The Arkansas Special Cemetery Gift Trust Fund is a specialized financial resource established to support the preservation, maintenance, and enhancement of cemeteries within the state of Arkansas. As an essential component of cemetery care, this trust fund plays a crucial role in ensuring the longevity and respectful upkeep of these final resting places for generations to come. The primary objective of the Arkansas Special Cemetery Gift Trust Fund is to provide financial assistance to cemeteries facing financial constraints or requiring additional resources to carry out necessary activities. These funds may be utilized for a range of purposes such as repairing damaged grave markers, maintaining landscaping and grounds, constructing necessary infrastructure, and enhancing overall cemetery aesthetics. The creation of the Arkansas Special Cemetery Gift Trust Fund highlights the state's commitment to honoring and preserving its rich history and cultural heritage. By establishing this dedicated fund, the Arkansas government demonstrates its recognition of the unique importance cemeteries hold in reflecting the state's past, memorializing its residents, and contributing to the tourism industry. The Arkansas Special Cemetery Gift Trust Fund can be classified into several types based on the nature of cemeteries it supports: 1. Public Cemetery Gift Trust Fund: This specific fund is designated to provide financial assistance to public cemeteries situated throughout the state. Public cemeteries are usually owned and operated by governmental bodies and are open to the community at large. 2. Private Cemetery Gift Trust Fund: Private cemeteries typically have limited access and are owned and managed by private entities or organizations. The Private Cemetery Gift Trust Fund aims to assist these cemeteries in meeting their financial obligations and maintaining their overall appearance and functionality. 3. Historical Cemetery Gift Trust Fund: Arkansas is home to numerous historically significant cemeteries that hold immense cultural, archaeological, and genealogical value. The Historical Cemetery Gift Trust Fund focuses on preserving and conserving these special burial sites, ensuring their historical integrity remains intact. The Arkansas Special Cemetery Gift Trust Fund is funded through contributions from individuals, organizations, and various fundraising initiatives. Individuals who hold a deep appreciation for the state's cemeteries and their role in preserving local heritage can also make donations to support the fund's activities. In conclusion, the Arkansas Special Cemetery Gift Trust Fund is a vital financial resource dedicated to preserving and enhancing the state's cemeteries. It offers support to public, private, and historical cemeteries, reinforcing the significance of these burial grounds in maintaining Arkansas's cultural legacy.

Arkansas Special Cemetery Gift Trust Fund

Description

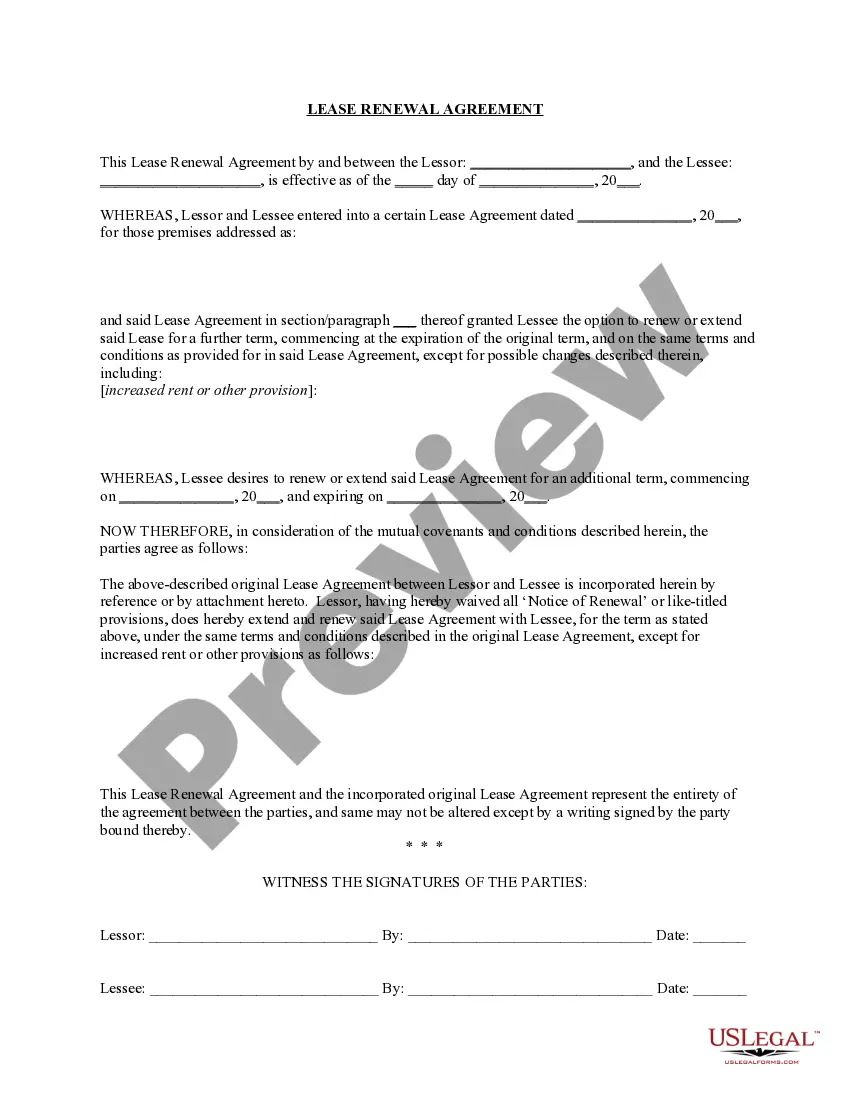

How to fill out Arkansas Special Cemetery Gift Trust Fund?

If you aim to finalize, acquire, or reproduce legitimate document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require.

A range of templates for commercial and personal purposes are organized by categories and states, or by keywords.

Step 4. Once you have found the form you need, select the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the purchase process. You can use either your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to access the Arkansas Special Cemetery Gift Trust Fund in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click on the Acquire button to obtain the Arkansas Special Cemetery Gift Trust Fund.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct state/region.

- Step 2. Utilize the Review option to browse through the details of the form. Be sure to read the summary.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other forms in the legal template directory.

Form popularity

FAQ

Yes, establishing a family cemetery on your property in Arkansas is permitted, but it requires compliance with state and local laws. You must consider zoning restrictions and possible permits before setting up a family burial site. With the Arkansas Special Cemetery Gift Trust Fund, you can secure necessary resources and guidance for your family's burial needs. This option provides a heartfelt way to honor your family's legacy.

In Arkansas, you can be buried on your own property under certain conditions. Local regulations may govern this practice, requiring you to follow specific guidelines. The Arkansas Special Cemetery Gift Trust Fund can help you navigate these regulations, ensuring your wishes are met. Engaging in proper planning allows you to create a personal and serene resting place.

Yes, natural burials are legal in Arkansas. Families often choose natural burials for their simplicity and environmental benefits. The Arkansas Special Cemetery Gift Trust Fund can assist in ensuring your burial preferences are honored. By planning ahead, you can provide peace of mind for your loved ones and leave a meaningful legacy.

Yes, many cemeteries in Arkansas can qualify for tax-exempt status. This exemption applies to non-profit organizations that operate these cemeteries and serve the public good. By utilizing the Arkansas Special Cemetery Gift Trust Fund, individuals can make prearrangements that may also benefit from this tax-exempt status, offering financial advantages to those planning ahead. Understanding these tax implications can aid families in making informed decisions about their cemetery arrangements.

In Arkansas, the regulation of funeral homes lies with the Arkansas State Board of Embalmers and Funeral Directors. This board sets guidelines regarding licensing, operations, and ongoing education for funeral professionals. When planning your end-of-life arrangements, it's wise to consider how the Arkansas Special Cemetery Gift Trust Fund can work in harmony with the services provided by these regulated funeral homes, ensuring a cohesive approach to your plans. Keeping informed about these regulations helps families make educated choices.

Cemeteries in Arkansas are regulated by the Arkansas Department of Health's Burial and Funeral Services Division. This agency oversees the operational standards and ensures that cemeteries comply with state laws, which include the management of funds, like those in the Arkansas Special Cemetery Gift Trust Fund. By adhering to these regulations, cemeteries provide a dignified and respectful service to the public while ensuring ethical practices are followed. It is essential for families to understand these regulations when making arrangements.

If you wish to sell cemetery plots in Arkansas, start by consulting the cemetery to understand their policies regarding sales. Some cemeteries have specific procedures or restrictions on transferring plots. Leveraging the Arkansas Special Cemetery Gift Trust Fund can help ensure that financial aspects are handled smoothly, providing financial security for your beneficiaries. Connecting with local real estate professionals who specialize in cemetery properties may also assist in your efforts.

In Arkansas, burial in a cemetery is not mandatory; however, many people opt for this choice for various reasons, including respect, tradition, and ease for loved ones. The Arkansas Special Cemetery Gift Trust Fund allows individuals to plan their final arrangements and ensure funds are set aside for cemetery expenses. This fund provides peace of mind, as it simplifies the process for family members at a difficult time. Thus, while it’s not required, choosing to have a burial in a cemetery can be beneficial.

To register a cemetery in Arkansas, you must first complete an application through the Arkansas Cemetery Board. This application requires specific documentation, including proof of ownership and a proposed plan for managing the cemetery. After submitting your application, the board will review it and may conduct an inspection. Utilizing resources like the Arkansas Special Cemetery Gift Trust Fund can help ensure proper funding and management for your cemetery.

Burial laws in Arkansas encompass various regulations concerning burial sites, cemeteries, and cremation. The laws address issues such as cemetery maintenance, burial permits, and the rights of family members regarding burial decisions. To gain a thorough understanding of these laws, utilizing resources like the Arkansas Special Cemetery Gift Trust Fund can enhance your planning experience.

More info

“ —George Washington, 1799 “A cemetery is a place of rest and happiness There will be no death in a happy place.” —Walt Whitman “What I would most like to live [for] are my friends. I would prefer them not always to be alive, but to die when they're gone. I have friends now, but I wouldn't want them to [be] buried in a cemetery.” —Goblet, from his Journals, 1824 “It is better to die for that which you believe than to live for that which you do not believe.” —Jesus Christ, from The Sermon on the Mount “Cemetery remains that lie unmarked, or in cemeteries that are not kept in full conformity to the law” “For I do not want you to be silent, but I want you to speak of these things openly. For a long time I've been teaching the people of Israel what I felt should not be spoken of by the mouth of an ordinary man — namely, that you should not touch the bodies of the departed. Now, why?