The Arkansas Agreement for Purchase of Business Assets from a Corporation is a legally binding document that outlines the terms and conditions under which a corporation agrees to sell and transfer its business assets to another party. This agreement serves as an essential tool for buyers and sellers looking to engage in the sale or purchase of a business in Arkansas. The agreement typically begins with a comprehensive introduction, detailing the names of the parties involved (buyer and seller), their legal addresses, and the effective date of the agreement. It also highlights the purpose of the agreement, which is to facilitate the transfer of business assets from the corporation to the buyer. The agreement then proceeds to provide a detailed description of the business assets being purchased. This includes listing all tangible and intangible assets, such as real estate, equipment, inventory, intellectual property rights, customer lists, and contracts. It is crucial for this section to be thorough and accurate to avoid any ambiguity or disputes. The purchase price and payment terms are another critical aspect covered in the agreement. It outlines the agreed-upon price for the business assets, along with any payment schedules, terms of installment payments, or conditions for payment adjustments. The agreement may also specify if any portion of the purchase price is allocated to specific assets for tax or accounting purposes. To ensure a smooth transition, the agreement includes various provisions related to closing conditions. These conditions typically cover the buyer's due diligence process, representations and warranties from the seller, title and lien searches, necessary consents and approvals, and any other requirements to be fulfilled before the transaction can be completed. Additionally, the agreement may contain indemnification clauses to protect both parties from potential losses or liabilities arising from the transaction. These clauses clarify who will be responsible for any outstanding debts, obligations, or legal claims related to the business assets being transferred. It is essential to note that while there may not be specific types of Arkansas Agreement for Purchase of Business Assets from a Corporation, the agreement can vary depending on the nature and complexity of the transaction. The terms and conditions outlined in the agreement are highly customizable to meet the unique needs and requirements of the buyer and seller. In conclusion, the Arkansas Agreement for Purchase of Business Assets from a Corporation plays a crucial role in ensuring a smooth and transparent transaction between the buyer and the seller. This comprehensive document outlines the terms and conditions of the sale, safeguards the interests of both parties, and provides a clear framework for transferring the business assets.

Arkansas Agreement for Purchase of Business Assets from a Corporation

Description

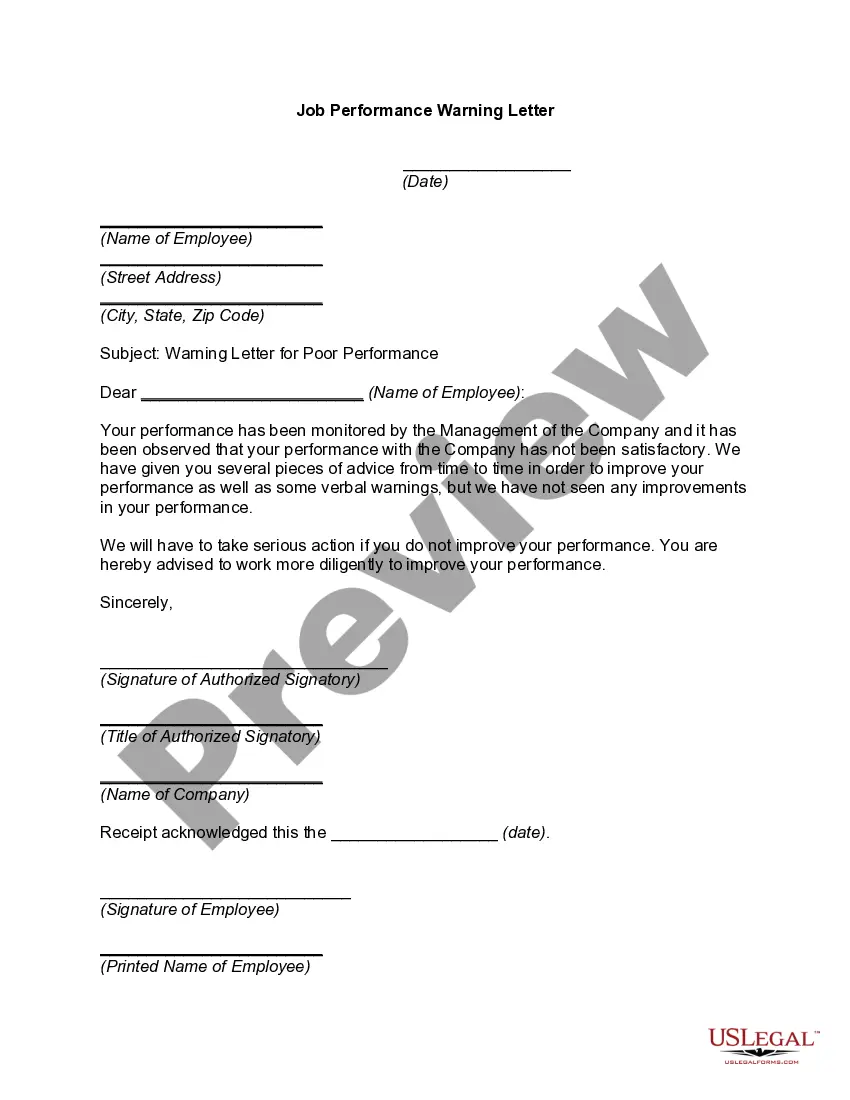

How to fill out Arkansas Agreement For Purchase Of Business Assets From A Corporation?

US Legal Forms - one of many most significant libraries of lawful varieties in America - offers a wide array of lawful document templates you can download or produce. Using the web site, you may get a large number of varieties for business and personal reasons, categorized by classes, claims, or keywords.You will discover the latest models of varieties much like the Arkansas Agreement for Purchase of Business Assets from a Corporation within minutes.

If you have a membership, log in and download Arkansas Agreement for Purchase of Business Assets from a Corporation from the US Legal Forms collection. The Down load key will appear on each and every form you perspective. You have accessibility to all earlier saved varieties in the My Forms tab of your profile.

In order to use US Legal Forms for the first time, listed here are easy recommendations to get you started off:

- Ensure you have picked the right form for your city/state. Click on the Preview key to examine the form`s articles. Read the form outline to ensure that you have chosen the proper form.

- In the event the form does not match your demands, take advantage of the Lookup field on top of the display screen to find the one which does.

- Should you be content with the shape, confirm your option by visiting the Get now key. Then, choose the costs program you like and provide your credentials to sign up on an profile.

- Method the deal. Make use of your bank card or PayPal profile to accomplish the deal.

- Find the file format and download the shape in your gadget.

- Make adjustments. Load, modify and produce and indicator the saved Arkansas Agreement for Purchase of Business Assets from a Corporation.

Each format you put into your money lacks an expiry date and is also your own permanently. So, if you wish to download or produce one more duplicate, just check out the My Forms area and click on about the form you will need.

Get access to the Arkansas Agreement for Purchase of Business Assets from a Corporation with US Legal Forms, probably the most extensive collection of lawful document templates. Use a large number of professional and condition-particular templates that satisfy your small business or personal requirements and demands.