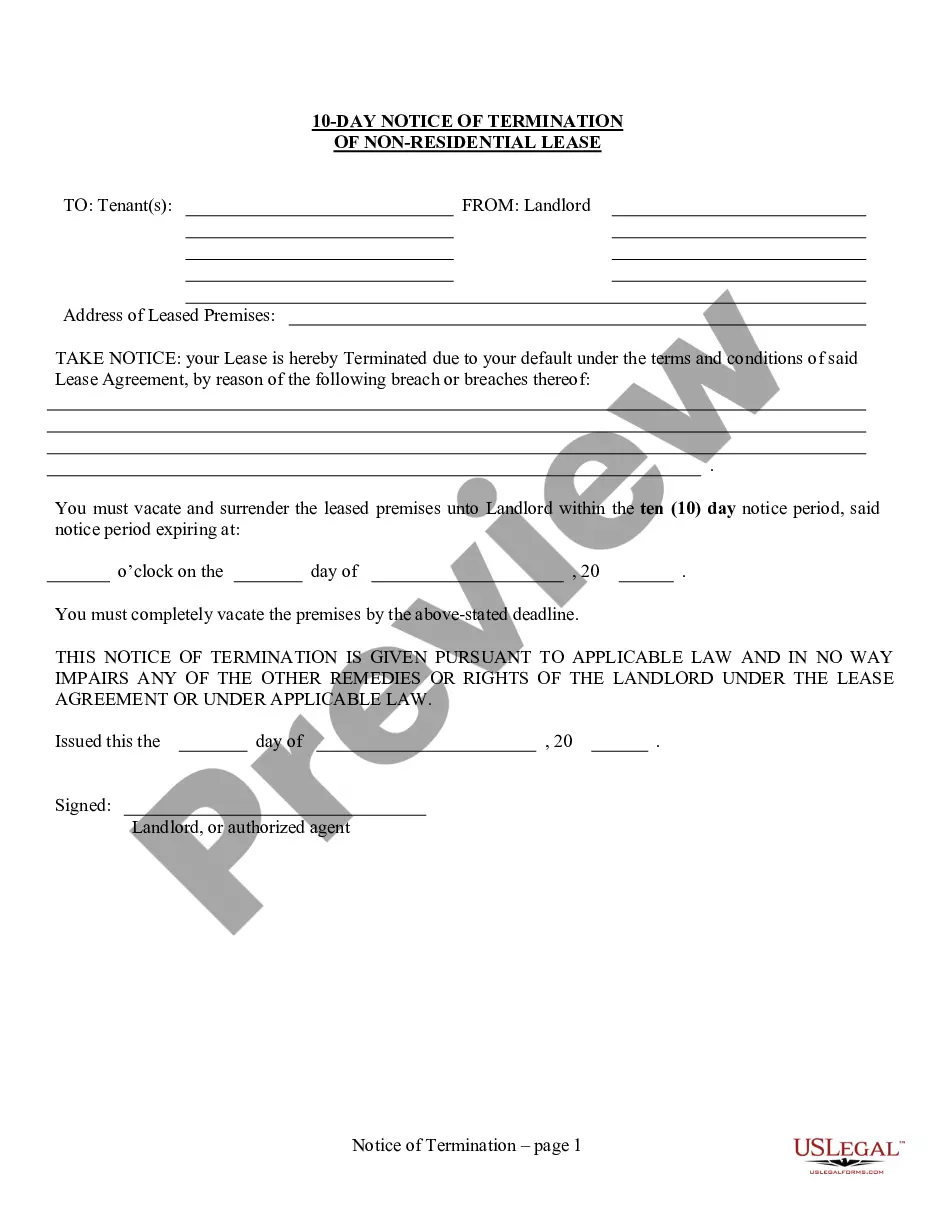

- Make use of the Preview option to examine the form.

- Browse the explanation to actually have chosen the proper form.

- If the form isn`t what you are looking for, utilize the Search area to find the form that meets your needs and demands.

- If you obtain the right form, click Purchase now.

- Pick the pricing plan you need, complete the desired information to produce your money, and buy your order using your PayPal or credit card.

- Choose a convenient paper format and obtain your backup.

Locate all the document themes you might have bought in the My Forms menu. You may get a more backup of Arkansas Letter to Credit Card Companies and Financial Institutions Notifying Them of Death whenever, if required. Just click the essential form to obtain or print out the document design.

Use US Legal Forms, one of the most extensive selection of legitimate forms, in order to save time and prevent blunders. The services provides appropriately produced legitimate document themes which can be used for an array of uses. Make your account on US Legal Forms and begin making your life a little easier.