Arkansas Triple Net Commercial Lease Agreement — Real Estate Rental: A triple net (NNN) commercial lease agreement is a widely used real estate contract in Arkansas that outlines the terms and conditions of a rental arrangement for commercial properties. In this agreement, the tenant is responsible for paying the net real estate taxes, net building insurance, and net common area maintenance (CAM) expenses, in addition to the base rent. This type of lease transfers a significant portion of financial responsibilities from the landlord to the tenant, making it a popular choice for commercial property owners and investors. Arkansas recognizes several types of triple net commercial lease agreements, each with its own characteristics tailored to the specific needs and preferences of the parties involved. These may include: 1. Arkansas Triple Net Commercial Lease Agreement with Retail Tenant: This agreement specifically caters to commercial properties intended for retail use. It covers various aspects, such as tenant obligations related to signage, parking, maintenance of common areas shared by multiple businesses within the retail premises, and compliance with zoning regulations, among others. 2. Arkansas Triple Net Commercial Lease Agreement with Office Tenant: Designed for commercial properties primarily used as office spaces, this agreement outlines obligations related to utilities, janitorial services, parking allocation, and adherence to building rules and regulations. It may also include provisions for modifications and improvements made by the tenant to meet their specific office requirements. 3. Arkansas Triple Net Commercial Lease Agreement with Industrial Tenant: This lease agreement pertains to industrial properties, such as warehouses, manufacturing facilities, or distribution centers. It may address matters like compliance with environmental regulations, allocation of maintenance costs for specialized equipment or machinery, as well as the responsibility for maintaining loading docks, ramps, or other industrial-specific infrastructure. 4. Arkansas Triple Net Commercial Lease Agreement with Restaurant Tenant: This agreement targets properties suitable for restaurant establishments. It typically covers provisions related to compliance with health and safety regulations, waste management, shared common areas, parking spaces, and specific requirements related to the installation and maintenance of commercial kitchen equipment. 5. Arkansas Triple Net Commercial Lease Agreement with Medical Tenant: This agreement focuses on properties leased by medical practitioners or healthcare providers. It may include clauses that address privacy rights and patient confidentiality, building accessibility, tenant obligations regarding medical waste handling and disposal, and the maintenance of specialized medical equipment and infrastructure. These types of triple net commercial lease agreements in Arkansas, along with many others tailored to specific industries, provide clear guidelines and responsibilities for both landlords and tenants in the realm of real estate rentals. By clarifying the financial burdens and obligations, these comprehensive agreements seek to foster fair and sustainable relationships between parties.

Arkansas Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Arkansas Triple Net Commercial Lease Agreement - Real Estate Rental?

If you want to comprehensive, down load, or print out lawful record templates, use US Legal Forms, the largest assortment of lawful types, that can be found on the Internet. Take advantage of the site`s easy and handy research to get the documents you require. Different templates for business and personal uses are sorted by classes and states, or keywords. Use US Legal Forms to get the Arkansas Triple Net Commercial Lease Agreement - Real Estate Rental in just a few clicks.

If you are previously a US Legal Forms consumer, log in in your profile and then click the Acquire button to obtain the Arkansas Triple Net Commercial Lease Agreement - Real Estate Rental. You may also accessibility types you earlier saved inside the My Forms tab of the profile.

If you use US Legal Forms for the first time, refer to the instructions listed below:

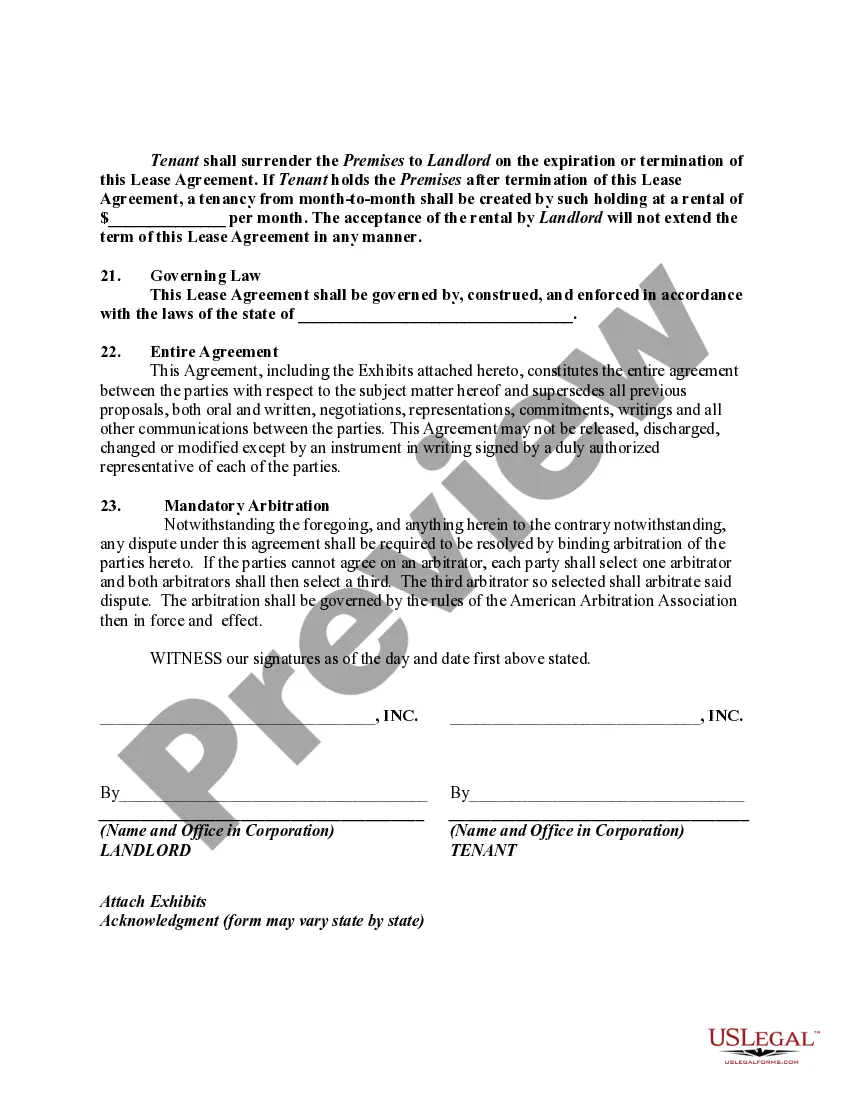

- Step 1. Make sure you have selected the form to the correct area/land.

- Step 2. Utilize the Review option to look through the form`s content material. Do not overlook to learn the explanation.

- Step 3. If you are unhappy together with the form, take advantage of the Research industry on top of the monitor to get other types in the lawful form design.

- Step 4. When you have discovered the form you require, go through the Purchase now button. Choose the pricing program you like and include your references to register on an profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to perform the financial transaction.

- Step 6. Choose the format in the lawful form and down load it on your own system.

- Step 7. Comprehensive, revise and print out or sign the Arkansas Triple Net Commercial Lease Agreement - Real Estate Rental.

Each and every lawful record design you purchase is yours permanently. You possess acces to every form you saved within your acccount. Go through the My Forms portion and pick a form to print out or down load again.

Be competitive and down load, and print out the Arkansas Triple Net Commercial Lease Agreement - Real Estate Rental with US Legal Forms. There are many skilled and condition-distinct types you can utilize to your business or personal demands.