Title: Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices Introduction: In Arkansas, when accounting errors occur or past due notices are sent to customers, it is essential to rectify the situation promptly and maintain strong professional relationships. This article provides detailed information about Arkansas sample letters for apology, accounting errors, and past due notices, ensuring effective communication while rectifying financial discrepancies. Below, we discuss three common types of Arkansas sample letters for these situations: 1. Arkansas Sample Letter for Apology for Accounting Errors: Accounting errors can happen due to various reasons, such as incorrect calculations, data entry mistakes, or system glitches. To address such issues and apologize to affected parties, an Arkansas Sample Letter for Apology for Accounting Errors should be clear, concise, and straightforward. It should include details about the error, reasons for its occurrence, and steps taken to correct it. Focus keywords for this letter could include: apology, accounting errors, clarification, rectification, and improvement. 2. Arkansas Sample Letter for Apology for Past Due Notices: Sending past due notices can inadvertently cause inconvenience and strain relationships with customers. When such situations arise, an Arkansas Sample Letter for Apology for Past Due Notices helps in expressing regret and taking responsibility for the oversight. The letter should offer a sincere apology, provide an explanation for the delay, and outline measures taken to prevent recurrences. Important keywords for this letter might include: apology, overdue, payment, delay, and amends. 3. Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices: In some scenarios, businesses might encounter a combination of both accounting errors and past due notices. Addressing these dual issues appropriately requires an Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices. This comprehensive letter should acknowledge both the mistakes made and the tardiness in payments. It should apologize for any inconveniences caused, provide clear explanations for the issues, and present actionable steps taken to rectify them promptly. Key terms for this letter could include: apology, accounting errors, past due, acknowledgment, improvement, and resolution. Conclusion: Handling accounting errors and past due notices effectively is crucial to maintaining strong business relationships in Arkansas. By utilizing tailored sample letters for apologies, businesses can demonstrate accountability, transparency, and commitment to rectifying any financial discrepancies. Whether it's an apology for accounting errors, past due notices, or a combination of both, these letters help address the concerns professionally, fostering trust and goodwill in business transactions.

Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices

Description

How to fill out Arkansas Sample Letter For Apology For Accounting Errors And Past Due Notices?

US Legal Forms - one of several most significant libraries of legitimate kinds in the United States - gives a wide array of legitimate papers web templates you can download or print out. Making use of the internet site, you can find a huge number of kinds for business and personal uses, categorized by categories, suggests, or key phrases.You will discover the most recent models of kinds such as the Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices in seconds.

If you currently have a registration, log in and download Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices through the US Legal Forms library. The Obtain button can look on every type you view. You have accessibility to all formerly delivered electronically kinds in the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, allow me to share basic directions to help you started off:

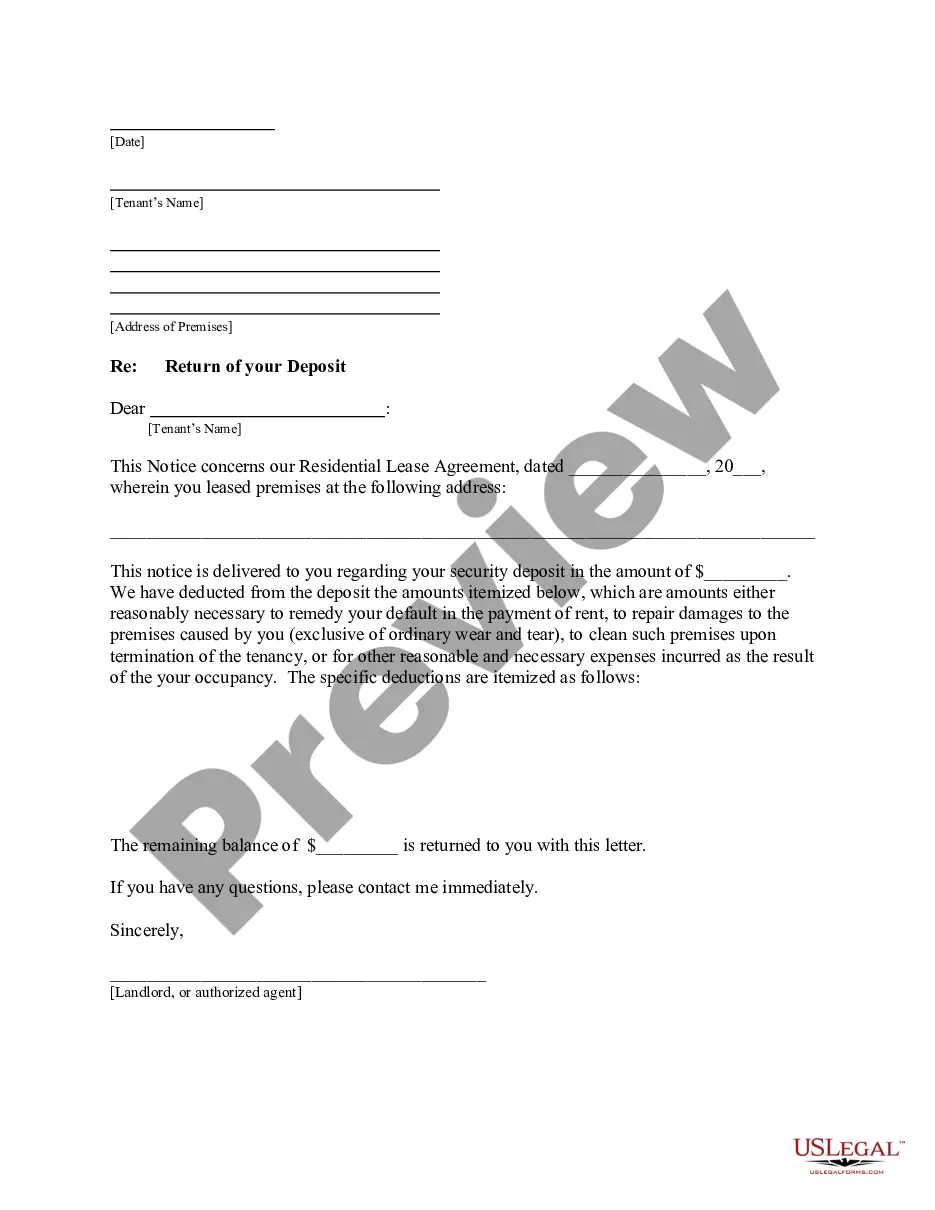

- Be sure you have selected the right type for your town/area. Select the Preview button to check the form`s articles. Look at the type outline to ensure that you have selected the proper type.

- When the type doesn`t suit your needs, make use of the Lookup field on top of the monitor to obtain the one who does.

- If you are pleased with the shape, confirm your option by visiting the Acquire now button. Then, choose the prices prepare you favor and supply your references to sign up for an profile.

- Method the transaction. Make use of credit card or PayPal profile to accomplish the transaction.

- Select the structure and download the shape on your own product.

- Make modifications. Fill up, change and print out and indication the delivered electronically Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices.

Each and every format you included in your bank account does not have an expiry day which is your own property eternally. So, if you would like download or print out an additional copy, just go to the My Forms section and click on on the type you will need.

Get access to the Arkansas Sample Letter for Apology for Accounting Errors and Past Due Notices with US Legal Forms, the most comprehensive library of legitimate papers web templates. Use a huge number of expert and status-specific web templates that meet up with your business or personal demands and needs.