Arkansas Director's Fees — Resolution For— - Corporate Resolutions: A Comprehensive Guide Introduction: In Arkansas, corporate entities often need to address the issue of director's fees through a formal resolution. This detailed guide will provide you with key information about the Arkansas Director's Fees — Resolution Form and its significance for corporate resolutions. It also sheds light on various types and variations of these resolutions commonly found in Arkansas. Key Keywords: Arkansas, Director's Fees, Resolution Form, Corporate Resolutions, Types 1. Understanding Director's Fees: Director's fees are a form of compensation paid to directors for their services and contributions to a corporate board. These fees recognize the time, effort, and expertise that directors invest in guiding and managing the company's affairs. 2. Importance of Corporate Resolutions: Corporate resolutions are crucial legal documents that record decisions made by a company's board of directors or shareholders. These resolutions provide an official record of important actions taken, including the approval of director's fees. They serve as evidence of the company's intent and protect the interests of all stakeholders. 3. Arkansas Director's Fees — Resolution Form: The Arkansas Director's Fees — Resolution Form is a standardized document utilized by corporations to authorize the payment of director's fees. It includes specific details about the board members, the nature of fees, payment terms, and other essential information required for legal compliance. 4. Types of Arkansas Director's Fees Resolutions: a. Annual Director's Fees Resolution: This resolution outlines the fees to be paid to directors on an annual basis. It typically considers factors such as the director's role, responsibilities, and the overall financial health of the company. b. Special Director's Fees Resolution: This resolution is used when additional director's fees are required for specific services beyond regular board duties. It may cover tasks such as conducting special audits, participating in strategic planning, or advising on mergers and acquisitions. c. Non-Monetary Director's Fees Resolution: In some cases, directors may opt to receive compensation other than monetary remuneration, such as stock options, equity, or other valuable perks. This type of resolution documents such alternative arrangements. d. Retainer Director's Fees Resolution: A retainer resolution sets a fixed annual amount payable to directors, irrespective of the number of board meetings attended or additional tasks performed. This type of resolution provides stability and predictability in compensation. Conclusion: The Arkansas Director's Fees — Resolution Form is a critical component of corporate governance, ensuring transparent and legal authorization for director's fee payments. By utilizing the appropriate type of resolution, companies can reward directors appropriately and facilitate smooth decision-making processes within their boardrooms. Make sure to leverage these resolutions in accordance with Arkansas laws and regulations to protect the interests of your organization and its stakeholders.

Arkansas Director's Fees - Resolution Form - Corporate Resolutions

Description

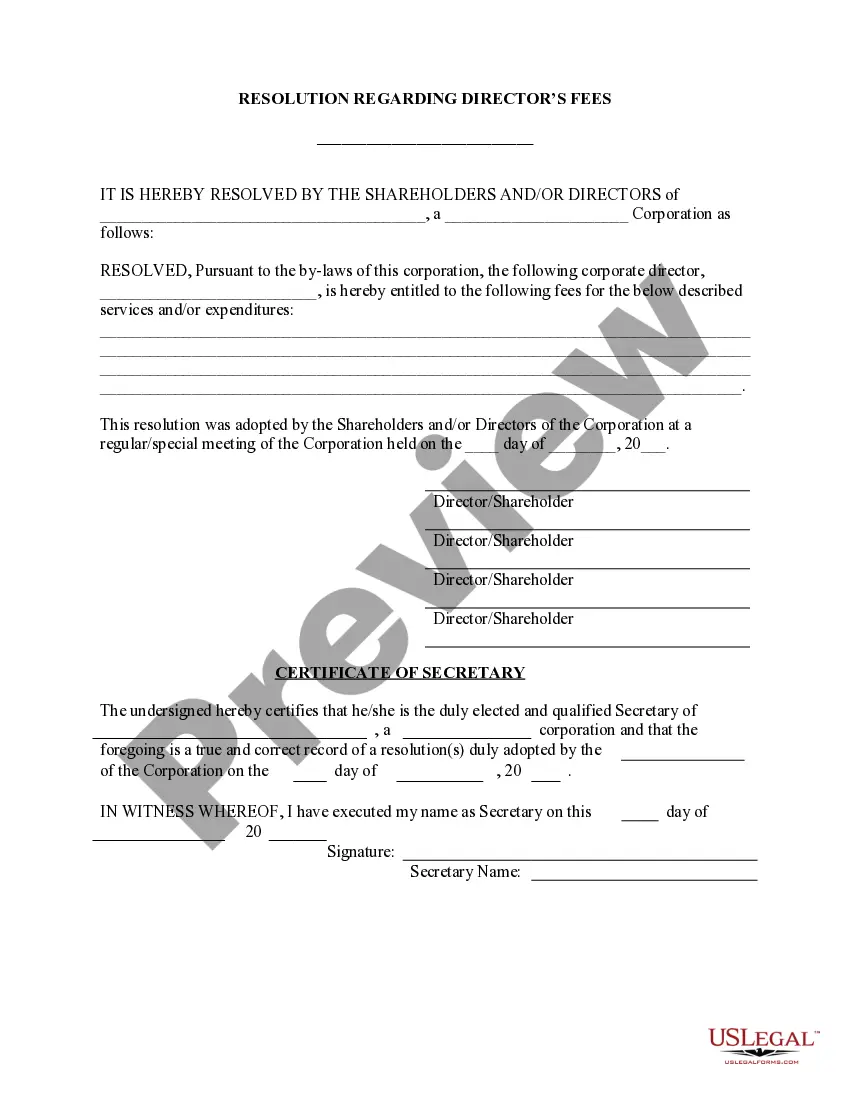

How to fill out Arkansas Director's Fees - Resolution Form - Corporate Resolutions?

If you wish to full, download, or printing lawful papers themes, use US Legal Forms, the greatest collection of lawful forms, that can be found on the Internet. Utilize the site`s easy and practical lookup to find the documents you need. Different themes for enterprise and specific functions are categorized by types and claims, or search phrases. Use US Legal Forms to find the Arkansas Director's Fees - Resolution Form - Corporate Resolutions within a number of clicks.

In case you are currently a US Legal Forms buyer, log in in your account and then click the Download button to have the Arkansas Director's Fees - Resolution Form - Corporate Resolutions. You can even gain access to forms you previously downloaded from the My Forms tab of your respective account.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for your proper town/country.

- Step 2. Use the Review option to examine the form`s articles. Never neglect to read through the description.

- Step 3. In case you are unhappy using the type, utilize the Lookup discipline towards the top of the display screen to discover other versions from the lawful type template.

- Step 4. When you have found the shape you need, click the Buy now button. Pick the pricing strategy you prefer and include your qualifications to register to have an account.

- Step 5. Procedure the purchase. You may use your charge card or PayPal account to accomplish the purchase.

- Step 6. Select the formatting from the lawful type and download it on the gadget.

- Step 7. Total, modify and printing or indication the Arkansas Director's Fees - Resolution Form - Corporate Resolutions.

Every lawful papers template you acquire is the one you have for a long time. You might have acces to each type you downloaded inside your acccount. Go through the My Forms segment and choose a type to printing or download again.

Remain competitive and download, and printing the Arkansas Director's Fees - Resolution Form - Corporate Resolutions with US Legal Forms. There are thousands of specialist and status-particular forms you can utilize for the enterprise or specific needs.