Arkansas Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is a legal document that outlines the terms and conditions for the liquidation of a debtor's collateral in order to meet their outstanding debts. This agreement is specific to the state of Arkansas and is designed to protect the rights of both the debtor and the creditor in the event of default or inability to repay the debt. Key features of an Arkansas Liquidation Agreement include: 1. Definition of Collateral: The agreement clearly identifies the collateral that the debtor has pledged to secure the debt. This can include tangible assets such as property, vehicles, equipment, or intangible assets like accounts receivable or patents. 2. Liquidation Process: The agreement outlines the process by which the creditor can liquidate the debtor's collateral to satisfy the outstanding debt. This may involve selling the assets through public auction, private sale, or any other legally acceptable means. 3. Notification Requirements: The debtor must be provided with a notice of intent to liquidate the collateral. The agreement specifies the timeframe within which the debtor should respond, either by paying the outstanding debt, proposing an alternate repayment plan, or contesting the liquidation. 4. Distribution of Proceeds: The agreement states how the proceeds from the liquidation will be distributed. Typically, the creditor is entitled to be repaid the outstanding debt first, followed by any associated fees, penalties, or interest. Any remaining amount is returned to the debtor, if applicable, according to the agreement terms. 5. Dispute Resolution: The agreement may include provisions for dispute resolution in case of disagreements between the debtor and creditor regarding the valuation, sale process, or distribution of proceeds. Different types of Arkansas Liquidation Agreements regarding Debtor's Collateral in Satisfaction of Indebtedness vary based on the specific nature of the collateral or the type of debt involved. Some common variations include: 1. Real Estate Liquidation Agreement: This type of agreement is specifically tailored for cases where the debtor has pledged real estate or immovable property as collateral. 2. Vehicle Liquidation Agreement: This agreement is used when the debtor's collateral includes automobiles, motorcycles, or any other form of vehicles. 3. Equipment Liquidation Agreement: When the debtor has pledged machinery, tools, or other types of equipment as collateral, this agreement addresses the liquidation process specific to those assets. 4. Accounts Receivable Liquidation Agreement: This variation is suitable when the debtor has offered accounts receivable as collateral. It outlines the process of collecting outstanding payments from customers to satisfy the debt. In conclusion, an Arkansas Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is a crucial legal document that provides guidelines for the liquidation of collateral to repay outstanding debts. Different types of agreements exist, depending on the type of collateral involved.

Arkansas Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

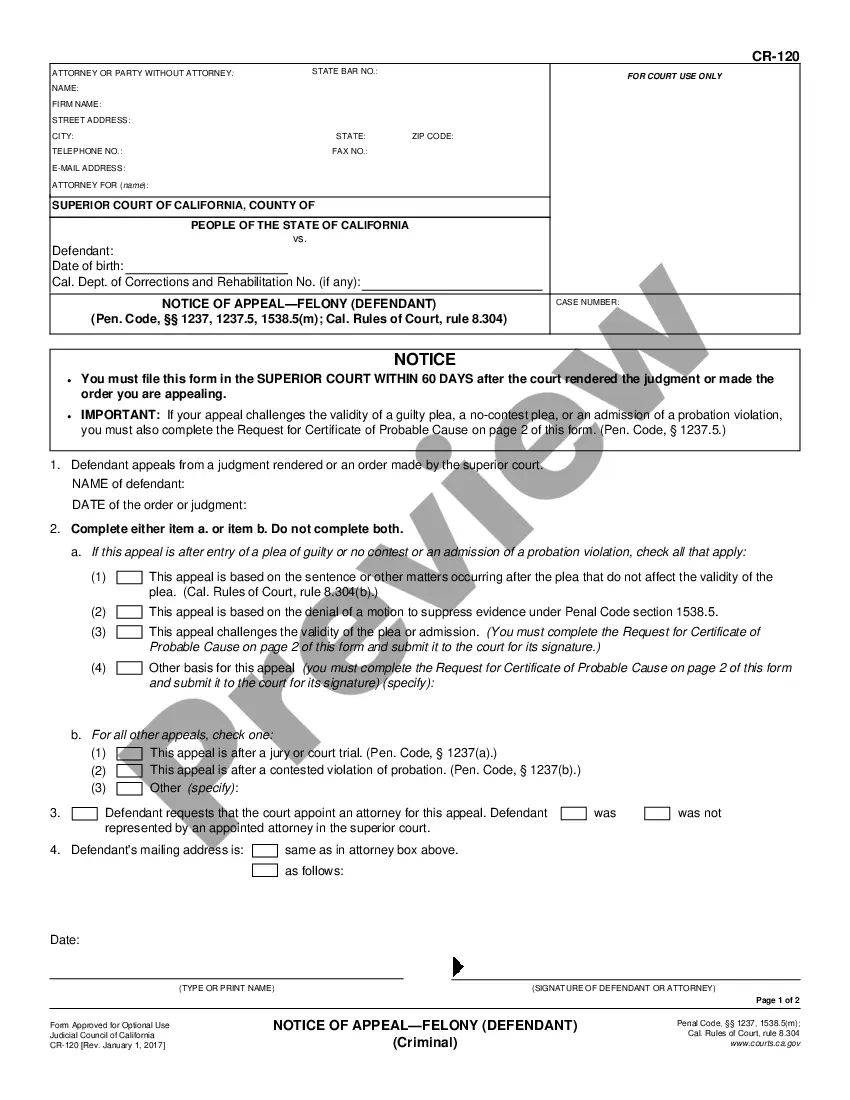

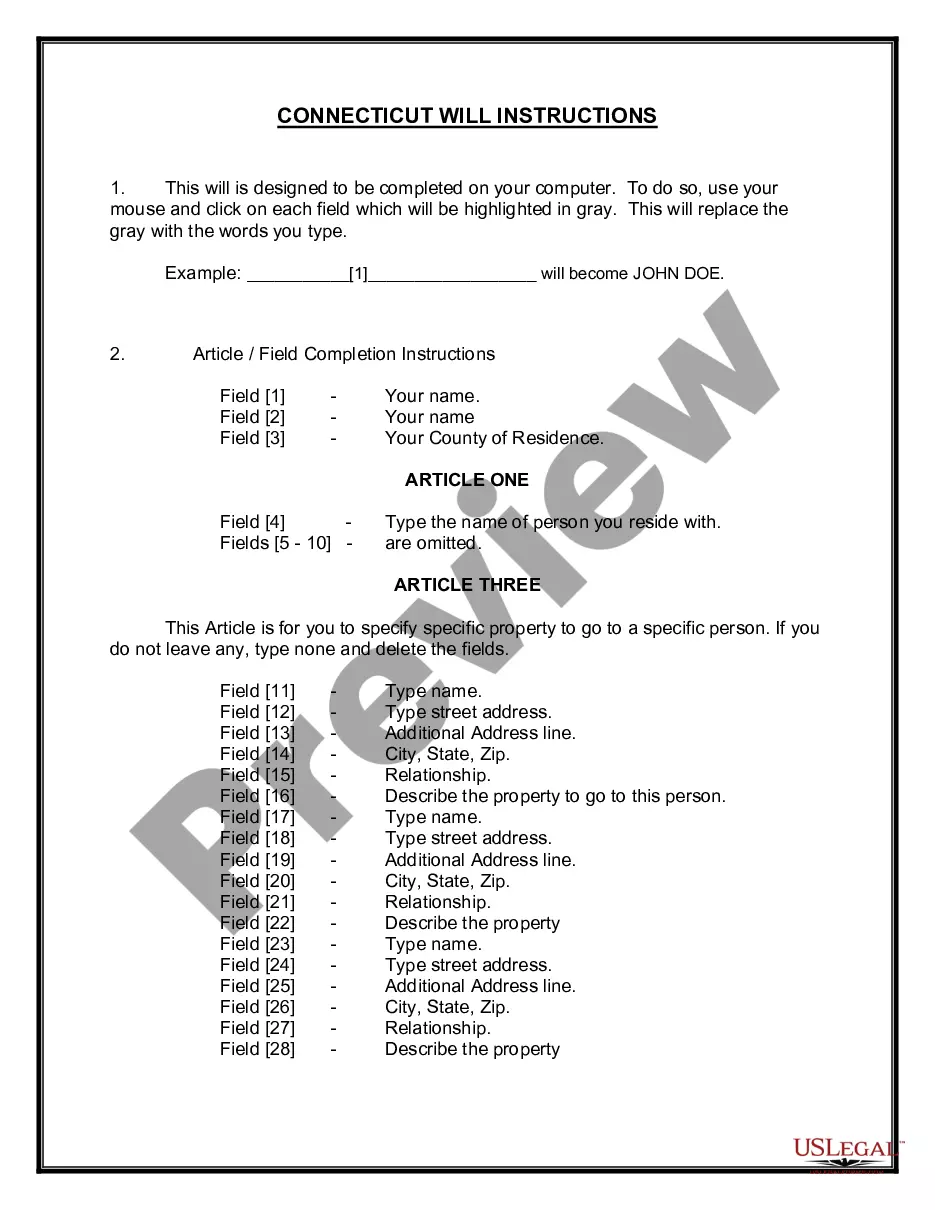

How to fill out Arkansas Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

Choosing the best legal file template can be a have difficulties. Naturally, there are plenty of web templates available on the net, but how will you get the legal form you will need? Use the US Legal Forms internet site. The assistance offers thousands of web templates, like the Arkansas Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness, that can be used for company and personal requires. Every one of the forms are examined by pros and satisfy state and federal specifications.

When you are currently listed, log in for your accounts and click on the Acquire switch to have the Arkansas Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness. Use your accounts to search from the legal forms you possess ordered in the past. Check out the My Forms tab of your own accounts and have one more duplicate of the file you will need.

When you are a new customer of US Legal Forms, allow me to share straightforward recommendations that you should adhere to:

- Very first, make sure you have selected the right form for the city/county. You are able to look through the form utilizing the Review switch and read the form description to make certain this is basically the right one for you.

- In the event the form is not going to satisfy your expectations, use the Seach field to obtain the appropriate form.

- When you are positive that the form is proper, go through the Purchase now switch to have the form.

- Pick the pricing strategy you need and enter in the necessary details. Design your accounts and buy an order utilizing your PayPal accounts or bank card.

- Pick the submit file format and obtain the legal file template for your device.

- Comprehensive, revise and printing and indication the attained Arkansas Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness.

US Legal Forms will be the greatest local library of legal forms in which you can discover a variety of file web templates. Use the company to obtain skillfully-produced papers that adhere to status specifications.