Arkansas Triple Net Lease

Description

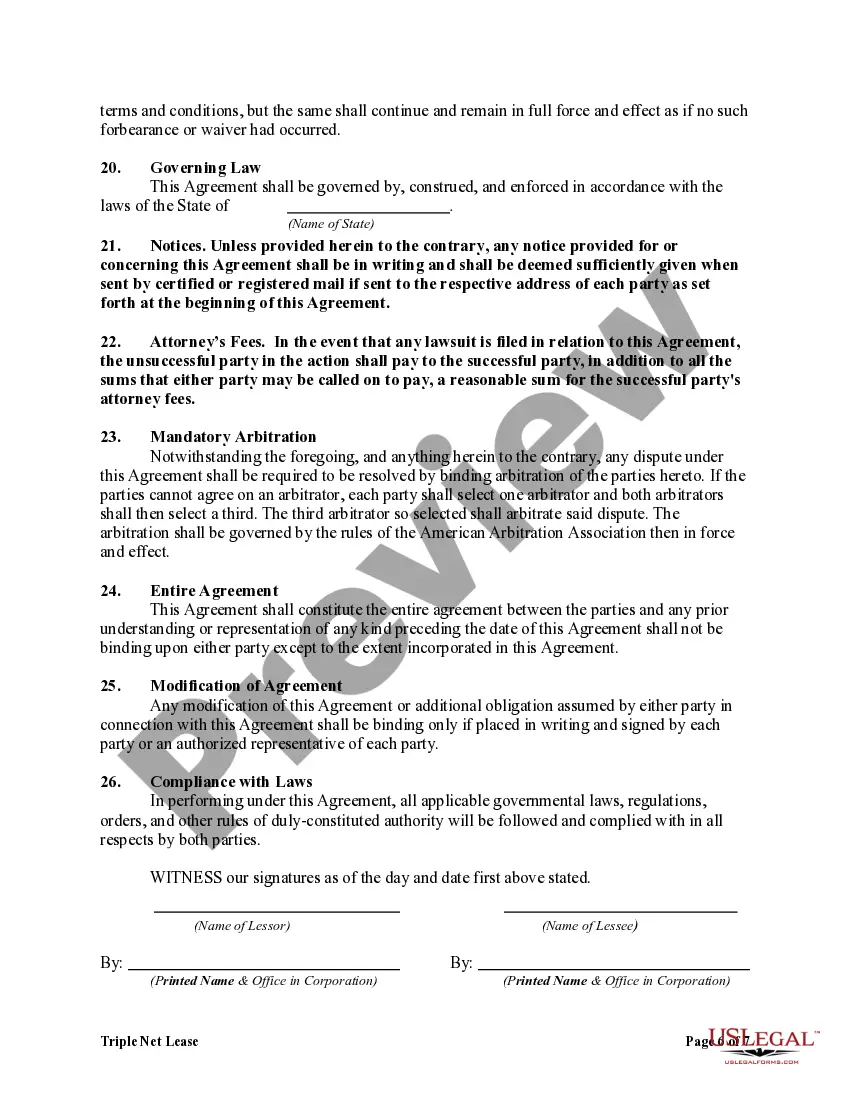

How to fill out Triple Net Lease?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers a range of legal document templates that you can download or print.

While browsing the site, you can access thousands of documents for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Arkansas Triple Net Lease in moments.

If you already have a subscription, Log In and download the Arkansas Triple Net Lease from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously stored forms from the My documents section of your profile.

Process the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Arkansas Triple Net Lease. Every template saved in your account does not expire and is yours indefinitely. Therefore, to download or print another version, simply visit the My documents section and click on the template you need. Gain access to the Arkansas Triple Net Lease with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that comply with your business or personal requirements and specifications.

- Ensure you have selected the correct document for your city/state.

- Click the Preview button to review the document’s content.

- Check the document info to confirm you have chosen the correct form.

- If the document does not fit your needs, use the Search field at the top of the screen to find the appropriate one.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button.

- Next, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The best triple net lease tenants typically include established companies with strong credit ratings and long-term operational history. Retailers, pharmacies, and fast-food chains often rank among top tenants due to their stability and brand recognition. When selecting a tenant for an Arkansas Triple Net Lease, consider their financial strength and lease duration to ensure a reliable income stream.

The best triple net lease is one that aligns with both the landlord's investment strategy and the tenant's operational needs. Factors such as tenant creditworthiness, property location, and lease length contribute to an optimal arrangement. In the context of an Arkansas Triple Net Lease, evaluating these components leads to sound investment decisions.

An absolute NNN lease takes the concept of a triple net lease one step further. In this type of lease, the tenant assumes full responsibility for all property expenses, including structural repairs and damages. This arrangement offers landlords the ultimate security and predictability, making it an attractive option for those seeking an Arkansas Triple Net Lease.

Commercial properties, such as retail spaces, warehouses, and office buildings, are most likely to have a triple net lease in Arkansas. Investors favor this leasing type due to its stability and reduced management responsibilities. If you're searching for Arkansas Triple Net Lease opportunities, consider properties in thriving commercial areas.

Structuring a triple net lease involves outlining clear terms that detail each party's responsibilities, including rent amounts and NNN costs. It's essential to specify how expenses will be calculated and any potential increases over time. Working with a legal platform like uslegalforms ensures your Arkansas Triple Net Lease agreement is comprehensive and enforceable.

The triple net format, or NNN lease, refers to a commercial real estate rental agreement where the tenant is responsible for paying property taxes, insurance, and maintenance costs in addition to the rent. This structure provides a predictable income stream for landlords while shifting operational responsibilities to tenants. For those interested in Arkansas Triple Net Lease properties, this format can offer unique benefits.

To calculate a triple net lease in Arkansas, start with the base rent and add estimated costs for property taxes, insurance, and maintenance. These additional costs, often referred to as NNN expenses, can vary based on the property's specifics. Understanding these components helps you assess the total financial commitment of the Arkansas Triple Net Lease.

In Arkansas, a lease does not have to be notarized to be valid. However, notarization can provide an added layer of authenticity and security. It's wise to consult legal advice when drafting your lease, especially for an Arkansas Triple Net Lease, to ensure all requirements are met. Utilizing platforms like US Legal Forms can help create compliant leases that fit your needs.

To calculate a triple net lease in Arkansas, you first determine the base rent per square foot. Then, add the costs for property taxes, insurance, and maintenance, which are typically passed on to the tenant. It's essential to review the lease agreement carefully, as it should outline these additional expenses. Using a clear formula helps both landlords and tenants understand their financial obligations in an Arkansas Triple Net Lease.

In an Arkansas Triple Net Lease, the tenant usually assumes responsibility for property taxes. This arrangement is part of the lease structure, where the tenant covers not only rent but also property-related expenses. Clear terms should be established in the lease agreement to confirm responsibilities regarding property taxes. Using platforms like USLegalForms can provide templates to ensure that the lease outlines these obligations effectively.