Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

You can dedicate hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers an extensive collection of legal forms that have been reviewed by specialists.

You can download or print the Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause from my service.

If available, use the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- Then, you can complete, edit, print, or sign the Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- Every legal document template you purchase is yours permanently.

- To acquire another copy of a purchased form, visit the My documents tab and click on the relevant option.

- If you're using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you’ve chosen the right one.

Form popularity

FAQ

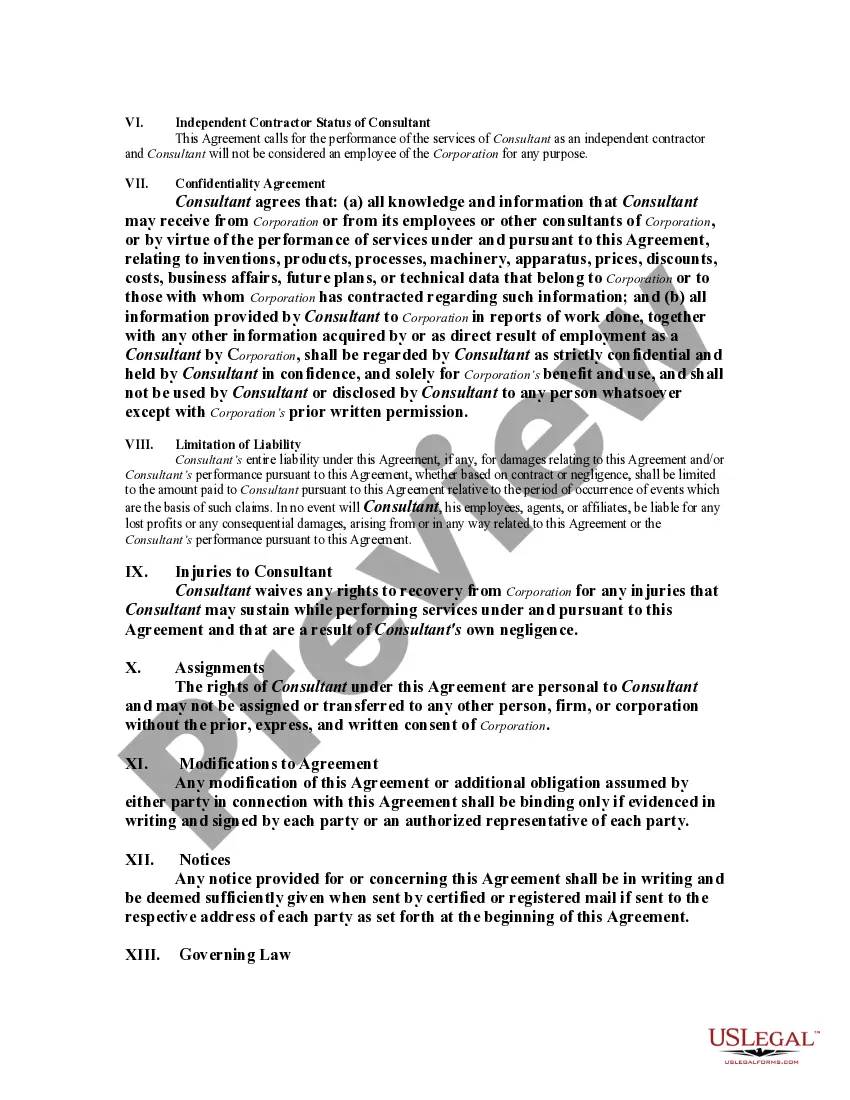

The Limitation of Liability Clause in a service agreement limits the amount one party can claim from another in case of a breach or negligence. This clause is vital for protecting both parties and clearly defines the extent of liability. Including this in your Arkansas Contract with Consultant as Self-Employed Independent Contractor ensures that you mitigate potential risks involved in any contractual relationship.

As an independent contractor, you usually need to fill out a W-9 form to provide your taxpayer information to clients. Additionally, you should track your earnings, expenses, and keep invoices for services rendered. This is essential for reporting income when filing taxes as part of your Arkansas Contract with Consultant as Self-Employed Independent Contractor.

Independent contractors generally do not qualify for unemployment benefits in Arkansas because they do not have an employer-employee relationship. However, under certain circumstances, such as the COVID-19 pandemic, specific programs may offer assistance to self-employed individuals. It's wise to stay informed about any changes in legislation regarding unemployment benefits for Arkansas Contractors.

To write an effective independent contractor agreement, start with outlining the scope of work and the specific services the consultant will provide. Include payment details, deadlines, and any relevant expectations from both parties. Don't forget to incorporate the Limitation of Liability Clause to protect your interests, especially in an Arkansas Contract with Consultant as Self-Employed Independent Contractor.

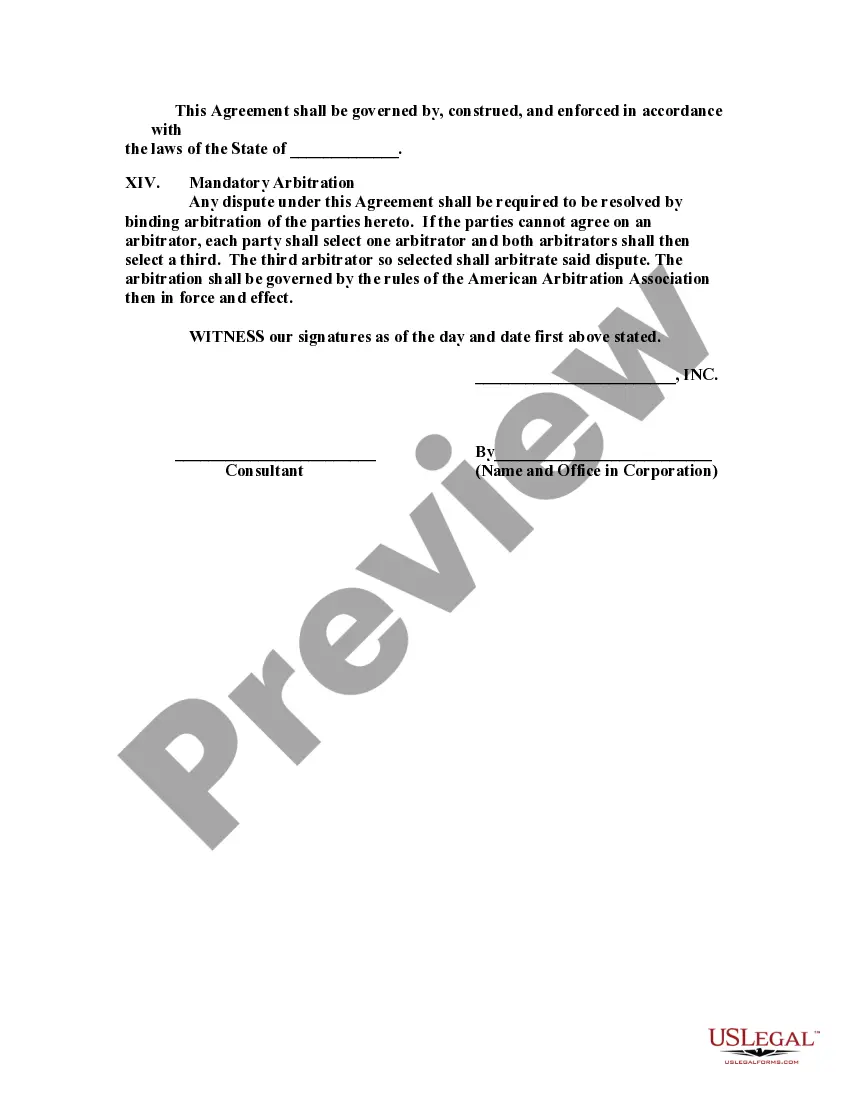

Contract law in Arkansas governs the agreements made between parties and defines how contracts are formed, executed, and enforced. Under this law, for a contract to be legally binding, it must include essential elements such as offer, acceptance, and consideration. In the context of an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, understanding these legal principles is crucial. Utilizing the US Legal Forms platform can help you draft compliant contracts that adhere to Arkansas law, ensuring your agreements hold up in legal disputes.

A valid contract requires offer, acceptance, consideration, capacity, and legality. Each party must understand and agree to the contract's terms, and it cannot involve illegal activities. In Arkansas, an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause encapsulates these principles, helping you create enforceable agreements while minimizing liability.

The four requirements for a legally binding contract in Arkansas include mutual agreement, legality of the terms, consideration, and competency of parties. First, both parties must agree to the terms through an offer and acceptance. Secondly, the contract's purpose must be lawful. Incorporating an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause meets these criteria and ensures a clear understanding of each party’s obligations.

A legally binding contract is determined by the mutual agreement of the parties involved, which must be clear and intentional. The contract must outline the specific terms and conditions, including what happens if the agreement is breached. In Arkansas, an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can clearly establish these parameters and expectations, providing reliable legal backing.

For a contract to be legally binding in Arkansas, it must meet specific criteria: offer and acceptance, consideration, and intention to create legal relations. All parties must be competent to consent, and the contract must not violate public policy or law. A well-drafted Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause ensures compliance with these requirements, safeguarding your interests.

The primary difference lies in control and relationship. An independent contractor operates with greater autonomy and typically manages their own work schedule, while an employee works under the direction of an employer. Independent contractors in Arkansas, such as those in an Arkansas Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, usually have more flexibility in how they deliver their services. This distinction can significantly impact taxes and liabilities.