The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

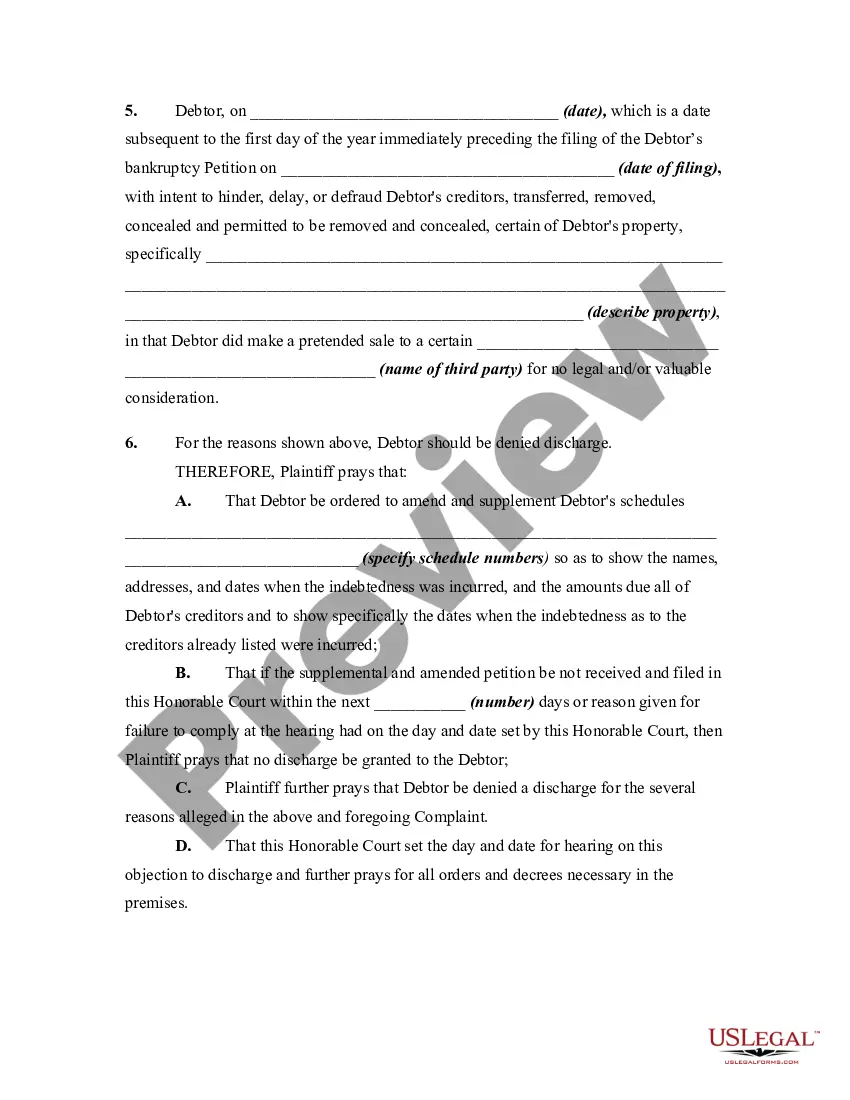

An Arkansas complaint objecting to discharge in a bankruptcy proceeding for transfer, removal, destruction, or concealment of property is a legal document filed by a creditor or interested party to challenge the discharge of a debtor's debts in bankruptcy. This type of complaint is specifically aimed at cases where the debtor engaged in actions that impede the proper administration of the bankruptcy estate, such as transferring, removing, destroying, or concealing property with the intention to defraud creditors. Various types of Arkansas complaints objecting to discharge in bankruptcy proceedings for transfer, removal, destruction, or concealment of property may include: 1. Complaint alleging fraudulent transfers: This type of complaint asserts that the debtor transferred property or assets to another person or entity with the intent to hinder, delay, or defraud creditors. The purpose of this complaint is to seek the recovery or avoidance of the transferred property for the benefit of creditors. 2. Complaint for violation of bankruptcy code provisions: This type of complaint accuses the debtor of violating specific provisions of the bankruptcy code related to transfer, removal, destruction, or concealment of property. It may involve allegations of fraudulent conveyance, destruction or concealment of records, or other similar actions. 3. Complaint for concealment of assets: This type of complaint focuses on instances where the debtor has intentionally concealed assets from the bankruptcy estate with the intent to hinder, delay, or defraud creditors. The complaint requests that the concealed assets be discovered, liquidated, and used to satisfy the debtor's debts. 4. Complaint for destruction of property: In some cases, a creditor may file a complaint objecting to discharge if the debtor has intentionally destroyed or damaged property in an effort to hinder, delay, or defraud creditors. This type of complaint seeks compensation for the destroyed property or the imposition of penalties on the debtor. 5. Complaint for removal of property: This complaint alleges that the debtor has removed property from the bankruptcy estate without authority or permission, with the intent to hinder, delay, or defraud creditors. The purpose is to seek the return or recovery of the removed property for distribution to creditors. When filing an Arkansas complaint objecting to discharge in a bankruptcy proceeding for transfer, removal, destruction, or concealment of property, it is crucial to provide detailed evidence, documentation, and relevant legal arguments supporting the allegations. The creditor or interested party must follow the Arkansas bankruptcy court's procedural rules and provide a clear and comprehensive description of the fraudulent or improper actions taken by the debtor. By doing so, the party filing the complaint seeks to prevent the debtor from receiving a discharge and ensures a fair distribution of assets to the creditors involved in the bankruptcy proceedings.